Two-Minute Tech

Chipmakers rode the first generative AI wave. Who’s next?

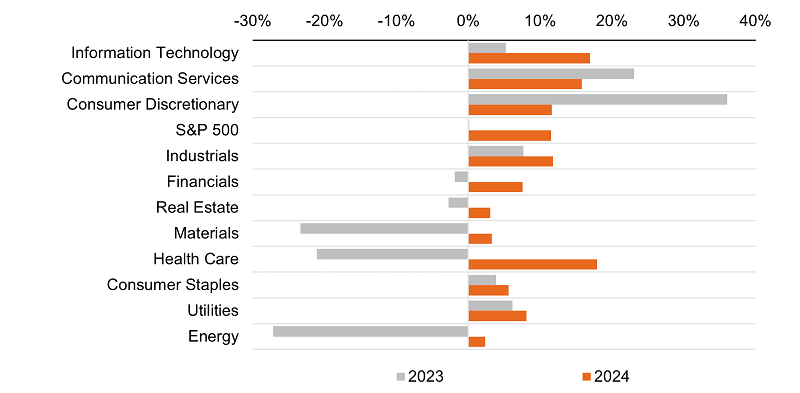

Artificial intelligence certainly made headlines in 2023, but how many companies actually made money from it? ChatGPT and other generative AI tools have directly benefited a small number of stocks so far – particularly the semiconductor firms that make essential chips. However, we believe that could start to change. Here are some of the key factors to watch as this narrow market begins to broaden.

- As new technologies are adopted, infrastructure companies have traditionally been the first to benefit – and that matches what we’re seeing today with the generative AI cycle.

- Hyperscaler stocks are lagging semiconductors for now. Markets want to see more of an impact on earnings before bidding up share prices.

- Despite the enthusiasm from software companies investing in AI, that’s not what’s fueling their stock prices – yet.

Three things to watch as we move through the gen-AI investment cycle

#1: In prior tech cycles, infrastructure was the first to benefit from new technologies, but other parts of the tech stack weren’t far behind.

How have the public markets’ forward discounting mechanism assessed the impact of ChatGPT and other generative AI (gen-AI) technologies? Until now, much of the gains have gone to the infrastructure providers that have shown actual earnings from gen-AI – namely the handful of semiconductor companies whose chips are critical for training large language models (LLMs). This is not unlike past tech market cycles, when the companies that provided the infrastructure for new technologies saw benefits well before other parts of the tech stack. Yet some of the very same chipmakers that have benefited from AI are limited by capacity constraints even amid growing demand for their chips from “hyperscale” cloud platforms. This may bode well for a broader swath of semiconductor firms.

#2. Stock prices for hyperscalers are lagging semiconductors – at least for now. Markets want to see more of an impact on earnings.

Large-scale cloud service providers called “hyperscalers” (shown as platform providers in the accompanying chart) are essential to fulfilling AI’s promise, since they’re the only ones equipped to handle the enormous data requirements. These firms outperformed the broader market in 2023, though a handful of chipmakers did far better. The performance dispersion among gen-AI platform and software players is subtle – mostly reflecting the near-term trajectory of earnings, which are still being driven by legacy revenue sources and overall expense discipline. We believe the market is taking a wait-and-see approach in valuing gen-AI benefits for the cloud platforms. These companies are still ramping up their infrastructure investments, which can dampen earnings growth trajectories in the near term. Many are also launching AI-related products and modules that have yet to demonstrate meaningful earnings contributions. We expect greater clarity on gen-AI’s impact in the coming year.

One year post-ChatGPT launch, gen-AI platform and software providers did well, but lagged infrastructure

Total returns (21/11/2022-21/11/2023; indexed to 100)

Source: FactSet, Voya Investment Management as of November 2023. The Gen-AI composites are equal weighted baskets of companies that were top mentioners of Gen-AI in earnings call transcripts. The composites were created by the Voya Investment Management Global Artificial Intelligence Equity Team. Gen-AI platforms = major hyperscale cloud providers. Gen-AI infrastructure = companies that belong to the semiconductor & semiconductor equipment and technology hardware & equipment industry groups. Gen-AI software = companies in the software & services industry group, excluding the major hyperscale cloud providers. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

#3. The big software companies expanding with AI haven’t (yet) seen a corresponding share price jump.

Since ChatGPT made its public debut in late 2022, several high-profile software companies moved quickly to add LLM and gen-AI capabilities to their products. Not surprisingly, their management teams expressed a great deal of enthusiasm about the opportunities they believe their gen-AI investments will provide. Yet in our view, this technology’s full potential has so far not been fully reflected in earnings expectations or meaningful earnings multiple expansion. Generally speaking, as markets recognise improved long-term growth potential, valuation multiples should increase. But that hasn’t happened yet. From our perspective, the majority of price appreciation for these names in 2023 was due to the increase in forward estimates of operating income. Meanwhile, the average/median valuation multiple remained relatively flat year over year.

The bottom line: Cloud and software companies could be next to benefit from AI investments, but markets likely want to see positive earnings news first

Despite a dynamic year of AI news, it appears that LLM/gen-AI developments have benefitted a small subset of beneficiaries. Semiconductor companies whose chips power these AI models have grown the most. Certain cloud platforms and software companies have also done well, but it seems their recent performance has come from legacy revenue and earnings sources – not enthusiasm for potential benefits of gen-AI. This reinforces why we seek to not only identify key emerging technologies, but which phase of the tech cycle we’re in – and which companies might benefit from each phase. In today’s environment, we believe cloud platform providers and software companies may be the next to reap gains from the gen-AI tech market cycle, but stock prices will likely not reflect that until it’s clear there will be a positive impact on earnings.