Navigating Rates

Can Asian fixed income continue to outperform this year?

We see several reasons why last year’s strong performance of Asian credit may continue over the rest of 2025.

Key takeaways

- Most Asian economies are better positioned to weather trade tensions imposed by the US administration than they were during President Trump’s first term in office, thanks to more diversified trade partners and stronger macro fundamentals.

- We think Asian credit presents a compelling investment opportunity for global investors looking for diversified returns, with particularly attractive return potential in high yield bonds.

- We continue to believe Asia has entered a multi-year virtuous cycle that will lead to lower foreign exchange volatility and significant repricing of local bonds and credits.

The Year of the Dragon, which ended in February, turned out to be a strong year for Asian fixed income. Supporting factors included good export performance from China and a surge in tech and semiconductor exports from countries such as Korea, Taiwan and Malaysia. Several southeast Asian economies saw healthy domestic demand growth, as well as India, which completed elections smoothly.

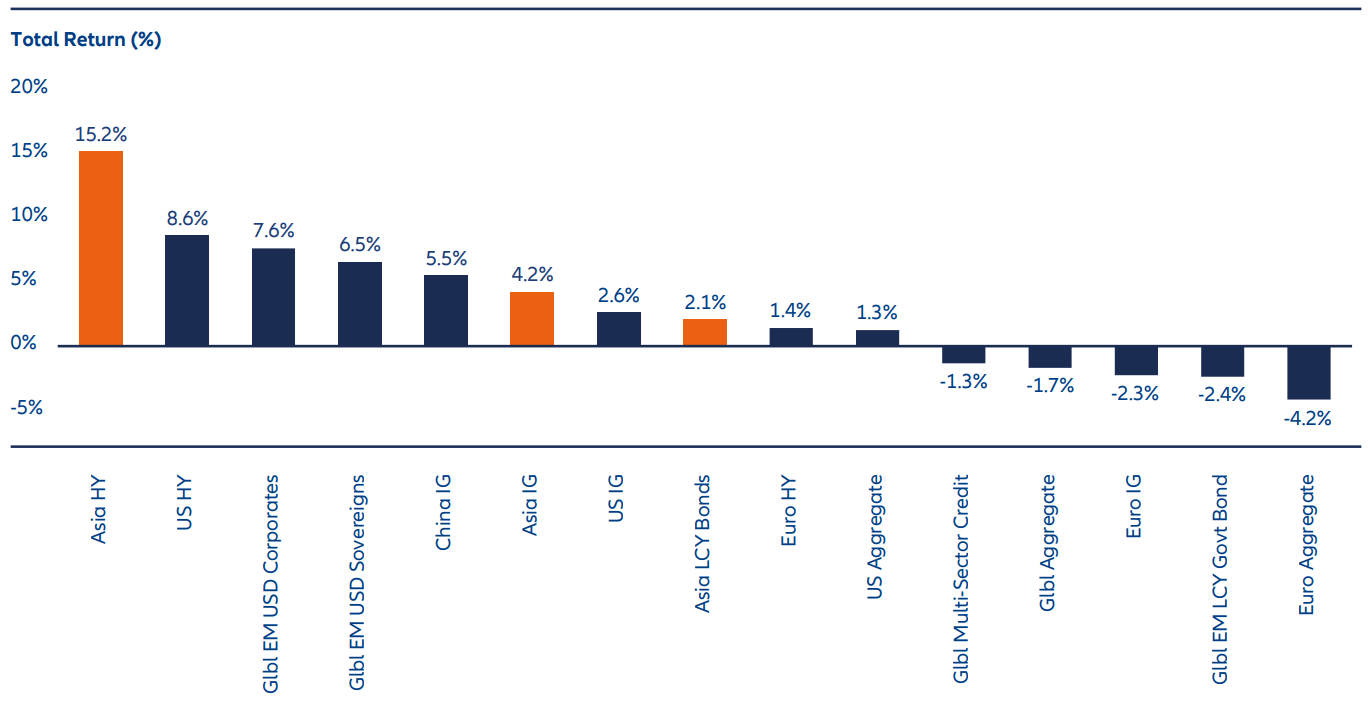

Even frontier countries, such as Mongolia, delivered strong growth, while Pakistan and Sri Lanka made significant progress towards debt restructuring or liability management. Corporate earnings across the region were solid while China’s step-up in policy support significantly reduced tail risks in the system. As a result, sub-sectors within Asian fixed income outperformed their respective peers in other fixed income markets (Exhibit 1).

