Five themes for 2024

Theme 3: ESG is dead, long live ESG 2.0

We recently set out five themes that could dominate the discourse on sustainability in 2024. Here we explore the third of these themes – how ESG is going back to its original purpose.

Rarely have three letters generated as much confusion – or, indeed, convulsion – as ESG. First formalised as a concept in 2004i, environmental, social and governance (ESG) investing has suffered from mission creep in recent times, being seen as prioritising “doing good” or imposing values ahead of driving financial returns. Another challenge is the opaque ESG scoring among the main providersii, which can make it difficult to compare the ESG assessments of different firms.

But we think the tide is turning and ESG will return to its original purpose – risk materiality. The renaissance of ESG will be driven by high-quality, innovative data capture that allows for robust, transparent quantification of impact and dependency risks.

How do we approach ESG at Allianz Global Investors? All of our assets under management are risk assessed, where we view risk materiality in three stages.

Stage 1: thematic materiality

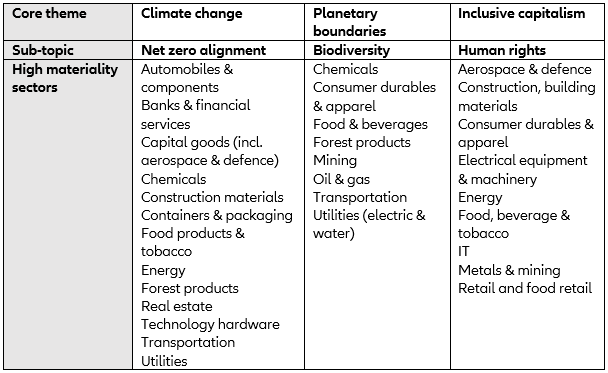

At a top-down level, we identify sectors with highest impact or materiality to our three core sustainability themes: climate change, planetary boundaries and inclusive capitalism (see examples for each pillar below).

Source: Allianz Global Investors Sustainability Research and Stewardship

These thematic materiality mappings provide the cornerstone of focused engagement and research, providing the team with high conviction on risk and opportunity assessments for both sectors and individual companies. They also help substantiate our proprietary company assessments, our scoring systems (eg, net zero alignment shareiii) and our participation in industry or thematic collaborative initiatives (eg, Nature Action 100).

Stage 2: sector materiality

We developed sustainability sector frameworks for 24 broad industry classifications in collaboration with our research teams and investment sector specialists. These frameworks include a proprietary sustainability materiality matrix, where materiality (high, medium, low) is assessed for four common factors – environmental, social, corporate governance and business behaviour. The materiality mapping not only guides our research and engagement activity – including recommended engagement questions – but each sub-factor is also aligned to specific, relevant raw data and will feed our new proprietary sustainability rating (PSR) to be introduced in 2024.

Stage 3: company materiality

We continuously review the best ESG data – in terms of both quality and coverage – to assess individual entities. The “ESG Profile” available in our sustainability insights engine, SusIE, continues to expand its coverage of risk, controversy, sustainability, carbon, climate and other indicators. We also recognise the importance of separating risk materiality into two key categories:

- Harmful impacts – these are the outcomes of an entity’s specific activities. These can translate into financial materiality through fines, lower revenues or higher costs owing to regulatory, political, consumer or reputational intervention.

- Vulnerable dependencies – these are the outcomes of external impacts on an entity’s activities or the supply chain supporting those activities. These can translate into financial materiality through revenue and cost volatility.

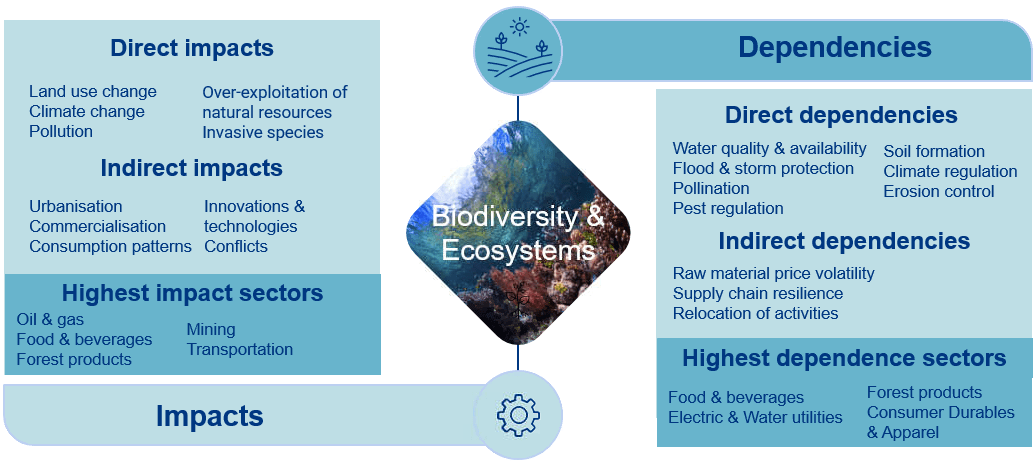

Below we provide an example of an impact and dependency analysis for biodiversity, together with the most impacted sectors.

Double materiality of biodiversity-related risks

Source: Allianz Global Investors

Overall, we think our approach to ESG gets back to its original purpose of assessing risk materiality across multiple dimensions. Data is key, and we are excited about the future for both new data capture techniques – including AI and machine learning – and the potential for more forward-looking data.

i The Global Compact, https://www.unepfi.org/fileadmin/events/2004/stocks/who_cares_wins_global_compact_2004.pdf, 2004

ii CFA Institute, https://blogs.cfainstitute.org/investor/2021/08/10/esg-ratings-navigating-through-the-haze/, August 2021

iii Net zero alignment share (NZAS) is a proprietary AllianzGI KPI, assigning entities with one of five net zero preparedness assessments.