Embracing Disruption

How do recent events in Europe affect the opportunities in transitional energy?

Summary

The invasion of Ukraine by Russian armed forces has destabilised security in Europe, creating a humanitarian crisis and market turmoil. With half of Europe’s oil and 30% to 40% of its gas imported from Russia, the invasion has escalated concerns over what Europe’s existing and long-term energy mix will look like in providing the region with dependable, affordable and climate-friendly access to energy. Here, we look at some considerations for investors assessing the energy market.

Key takeaways

|

In recent decades, Europe has grown highly dependent on Russian oil and natural gas, and the invasion of Ukraine by Russian armed forces has put Europe in a difficult position. The price of energy has soared even as Europe feels growing pressure to increase economic sanctions against Russia. This has reignited a discussion about Europe’s energy mix, the impact of rising costs and how to make a faster transition to clean energy.

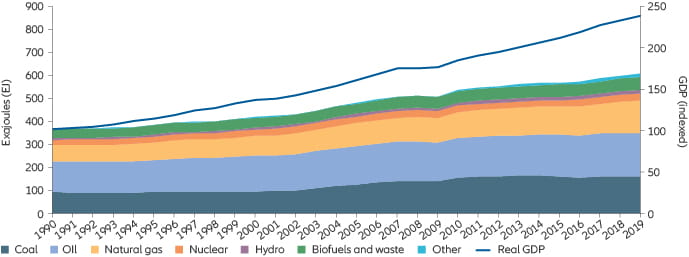

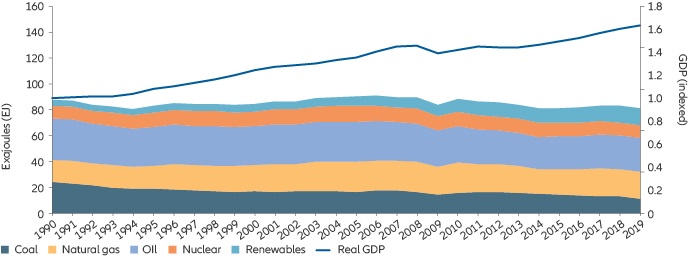

- The energy mix: Europe has been grappling with a sustained, widening gap between its investment in energy infrastructure and its dependence on energy – a trend that is replicated globally (see Exhibits 1 and 2). Since 1990, Europe’s total energy supply has contracted overall. And while its dependence on coal, oil and natural gas has fallen from 84% to 71% since 1990, its use of gas has risen from 20% to 26%.

- The impact of rising costs: Given the disruptions to the supply chain caused by events in Ukraine, the impact on energy pricing is already very evident. At current price levels, it is now cheaper for many power stations to burn coal than gas. And costs aside, to maintain current energy levels while burning less Russian gas, it may be necessary to burn more coal – hardly a sustainable proposition.

- Investing in clean energy: Given this backdrop, European governments are under pressure to increase the use of clean energy and accelerate the delivery of green technologies. They are also assessing where nuclear power stands in the long-term energy mix, and they are looking to invest in carbon capture technologies to compensate for slow progress in reducing carbon emissions.

How Europe plans to speed up the transition to clean energy

Rising energy costs are making the already politically charged topic of energy even more political. Policymakers must find a balance between making energy affordable in the near term and investing in alternative energy sources over the long term. The European Commission has already commented that “terminating our dangerous overdependence on fossil fuels from Russia can be achieved well before 2030”. But getting there may involve acting on several fronts.

- Reclassifying nuclear as “green”. Nuclear power’s contribution to Europe’s energy mix has risen only marginally in the last 30 years, to 12.5% in 2019. The European Commission had already approved draft rules for classifying nuclear (along with gas) as “green” in the EU taxonomy – a classification system for environmentally sustainable economic activities. However, the greater acceptance of nuclear as a possible core clean-energy source (albeit with waste-disposal issues) was put to the test with the shelling of Ukraine’s Zaporizhzhia nuclear plant by Russian armed forces.

- Expanding renewable energy sources. Europe’s renewable energy expansion appears on track, but will need to accelerate to respond to the current crisis. Its contribution to the European mix reached 22.1% in 20201 compared with only 4.3% in 19902. The European Union has targets of 32% and 60% market share for renewables for 2030 and 2050, respectively.

