The China Briefing

The AI buzz continues

AI has overtaken the GDP target as the key focus of China's annual parliamentary meeting this year

Please find below our latest thoughts on China:

- The curtain has just fallen on the week-long annual meeting of China’s parliament. The so-called “Two Sessions” is closely watched as it sets the policy agenda for the year ahead.

- In most years, the main focus is on the GDP target. This year, however, AI fever has swept the political huddle.

- Indeed, the emergence of AI as a key topic has sparked a new narrative for China's economy, with policymakers and regulators emphasising the importance of innovation and technology, and considering new approaches to support private companies.

- The breakthrough success of DeepSeek has turned the spotlight on the company’s hometown – Hangzhou. As well as being home to tech giant Alibaba, it is also famous for six hot mainland start-ups often referred to as “Hangzhou’s six little dragons”.

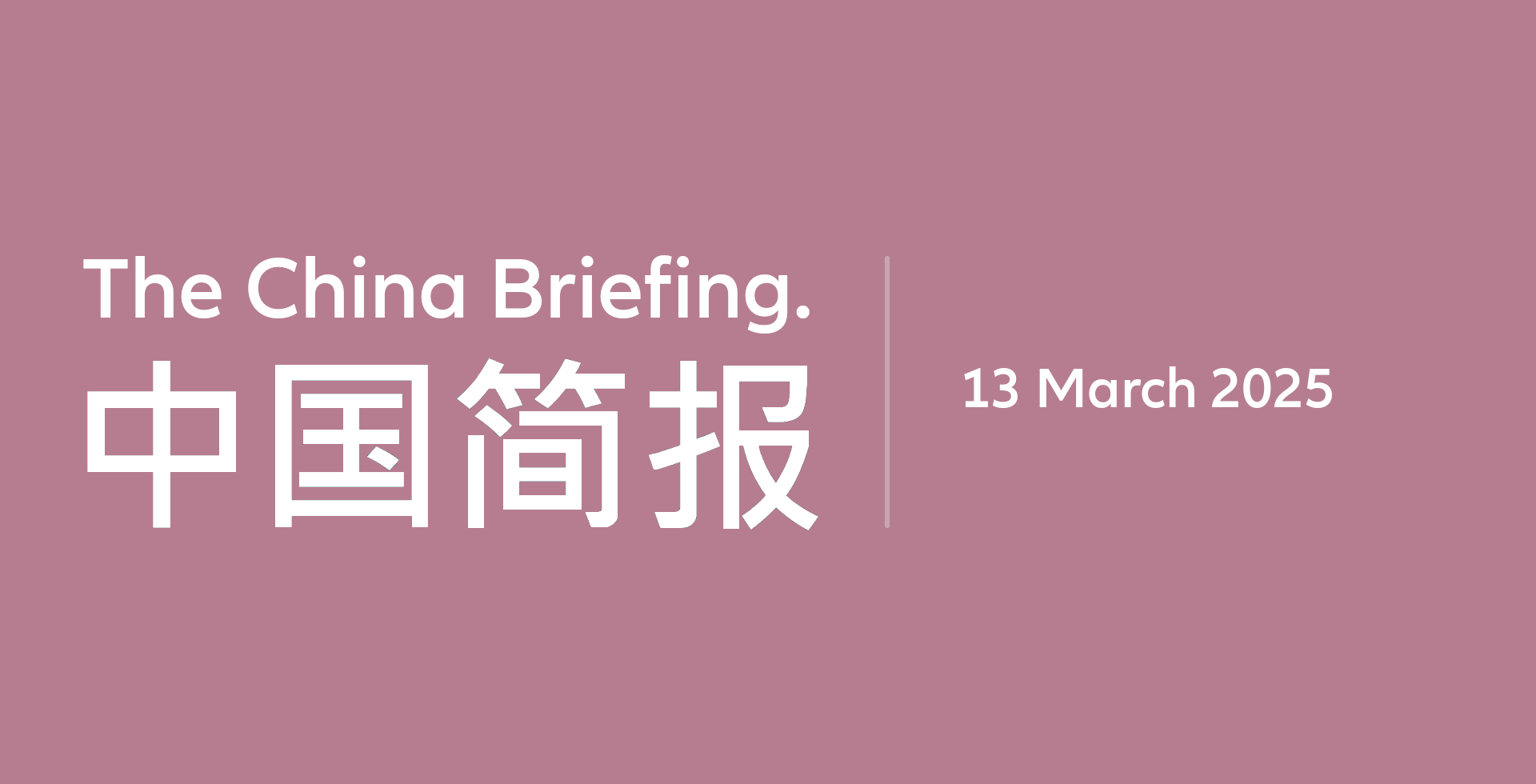

Chart 1: Performance of major stock market indices since Jan 2024 (USD, rebased to 100)

Source: LSEG Datastream, Allianz Global Investors, as of 12 March 2025

- These include Unitree Robotics, the company behind the attention-grabbing humanoid robot display at the annual Spring Festival Gala (Bing Videos).

- Such successes are prompting other local governments to take action. Shenzhen, Beijing, Chengdu and Wuhan – with a combined population of more than 60 million1 – have all unveiled specific policies to foster AI innovation.

- A further notable announcement has been the government preparing a “national venture capital guidance fund”, which aims to raise around RMB 1 trillion (USD 140 billion) for funding high-tech companies.

- Although few details are available yet, it is likely to focus on areas emphasised at the Two Sessions, described as “industries of the future” such as “biomanufacturing, quantum technology, embodied AI, and 6G technology”.

- As such, this new fund can be seen in the context of China’s increasing emphasis on establishing leadership in new areas of technology, rather than fighting established incumbents. An analogy could be how China has come to dominate the electric vehicle (EV) space rather than focusing on development of the internal combustion engine.

