The China Briefing

Is the rally for real?

The last month has been a period of consolidation for China equities. Nonetheless markets have held on to significant gains from their low point.

Please find below our latest thoughts on China:

- The last month or so has been a period of consolidation for China equities from their year-to-date peak in midMay.

- Although returns overall so far in 2024 are quite muted, nonetheless markets have held on to significant gains from their low point. Since Chinese New Year, China A-shares are up around 13% and H-shares more than 20% (USD).1

- The question now, of course, is whether this rally is for real or just another “head fake” similar to what occurred last year.

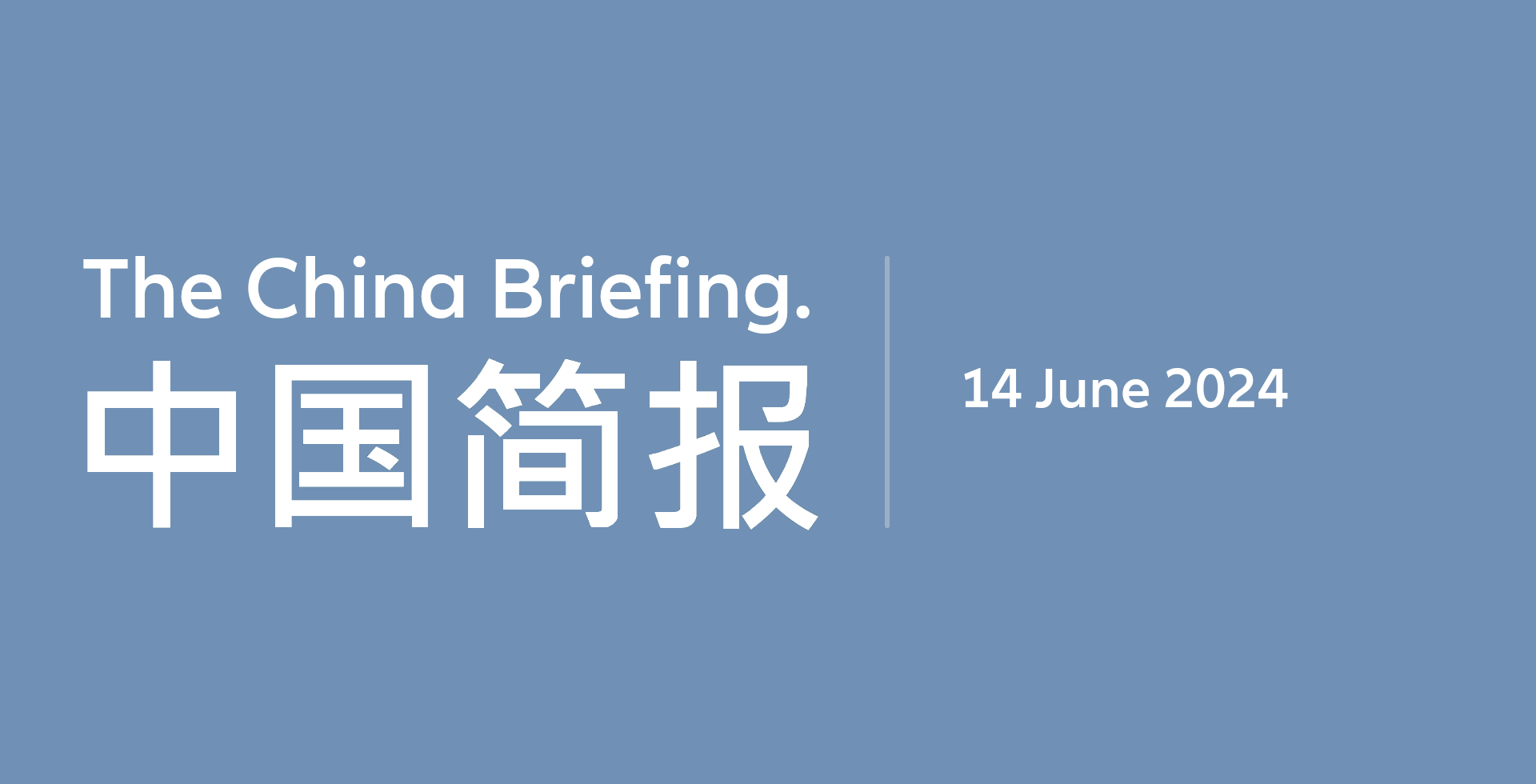

Chart 1: China A shares - IPO and secondary issuance vs share buybacks (in RMB billion)

Source: Wind as at 31 May 2024

- In our view, we see considerable differences this time around. Most notably, there has been an important shift in policy direction, in particular with a focus on containing downside risks in both the property market and also domestic equities.

