The India Briefing

Venture India: the startup super-cycle

This month, we take a look at developments in India’s thriving startup community and the creative thinking and supportive policymaking leading to a broader set of investment opportunities.

Please find below our latest thoughts on India:

- June has delivered a series of favourable developments to Indian equity markets. Softer inflation data, real GDP growth at 7.4% year-on-year in the March quarter (coming in above consensus expectations of 6.8%), a deeper than expected 50 basis point cut to the repo rate, and a surprise 100 basis point reduction in the Cash Reserve Ratio (CRR) were some of the notable highlights (see India shifts gears | Allianz Global Investors).

- At the corporate level, the recent reporting season suggests that negative earnings revisions are likely to improve after an eight-month downturn, and domestic retail investors continue to support local shares with steady inflows.

- This positive momentum has fed through to a significant equity market recovery after the pullback earlier this year. Nonetheless, India equity returns are quite muted year-to-date, up 2.8%.1

- Geopolitical jitters linger in the background as the terms of a much-awaited bilateral trade deal between India and the US are still pending and new external risks have arisen in the Middle East.

- Gold, deeply loved by Indians for wedding/festival jewelry and as an investment, has returned around 30% this year, outperforming other “safe haven” assets like US Treasuries – boosted in good part by a weaker US dollar.2

- This is important, as 14% of the world’s total gold stock is owned by Indian households and government. With gold prices hitting USD 3500 per ounce, the wealth effects for Indians are significant.3

- Evidence suggests that Indian jewelry demand has softened against record high gold prices, yet investments into gold remain robust. In our view, some of this is due to momentum chasing, but it also can be attributed to gold’s perceived diversification benefits.

- It appears that investors globally are seeking diversification. Foreign investors (FIIs) were net buyers of USD 1.3 billion in Indian equities in May. This marks the second month in a row of net FII buying following previous outflows. May saw more than double April’s net inflows.4

- Overall, Indian equities represent a large and liquid USD 4 trillion opportunity set that continues to grow. MSCI India today includes roughly twice the number of constituent stocks than it did a decade ago, reflecting a broad and deep investable universe with diverse sector and thematic representation.

- In each of the last two years, India has been crowned the most vibrant IPO market in the world based on the number of new listings. As well as the number of new companies coming to market, some Indian IPOs have also been unicorns or “jumbo” deals, raising more than USD 1 billion.5

- Many of these newly public companies are the product of home-grown Indian talent and resources.

- AI, baby care, quick commerce, renewable energy, co-working, biopharma, and mobile payments are just a few of the categories that have seen new listings.

- Not every IPO is a success, of course, but collectively they help sustain the forward-looking market dynamic by promoting entrepreneurship and innovation, attracting fresh capital, boosting liquidity, and creating jobs for India’s young, well-educated population.

- In fact, the startup community in India is thriving. Supportive government initiatives include programmes for incubation and seed funding, credit guarantees for loans to eligible Department for Promotion of Industry and Internal Trade (DPIIT)-recognised businesses, tax exemptions on startup profits in the early years, and other schemes to encourage the entrepreneurial ecosystem.

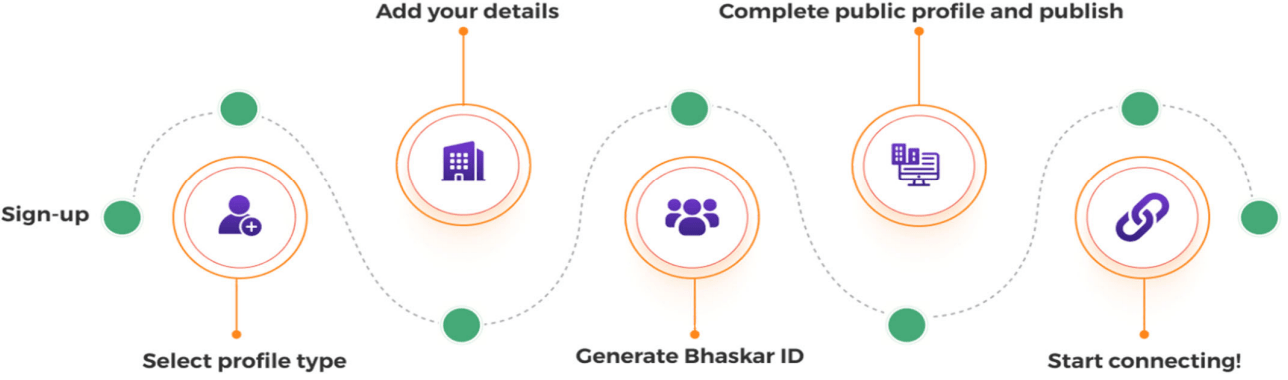

- Consistent with India’s digital revolution, DPIIT launched the Bharat Startup Knowledge Access Registry (BHASKAR) in September 2024 – a digital interface for connecting startups, investors, mentors, service providers, and government bodies. This centralised platform goes a long way in helping startups scale in a secure and transparent way and has added more than 565,000 subscribers in its initial nine months.6

Chart 1: Bharat Startup Knowledge Access Registry (BHASKAR)

- A markedly hot category in the Indian startup and IPO space is quick delivery, a play on consumer convenience. 20-something Indians don’t just want to set trends, they want them delivered in less than 30 minutes.

- Last-minute dinner plans but nothing to wear? Not a problem for 30-minute viral fashion drops. With unit economics for ultra-quick fashion pointing to higher average order values, better margins, and stronger customer loyalty rates than grocery delivery, spontaneous outfit delivery is raising venture capital rapidly.

- This is just one example of channel disruption and innovation. There are many more. A quick scroll through Shark Tank India’s (now in its fourth season) successful pitches showcases diverse categories that extend from vitamin patches, vegan food, and mental health wearables to biodegradable plastics and biofuels, online college counseling, and mixed reality cricket bats.

- In conclusion, we believe the foundation is set for longer-term economic expansion as Indian entrepreneurship accelerates. In addition to favourable fiscal policies, accommodative monetary measures, and improving corporate earnings growth, India’s startup community represents a key pillar of economic development.

1 IDS, Allianz Global Investors, as of 20 June 2025

2 JP Morgan, A New High – Gold price predictions, as of 10 June 2025.

3 UBS, India and gold: all that glitters, as of 17 June 2025.

4 Citibank, India Mutual Funds snapshot May 2025, as of 13 June 2025.

5 White & Case, APAC lifted by bumper year for Indian IPOs, as of 27 March 2025.

6 https://startupindia.gov.in/bhaskar