The China Briefing

Reading the Third Plenum tea leaves

China’s Third Plenum focuses on shifting resources from real estate to technology and manufacturing, aiming to become a science and technology superpower by 2035.

Please find below our latest thoughts on China:

- Much of the focus recently has been on China’s so-called “Third Plenum”, a five-yearly gathering of top policymakers designed to set the high level economic agenda for the coming years.

- While there is, as usual, a substantial official communiqué – the English translation runs to more than 17,000 words1 – very broadly the main thrust of government strategy remains unchanged.

- Overall, it can be characterised as looking to shift resources, capital and talent from out-of-favour sectors such as real estate towards future growth areas, mostly related to technology and manufacturing.

- Indeed, most of the document explains how the government will do more to achieve its goal of becoming a “science and technology superpower” by 2035.

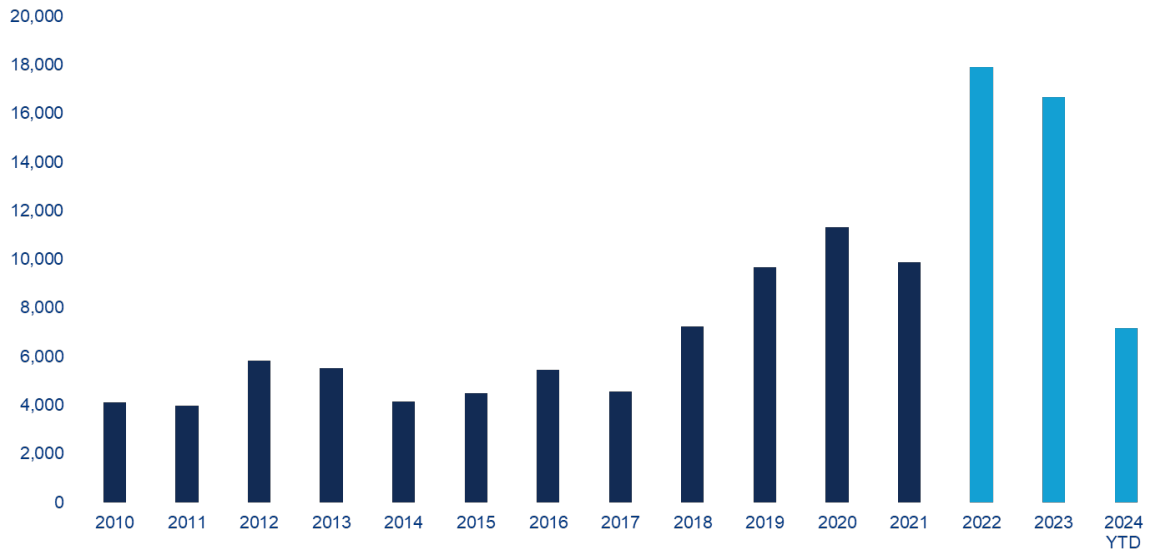

Chart 1: Annual increase in household deposits (RMB billion)

Source: Wind, HSBC as at 31 May 2024

- One key challenge this shift presents is on timing. What has been evident for the last two years is that the growth of favoured sectors has not been large enough to fully offset the drag from property, leaving the economy as a whole with significant slack.

- This was, to an extent, recognised at the Third Plenum. For example, there were notable pledges to "unswervingly achieve the full-year growth target", "proactively expand domestic demand", and "enhance the consistency among various macro policies".

- The backdrop is that earlier this month China announced Q2 GDP of 4.7%. This was a significant deceleration from the Q1 figure of 5.3%.2

- As a reminder, China has only failed to meet or surpass its official GDP target once in the last 15 years3 – and that was in 2022 as a result of Covid.

- Given the ongoing weakness of the property sector, the economy will very likely need a further injection of government policy support to rebuild momentum. We expect to see further announcements of both fiscal and monetary stimulus quite soon.

- Indeed, on the first day of trading after the Plenum, the PBoC delivered a 0.1% cut in the seven-day reverse repo rate and subsequently followed this up with a 0.2% cut in its one-year policy loans, representing a coordinated easing effort across all key interest rates. 4

- While this monetary easing is helpful, it seems unlikely to us that it will have much of an impact on the property market. Mortgage rates, for example, were already at record lows even before this move. 5

- More importantly, the question is when the government will introduce further direct and forceful measures regarding the property sector.

- Recent data on the housing market continues to show few signs of recovery. The good news is that Beijing and Shanghai have recorded their first sequential increases in home prices in nine months. 6 Elsewhere, however, prices continue to decline.

- A key issue is the number of pre-sold and unfinished homes – estimated at around 20 million nationwide7 – which has undermined buyer confidence in the pre-sale system.

- This lack of confidence can be seen more broadly in spending patterns. The ongoing rise of household bank deposits, for example, signals that consumers remain predominantly in saving rather than spending mode.

- Improved visibility of property stabilisation is likely, in our view, to be a key trigger for China’s equity markets.

- And finally….on the topic of future growth, there was a glimpse recently into some of the social challenges that technology and AI may bring in coming years.

- A fleet of 500 driverless “robotaxis” in Wuhan has become so popular since it launched two years ago that “traditional” taxi drivers have petitioned the local transport authority to limit their use. This seems unlikely, however. There are plans to make robotaxis available in 100 cities in China by the end of the decade.8

1 Source: Chatham House as at 22 July 2024

2 Source: Goldman Sachs as at 15 July 2024

3 Source: Macrobond as at 30 June 2024

4 Source: Bloomberg as at 25 July 2024

5 Source: Gavekal as at 23 July 2024

6 Source: Nomura as at 24 July

7 Source: Nomura as at 24 July

8 Source: South China Morning Post as at 10 July 2024