Five themes for 2024

Theme 2: From climate change to climate impact

We recently set out five themes that could dominate the discourse on sustainability in 2024. Here we explore the second of these themes – how understanding and quantifying the real-world impacts of climate change supports a more transparent and informed approach.

Damaging weather-related events – from tropical storms to heatwaves and drought – are growing more frequent and severe, and the return of El Niño will likely test records in the coming year. This will shift the focus on climate from a distant 2050 concept to a nearer-term priority.

But while academic studies have modelled temperature and emission increases, they have been less effective at determining the impacts of these increases.

Reinsurer Swiss Re estimates that property losses from natural disasters due to climate change could increase by over 60% by 2040. And while 2023 was a defining year for climate disasters, there remains a sizeable insurance protection gap for these events.i

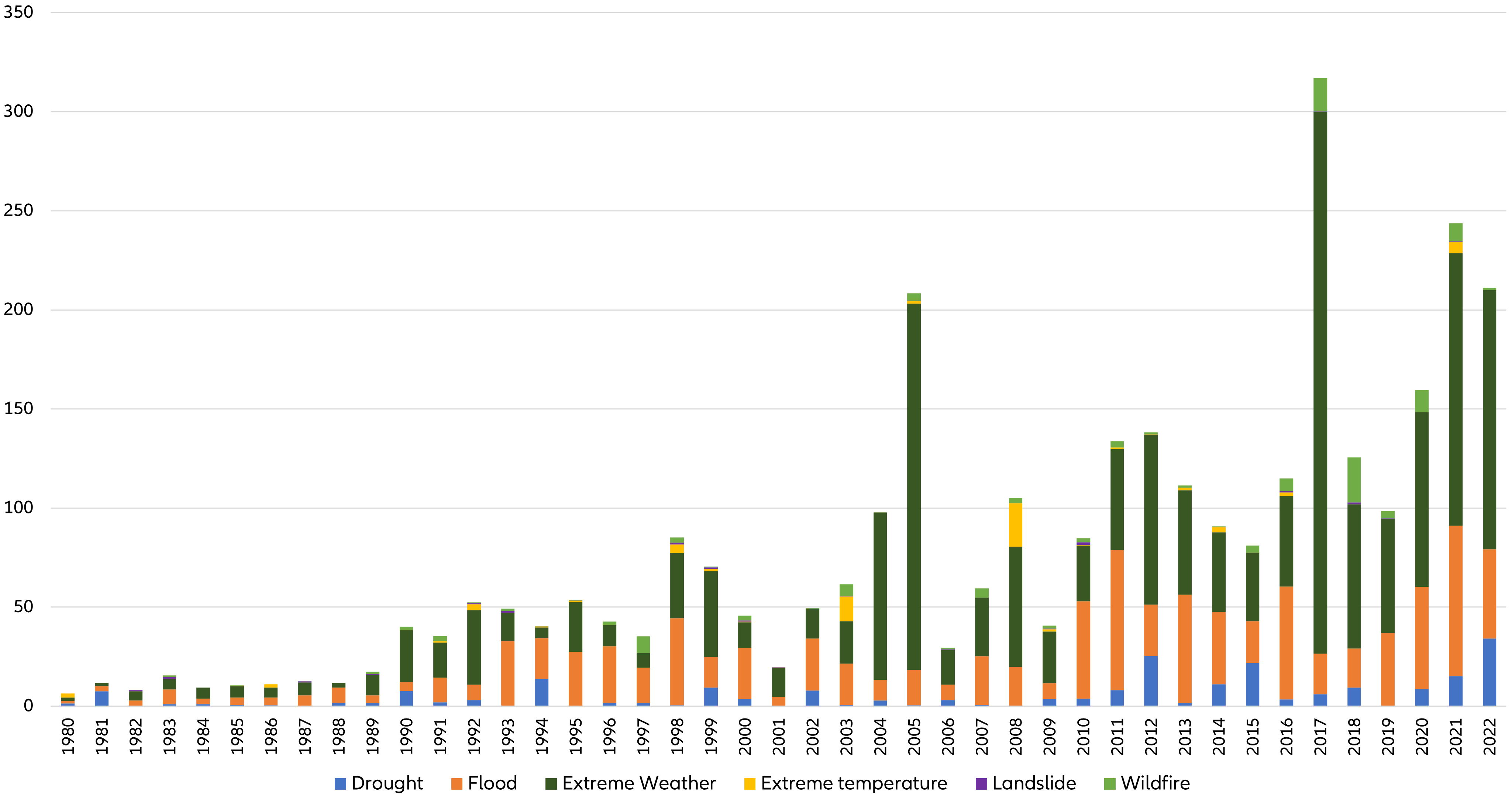

Global damage costs from weather-related natural disasters, 1980–2022 (USD billion)

Source: World in Data, December 2023

The most far-reaching physical risks relate to water: too much or too little water or water pollution and disruption to freshwater systems.ii The World Resources Institute estimates that 44 countries face “extremely high” or “high” water stress levels by 2040 with significant risk materiality for populations and businesses.

Driven by these trends, an increased focus on climate impact could prompt several changes:

- Formalised climate or physical risk assessment in portfolios. Although at a relatively early stage of development, we expect swift evolution and adoption of physical risk methodological frameworks (eg, the Institutional Group on Climate Change), climate risk and opportunity guidance (eg, the US Environmental Protection Agency) and climate risk-specific data from external providers (eg, Trucost Climate Change Physical Risk analytics and the Integrated Biodiversity Assessment Tool).

- Improved climate and physical risk disclosures. There are high quality company responses to the Climate Disclosure Project’s climate and water questionnaires. Over time we expect client demand for this level of detail to pressure companies into improving their public disclosures.

- Increased scrutiny on sovereign financial planning and disclosures. Higher temperatures place additional burdens on already stretched healthcare servicesiii and biodiversity risks are rising within the global supply chain.iv As part of the Paris Agreement, signatories must update their nationally determined contributionsv (NDCs), and evolving climate impacts could shape policies in coming years.

- Increased regulation around energy efficiency and transition. Reducing energy intensity will be critical in mitigating risks and boosting growth according to the World Economic Forum, and regulation will likely have a bigger role to play.

Climate and physical risks are a core element of our engagements with investee companies. We continue to explore ways to develop physical risk data and methodologies into our proprietary sustainability data engine SusIE, which feeds our investment advisory tool and supports front-office decision making.

- Read the first blog post in this series: Politics in 2024: risking the climate?

- Read an overview of our five themes: Sustainable investing: five themes for 2024 | Allianz Global Investors (allianzgi.com)

i Aon, Q3 Global Catastrophe Recap, page 8, October 2023

ii OECD, The Water Challenge, December 2023

iii Allianz Global Investors, Health is wealth?, October 2023

iv Allianz Global Investors, Defining the rules of engagement to protect biodiversity, June 2023

v UN, All About the NDCs, December 2023