Stewardship | ~ 4 min read

Proxy voting 2024 – three major trends

Incorporating environmental and social considerations into proxy voting is essential for driving corporate sustainability. However, changing perspectives emerged in the 2024 voting season across Europe and the US.

In our review of the 2024 proxy voting season, three major trends came to the fore:

- Say on Climate (SoC) continues to decline

- Increased US shareholder proposals, but mixed support

- Companies push back on shareholders

SoC allows investors to vote on a company’s climate transition plan or related reporting, thereby directly opining on its ambitions. In the first seven months of the year, we voted on only 25 such resolutions from a peak of around 50 during the full year 2022. This confirms our assessment that SoC is losing momentum – despite Germany’s first SoC resolution being tabled this year.

With half of these resolutions in France and the UK and the rest scattered across Europe, there is no level playing field for investors to vote on these plans. In some countries there were only two or three resolutions, making comparability challenging for shareholders. With the decline in SoC resolutions, we expect director votes to become the channel for signalling views on companies’ climate strategies.

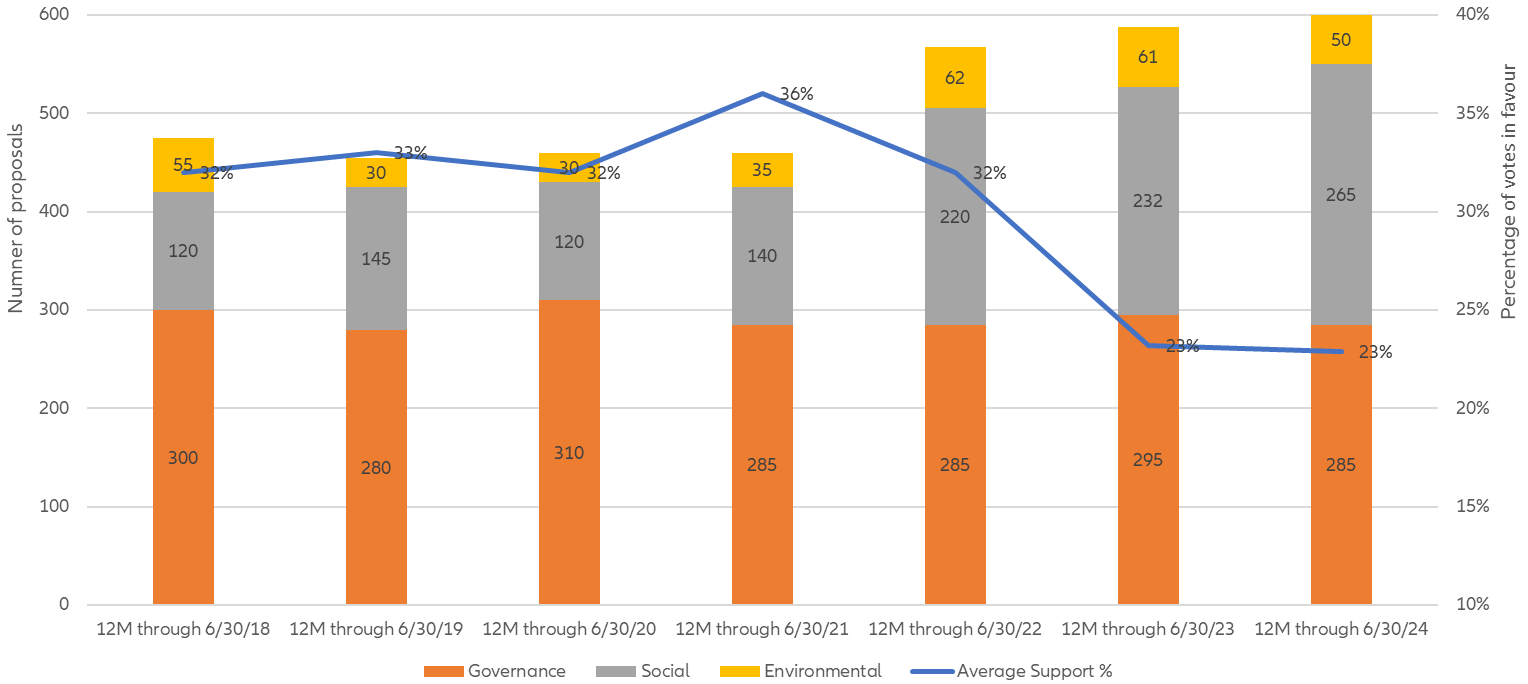

Shareholder resolutions are the major route for investors to drive sustainability-related issues in the US, but support remains geared towards governance topics (rather than social or environmental concerns). The number of proposals at Russell 3000 companies1 rose to another record in the year to 30 June 2024, but support remains low at just under 20% of votes in favour.

The number of resolutions securing majority support fell dramatically – only one environmental resolution and no social resolutions passed this year. However, 36 governance proposals passed.2 In terms of themes, artificial intelligence was a notable emerging topic, with 15 proposals, while climate proposals were flat on the year.