Exhibit 1: Asian fixed income performed strongly in 2024

Source: Bloomberg; Allianz Global Investors, as at 31 December 2024. Abbreviations include: high yield (HY), emerging markets (EM), investment grade (IG), local currency (LCY).

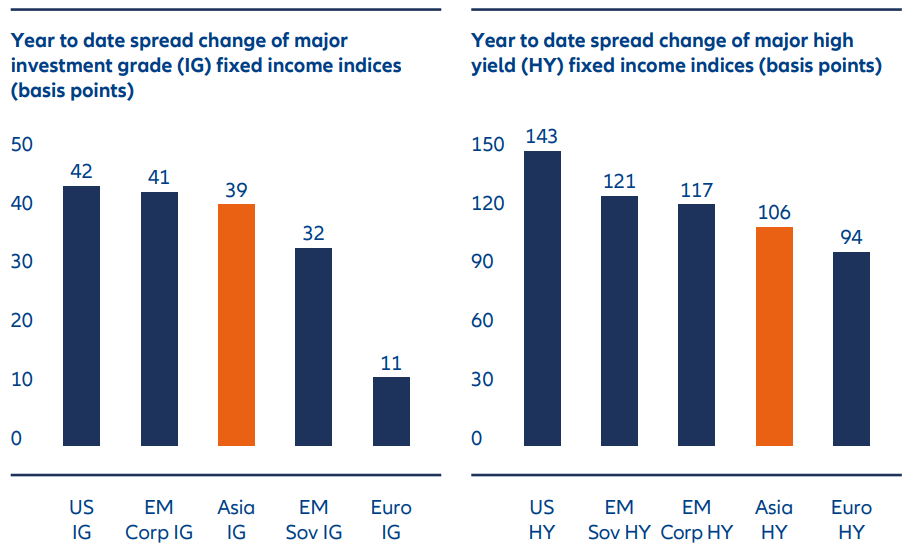

So far this year, amid a period of elevated market volatility driven by US tariff policies, Asian fixed income markets have once again demonstrated their resilience. While the market consensus seems to perceive Asia as bearing the brunt of US reciprocal tariffs, the defensive quality of Asian credit continued to shine through, with Asian credit spreads outperforming US and emerging market peers (Exhibit 2)

Exhibit 2: Asian credit shows continued resilience

Source: Bloomberg, Allianz Global Investors, as of 11 April 2025. Asia Investment Grade (IG) and Asia High Yield (HY) represented by J.P. Morgan Asia Credit Index. US Investment Grade (IG) and Euro IG represented by ICE BofA Corporate index, US and Euro HY represented by ICE BofA HY index, Glbl Emerging Market (EM) USD Sovereigns represented by JP. Morgan EMBI, Glbl EM USD Corporates represented by JP. Morgan CEMBI index. The information above is provided only for illustrative purposes, it should not be considered a recommendation to purchase or sell any particular security or strategy or an investment advice. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

Notably, issuers in China – seemingly at the epicentre of geopolitical tensions – outperformed Asian and US peers in the year to mid-April. Chinese US dollar-denominated high yield has, in fact, been the best-performing high yield market compared with its peers in other regions.1

Can this outperformance continue? US growth remains reasonably resilient, and recent high-frequency data in China has looked a little stronger as the country starts to roll out policy support. Indeed, regional growth data has largely picked up in recent months. With inflation under control, current accounts doing well, and foreign currency reserves being accumulated, some central banks in Asia have started cutting rates.

