Simon Outin

Director of Financials Research, Global

“Monetary policy dilemma at the heart of the recent banking stress”

Questions about the liquidity of the banking sector have loomed large for many investors in recent weeks.

Efforts by central banks to control inflation by raising interest rates can have implications for financial system stability. We believe this monetary policy dilemma is the root cause of the recent stress in the banking sector. In our view, this challenge is here to stay – and we are seeking to adjust our portfolios based on this new reality where liquidity and funding are the most important consideration for markets over the next few months.

With this in mind, we have taken a closer look at the liquidity regulatory disclosures provided by a sample of 50 European and US banks in their Pillar 3 reports. These are mandatory regulatory disclosures banks must make about their levels of capital, liquidity and risk exposure as part of Basel III banking rules.

Our findings: the proportion of stable retail deposits is an excellent indication of credit strength in the current volatile environment

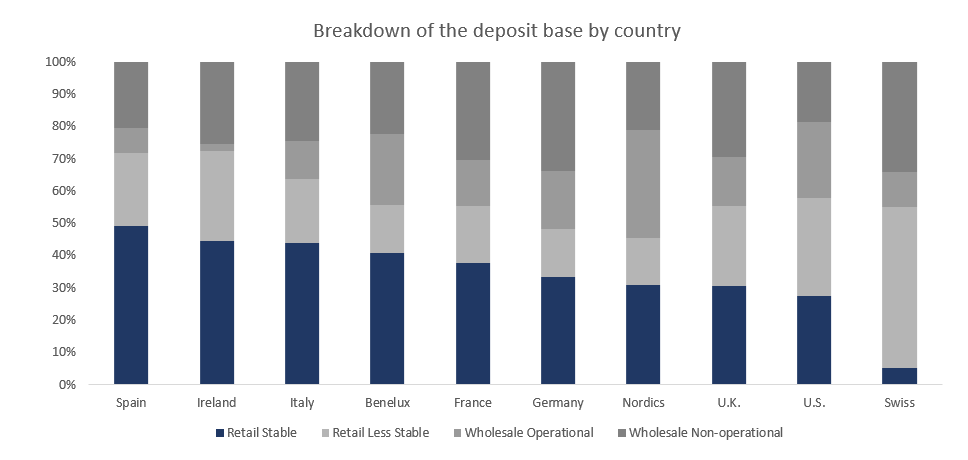

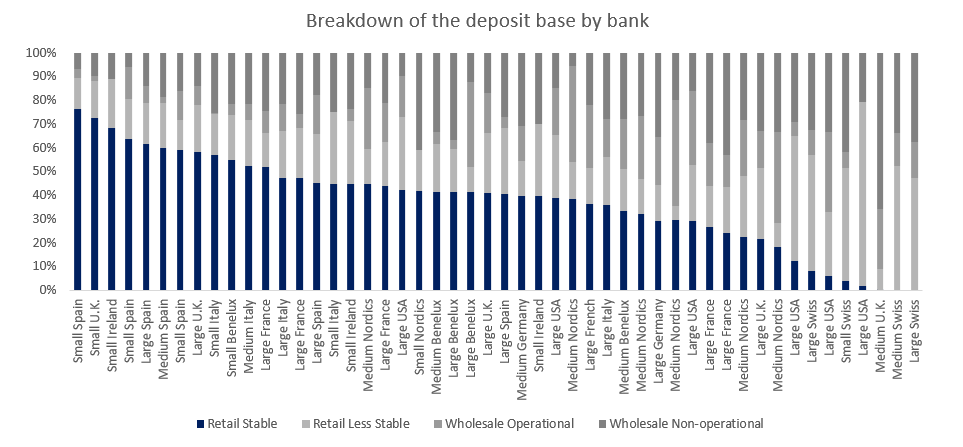

We compared the breakdown of the deposit base across four categories – from the most stable retail deposits (those that are, among other factors, fully insured by an effective deposit insurance scheme or by a public guarantee) to wholesale non-operational deposits, modelled by regulators as the most volatile type of deposits. The categories are defined under the Basel Framework measure of Liquidity Coverage Ratio4 – the proportion of highly liquid assets held by financial institutions to ensure they can meet short-term obligations.

We found significant differences by comparing the deposit base of banks by country (see Exhibit 2). For example, banks in Spain, Ireland, and Italy hold a much higher proportion of stable retail deposits than their counterparts in Switzerland, the UK, or the US. In our opinion, a high share of stable retail deposits is an excellent indication of credit strength in the current volatile environment for two main reasons:

- These banks are potentially more resilient in a confidence crisis scenario as the key funding source is coming from fully insured transactional deposits with a well-established stability track record.

- They rely more heavily on traditional banking business models and are less exposed to corporate and investment banking activities that are potentially more at risk from changes in market sentiment.

Exhibit 2: breakdown of the average deposit base of banks by country

Source: Allianz Global Investors research based on Pillar 3 reports for a sample of 50 banks. Data as at 31 December 2022

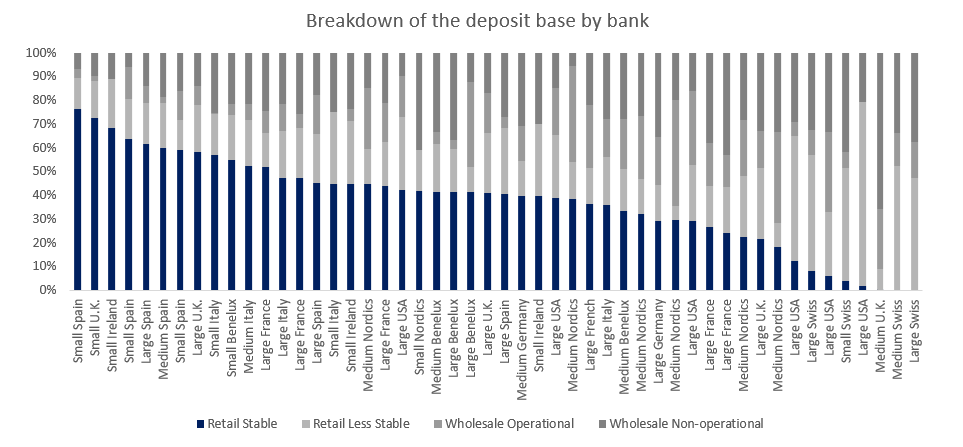

The contrast between deposit bases is even higher when comparing bank by bank (see Exhibit 3). For example, small-sized Spanish and UK banks have a much higher proportion of stable retail deposits. In contrast, large-sized US and Swiss banks hold a bigger proportion of wholesale, non-operational deposits.

Naturally, we consider other factors in our investment decision making. Generally, we believe the most systemic banks – those considered “too big to fail” in a crisis – are likely to emerge stronger because of a flight to quality.

Exhibit 3: breakdown of the average deposit base by bank size

Source: Allianz Global Investors research based on Pillar 3 reports for a sample of 50 banks. Data as at 31 December 2022