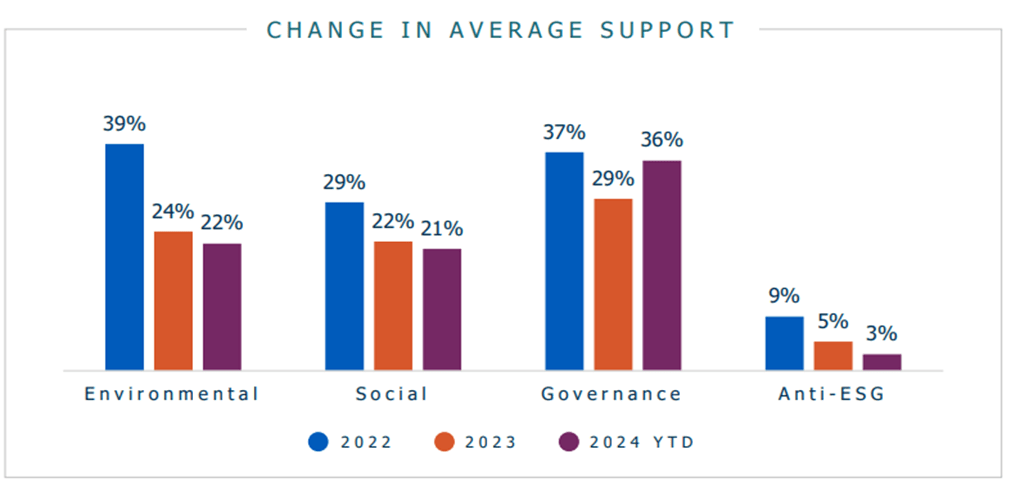

Figure 1: Lower average support for environmental and social resolutions

Source: Georgeson, An early look at the 2024 proxy season.

Figure 2: US shareholder resolutions at record high

Source: Bloomberg Intelligence as at 30 June 2024

The major story in the US is rising litigation through State courts, to frustrate the application of federal acts and activism of minority shareholders. For example, earlier in the year the board of ExxonMobil launched litigation through the Texas district court against two shareholders seeking to file proposals. While the litigation was ultimately withdrawn, it has emboldened corporate pushback. Companies’ frustration at the increasing number of shareholder resolutions is illustrated by a 50% rise in “No Action” requests3 submitted to the Securities and Exchange Commission this year.

Constructive engagement to generate outcomes

Notwithstanding some of the trends that are emerging, we believe shareholder proposals remain a critical tool to improve corporate practice if they tackle material investor issues, target lagging companies, and generate constructive engagement to achieve impactful outcomes. This is reflected in our own approach to stewardship.

1 FTSE Russell, The Russell 3000® Index measures the performance of the largest 3,000 US companies designed to represent approximately 98% of the investable US equity market.

2 Source: Georgeson, “An Early Look at the 2024 Proxy Season”, The growing support for governance resolutions is notable also in average voting approval levels, which have risen from 29% last year to 36% this year, 2024

3Typically, these requests are seeking the striking out of proposals on technical and substantive grounds.