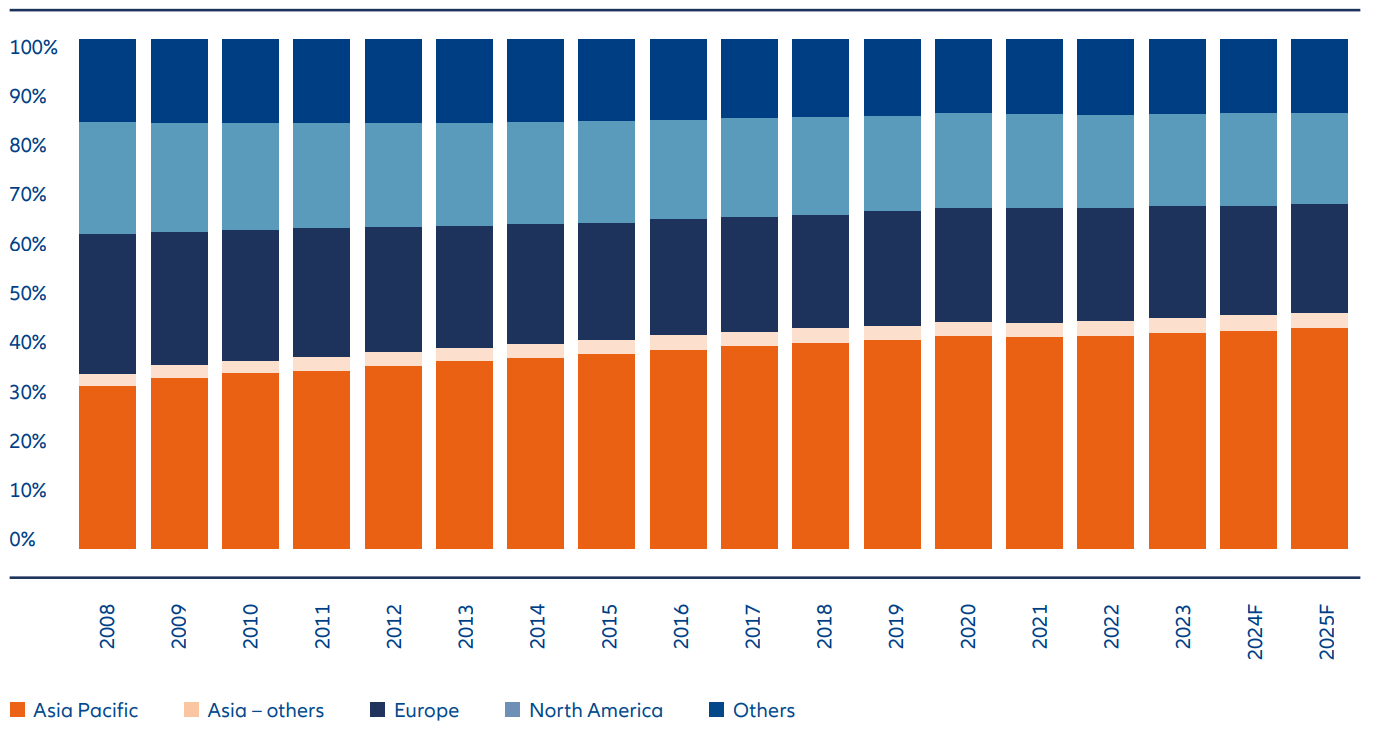

There are headwinds – notably continued uncertainties over US tariff policies – but, on balance, we think it likely that Asia can still lead global growth, continuing the trend seen in recent years (Exhibit 3). We see three reasons why Asian fixed income should continue to outperform in 2025.

Exhibit 3: Asia’s share of global GDP continues to rise

Source: International Monetary Fund, Allianz Global Investors, as at 31 October 2024.

1. Asian countries are better positioned for Trump 2.0

The start of the 2025 brought a fairly resilient US economy and stabilising China growth, as the latter starts to roll out policy support. Conventional wisdom for Asia states that when both China and the US are doing reasonably well, Asian countries benefit too. In particular, if both countries embrace looser monetary and fiscal policies, it usually creates a supportive macro backdrop for Asian economies and markets.

Nonetheless, the re-election of Donald Trump to the White House brings uncertainty – notably on the impact of tariffs imposed on US imports. How much has Asia or China to fear from the second Trump administration?

On a positive note, most Asian countries are better positioned this time around. The region has grown strongly since the last trade war and inflation is more manageable in Asia than in most OECD countries. Barring a few exceptions, such as Vietnam and Thailand, most Asian countries have diversified their trade away from the US and other traditional partners – thanks to the structural improvement of purchasing power within the region.

For example, the US accounted for 15% of China’s exports in 2024 – down from a peak of about 19% in 2018. Moreover, China has moved up the export value chain and become more technologically self-reliant. While China continues to export low-margin goods to the US, such as branded shoes, garments and iPhone assembly, it also exports cars and trains to Southeast Asia and Latin America, and power plants to Central Asia and the Middle East.

This means that from the vantage point of China – and Asia as a whole – the 2025 version of the Trump threat may not look as unsettling as the 2017 version.

That said, the range of possible trade policies in Trump’s second term is wide, and bets on any particular outcome are speculative. We like markets that are less correlated to the US and the rest of the OECD. These include China, India and the Philippines, where central banks are more willing and capable to make decisions driven by domestic factors rather than by what the US Federal Reserve may do.

