Five themes for 2024

Theme 1: Politics in 2024 – risking the climate?

Recently we set out five themes that could dominate the discourse on sustainability in 2024. In a new blog series, we explore each theme in more detail – and explain the implications for sustainable investing. First, we look at how political agendas and the fight against climate change might clash in a critical year.

This year is expected to be a record one for elections,i with more than 2 billion people in 50 countries heading to the polls. Eight out of the world’s 10 most populous countries are holding elections, accounting for over 50% of global GDP.ii They include the US, India and the European Parliament.

These polls take place against a backdrop of an ongoing cost of living crisis, precarious geopolitics and the politicisation of climate or “green” agendas.

Meanwhile, the climate crisis continues. This year is widely expected to be the hottest on record and may even temporarily cross the 1.5°C threshold due to the return of El Niño. It could be a pivotal year in defining when – and at what level – temperatures may peak.

But while the global economy needs to accelerate climate transition plans, the election cycle means the political will could be elsewhere. In this crucial election year, scarce funds may be deployed to meet popular or populist vote-winning agendas – rather than being invested in the transition.

Perhaps the most visible example is November’s US election, where current Republican frontrunner Donald Trump indicates he would reverse climate commitments made by the Democrats.iii

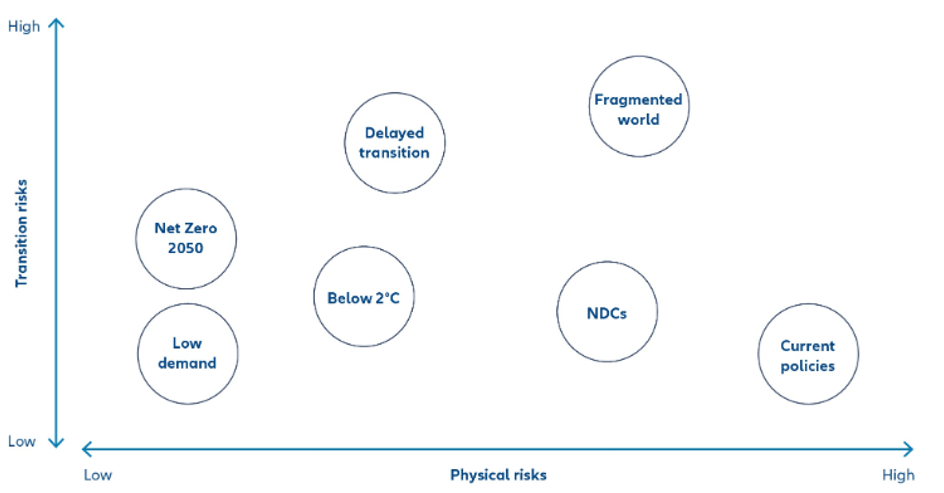

The risk that the political agenda could delay the financing and implementation of transition plans may make a “delayed transition” scenario – as described by the Network for Greening the Financial System (NGFS) – more likely.

In such a scenario, the global economy finally wakes up to the climate emergency in the late 2020s, global annual emissions do not decrease until 2030, and significant catch-up investment is required to limit warming to below two degrees.

Network for Greening the Financial System (NGFS) scenario analysis

Source: https://www.ngfs.net/ngfs-scenarios-portal/explore/

A NASA study has identified the multiple compounding impacts of climate change in a world that is two degrees warmer. It predicts significant volatility in both the scale and location of climate events, with potentially significant implications for sovereign fiscal, growth and inflation planning for the coming decade.iv Basic needs such as food and water could get politicised.

A world of unpredictable weather events has important implications for economic growth and risk modelling, while also increasing the finance needed to achieve a delayed transition.v

Understanding the implications for investment portfolios is crucial, and we are already providing advisory analysis on the potential impact on client portfolios in terms of the drag on returns under different climate scenarios. This analysis, using our in-house climate tool, allows for forward-looking quantification of climate risk.

- Coming soon: Theme 2: From climate change to climate impact – how increasing weather events are driving improved reporting and risk assessment around climate impacts.

- Read an overview of our five themes: Sustainable investing: five themes for 2024 | Allianz Global Investors (allianzgi.com)

i Source: World Economic Forum, https://www.weforum.org/agenda/2023/12/2024-elections-around-world/, December 2023

ii Source: Brunswick Group, https://www.brunswickgroup.com/eight-key-elections-to-watch-in-2024-i25831/, September 2023

iii Source: Reuters, https://www.reuters.com/world/us/trump-says-he-would-renege-3-billion-us-pledge-green-climate-fund-2023-12-14/, December 2023

iv Source: Network for Greening the Financial System, https://www.ngfs.net/sites/default/files/medias/documents/conceptual-note-on-short-term-climate-scenarios.pdf, October 2023

v Source: IMF, https://www.imf.org/en/Blogs/Articles/2022/10/05/further-delaying-climate-policies-will-hurt-economic-growth, October 2022