Navigating Rates

Emerging market short duration bonds – an attractive diversifier?

Emerging market debt has shown resilience in a year that has brought significant market volatility and uncertainty in global trade relations. In this environment, we think short duration bonds could be a useful way to diversify portfolios.

Key takeaways

- Sound reforms and structural improvements have put emerging market (EM) countries in a stronger position to weather volatility than before.

- EM short duration hard currency bonds may offer higher spreads than comparable developed market bonds without exposure to local currencies and with low interest rate risk.

- The universe is geographically dispersed among 80 countries including both sovereigns and corporates, investment grade and high yield issuers.

In the first part of the year, markets have been volatile, driven by significant uncertainty surrounding US tariffs. However, despite the sizeable macroeconomic shock delivered by President Donald Trump’s “liberation day” tariff announcement on 2 April, emerging market (EM) assets look relatively well positioned – especially hard currency bonds, namely those issued in US dollars rather than local currencies.

One reason for this is that many of the larger constituents of the EM debt universe have been relatively lightly touched, particularly in Latin America and the Middle East. In fact, the highest tariff risks seem likely to fall on smaller, open economies in Asia, such as Vietnam, Taiwan and Thailand, which are not large exposures in EM debt indices.

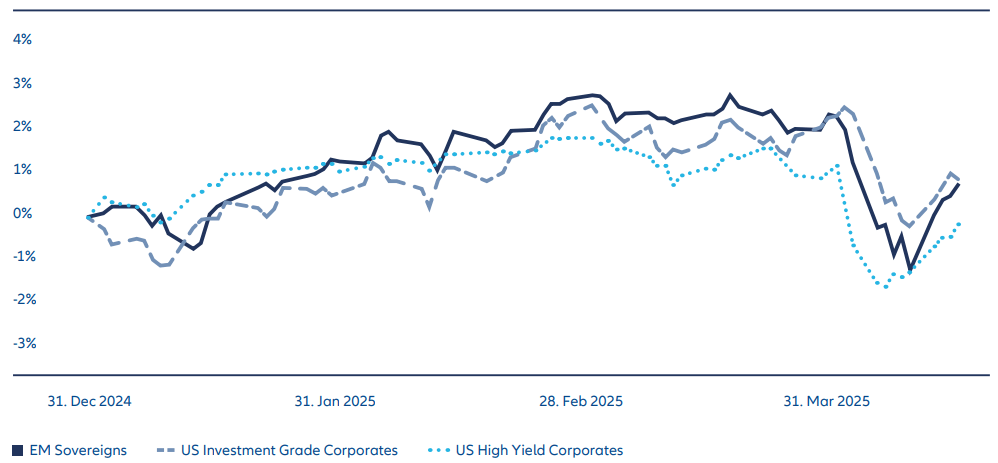

Thanks to these and other trends, EM assets have remained buoyant despite the challenges. In spite of spread widening across credit markets, EM hard currency bonds have performed well comparedwith equivalent developed market assets (Exhibit 1). We believe this performance can continue given the strong fundamentals we see in the EM debt universe.

Exhibit 1: Despite tariffs, EM sovereign debt has performed well compared with US bonds

Source: AllianzGI, Bloomberg as at 18 April 2025.

These strong fundamentals include a range of economic and structural factors. For example, in recent years many EM countries have undertaken sound reforms and turned to conservative, conventional economic policies. Many countries in the EM universe responded prudently through the pandemic years and also during the energy shock that followed the Russia-Ukraine conflict, demonstrating stability.

In the last two years, the universe has seen far more ratings upgrades than downgrades, demonstrating that credit agencies tend to agree with our positive outlook. Today, emerging market indices typically hold an average rating of investment grade.

And it’s not only emerging market sovereigns that have achieved significant improvements in their fiscal positioning. In the last decade, EM corporates have typically reduced leverage and improved liquidity positions, resulting in better credit metrics. Additionally, most EM corporate issuers diversified their business models to improve resilience to external shocks.

