Climate | ~ 4 min read

When is a climate transition plan a real plan?

Investors are increasingly focused on assessing the credibility and resilience of corporate climate transition plans as part of net zero commitments. We have a structured approach in evaluating these, which can be applied across public and private markets, and both developed and emerging economies.

A climate transition plan involves more than just emissions targets. It is a clear and coordinated roadmap, which integrates climate objectives into a long-term resilient and profitable business strategy. Effective plans require strong governance structures, alignment across all stakeholders, operational and financial levers to achieve decarbonisation, risk management frameworks, and transparency in tracking and reporting progress. These provide investors with the best opportunity to gauge how well companies are prepared for potential changes in climate scenarios, regulation, political leadership and financial markets.

Can you achieve a standard framework?

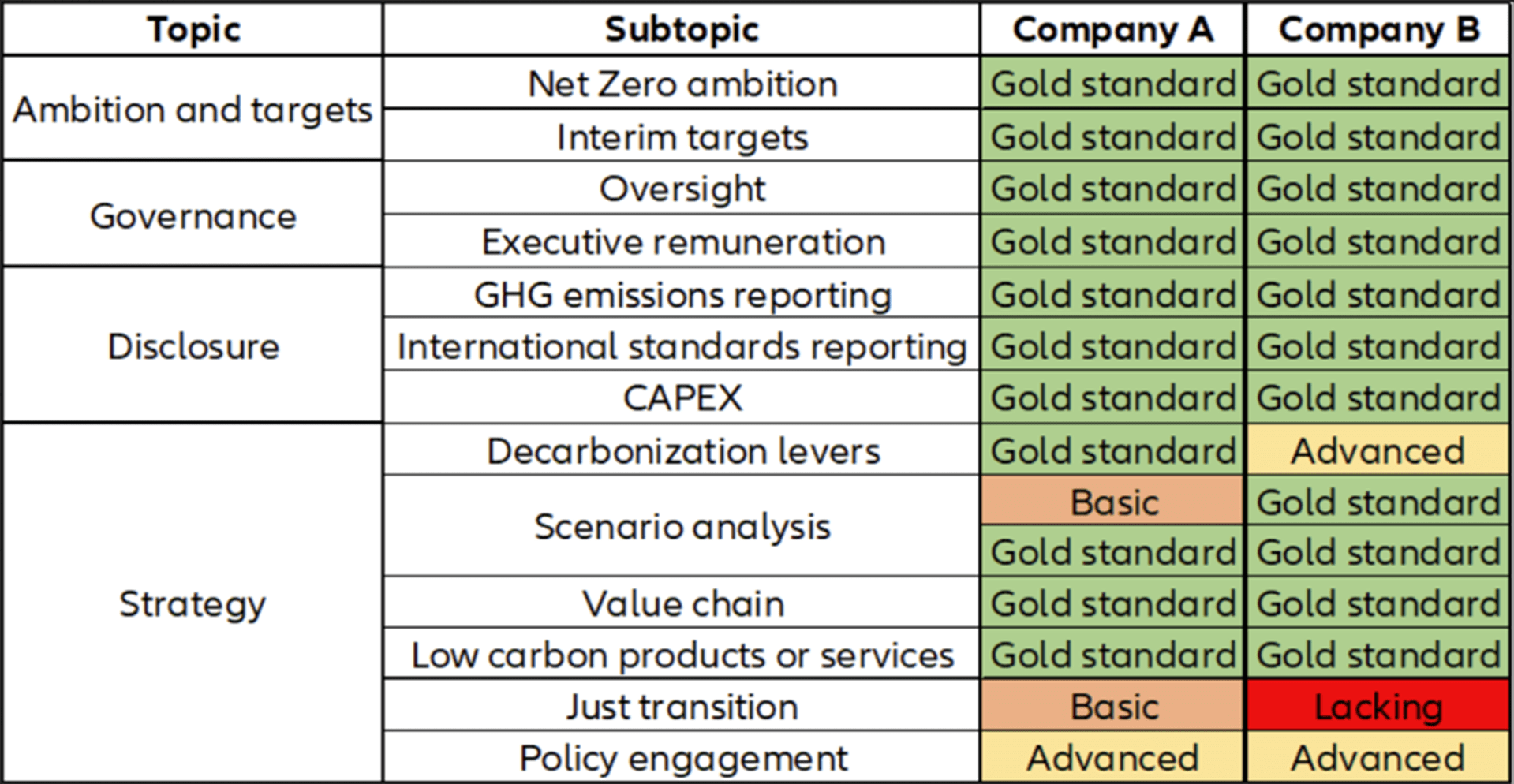

A framework as standardised as possible is required to compare the variety of climate transition plans. As more companies publish these plans, the differences in detail and quality widen. Drawing on leading climate frameworks1, we have developed a template for assessing such transition plans, including clear elements and benchmarks for climate commitments. Exhibit 1 shows our assessment of the transition plans of two companies in the electrical equipment sector with identical science-based validated targets.

Our template includes four key components expected in a climate transition plan:

- Governance: Clear roles and accountability for climate action, including board oversight and incentives.

- Ambition and targets: Emissions reduction targets, ideally aligned with science-based benchmarks, that cover short-, mid- and long-term goals.

- Strategy: A detailed action plan covering operation, financial planning and decarbonisation actions.

- Disclosure: Transparent reporting on progress, with quantitative data and qualitative insights.

Reviewing these four elements may provide investors with a comprehensive guide as to the integrity of a company’s climate strategy.

Exhibit 1: Assessment of the climate transition plans of two companies in the electrical equipment sector

Source: AllianzGI analysis

New regulation will push for improved transparency

Incoming regulation, such as the EU Corporate Sustainability Reporting Directive (CSRD), will drive improvements in climate strategy disclosures for most EU-based companies, and for non-EU companies with a substantial presence in the EU. Coupled with clearer expectations from investors on what they need to assess climate transition plans, this should improve standards of corporate climate commitments.

1 Including the Task Force on Climate-Related Financial Disclosures (TCFD), Transition Pathway Initiative (TPI), Science-Based Targets Initiative (SBTi), Carbon Disclosure Project (CDP), Transition Plan Taskforce (TPT), and Net Zero Asset Owners Alliance (NZAOA).