The China Briefing

Dividends and AI

The relatively weak performance of China’s AI indices belies a significant commitment of resources in AI

Please find below our latest thoughts on China:

- China equities have continued their period of relative stability. Both onshore and offshore equities have recovered from their weakness in January (at one stage down more than 10%) and are now close to flat year-to-date in USD terms.1

- Recent economic data has been helpful in supporting sentiment. The March manufacturing PMI increased to 50.8, returning to expansionary territory for the first time in six months.2

- The recently finished Qingming Festival – traditionally a time to honour ancestors through sweeping their tombs, which has become a broader three-day holiday – also saw a significant surge in travel. There were around 119 million domestic passenger trips over the period, which is higher than the same period in pre-Covid 2019.3

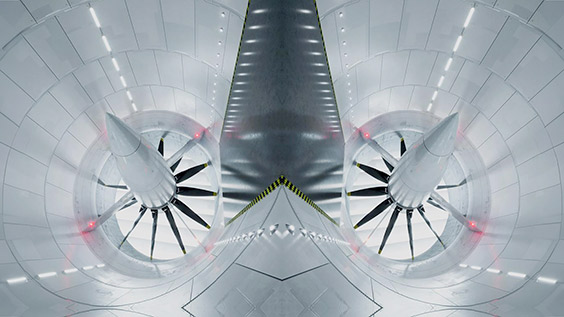

Chart 1: CSI Dividend Index vs CSI 300 1 year performance (CNY, rebased to 100)

Source: Bloomberg, Allianz Global Investors as at 10 April 2024

- The other feature of recent weeks has been a flurry of diplomatic activity. This includes President Xi having a “candid” 105-minute phone call with President Biden, the first contact between the two leaders since meeting in San Francisco in November. Xi Jinping also entertained high-profile US CEOs in Beijing.

- US Treasury Secretary Janet Yellen’s visit to China got a notably warm reception from Chinese state and social media, with much attention on her culinary choices (Cantonese and Sichuanese restaurants) and even praise for her chopsticks skills.

- There was also good news for Australian wine makers with China lifting tariffs of more than 200% imposed around three years ago.4

- While relations between the US and China in particular will likely remain tense, especially in the run-up to the US elections, nonetheless signs that both sides are looking to put a floor under the relationship are at least a more positive signal than we saw last year.

- One feature of China A market performance has been the resilience of higher yield stocks. The total return of the CSI Dividend Index is 4.8% over the last year compared to the broader CSI 300 Index return of -12.4% (local currency).5

