Navigating Rates

Revealed: the secret to managing risk in volatile markets

Recent equity market volatility has underlined the value of a diversified approach to building a portfolio. A multi asset formula that blends a mix of aggressive and defensive assets may help to provide a steadier investment journey.

Key takeaways

- Multi asset portfolios aim to manage risk through a diversified set of assets, combining equities with a diversified set of diversifiers – including bonds, commodities and currencies – that can offer stability to a portfolio in difficult times.

- Our analysis shows diversifiers are generally reliable: the majority have risen in value in most of the tricky periods for the stock markets.

- As no single defensive asset is guaranteed to protect a portfolio during every instance of equity market volatility, investors should consider allocating to a range of diversifiers and adjusting the mix based on changes in the market environment.

Multi asset funds aim to generate returns, outpace inflation, and build wealth. In pursuit of these goals, they seek to manage risk through a diversified blend of assets, with a view to ensuring a smoother investment journey. That approach can be helpful during periods of market volatility – such as when equity markets sell off.

The multi asset formula: a blend of aggressive and defensive assets

Equities are a key component of most portfolios, providing the growth to help build value and beat inflation over the long term. Known as an aggressive asset, equities seek to maximise gains by taking a higher level of risk relative to other asset classes.

However, portfolios need a balance of risk. One way of achieving that is by investing in defensive assets – including bonds, commodities and currencies – that can offer stability to a portfolio in difficult times. The aim is to ensure a portfolio’s performance is generally steady, so that when equities struggle, other assets can deliver the growth required to support overall performance. For the reasons outlined below, we favour a range of defensive assets – a diversified set of diversifiers.

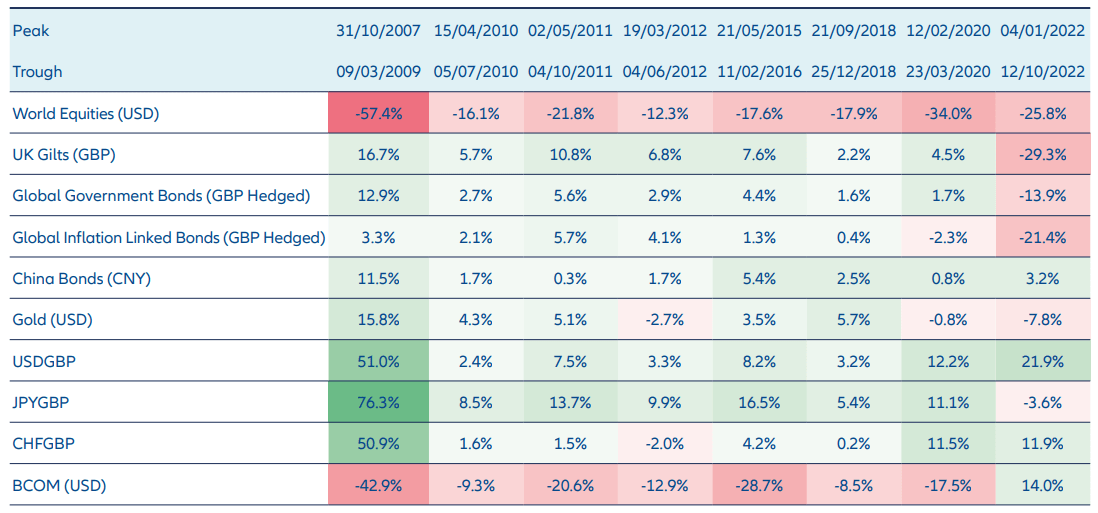

We analysed the returns of a select number of diversifiers during the most significant equity market drawdowns – the fall from peak to trough (see Exhibit 1):

- Diversifiers are generally reliable: the majority have risen in value in most of the tricky periods for the stock markets (see green in Exhibit 1), showing that they are typically reliable sources of diversification overall.

- No individual asset is foolproof: government bonds dropped sharply in 2022, inflation-linked bonds struggled in 2020, while gold fell in value in 2012.

- Look beyond the usual suspects: for example, Chinese government bonds represented an excellent source of diversification in 2022, rising in value when government bonds from many other regions nosedived.

- Protection levels can differ: cover – the level of positive return from a diversifier during an equity market drawdown – can vary significantly. For example, during the slide in equities in 2011, the US dollar, Japanese yen and Swiss franc all delivered positive returns, but the amount of protection varied significantly (7.5%, 13.7%, 1.5% respectively).

The takeaway from our analysis? As the causes of each equity market drawdown can vary, we see merit in considering a dual-pronged approach to maintaining a diversified set of diversifiers:

Exhibit 1: Historically, diversifiers have generally delivered returns during equity market drawdowns

USDGBP: US dollar to British pound currency pair; JPYGBP: Japanese yen to British pound currency pair; CHFGBP: Swiss franc to British pound currency pair; BCOM (USD): Bloomberg Commodity Index.