- While it is too early to see how this new fund translates into investable opportunities, it has helped to maintain the buzz around China’s AI developments.

- More broadly, it was clear from the Two Sessions that the focus is very much back on growth. The official 800-word summary document focused almost exclusively on the economy.

- The official GDP target for 2025 is the same as 2024 and 2023 – “around 5%”.

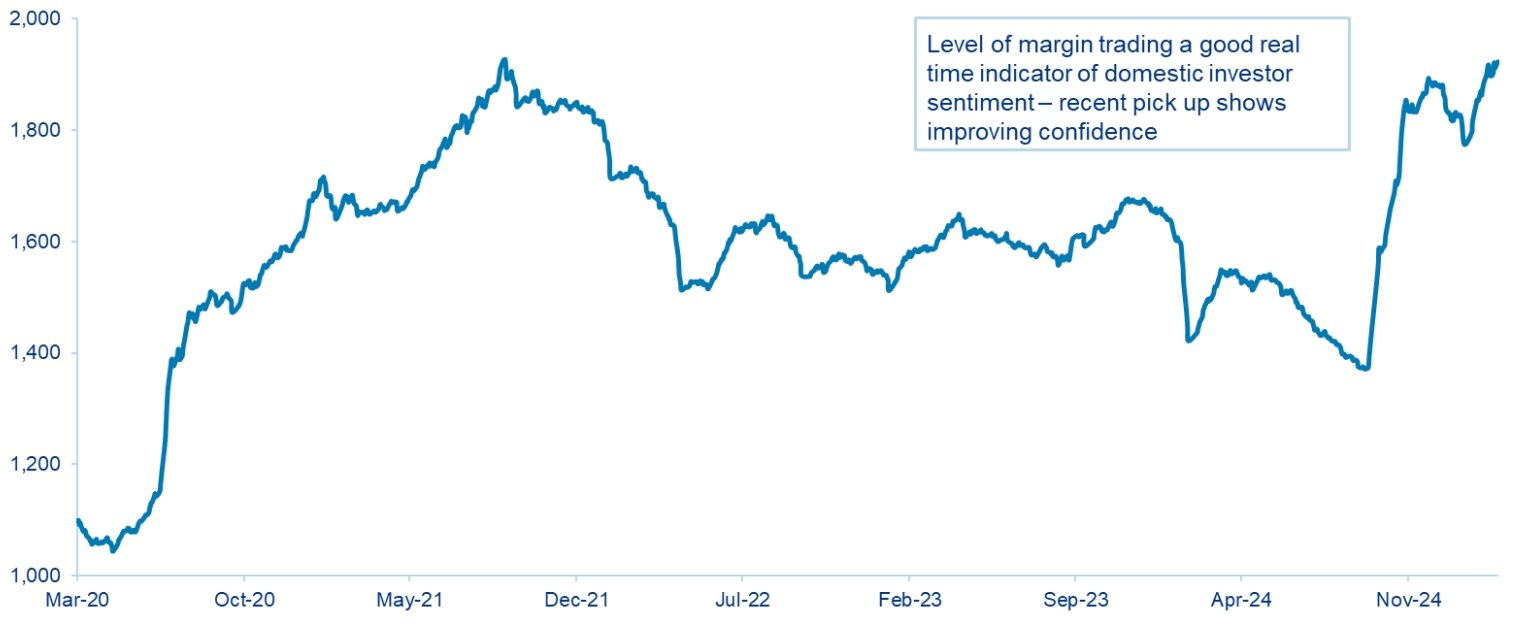

Chart 2: Margin trading outstanding balance in China A-Shares (CNY billion)

Source: Bloomberg, Allianz Global Investors as of 11 March 2025

- However, in our view, the target is a lot more ambitious this time around. Last year, net exports accounted for around 30% of GDP expansion.2 But export momentum is set to fade sharply and will need to be replaced by significantly stronger domestic demand if the 5% target is to be achieved. Indeed, the Bloomberg consensus for 2025 GDP growth is 4.5%.3

- Given the importance attached to achieving the annual growth target – it has been met or exceeded in each of the last 15 years with the exception of Covid in 20224 – both monetary and fiscal policy should remain solidly in expansion mode.

- The biggest risk to growth is, in our view, US trade policy, both because of the direct impact of higher US tariffs on Chinese goods and more broadly as a potential shock to global growth. In this regard, Chinese policymakers are keeping their cards close to their chest, and appear ready to ramp up economic support further if needed.

- It is in this context that China equity markets have remained well supported in the context of wider global volatility. Much of this is a result of increasing domestic investor confidence.

- The level of margin trading, a good real-time sentiment indicator, has recovered to levels last seen in 2021.5 And there are signs the previous extreme risk aversion has started to ease, with the 10-year government bond yield rising steadily as money moves from bonds to equities.

- Overall, we maintain our more positive outlook on China equities.

- We are often asked whether we favour onshore or offshore markets. In our view both should benefit from the more supportive policy environment. Both also have different risk/reward characteristics.

- Offshore equities have higher exposure to beneficiaries of China’s advances in AI, mainly through the sizeable index weights of the internet platforms. However, they are also likely to be more vulnerable to “Trump risk”.

- In comparison, China A-shares have a more diversified investment universe, and the “Beijing put” should help to limit the downside risk.

1 Source: National Bureau of Statistics of China, June 2024

2 Source: BNP Paribas Exane as at 6 March 2025

3 Source: Macquarie as at 5 March 2025

4 Source: Macrobond as at 31 December 2024

5 Source: Bloomberg as at 10 March 2025