All these factors, we believe, make EM debt a compelling asset class. Within this universe, we think short duration hard currency bonds offer a particularly appealing combination of return potential and defensive qualities.

Short duration may offer a sweet spot for credit investing

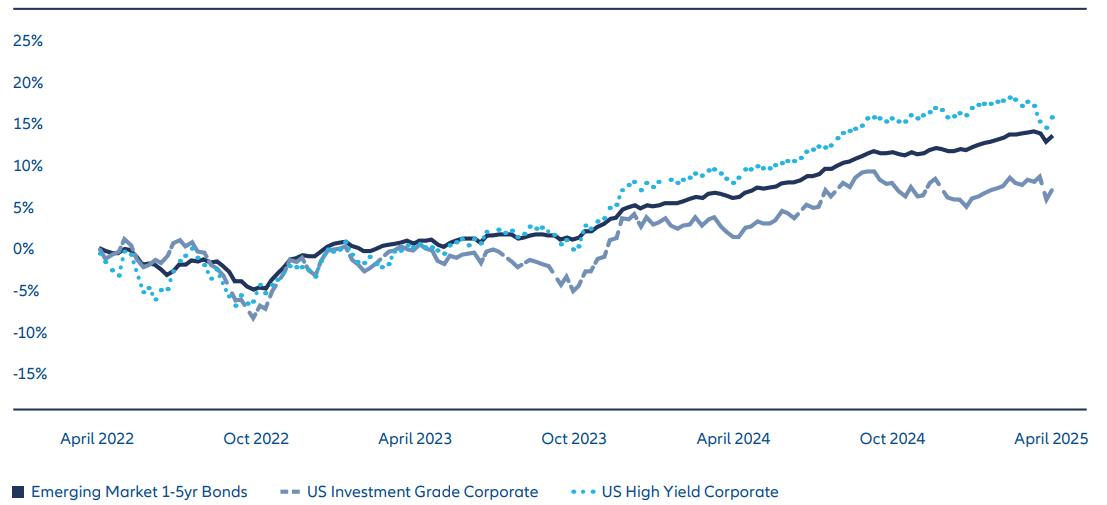

Bonds issued by EM sovereigns and corporates with short maturities, typically up to five years, have historically offered attractive risk-adjusted returns. They are less exposed to interest rate risk than longer duration bonds (see Exhibit 2). All things being equal, they tend to have lower credit risks too, since it is easier to assess a creditor’s solvency over a shorter timeline than a longer one.

The credit spread on offer provides an attractive yield relative to cash or money market products, without the typical volatility associated with most credit indices. Additionally, while US Treasury curves have steepened from very inverted levels seen in 2023, they remain relatively flat in historical terms, providing little benefit for extending duration and supporting the appeal of short duration fixed income strategies as a “carry” anchor for an investor’s portfolios.