2. Asia high yield can continue to outperform

Asia’s credit cycle remains largely in the favourable parts of the cycle. The latest corporate earnings have shown stable-to-improving profitability, helping to bring down debt levels across most sectors. We think the solid fundamental backdrop will continue to underpin relatively low spread volatility, leading to potentially good risk-adjusted returns for the broader Asian credit market.

On high-yield credit specifically, we expect another strong rebound in 2025 as the default rate continues to trend down following recent spikes (see Exhibit 4).

Exhibit 4: Asian high yield defaults are on a downward trend

Source: BofA Research, Bloomberg, Allianz Global Investors, as at 31 March 2025.

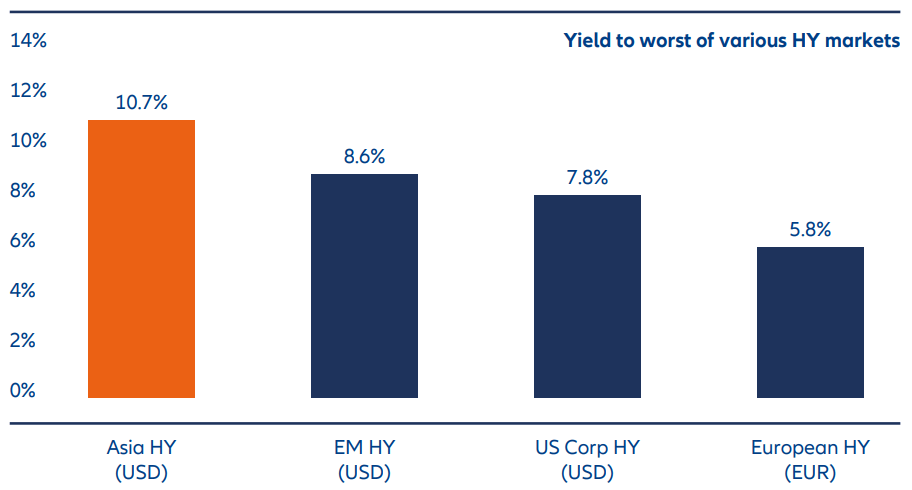

Just like other high-yield markets that have experienced prolonged market stress, the Asian high-yield market now is much more diversified structurally, while remaining attractive compared with other global high-yield markets in terms of yields. Meanwhile, we believe the wide dispersion in valuations across sectors provides opportunities to add value through active management.

To take one sector that has come under pressure – Chinese real estate – we observe that new construction starts dropped to a 20-year low in 2024. This should lead to limited new supply in the next 12-18 month while demand starts to stabilise. Developers that are still standing have weathered a storm and should come out much stronger – in terms of operations, brand name, market share and capital structure.

Overall, we think the Asian high-yield market offers good opportunities for global investors seeking diversified returns.

3. Asia offers diversification in a multipolar world

The world has changed since 2016, when President Trump was first elected. A significant shift is the move towards a multipolar world, where power is increasingly distributed across multiple centres. Seen against this backdrop, the “US exceptionalism” narrative, which assumes Mr Trump can use tariffs to impose pain on the rest of the world without suffering any significant cost to the US, seems unrealistic.

We believe Asia is well-positioned to benefit as the world shifts toward a more multipolar order. Deepening regional trade, economic and financial integration reinforce the region’s structural strengths – favourable demographics, resilient economic fundamentals, with relatively stable, reform-minded leadership – all of which underpin Asia’s relative growth resilience. We believe that this is a multi-year virtuous cycle that is set to reshape Asia’s market dynamics, and drive a sustained decline in currency volatility, which should eventually lead to a structural repricing of bonds and credit assets.

This cycle could add momentum to a trend that has already seen Asian fixed income assets perform favourably compared with similar assets in other regions over the past decade (see Exhibit 5).

Exhibit 5: Historical risk-adjusted returns of Asian investment grade bonds over 10 years

Source: J.P. Morgan, Bank of America, Allianz Global Investors, as at 25 April 2025.

As we navigate ongoing secular shifts and the accompanying macro uncertainty, global investors are increasingly seeking to strengthen portfolio resilience through diversification. With lower beta and correlation relative to other fixed income markets, we believe Asian credit stands out as a compelling source of diversified returns in 2025.

1 Source: Bloomberg data as at 15 April 2025.