Source: AllianzGI, Bloomberg

1. Strategic diversification: the value of casting the net wide in asset selection

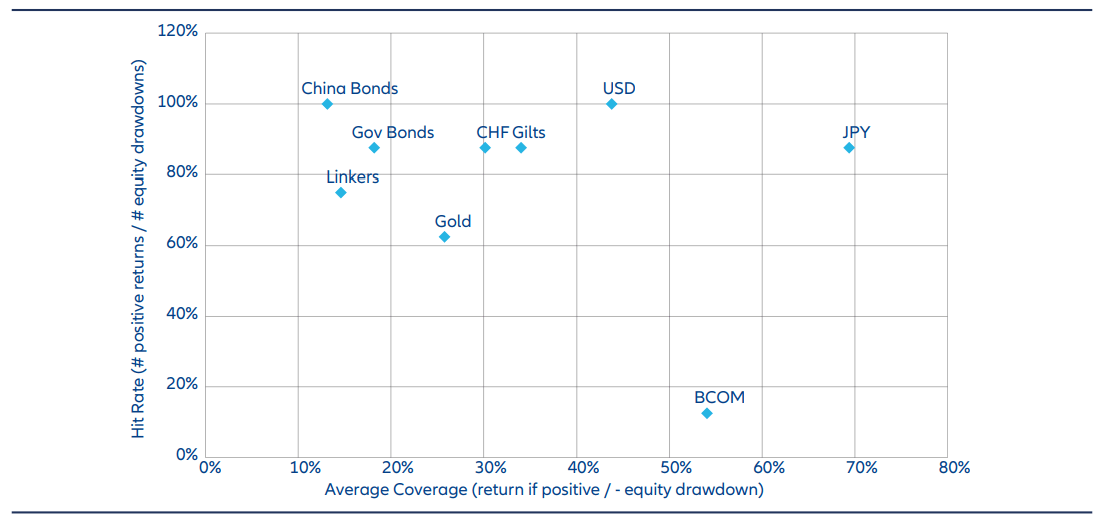

In an ideal world, asset managers would select diversifiers able to deliver on two key targets. First, they want to gain a high probability of a positive return, known as a high hit rate. Second, they want to offer a substantial positive return, described as a high cover.

But, as our analysis in Exhibit 2 shows, no single diversifier can deliver on both goals:

- Government bonds have a high hit rate but offer lower cover.

- Conversely, broad commodities have a very low hit rate but provide substantial cover when effective.

- Over the period we analysed, the Japanese yen came closest to providing a high hit rate and high cover.

The results underline the importance of adding a broad range of assets within a portfolio.

Exhibit 2: Cover versus hit rate of a range of diversifiers

BCOM: Bloomberg Commodity Index; Linkers: Global inflation-linked bonds; CHF: Swiss franc; Gilts: UK government bonds; USD: US dollar; JPY: Japanese yen.

Source: AllianzGI, Bloomberg. Based on historic risk-off events described in Exhibit 1.

2. Tactical flexibility: the agility to respond fast when markets shift

A strategic approach to building a diversified portfolio can help ensure it has the potential to deliver on investors’ return expectations. However, it is also important to be flexible when economies and markets shift.

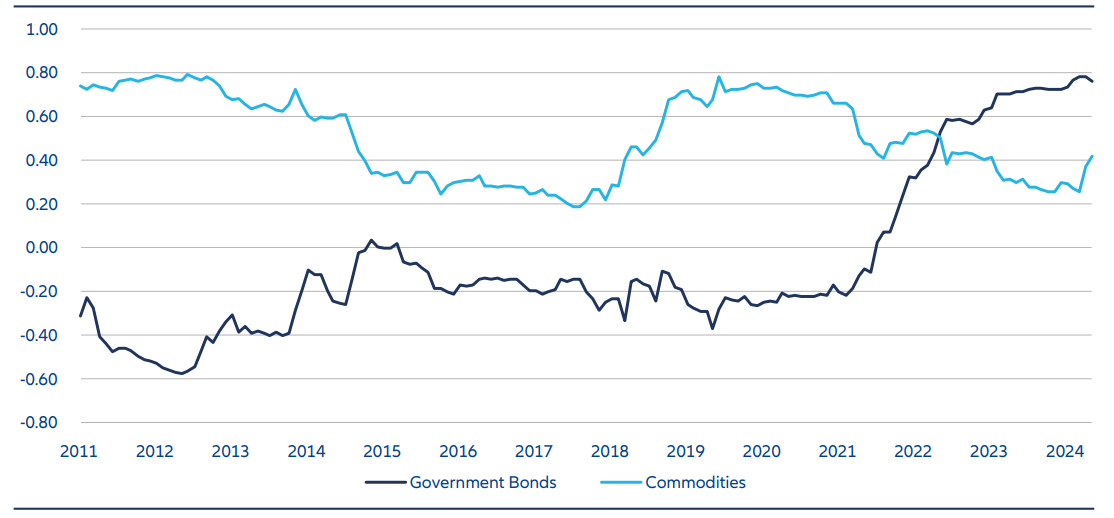

For example, when inflation surged in 2022, equities, bonds, gold and the Japanese yen all declined. In contrast, broad commodities benefited from higher inflation, gaining 14% during the period. The divergence between commodities and equities during this time contrasted with the usual pattern of a high positive correlation between the two asset classes. It came as government bonds also diverged from their usual low or negative correlation to equities (see Exhibit 3).

Episodes of unfamiliar performance in assets underline the necessity for a nimble approach to asset allocation to respond to twists and turns in financial markets.

Exhibit 3: The usual pattern of performance of government bonds and commodities against equities diverged in late 2022

Source: AllianzGI, Bloomberg. Three-year correlations using monthly data since 28/11/2008.

Consider a range of diversifiers in a portfolio

No single defensive asset is guaranteed to protect a multi asset portfolio or provide a certain level of protection during every instance of equity market volatility. As a result, we think there’s merit to allocating to a range of diversifiers and adjusting tactical allocations based on changes in the market and economic backdrop. Together, diversification and tactical flexibility create a robust investment strategy that balances risk and reward. That is the approach we take.