Outlook & commentary

Will the US risk rally endure – and can cyclicals continue to lead?

Summary

With equities rallying more than 30% since late March, driven most recently by cyclicals, financial markets were perhaps due for a period of consolidation. New risks could emerge, but we continue to believe in the ongoing economic re-opening story – so cyclical sectors may remain market leaders in the near term. Markets could be supported further as elevated levels of cash are put back to work.

Key takeaways

|

Risk assets have rallied since their 23 March lows, and the stellar May US jobs report released in early June provided yet another upside surprise. Non-farm payrolls were up 2.5 million versus an expected 7.5 million decline – a figure that sparked further market optimism.

The market’s reaction to this report also helped confirm the rotation in US markets that has been underway since mid-May: a pivot towards cyclical “laggards” (such as industrials, financials and energy) and away from the “winners” that fuelled the early part of the rally (such as technology, consumer staples and healthcare).

But after digesting the surprising jobs report figures, the markets seemed to undertake a period of consolidation driven by two factors. First, there is a general view that markets went up too far, too fast – perhaps ahead of fundamentals – and were overdue for a correction. And second, there has been an ominous rise in coronavirus cases and hospitalisations in certain states in the US.

Our view is that this broadening of the equity rally to include cyclical sectors was healthy, and that the virus outbreaks will be managed on a regional basis – without another shutdown of the entire US economy. As a result, as the economy re-opens, we expect select cyclical sectors to continue performing well in the near term, as the performance gap between the winners and laggards remains high. Longer term, we favour increasing tactical exposure to our ongoing secular growth themes as well.

What could spark a further rally in risk assets?

While periods of consolidation are natural, the risk rally may well resume once again. We will be monitoring both fundamental factors (including health developments and economic activity) and technical factors (which primarily revolve around market data) to identify renewed appetite for market risk.

Fundamental factors to watch

- Good news about the virus curve.. We will watch for stabilisation in health data, and confirmation that state and local governments are taking action to contain flare-ups, including expanding testing and implementing contact-tracing programs. We would also hope to see continued containment of the virus in the epicentre of the US crisis, namely New York and New Jersey.

- A continued pick-up in economic activity. We would like to see ongoing improvement in economic and mobility data across consumer sectors, including retail stores, restaurants and hospitality. This would likely then also be reflected in economic metrics like retail sales and PMI (purchasing managers’ index) data.

- Ongoing progress on therapies and vaccines. We hope to see more positive news and trial updates throughout the summer months. Ultimately, the development and distribution of a vaccine may be critical in restoring confidence and activity to pre-crisis levels.

- Another round of fiscal stimulus. We believe a new fiscal stimulus package (perhaps a final one) could be approved by both parties in Congress in late July, perhaps in the USD 1.5 trillion range. This kind of stimulus, which may include infrastructure reform, would have positive impact on both the economy and market sentiment.

Technical factors to watch

- The S&P 500 Index’s ability to stay above the 3,000 technical level. This is roughly the 200-day moving average, and the index moved above it in late May – which was a buy signal for some investors. It has approached this level in recent years but sustainably crossed it only once before – reaching an all-time high of 3,300 in early February – before falling back down. We will continue to monitor whether these levels can be sustained.

- Declines in above-average cash levels. Cash-heavy institutional and retail investors who missed at least some of this impressive rally in risk assets are still looking to play “catch-up” in performance. More recently, retail cash levels have come down (as more retail investors have perhaps participated in the recent cyclical rally), while institutional levels remain elevated.

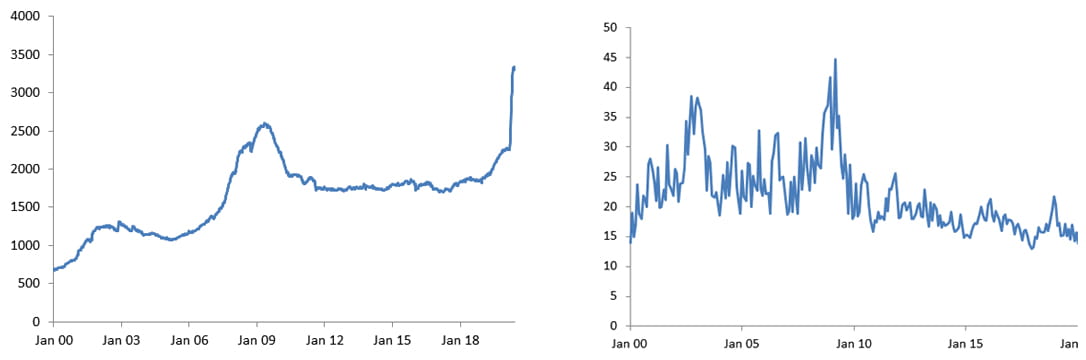

Institutional investors are still holding large amounts of cash, though retail cash levels have recently dropped

(Institutional money funds (ICI), $B / AAII, Asset Allocation Survey, Cash (%))

Source: St. Louis FRED, ICI, AAII, FactSet, 9 June 2020

- A further drop in the VIX. The so-called “fear index” (the CBOE volatility index, or VIX) moved higher, back to the 30s, as we entered this period of consolidation. This is after spiking as high as 83 in March. But given that the VIX averaged 15 in 2019, today’s levels still seem elevated. We will watch for additional declines as “peak fear” may be behind us.

