Summary

Recent examples of German supervisory boards adding the role of lead independent director (LID) are useful role models for their peers. A LID can help strengthen trust and improve communication between boards and investors. Additionally, it should foster independent, transparent and well-communicated succession planning, which can be lacking among German companies.

Key takeaways

|

From a governance perspective, we favour a clear division of responsibility at the top of companies and a system of checks and balances on the board. Furthermore, we see value in having more than one channel of communication and engagement between boards and investors.

The 2021 voting season saw the start in the German market of what could prove a new development across the country: two listed companies installed lead independent directors (LIDs) on their supervisory boards.2 As is typical in Germany, both have a two-tier board structure and in both cases the existing chairperson was considered non-independent. One case was Siemens Energy whose new chairperson was a former CEO of its parent company. In the other firm – Fresenius Medical Care – the chairperson had been a member of the board for more than 20 years.3

This year, SAP announced a LID role reacting to investor concerns related to the non-independent chairperson.4 Here, the purpose was also to facilitate investor dialogue. We welcome the introduction of this role in each of these cases and encourage other German companies to consider following suit.

LIDs, also known as senior independent directors, are a key component of governance in a number of established markets. In France and the United States, the position is frequently used to counterbalance the combined role of chairperson and CEO. Additionally in the UK and Ireland, the role of LID is also well established on public company boards, irrespective of their leadership structure.

What does a lead independent director do?

As a fully independent member of the board, the LID provides counsel to the chairperson in “normal” times and contributes to the effective functioning of the board. The LID is also an independent point of contact for other board members, company executives, investors and other stakeholders who may be unable or unwilling to raise issues directly with the chairperson.

In times of stress or when the company is facing a crisis, the LID could be expected to help resolve the situation. This might involve liaising with external stakeholders, including investors, where this cannot be done effectively by the chairperson or company management. We also see the LID as instrumental in assessing the chairperson’s performance and leading the process of nominating and installing a successor.

Experience from other countries shows that a LID can be a valued intermediary between the chair or the board as a whole and investors. This is especially true when there are differing views on the best strategy ahead, where investors are dissatisfied with their interactions with the chairperson, or where the chair of the supervisory board is not considered independent.

The role of the LID in the German context

While we acknowledge that introducing the concept of a LID in Germany may not always be straightforward, there are several scenarios where the role could add value for companies and investors alike:

- During succession planning and the transition to a new chairperson, it is not always clear who investors should approach to discuss the future composition of the board. The outgoing chairperson is no longer the appropriate point of contact, and the deputy chairperson (usually an employee representative) is neither responsible for such decisions nor an objective representative of shareholder interests. In this situation, a LID – who should ideally chair the nominating committee – could lead the selection process for the new chairperson, representing an independent point of view and thus avoiding the involvement of the previous chair in the selection process. As such, the individual would provide an alternative channel of communication for investors and be a continuous point of contact in times of transition. Combining the role of LID with chairing the nominating committee should foster independent, transparent and well-communicated succession planning, which is lacking among German companies.

- Investors may have legitimate concerns over the chairperson’s independence, qualifications or performance which can result in dialogue between them becoming confrontational. Acting as a valuable intermediary between the board, the chairperson and shareholders, the LID can enable investors to express their concerns and expectations openly, ensuring that the entire board is made aware of their views. Having an independent, objective channel to the board in these circumstances can allow honest and constructive conversations to take place. This ultimately builds trust between boards and investors.

- Periods of difficulty for companies and their boards can arise from the deteriorating global economy, litigation undermining public trust in company leadership, cases of large transactions that have attracted negative publicity or, as in the last couple of years, the Covid pandemic. In these situations, the chairperson may have adopted a position that is seen as too closely aligned with the management’s strategic decision-making and is therefore perceived as lacking independence. In such instances, the LID can provide a means of communication between the board, management and investors, strengthening trust among investors and the wider public alike. Experience from other countries shows that, in difficult situations, a LID serving as chair of a combined nominating and governance committee can help to resolve litigation or other governance issues that could affect the company’s valuation.

An important addition to the governance framework

We believe the role of LID can add significant value in the German system of two-tier, co-determined boards. It should be an independent role that complements the chair of the supervisory board. The LID should always chair the nominating committee but could also chair a combined nominating and governance committee with responsibility not only for succession planning and shareholder concerns, but also for broader governance and litigation issues.

