Interpreting China

Year of the Rabbit: luckier for investors?

Last year was challenging for Chinese equities. Investors will be hoping the Year of the Rabbit is more rewarding after signs of a market rebound in 2022.

Key Takeaways

- The Year of the Rabbit comes as China investors hope signs of a rebound in markets at the end of 2022 – after a challenging year – spell better fortunes to come.

- With equity valuations looking reasonable, and corporate earnings potentially set to rebound, progress is being made on two issues that weighed on market sentiment over the past year – the government’s zero-Covid policy and difficulties in the property market.

- Investors can also explore the long-term investment case for China around technology innovation and climate progress amid its drive for self-sufficiency.

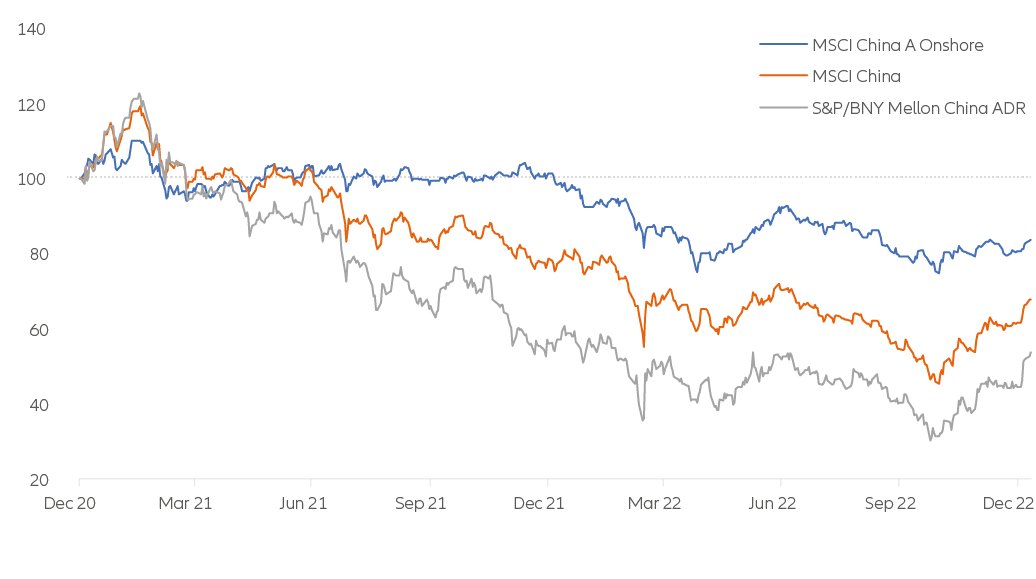

On 22 January China marks the start of its new year, symbolised by the water rabbit. This animal is said to represent longevity, peace, prosperity and luck. The year just passed, however, could hardly be described as lucky. The MSCI China index was down 14.7%, primarily because of the country’s zero-Covid policy and the troubles continuing to plague the property sector.

One of the most important events of 2022 was President Xi Jinping’s re-election for a third term at the 20th National Congress of the Chinese Communist Party in October. This historic achievement suggests that, overall, there is likely to be a continuity of policy from here.

Of particular note for investors is President Xi’s ambition to make China more self-sufficient in a wider range of industries, reducing its reliance on global supply chains. This could result in a range of investment opportunities. Meanwhile, political tensions between the US and China seem to have eased for now, with President Xi meeting President Biden at the G20 summit, signalling improving relations.

2022 wasn’t all bad news for investors – signs of a market rebound towards the end of the year led to hopes of a more positive 2023. This year investors in China will be hoping some of the rabbit’s purported good luck rubs off, but we believe conditions could already be in place for a better year.

Chinese equity valuations look reasonable and corporate earnings could be set to rebound, but the most important factors are that progress is already being made in the two areas that caused the biggest problems last year – Covid and the property market, as we set out below. And looking further ahead, several secular themes may make China a compelling long-term investment case.

Exhibit 1: China equity market performance since 2021 (rebased to 100, local currency)

Source: Refinitiv Datastream, Allianz Global Investors, as of 30 December 2022. Based on total return performance in gross, USD. Market and economic conditions are subject to rapid change, all opinions and views expressed constitute judgments as of the date of the writing and may change at any time without notice and with no obligation to update. Past performance, or any prediction, projection or forecast, is not indicative of future performance. The information above is provided for reference only, it should not be considered a recommendation to purchase or sell any particular security or strategy or an investment advice.

Reasons for optimism in 2023: the Covid policy U-turn…

After China’s zero-Covid stance was defended at the Party Congress in October, less than a month later the policy had effectively been dismantled. Amid wide-scale public protests – a rare occurrence in China – the government decided it would no longer try to stamp out localised Covid outbreaks by implementing strict lockdowns.

Given the low rate of vaccination in China, the impact of this turnaround has been severe: there was a huge surge in Covid infections in the aftermath, estimated to be around 250 million in the first 20 days of December alone. However, markets rallied sharply on the news of the policy change and anticipation of economic reopening. Consumers were initially cautious, staying at home rather than visiting shopping malls and restaurants, but the relaxation of restrictions could start to unleash three years’ worth of pent-up consumer demand as people saved money during lockdowns.

