Sustainability | ~ 4 min read

What Netflix tells us about the future of sustainable investing

Sustainability has attracted significant investor interest – and inflows – in recent years and for good reason. Seeking financial returns in our rapidly changing world increasingly requires a deeper understanding of sustainable growth opportunities.

Sustainability means different things to different investors who, we know, have varying objectives for their investments. Hence at AllianzGI we offer a range of strategies to support sustainability-minded investors. One approach, known as best-in-class, is where my team is focused. Essentially, our starting point is a conviction in the companies and sectors that will be around 10 years from now and far beyond that.

We know some companies will thrive and others won’t over the coming decades. Looking back, a famous example is video rental chain Blockbuster, which failed to keep pace with changes in how we watch films and TV and ultimately ceased trading. Compare it with Netflix, which started out as a DVD-by-mail company and evolved into the world’s biggest streaming service by understanding changes in the consumer and technology.

Our role is to dig into the details of companies and sectors to determine which companies are best positioned for future sustainable growth, and to capture those opportunities at the right time. Underpinning this is our belief that this century will not be about polluting to grow. Instead, economic growth will be within the boundaries and standards that we expect as global citizens. This is how we see the future for sustainability.

Digging deeper

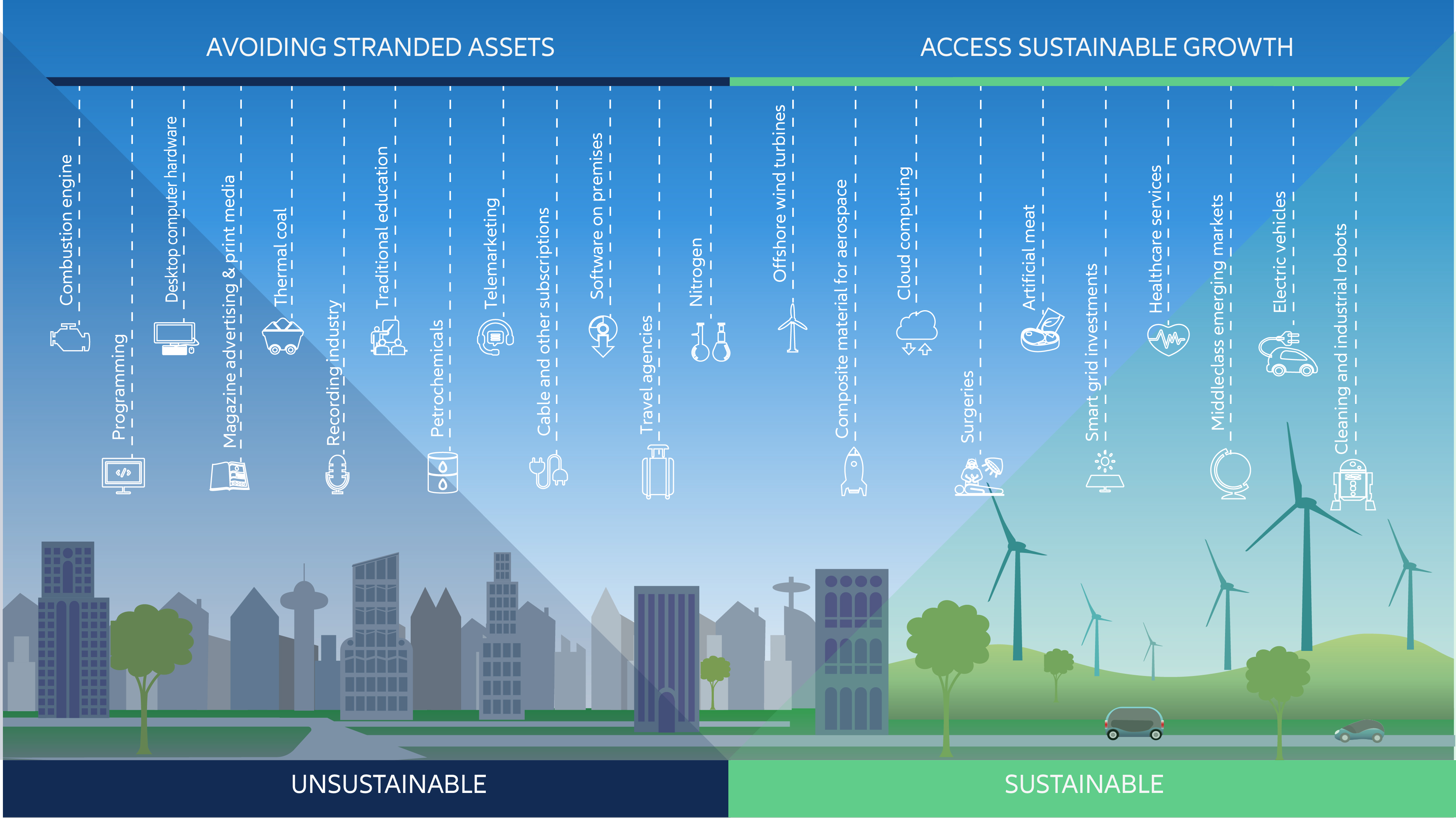

When I’m presenting, one of the most popular slides I use is the one below. Sectors shown on the left are those that present some risks because of their limited scope for sustainable growth, or they may have business models that are not fit for the future. Some of these you might expect to see featured, such as combustion engines and thermal coal. But we also think of sustainability more broadly. In an age of online travel booking are travel agencies likely to be an investable option long term? Those on the right are where we see greater potential, such as companies shaping the energy transition or spearheading innovative technologies.

Accessing sustainable growth opportunities

Source: Allianz Global Investors, 2024. EM: Emerging markets. Schematic representation for illustrative purposes only (no reference to any real strategy, portfolio or product data). This does not constitute a recommendation or solicitation to buy or sell any particular security or strategy. This is for guidance only and not indicator of future allocation. A performance of the strategy is not guaranteed and losses remain possible.)

Supported by an in-house research capability and proprietary Sustainability Insights Engine (SusIE) our best-in-class approach aims to find those companies that are prioritising these environmental, social and governance (ESG) issues and aligning their business models with positive societal and environmental outcomes. We also engage with companies to help optimise their ESG performance.

Our approach is about understanding future trends and acting now for the long-term. Global challenges won't be resolved overnight. New solutions are needed to tackle ESG issues, while some sectors need time – and investment – to transition towards climate goals or biodiversity targets, or to align with evolving regulation.

This is why for sustainable investors, detail is everything.