Embracing Disruption

China’s AI revolution

The launch of DeepSeek R1 in January this year – amid already fervent global interest in the artificial intelligence (AI) field – shone a light on the capabilities of homegrown Chinese corporates in this area. Now the dust has settled somewhat, many observers have noted that DeepSeek might not quite be the game changer initially thought – for instance, it is likely the all-in cost of training was more than has been disclosed. However, what is clear is that DeepSeek has demonstrated that competitive large language models (LLMs) can be effectively deployed using chips that are “good enough” – if not the best in class – and that DeepSeek has shown how AI can be deployed in a more efficient and cost-effective manner.

The innovation behind DeepSeek was driven by several factors, most notably the current constraints on advanced computing chips in China. However, domestic competition – against other Chinese LLMs – and the limited funding environment for start-ups both also played a notable role. Indeed, the latter has motivated Chinese players to innovate in terms of model efficiency – exactly what we have seen with DeepSeek. And this is likely just the beginning; the current blossoming of AI LLMs in China will drive down costs, lead to faster adoption, and an increase in demand for this type of computing.

Core beneficiaries – the hardware perspective

We see several layers of domestic beneficiaries from these recent developments. First, Chinese datacentres. We are already witnessing the wider adoption of DeepSeek and other Chinese LLMs, driving a potential upcycle in AI capital expenditure in the country, and various Chinese internet companies have voiced optimism in this respect with elevated capex guidance in this area. We are thus positive on datacentre demand in China and we expect an accelerating number to be built in the coming years.

Second, local AI chip providers will benefit from DeepSeek’s proof that AI can be implemented using “good enough” chips. And with the US likely to implement stricter export controls on semiconductors, these factors will drive the domestic substitution of AI chips not available for import.

Third, the broader Chinese semiconductor ecosystem is set to benefit. Domestic foundries will see higher demand as foundry services from overseas – Taiwan and Korea, for instance – become less available, and China will strive for greater self-sufficiency along the entire AI hardware chain.

Finally, “edge AI” – the deployment of AI on local devices such as smartphones, laptops, or internet-of-things integrated devices. Given China’s already leading role in the design and manufacture of such devices, we expect to see local firms benefit from the deployment of LLMs on them, with lower computing requirements. Indeed, this could potentially drive a product replacement cycle as consumers seek new devices with AI capabilities.

Transforming traditional industries

Aside from these beneficiaries intimately linked to the AI value chain, China’s rapid AI progress is likely to have beneficiaries across the broader tech sector, and beyond. For instance, Chinese internet giants are already beginning to deploy DeepSeek’s analytical capabilities to enhance monetization across advertisements, ecommerce and video platforms. Meanwhile, demand for cloud services is soaring as DeepSeek usage expands, and Chinese content creators – for instance, video gaming companies – are rushing to use this technology to reduce the time and cost associated with product development.

AI is also revolutionizing traditional industries such as automobile, healthcare and education, and beyond. The advances in training methods evidenced by DeepSeek are also already having an impact on autonomous driving in China, in particular in terms of training efficiency, with one leading electric vehicle (EV) already using the model to this end. Finally, healthcare and education are two further fields where China’s new AI capabilities are set to deliver benefits. Innovative algorithms are being developed to analyse personal healthcare data, while drug discovery will also be expedited as AI increasingly allows for the simulation of drug interactions. In terms of education, we have already seen one leading educational provider use DeepSeek for customized learning paths, while AI is also set to boost motivation and engagement by incorporating gamification into student learning environments.

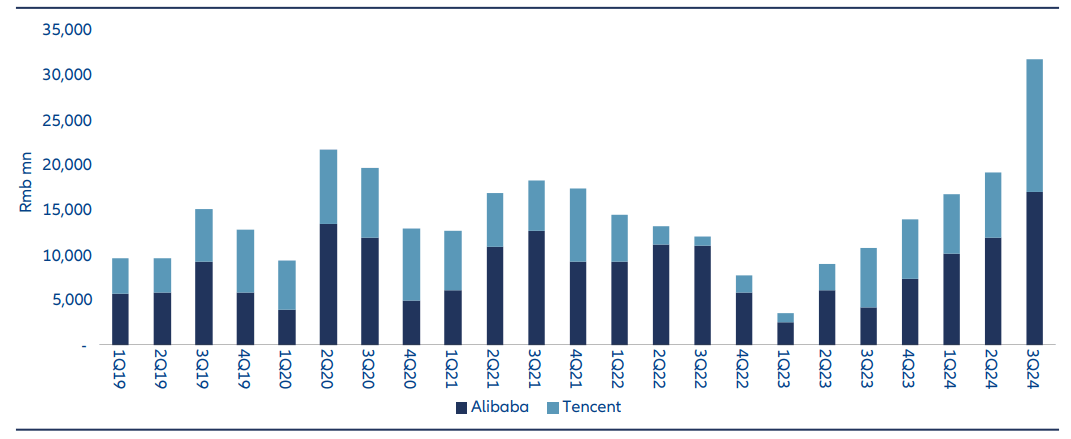

Operating capex of major Chinese internet companies

Source: Alibaba, Tencent, Allianz Global Investors, as of 31 December 2024

A burgeoning AI ecosystem

Now the furore that surrounded DeepSeek’s launch has subsided, it is clear that – despite some of the developer’s claims surrounding costs being called into question – the product represents a significant leap forward, both for the development of AI generally, and for the burgeoning tech and AI ecosystem in China. Of course, some of these benefits – in terms of improved efficiency, and advances in EVs or healthcare, for example – are no different to those that have been heralded in the West over recent years, but it is significant that China is now developing its own AI models that are among the world’s best. Indeed, for investors and commentators on the Chinese tech ecosystem, the key upshot of these developments will be the way that they empower domestic Chinese companies to leverage the benefits of AI without relying on overseas hardware or manufacturing capabilities.