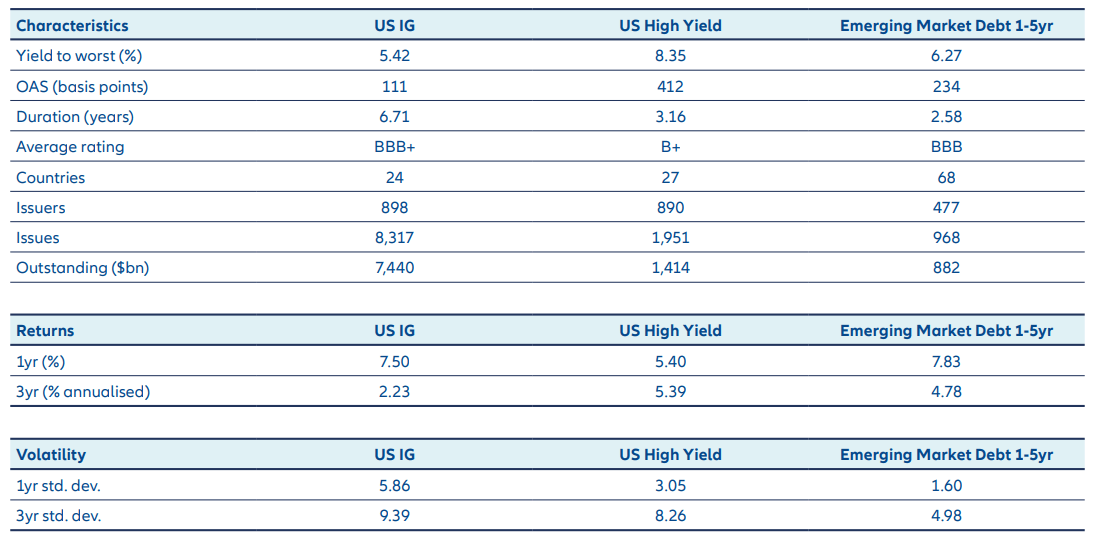

Being emerging market assets, these bonds typically offer a higher risk premium than bonds from developed markets, meaning investors can generally enjoy more attractive credit spreads than are available for US or European corporate bonds. In fact, EM hard currency short duration bonds have historically offered total returns comparable to US high yield bonds, and typically better than US investment grade, but with lower volatility (Exhibit 3).

EM short duration bonds include a diverse range of credit opportunities, from high-quality, defensive issuers to higher-yielding opportunities in issuers from growing economies and improving industries. The universe of these assets is geographically dispersed among around 80 different countries from Asia to Latin America (see Exhibit 4). And it includes both sovereign and corporate issuers, allowing investors to benefit from a “blended” strategy that includes both issuer types.

Additionally, EM short duration hard currency bonds are not exposed to currency risk as local currency bonds would be. This removes another source of risk that can potentially impact risk-adjusted returns.

Exhibit 2: EM short duration bonds offer comparable spread to US bonds with lower duration

Source: AllianzGI, Bloomberg as at 18 April 2025. US IG = Bloomberg US Corporate Bond Index. US HY = Bloomberg US Corporate High Yield Index. Emerging Market Debt 1-5yr = Bloomberg EM USD Aggregate 1-5 Year Index.

Exhibit 3: EM hard currency short duration bonds have tended to outperform US investment grade

Source: AllianzGI, Bloomberg as at 18 April 2025.

What are the potential drawbacks with EM short duration hard currency bonds? Because they are relatively insensitive to interest rate changes – ie, they have low duration risk – they would enjoy only limited participation in upside should interest rates fall. As with other EM assets, they may also face a higher liquidity risk than developed market bonds. And compared with developed market investment grade bonds, these assets may also carry higher risks of volatility and capital loss.

Exhibit 4: Comparison of EM short duration bonds with US bonds

Source: Bloomberg, Allianz Global Investors as at 22 April 2025. US IG = Bloomberg US Corporate Bond Index. US HY = Bloomberg US Corporate High Yield Index. Emerging Market Debt 1-5yr = Bloomberg EM USD Aggregate 1-5 Year Index.

A flexible approach may offer the greatest opportunity

Overall, however, we think that EM short duration hard currency bonds offer an attractive solution for investors to meet their return objectives without taking excessive interest rate or credit risks. In an uncertain environment, these bonds are a potentially compelling way to gain exposure to emerging markets and capture risk premium, while keeping a more defensive profile, and without exposure to local currencies.

Within this universe, we think there are good reasons to invest flexibly in an unconstrained approach. Unlike investing in a purely investment grade or high yield strategy, with strict rating requirements, an unconstrained EM debt strategy can take advantage of opportunities across credit ratings. Potential rising stars, or oversold “fallen angels”, can provide opportunities at the boundary of investment grade ratings. This allows the strategy to invest in opportunities with the best risk-reward potential, harvesting attractive starting yields, as well as benefiting from roll-down of credit curves and active trading opportunities.

In our view, the blended universe of EM sovereigns and corporates, including investment grade and high yield issuers, offers a diverse opportunity set in which an active investment strategy can take advantage of the most compelling entry points. Within this universe, we think short duration hard currency bonds are an attractive diversifier in an uncertain world.