Adjusting to the new regime

With interest rates set to stay “higher for longer”, investors are adjusting to a new regime where exuberance will be in short supply. But we see potential opportunities emerging within bonds and equities in the longer term.

Key takeaways:

- Markets are recalibrating as the US Federal Reserve makes clear its focus on fighting inflation by tightening financial conditions

- In equities, further short-term volatility may give way to opportunities as valuations in Europe and Japan have adjusted

- US government bonds may provide openings as they tend to perform well when inflation falls from higher levels

- Russia tensions and EU unity present risks at a time when many economies will face recessions and rising debt levels

While investors navigate a renewed bout of market volatility, they can at least take some reassurance from the US Federal Reserve, whose latest messaging – and direction of travel – is crystal clear.

Announcing a third consecutive 75-basis-point interest rate hike on 21 September, Fed chair Jerome Powell paved the way for further rate rises amid an emphasis – as expected – on rates that will stay “higher for longer”. The absolute focus on fighting inflation at all costs echoes the efforts of former Fed chair Paul Volcker, who helped tame double-digit inflation in the 1980s, albeit at the expense of two recessions.

In effect, we have moved from a “Fed put” to a “Fed call”. Rather than stepping in with accommodative policy to support financial assets, the central bank will use weaker financial assets actively to tighten financial conditions.

Meanwhile, geopolitics remain a headwind. The impact of the Russia-Ukraine conflict on energy prices and, indirectly, the EU economy is now mostly priced into markets. But while gas and energy supplies should be sufficient overall, a harsh winter could risk blackouts and – in a worse-case scenario – stoke tensions among EU countries. The expected victory of a very rightwing government in Italy could also be bad news for EU stability and lead to a further widening of periphery government bond spreads and euro depreciation.

In other words: exuberance is over. What does this mean for markets and investors?

Equities: attractive valuations emerging

Expect further volatility in equity markets in the coming months. The shift to a new regime focused on tackling inflation will be a particular shock for investors with no experience of higher rates and those drilled to “buy the dip”.

While the short-term period might remain volatile, valuations in Europe and Japan are now more attractive than 12 months ago for investors with a long-term investment horizon. For such investors, significant market setbacks have historically offered interesting entry points.

Investors clearly have cash sitting on the side lines. Average cash quotas now exceed even those seen at the height of the global financial crisis, while the number of Bank of America Fund Manager Survey participants who are overweight equities has hit an all-time low, according to the bank’s monthly survey of fund managers for September.

