Navigating rates

Four reasons why many portfolios hold too much risk (and what to do about it)

For a long time, US equity markets have been largely driven by the gains of a few big names. But recent volatility has demonstrated the risks of extreme market concentration. We believe an alternative strategy is needed: an active approach that invests in more diversified assets.

Key takeaways

- Portfolios that are weighted by market capitalisation may make sense when equity markets are operating efficiently but that may not be the case currently.

- Several factors, including the assumption that US stocks always deliver in the long run, lead us to believe that equity markets may not be working efficiently at present.

- We think uncertainty about whether a small number of large US companies will continue to do well will encourage more investors to rebalance their portfolio to increase diversification.

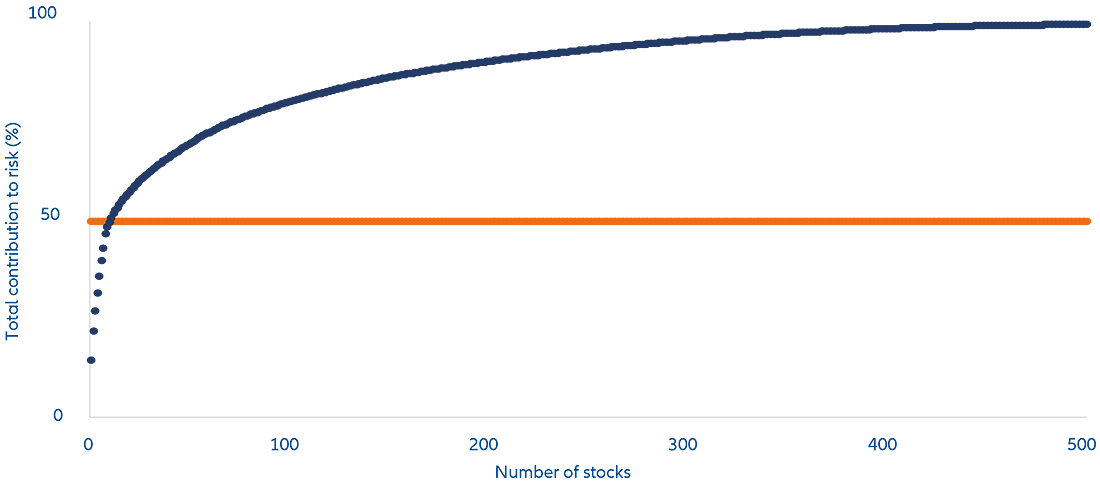

Imagine reviewing a portfolio of hundreds of stocks to find that just 10 shares account for half its total market risk, leaving the rest of the risk dispersed across the hundreds of remaining stocks – the weights of most of which are close to zero.

Most investors would conclude that this investment approach lacks diversification.

However, this is precisely the situation many investors find themselves in due to their allocations to US large-cap stocks (see Exhibit 1). Most will have built their exposure via a passive approach that invests in a cap-weighted market portfolio where each constituent’s market capitalisation determines its weight.

The risks of highly concentrated portfolios were vividly highlighted this year. First, advances announced by Chinese artificial intelligence start-up DeepSeek in late January 2025 led to outsized losses in the US stock market. Second – and more recently – a brewing global trade conflict after the rollout of US tariffs has further dampened sentiment towards US equities.

We believe such events demonstrate the need for an alternative strategy: an active approach that invests in a broader diversification of assets.

First, let’s explore how so many investors ended up with portfolios that rely on the performance of so few stocks. The quick answer is that they relied on markets being efficient when there is growing evidence that they have been anything but in recent years.

Exhibit 1: Just 10 stocks account for half of the US large cap stock market risk

Note: Risk split sorted by single-stock risk contribution.

Source: AllianzGI, using Bloomberg data for a US large-cap index with 500 constituents. As of 27 March 2025, based on short-term risk estimates (ie, contribution to portfolio volatility).

The efficient markets theory challenged

The huge concentration of just a few stocks poses a challenge to efficient markets. The efficient markets theory states that capital markets, through the collective actions of investors, determine the fair market value for each company at any given moment. This process could be thought of as an “optimisation engine” that determines the overall make-up of the market. If this engine works smoothly, it makes sense to invest in a cap-weighted market portfolio. All things being equal, the main way to do this might be through a passively managed portfolio that replicates the composition of the market.

But several factors lead us to believe that this “optimisation engine” and – as a result, equity markets – may not be working efficiently at present:

- Many investors assume that US stocks always deliver in the long run: Indeed, the S&P 500 has performed spectacularly in recent years – delivering a remarkable 788% total return between 2009 and 2024. The rewards investors have enjoyed as a result have left some with the sense that strong performance will continue. But given this performance, the US stock market now looks expensive: US stocks have a market capitalisation of around USD 65 trillion1 – equivalent to nearly double annual US GDP and about 50% of global market capitalisation.

- Passive flows have pushed up stock prices: Huge inflows into passive US equity portfolios in recent years have inflated the prices of market cap-weighted indices, and especially those of their biggest constituents (such as the Magnificent 7 US tech giants). As these heavyweight stocks have outperformed, the attractiveness of passive investing has risen, reinforcing the trend of spiralling prices.

- Being part of the consensus may offer false comfort: The above two trends – the belief in the continued strength of US equities and the price spiral caused by passive flows – have resulted in a wide variety of portfolios having remarkably similar compositions. Some investors take comfort from lining up with the consensus rather than adopting a contrarian allocation. However, the more investors that stick with the “herd”, the smaller the risk premium as increased demand for the biggest stocks reduces the potential reward.

- Speculators have fuelled market exuberance: Market exuberance can be driven by investors allocating to the US market simply because they feel compelled to participate. Their interest may be piqued by the market’s past performance, rather than its current fundamentals and future return potential. Such investors are most likely to allocate to the best performing stocks, driving their prices up even more.

Active management can deliver a more diversified approach

Many investors believe that their performance is driven by hundreds of stocks. In fact, their portfolios may be disproportionately influenced by just a few big holdings. A significant number of portfolios are currently so concentrated in a handful of US companies that to enjoy further success they are reliant on two trends persisting: i) the US continuing to outperform, and ii) outsized returns from mega-cap companies involved in artificial intelligence.

We think uncertainty about whether those trends will continue will encourage more investors to reassess their positioning. That shift may mean a portfolio rebalancing from passive investing principles to increase diversification. Those contemplating such a move should consider acting early – many investors selling their biggest holdings at once could undermine stock market performance.

In our view, the current environment represents a significant opportunity for active managers. Active management can help investors to add a wider mix of assets and asset classes to their portfolios – including broader equities, fixed income, commodities and alternatives. The goal is to deepen portfolio diversification and challenge the belief that investing in the US large-cap stock market alone can continue to serve investors well in the long term. As recent events have shown, investors always need to be ready for the unexpected.

1 As per 27 March, 2025