Signs are that the Lunar New Year Holiday sparked a boom in travel bookings, pointing to a revival in consumer spending. As a result, travel, retail and leisure-related stocks have been leading the stock market in recent weeks.

…and government support for cash-strapped property developers

A more stable property sector could be another catalyst for a rebound in confidence and consumption in 2023. Encouragingly, the government has begun to provide more direct support to property developers to help ensure pre-sold homes are completed. It has also enacted policies including extending repayment periods, ensuring additional bank lending, resuming equity market financing, and expanding government bond guarantees to ease the funding pressures that developers are facing.

Given China’s ageing population and falling birth rate, we think the property sector is in gradual structural decline. But over the shorter term, the easing of the financial problems facing the sector should help rebuild confidence and facilitate a macroeconomic recovery.

We expect these policy changes to pave the way for accelerated economic growth and potentially trickle down into corporate earnings, especially in the second half of 2023.

The long-term investment case: China’s drive for self-sufficiency

With the near-term outlook for China improving, it is also timely to reiterate the strategic opportunities that the country may represent for active investors with a long-term horizon.

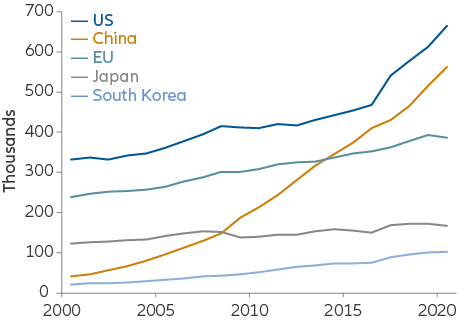

In the latest phase of its transformation, China is focused on safeguarding its economic prosperity while keeping global geopolitical tensions at bay.1 This includes a push for greater self-sufficiency by focusing on home-grown capabilities and resources, especially in areas like software, energy and food supplies, which are closely tied to national security. China is improving its manufacturing capabilities by automating more processes and developing its domestic semiconductor manufacturing industry, which should benefit as demand linked to technological advances like smart transportation increases.

Exhibit 2: Global R&D expenditure and growth (USD billion)

Source: OECD data 2019. The information above is provided for illustrative purposes only, it should not be considered a recommendation to purchase or sell any particular security or strategy or an investment advice.

Green tech innovation

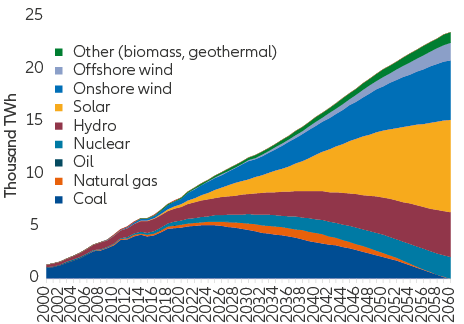

As part of its drive for self-sufficiency, China is investing heavily in green technologies. It is already a leader in renewable energy, with more than 70% of global output across the solar production chain2 and it is also the world’s largest market for electric vehicles, accounting for 40% of global sales.3

China is targeting peak carbon emissions in 2030 and net-zero carbon emissions by 2060, which could represent a challenge for a country that remains heavily reliant on fossil fuels and is still building new coal plants. However, it is providing sustained policy support for solar and wind power, as well as improving related technology infrastructure, which should help its green transition.

Exhibit 3: China power generation breakdown

Source: Goldman Sachs, January 2022. It is not a recommendation or investment advice to buy or sell any particular securities and should not be considered investment advice. A security mentioned as example above will not necessarily be comprised in the portfolio by the time this document is disclosed or at any other subsequent date. The information above is provided for illustrative purposes only, it should not be considered a recommendation to purchase or sell any particular security or strategy or an investment advice.

Opportunities in healthcare and financials

There is huge scope for innovation and growth within China’s healthcare sector, which has been thrust into the spotlight by Covid. China’s spending on healthcare still lags that in the EU, Japan and the US as a percentage of GDP. Greater investment must be a priority because the pressure on the healthcare system will only increase as 398 million people – nearly 30% of China’s population – will be aged 65 or over by 2060.

Meanwhile, reforms in the financial markets, including the ongoing liberalisation of capital markets and improvements to market infrastructure, could benefit some financial services companies and may also prove supportive of the wider economic outlook. While it is always difficult to know what the year ahead will bring, particularly in a market as volatile as China, there are some reasons to be positive as the Year of the Rabbit bounds into view.

Five reasons why the Year of the Rabbit could be lucky for investors

- Relaxation of zero-Covid measures could release three years of pent-up consumer demand, helping to drive economic growth.

- Policies to ease funding pressures in the property market could also support the economy.

- Tensions with the US seem to be easing.

- China’s drive for self-sufficiency may benefit areas including software, healthcare, semiconductors and electric vehicles.

- Chinese equity valuations are at reasonable levels and we believe the conditions are in place for an earnings recovery.

1. Read more: China’s Phase 3: a new chapter in its epic story (allianzgi.com)

2. Forbes, as of 31 March 2022

3. Virta Global, as of 30 June 2021