- While the support for equities was most apparent and direct in January, when the “national team” stepped in to buy onshore ETFs in size, since then there has been seemingly quite limited state-sponsored buying of the China A market.

- Instead, the main focus has been the securities regulator (CSRC) taking action to restore confidence in markets, especially through protection of investor interests.

- There has been a swathe of announcements in areas such as volume of new listings, challenging the use of funds raised from equity issuance, forced delistings for companies not meeting certain criteria, and increasing dividend payouts.

- Lifting the bar to raise equity, in our view, helps tackle one of the major structural issues that has weighed on China A markets for many years.

- While other markets such as the US and Japan have seen sustained equity shrinkage, with share buybacks consistently ahead of new issuance, China A-shares have had the opposite issue.

- New equity supply, in the form of secondary issuance and IPOs, has typically averaged around 1-2% of total market capitalisation. This far outweighs the level of share buybacks (0.2% in 2023, for

example).2

Chart 2: iBoxx USD Asia ex Japan China Real Estate High Yield Index (1 year)

Source: Bloomberg as at 31 May 2024

- In years when there has been strong investor appetite for equities, this excess supply can be absorbed. But when confidence is low – as in recent years – then the supply weighs heavily on the market.

- As a result of the policy changes, so far in 2024 the level of share buybacks is similar to the level of equity supply.3 If this pattern continues, then the impact of one of the equity market’s major headwinds will be significantly reduced.

- Real estate stocks were some of the biggest winners of the market rally post Chinese New Year. And they have also pulled back in recent weeks.4

- This reflects, in our view, the initial market hope that the property market is finally getting close to a turning point. And subsequent concerns about how policy rhetoric will translate into reality.

- Our perspective is the recent policy measures, especially government support for buying up housing inventories, is an important turning point that sends a strong message about intentions to put a floor under the housing market.

- While further measures are needed – the oversupply of property remains high in many areas – nonetheless, financial markets certainly appear to indicate that tail risks for developers have eased.

- The iBoxx USD Asia ex Japan China Real Estate High Yield Index bottomed in November 2023 and has moved steadily higher since then.5

- One of the most important reasons to stabilise the real estate sector is because of the broader impact it has on consumer sentiment – property accounts for close to 60% of household total assets in China.6

- Having said that, there have been several recent indicators that consumers’ willingness to spend is starting to stabilise. The largest food service delivery company in China has recently raised its earnings guidance and is seeing an increase in order volumes.7

- China’s second-largest ecommerce festival – so-called “618” – has been in full swing. Originally created by JD.com to coincide with its founding anniversary on 18 June (1998), it didn’t take long for other platforms to also adopt the festival.

- The final “618” results are not yet in, but indications are that competition remains intense as domestic ecommerce operators continue to strive to offer “value for money” products.The final “618” results are not yet in, but indications are that competition remains intense as domestic ecommerce operators continue to strive to offer “value for money” products.

- And to give some perspective on the scale of China’s consumption power, even 2023’s somewhat depressed “618” sales hit USD 111 billion, which is three times what US shoppers spent online in the equivalent Black Friday to Cyber Monday period.8

- And in another sign of the times, China has overtaken the US as the world’s largest freshly-made coffee market. The country now has around 50,000 coffee shops. Shanghai leads the coffee frenzy with almost 10,000 stores.9

1 Source: Bloomberg as at 12 June 2024

2 Source: Wind as at 31 May 2024

3 Source: Wind as at 31 May 2024

4 Source: Bloomberg as at 12 June 2024

5 Source: Bloomberg as at 12 June 2024

6 Source: Goldman Sachs as at 31 December 2022

7 Source: Goldman Sachs as at 11 June 2024

8 Source: statista.com as at November 2023

9 Source: Bank of America Securities as at 5 June 2024