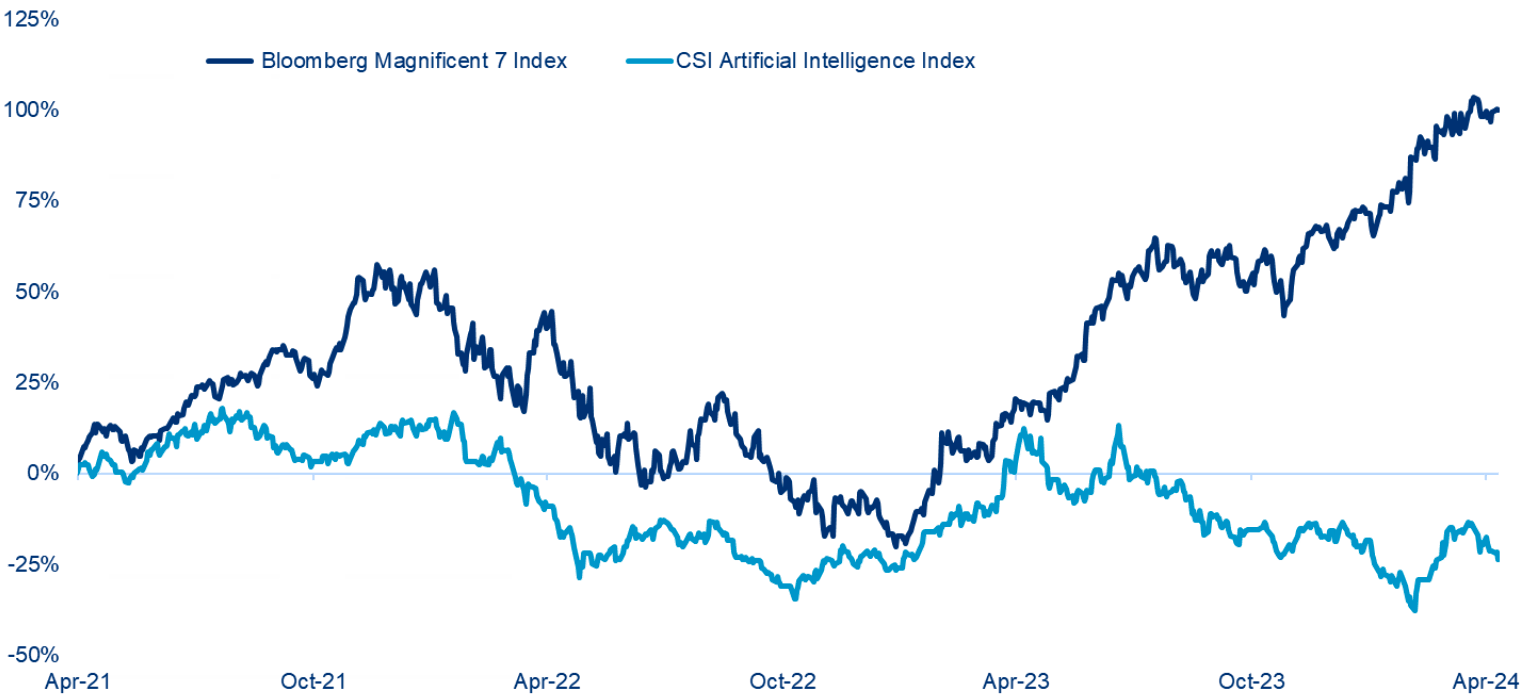

Chart 2: Bloomberg Magnificent 7 vs CSI Artificial Intelligence 3 years (Index total return, USD)

Source: Bloomberg as at 10 April 2024

- There have been two main factors behind this. The first is that dividend yields have risen significantly above domestic bond yields, thereby becoming more attractive for local investors who have a relatively limited investment universe.

- The second factor has been the enhanced regulatory focus on dividend payments as a corporate responsibility. First outlined at the National People Congress in early March, the China Securities Regulatory Commission (CSRC) has recently unveiled more details.

- The CSRC is encouraging companies with more robust business operations to raise their dividend payout ratio, to increase the frequency of dividend payments, and to prioritise dividends around Chinese New Year by delivering cash to shareholders ahead of the most important holiday in the Chinese calendar.

- Later this month will see the start of the Q1 earnings season, which should be a good opportunity to monitor how regulatory encouragement is translating into corporate action.

- At the other end of the spectrum, the artificial intelligence (AI) boom appeared to be passing China by, at least when looking at share price performance.

- Chinese AI-related stocks have lagged well behind the Magnificent Seven, for example.6 This is mainly because there is no Chinese equivalent of Nvidia, selling high-performance computing hardware, or a peer of Microsoft on the software side.

- However, this share price performance masks a high level of investment and significant commitment of resources in AI. Chinese companies have, for example, been active participants in the global race to develop larger-scale generative AI models.

- In our view, the Chinese models have improved quickly in a relatively short period of time. However, there is still a gap versus the quality of global leading models and it will be challenging for China to take the lead any time soon, especially given the US sanctions which are limiting access to high-performance semiconductors.

- As such, looking ahead, China’s technological advantage will probably come more from practical AI applications, which are able to use “sufficiently good” generative AI models.

- Just as Chinese companies have a track record of developing hugely popular super-apps such as Tencent’s social media platform WeChat, so the application of AI expertise in developing new consumer-focused products that can leverage China’s huge domestic market is potentially a big future growth driver.

- At this early stage of AI development, we see a number of opportunities in Chinese companies that are providing much-needed infrastructure, including areas such as AI servers, thermal control systems, data transmission technology and power grid equipment.

1 Source: Bloomberg, 10 April 2024

2 Source: Nomura Global Economics, 5 April 2024

3 Source: China Global Television Network, 7 April 2024

4 Source: Associated Press, 28 March 2024

5 Source: Bloomberg, 10 April 2024

6 Source: Bloomberg, 10 April 2024