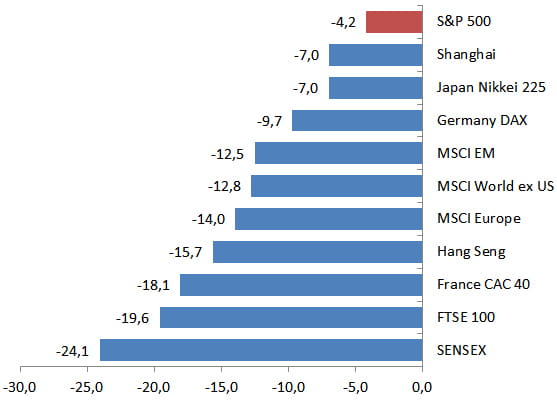

- Improvement in non-US markets. Globally, the S&P 500 Index remains the top-performing equity index year-to-date, in part because it provides liquidity and exposure to those companies – particularly in technology and healthcare – that have proved critical during the crisis. As markets move upward in the US, we are also watching to see whether emerging markets, Europe and Asia play catch-up, particularly as many of these markets continue to emerge from the pandemic, are exposed to cyclical sectors and also benefit from a softer US dollar on the margin.

US equities have outperformed their global counterparts

Source: FactSet, Allianz GI, 9 June 2020

What are the risks to our outlook?

While there is reason for optimism, we are mindful of looming risks that could cast a shadow on our outlook.

- A second wave of coronavirus cases. With the US population becoming more mobile and gathering together in larger numbers – especially given protests and civil unrest – we remain concerned about a resurgence in cases, particularly in areas that were early to reopen. That said, the likelihood of another country-wide economic shutdown remains low, and we think rising cases may be handled on a regional basis. We remain watchful for state and local governments to implement forms of enhanced testing and contact-tracing as containment measures.

- A slow return to pre-crisis levels of economic activity and employment. While we expect the reopening process to boost economic momentum – perhaps throughout the summer – a return to full pre-crisis levels of economic activity and employment will likely take time, perhaps years. During this period, investors may grow increasingly wary, particularly if the market valuations remain historically expensive. For now, however, investors may be more focused on the economic reopening, on ongoing fiscal and monetary stimulus, and on accommodative interest rates globally.

- A resumption of US-China tensions. We may see continued tension between the two superpowers as we head towards the US election season. The US has claimed that China mishandled and misled global players during the coronavirus crisis, which China denies, and the future of Hong Kong has become a new source of disagreement. We will be watching closely for any US action around tariffs or trade, or a de-listing of Chinese equities specifically, as these would have broader market implications. So far, the rhetoric has escalated, but actions have been more measured.

- Market fallout from US presidential elections. Current polls imply an increasing likelihood that former vice president Joe Biden could emerge victorious in November’s presidential elections. This may have implications for the market, as Mr Biden has spoken about increasing corporate and personal tax rates, and about rolling back some of President Donald Trump’s banking deregulation. However, Mr Biden is not considered an anti-Wall Street candidate and would likely not alienate this part of his base.

How should investors position portfolios for the road ahead?

As noted above, we continue to see opportunities in cyclical stocks in the near term, but we still think secular winners are attractive on a long-term horizon (three to five years or even longer), and investors should consider adding exposure here on a more tactical basis when there are pullbacks and opportunities. Some sectors we favour on both sides are highlighted below.

Consider the cyclical sectors tied to the “reopening”

Some of the more compelling risk-reward today may come from under-loved cyclicals, both in the US and globally:

- Travel and leisure. As consumers think about travel and leisure again, select airlines (which may have the backing of a fiscal bail-out), hotels, resorts and gaming companies may be winners. We expect to see more domestic travel at first, with international travel deemed harder and riskier.

- Parts of the energy complex. This sector has rebounded since the collapse of oil prices in mid-April. Areas of interest include renewable energy companies, which could grow more rapidly in the post-pandemic phase; natural gas companies, as telecommuting and cloud computing push up demand; and high-quality oil companies that survive the industry shakeout.

- Diversified financials. This category might include high-quality banks with large balance sheets. Also consider areas like private equity that can target distressed situations and even offer dividend yields, and financial information providers as trading volumes and capital markets deepen

- Med-tech and biotech. As elective procedures begin to re-open again, medical technology such as robotic surgery may be a winner. Biotechnology, such as gene and cell therapy, continues to be a secular theme.

Maintain exposure to key technology sector themes

We continue to prioritise secular growth themes in technology, particularly those parts of the tech sector that lend themselves to a longer-term “stay-at-home” world. These include wifi and 5G services, virtual access through the likes of remote education, video conferencing and e-gaming, and corporate IT infrastructure – such as cyber-security and cloud computing – to support a “work-from-home” workforce.

Healthcare and consumer sectors remain critical

As we re-emerge from the pandemic, healthcare and consumer staples companies will play a critical role for consumers worldwide. In addition to those companies involved in the development of medical therapies and vaccinations, we would prioritise testing and devices, telemedicine – including the remote monitoring of patients and diagnostics. Consumer “winners” could include food delivery companies, digital grocers and omni-channel retailers, as well as home improvement players.

Opportunities across fixed income

Finally, we also see opportunities across the spectrum in fixed income, particularly as the Federal Reserve stimulus programmes have supported credit markets in both the investment-grade and high-yield space. On the more defensive side, we favour areas like high-quality investment-grade, US Treasury and US dollar assets. We would also look to add risk in areas like select high yield – including short-duration and “fallen angel” strategies – convertible bonds (which offer upside via equity options) and select Asian high yield.

1210496

Summary

Data is sometimes called the “new oil” given its integral role in the functioning of the world’s economy. But how safe is this data? As more business activity and social interaction moves online – particularly in the wake of the coronavirus pandemic – companies’ approach to cyber security is being scrutinised. Through a dedicated engagement programme, we’re helping to influence companies’ policies and best practices in this area.

Key takeaways

|

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).