Most importantly, the role should not be a substitute for the chairperson. Rather, it exercises a complementary set of powers and responsibilities in the interests of the company and its investors. Once nominated, investors would expect the two roles of chairperson and LID to establish a constructive and practical division of responsibility that supports the distribution of tasks required of the two positions and helps them to exercise their roles effectively. Clear disclosure is required on the role and responsibilities of LIDs to assure investors about the scope of these tasks.

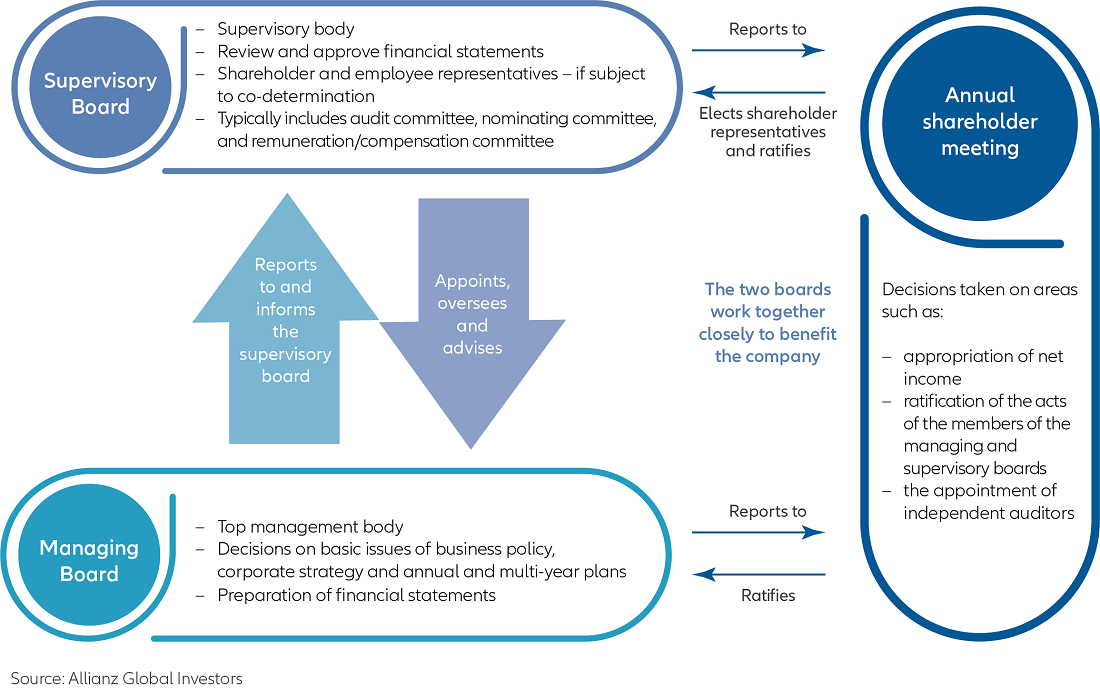

The two-tier board structure

1 Nominating and governance committees are a group of board members who are responsible for the selection of board members as well as ensuring good governance practices.

2 The supervisory board and management board are the two-tiers of board structure predominantly observed with German companies.

3 Disclaimer: issuer companies are named for illustrative purposes only, this shall not be deemed an offer to sell or a solicitation of an offer to buy any security, strategy, investment product or services nor shall this constitute investment advice or recommendation.

4 Corporate Governance | SAP Investor Relations, February 2022

5 Deloitte, The German Supervisory Board: A Practical Introduction for US Public Company Directors, 2021: In most companies with more than 2000 employees, half of supervisory board members are to be elected by employees, while for companies with 500-2000 employees, this applies to one-third of the board.

Issuer companies are named for illustrative purposes only, this shall not be deemed an offer to sell or a solicitation of an offer to buy any security, strategy, investment product or services nor shall this constitute investment advice or recommendation.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

China poised to bounce back

Summary

Allianz Global Investors’ 2022 Asia Conference explored how China’s commitment to pro-growth policies and the economy’s continuing dynamism were helping reinvigorate the country’s long-term investment prospects after a challenging period.

- Stability is emerging as a priority for Chinese policymakers following uncertainty created by China’s zero-Covid policy, regulatory crackdowns and slowing global growth

- Decarbonisation is a key theme: the government’s commitment to being carbon-neutral by 2060 is opening investment opportunities outside the normal areas of electric vehicles and renewables

- Technology and innovation, the driving force for China’s economy and equity market, is opening up opportunities in a range of sectors

- In the broader Asia region, a credit crunch for middle-market companies is creating openings for investors in private credit