Our 2020 vision: sustainable strategies may offer a path through volatile markets

In 2020, we expect markets to pivot between embracing and avoiding risk as they process muted economic growth, low rates and heightened political uncertainty. Consider managing risk actively rather than accepting volatile index returns, and think beyond the benchmark by investing sustainably and adopting thematic approaches.

Key takeaways

|

We think 2020 will be characterised by muted global growth, a slower US economy and continued uncertainty about how monetary policy and politics will move markets. In this environment, investors should aim to keep their portfolios on track by having conviction and actively managing risk – not avoiding it.

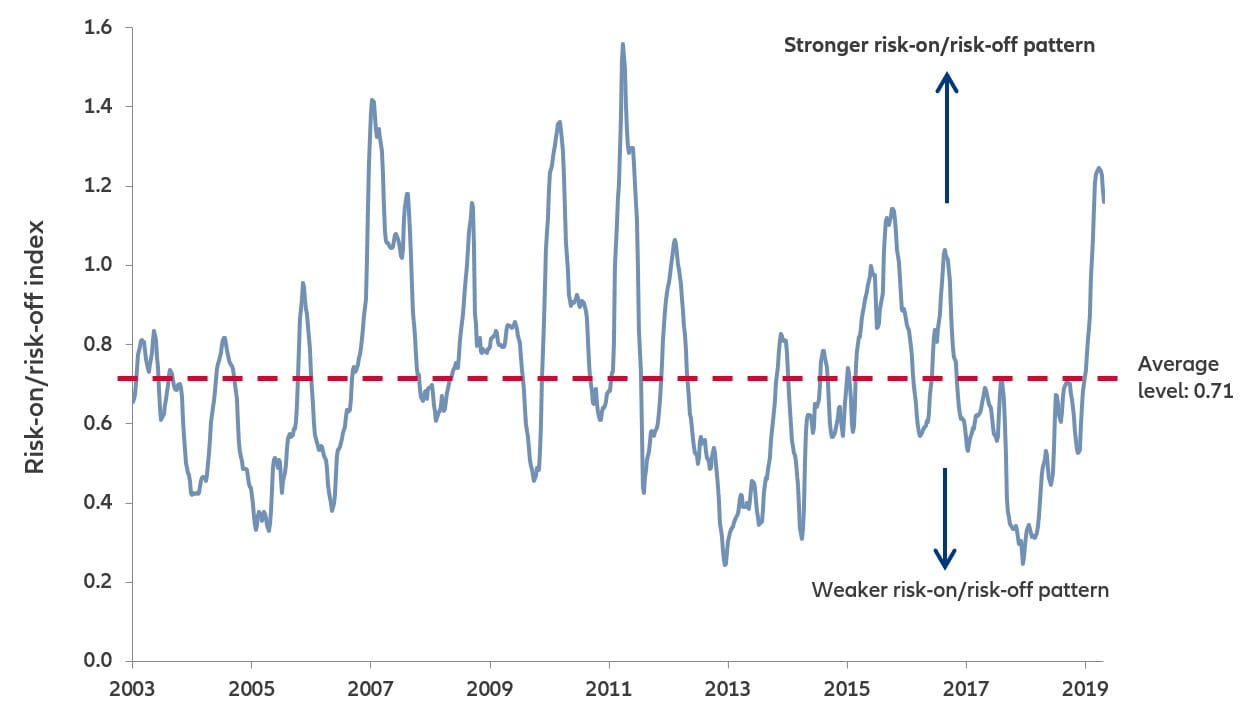

Major political developments, including US President Donald Trump’s bid for a second term in office, are on the horizon. This will likely contribute to wide “risk-on/risk-off” movements as sentiment swings between riskier and “safer” asset classes. We expect low beta returns for the overall market, which makes pursuing alpha – in excess of market returns – all the more important.

Risk-on/risk-off pattern is more visible again

Source: Allianz Global Investors Economics & Strategy; Bloomberg; Refinitiv; HSBC. Data as at 25 Oct 2019. Risk-on/risk-off index = average correlation between risky assets + average correlation between safe assets - average correlation between risky and safe assets (rolling 180-day correlations).

Central banks will remain a major market driver in 2020, even as their efforts to spark economic growth become less effective and today’s ultra-low interest rates provide less room for manoeuvre. Rates have been negative in Europe and Japan for some time, and the US Federal Reserve (Fed) has resumed cutting rates that were already low. This approach has supported stocks and other financial assets, but it has also artificially inflated their prices – and contributed to wealth inequality – while not restoring enough economic growth. Facing dwindling options, central banks will likely continue offering additional stimulus with limited effect. Governments may need to shoulder some of the burden by increasing spending, reducing taxes or both.

Unless they want to chase index performance in this up-and-down environment, investors will need to address risk in a deeper, more holistic way – for example, by focusing on climate change and other risks that a company may face as it produces its goods and services. Incorporating environmental, social and governance (ESG) factors into investment decisions can help manage risks and improve return potential. So can thematic strategies that help investors align their portfolios with their convictions about how powerful long-term shifts – triggered by innovation or regulation – could create investment opportunities.

There is no guarantee that actively managed investments will outperform the broader market. Investments in alternative assets presents the opportunity for significant losses, including losses that exceed the initial amount invested. Some investments in alternative assets have experienced periods of extreme volatility and in general, are not suitable for all investors.

1010493

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).