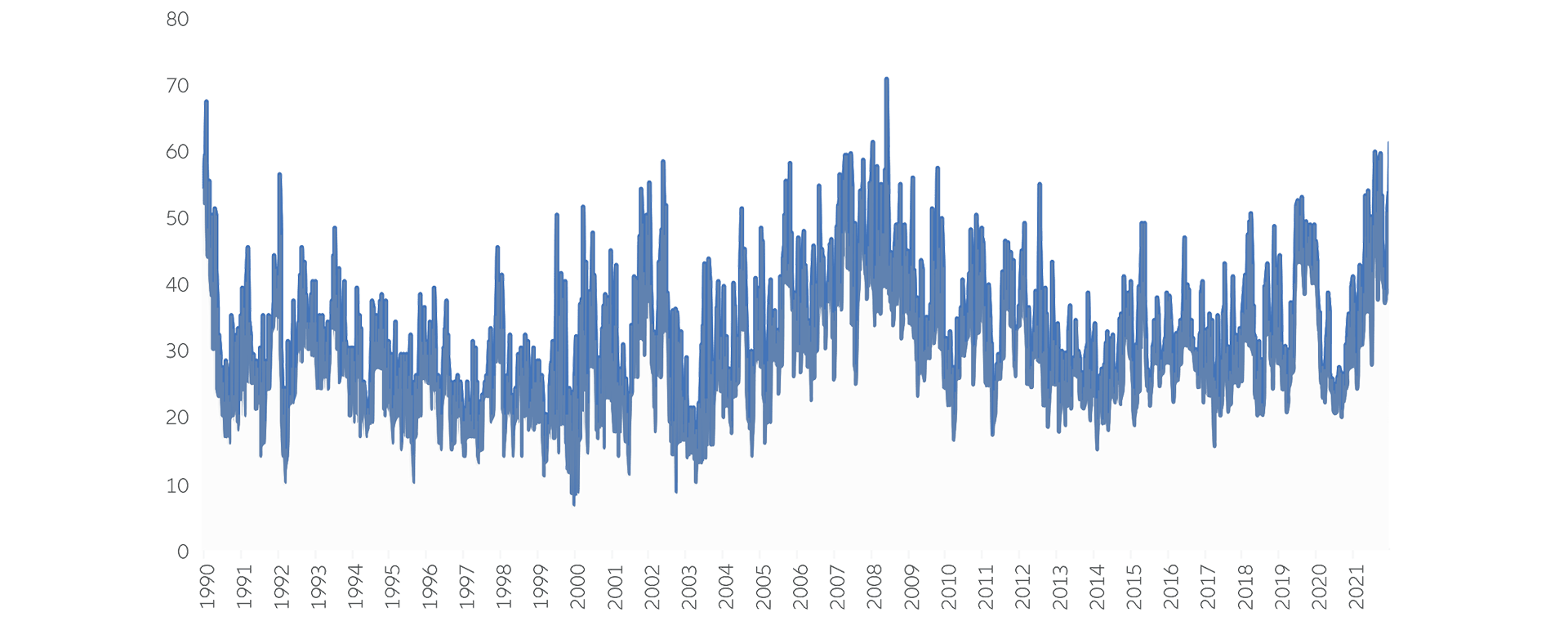

Reflecting their strong cash positioning, fund managers and high-net-worth retail investors are extremely cautious: the AAII Investment Sentiment Survey shows that bearish sentiment among the latter group is at its third highest in history (see Exhibit 1). Such numbers often coincide with major market lows, but we remain cautious about re-entering the markets at this point as this could simply represent a bear market rally.

Exhibit 1: Retail investor sentiment is extremely bearish

Source: American Association of Individual Investors, Bloomberg

Fixed income: diversification opportunities

The picture is more mixed for bond markets. While core inflation and long-term non-transitory inflation indicators remain worrying, the Fed’s hawkish tone and the high probability of a recession in 2023 support a stabilising picture.

So, while an entry point of 3.5% for US Treasury yields might still be too early for many investors, government bonds tend to perform well when inflation falls from high levels. This could also continue to support corporates that still profit from solid coverage ratios – a measure of a company’s ability to service its debt – at least if we assume that a US recession occurs a bit later than originally expected. Timing the way out will be critical as spreads are still far from historical highs.

But the worst could be behind us, at least for government bonds. As headline inflation starts to trend down, recession fears will likely trump concerns about inflation. As a result, government bonds should decorrelate from equities and start offering diversification opportunities again.

Indeed, while in the first half of the year we experienced an exceptional correction – both in terms of downside and volatility – the actual yield and carry on the 10-year government bond is becoming increasingly attractive to many investors. TINA, the familiar adage about buying equities – “there is no alternative” – may no longer hold true as most government bonds yields are now back in positive territory.

Opportunities from the regime shift

The shift to a policy regime focused on tackling inflation, rather than on spurring economic growth, is disruptive – but it also highlights opportunities:

- Green energy: In the short term, the drive for European companies to reduce their dependency on Russian energy may support more “traditional” sources like liquefied natural gas (LNG) and, indirectly, fracking. This could be positive for parts of the US high-yield sector and “big oil”. For the medium term, sustainable energy options are set to prevail. This means tremendous support for “green energy” as low-cost investment becomes possible, governments provide guarantees, and regulatory hurdles are removed.

- Defence and technology: Due to increased geopolitical tensions, sectors such as armaments that have been long underweighted are flourishing again. Given the evolution of the defence sector, technology in general might gain support as governments understand the importance of technology to modern warfare and national security.

- Robotics: As companies address some of the supply chain stresses revealed by Covid, amid higher wage inflation, we may see more automation and robotics rolled out in areas such as industrial production, which would support companies that are active in these sectors.

While investors may need to ride out further market volatility and geopolitical risks in the coming months, opportunities may still emerge within fixed income and equities in the “higher for longer” era.