- Investing in “clean tech”. An ambitious pathway to achieving “net-zero” carbon emissions by 2050 includes the significant expansion of renewable energy sources, increased carbon capture technologies and better energy storage.

What it may mean for investors

Clean tech is evolving rapidly – and needs investment

Even before the situation in Ukraine brought energy issues to the fore, clean-tech investments were already a critical solution for the climate crisis. Companies that help enable both climate mitigation and adaptation may benefit significantly from Europe’s energy transition. This includes firms that work on rapidly evolving technologies like energy storage, green and blue hydrogen, and grid technology, as well as more mainstream forms of renewables eg, solar and wind.

Be mindful of shrinking availability of “rare earths” and other raw materials

The current crisis touches upon the access to key strategic metals and minerals required for the production of renewable energy solutions. Rare-earth elements are essential for capturing wind power; magnesium is a key component of fuel cells, plus wind and photovoltaic technology; and cobalt and natural graphite are critical for batteries and fuel-cell technology. China and Russia are responsible for most of the EU’s imports of these metals and minerals. As such, given ongoing geopolitical tensions, it is difficult to ignore the scope for supply chain disruption. At the same time, as prices rise for these raw materials, previously shuttered mines outside of Russia and China may be able to restart and profitably provide local sourcing. This is a longer-term change, but it could significantly improve the scope for renewable energy development.

Look into carbon-capture solutions

During our AllianzGI 2021 Sustainability Days conference, we heard from Professor Johan Rockström, a director of the Potsdam Institute for Climate Impact Research in Germany and one of the world’s most influential Earth scientists. Professor Rockström highlighted the importance of “carbon sinks” to achieving net zero. (Carbon sinks are natural or human-made systems that can trap and store carbon emissions.) This is where the opportunity sits in carbon capture utilisation and storage (CCUS) solutions and technologies and energy storage. According to recent International Energy Agency (IEA) estimates:

- CCUS facilities in operation more than tripled between 2010-2021, with the ability to capture 43.7 million tonnes of CO2.

- Global CO2 emission reductions from CCUS retrofits in power generation and heavy industries could reach more than 2 gigatonnes CO2 annually by 2050.

- The global CCUS market was estimated at USD 1.9 billion in 2020, with the capacity to grow to USD 7 billion by 2030.

The current crisis has raised risks to energy security, affordability and the expansion of renewable energy sources. But it has also highlighted the necessity for accelerated investment in the European – and indeed global – energy infrastructure and mix, which provides a breadth and depth of opportunities. These extend across carbon capture and energy storage solutions, energy efficiency technologies, and local sourcing of strategic metals and minerals. Many solutions exist but need investment to achieve scalability – the growth opportunities are significant.

Exhibit 1: Fossil fuels are still a major source of the global energy supply

World total energy supply by source versus real GDP (1990-2019)

Source: International Energy Agency, World Bank. Data as at 2019.

Exhibit 2: Europe is more dependent on natural gas than 30 years ago, while the overall energy supply has fallen

Europe total energy supply by source versus real GDP (1990-2019)

Source: International Energy Agency, World Bank. Data as at 2019.

The exajoule (EJ) is equal to 1018 (one quintillion) joules.

1. Source: European Economic Area. Data as at 4 March 2022

2. Source: International Energy Agency, World Bank. Data as at March 2022.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Equities have tended to be volatile, and do not offer a fixed rate of return. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Credit risk reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. Emerging markets may be more volatile, less liquid, less transparent, and subject to less oversight, and values may fluctuate with currency exchange rates. Investments in alternative assets presents the opportunity for significant losses including losses which exceed the initial amount invested. Some investments in alternative assets have experienced periods of extreme volatility and in general, are not suitable for all investors. Environmental, social and governance (ESG) strategies consider factors beyond traditional financial information to select securities or eliminate exposure which could result in relative investment performance deviating from other strategies or broad market benchmarks. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; ; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

2078504

Don’t downsize your dreams

Is it time to revisit the UK as an asset class?

Summary

UK equities have grown increasingly unloved over the past decade. Could that be about to change? A recent uptick in performance reminded investors what they are missing, and the market could offer growth and value opportunities.

Key takeaways

|