Embracing Disruption

The investment implications of a slimmer world

Hailed in some quarters as “wonder drugs” and popularized by celebrity endorsements from the likes of Oprah Winfrey and Elon Musk, glucagon-like peptide-1 (GLP-1) receptor agonists are a class of medicines that has taken both the healthcare and investment worlds by storm over the past year. Better known to the public under several proprietary names, these drugs are already disrupting the pharmaceuticals and MedTech sectors, and we believe their impact beyond these is likely to be broad and profound.

A pharmaceutical breakthrough

Simply put, GLP1s are a class of drugs that make recipients feel sated for longer, eat less, and thus lose weight. These drugs were originally intended to stimulate insulin production, reducing blood sugar levels and serving as an effective treatment for type-2 diabetes; however, weight loss came as a serendipitous side effect and is now becoming what GLP1s are best known for. And there is growing evidence that these drugs can also have other positive outcomes, such as a reduction in cardiovascular events – for instance, heart attacks and strokes – as well as serving as an anti-addiction treatment.

These clinical effects are certainly impressive in themselves, but the hype around these drugs can only be fully understood by considering the demographic trends which they may help address. Studies estimate that around 70% of the US population is overweight, with 40% being obese and 10% severely obese. This means that around 120 million of the current US population is considered obese, a number forecast to rise to 150 million by 2030. Moreover, around one in ten Americans are currently diabetic, with over 90% of these having type-2. And while this is traditionally a disease affecting the over45s, we are increasingly seeing its development in young adults and even children. While the described trends pertain to the US, the global situation is similar. In 2020, it was estimated that around 38% of the world’s population aged five or over was overweight, a number expected to increase to over 50% by 2035.

Exhibit 1: Interest over time

Source: Google, 17.01.23

Of course, excessive weight and obesity are linked to a range of comorbidities that impose significant costs on both individuals and healthcare systems, and it is thus clear why the potential of drugs such as GLP1s have been so extensively hyped. And thanks to the type of celebrity endorsements mentioned above, the growing proliferation of these drugs has reached into the popular consciousness in an unprecedented way.

Upsetting the pharma sector

It is becoming increasingly clear that GLP1s, and their potential impact on long-term health outcomes, is causing one of the most disruptive paradigm shifts – in terms of healthcare and healthcare investing – in recent memory.

The impact is already trickling over and being felt in other sectors. So, given that GLP1s have already been about for some time, why has attention suddenly exploded over the past year?

The use of these drugs was previously concentrated around treating diabetes, with the breakthrough into the weight loss/obesity market coming more recently as evidence to support their broader utilization has grown. Indeed, the growing strength of this data led to the first approval of a semaglutide (a type of GLP1 receptor agonist) by the US regulator FDA specifically for the purpose of weight loss. Given the potential size of the market for such drugs, both in the US and globally, it is clear why their introduction has caused such excitement in the market.

Unsurprisingly, the two main players in this area have been highly vocal regarding the impact their drugs will have on preventing comorbidities associated with obesity, contributing to a sector-wide sell-off in medical technology. Indeed, as the growth engines of the leading lights in GLP1 have roared, concerns around potentially shrinking total addressable markets (TAMs) have hit providers in a range of areas, including, among others, cardiovascular treatments, orthopedics, sleep apnea, and bariatric surgery.

Exhibit 2: GLP1 Winners and Losers

Source: Bloomberg, 16.01.23

Of course, as in any new and lucrative therapeutic area with a vast TAM (estimated at USD 100 billion plus), fierce competition is likely to be attracted. As such, the key players are erecting “data walls” around completed – and ongoing – studies, many of which are of the type that competitors have not yet even started. Given that efficacy has now been established, these ongoing trials are aimed at further enhancing physician adoption and payer coverage, and should serve to provide a further marketing advantage to the first movers and sector leaders. Competitors will increasingly have to conduct head-tohead trials versus the existing players – a high bar to clear, and one that will be both costly and time consuming for newcomers to this space.

Adoption is, and will continue to be, strongly linked to payer coverage and developments in the health insurance sector should thus be keenly observed. At present, obesity coverage in the US is concentrated in the commercial market with much lower levels available through Medicare; a recent estimate indicated that coverage for obesity treatment in the US currently reaches around 50 million people. While Medicare plans are, since 2003, statutorily prevented from covering medications for weight loss, a bipartisan bill – the Treat and Reduce Obesity Act (TROA) – currently progressing through Congress seeks to repeal this law and enable coverage. While potential coverage is likely to broaden in the future, some employers have recently opted out of this provision and hurdles to long term adoption, such as cost, remain. However, ongoing and future comorbidity trials are likely to improve the cost-benefit profiles of these medications.

The disruptive potential of a slimmer population

Even on conservative estimates, the proliferation of GLP1s is likely to represent a significant boon for the market leaders. Assuming a 10% penetration of the obese population at a per year cost of USD 5,000 per patient suggests a market worth USD 60 billion in the US alone, not including potentially promising further uses such as the treatment of alcoholism and other addictions. Furthermore, we estimate that the two main players are likely to maintain a combined 80%+ share of this market over the long-term.

Yet the effect of widespread adoption of GLP1s will go much further than the bottom line of a handful of pioneering pharmaceutical companies. The disruptive potential across the rest of the MedTech sector is clear, in terms of reducing treatment demand for comorbid complaints across a swathe of areas, but the effect of a widespread reduction in consumed calories will be much more profound, affecting food and beverages, agribusiness, tobacco, and beyond. For instance, in the US soft drinks market, over 50% of consumption is undertaken by around 7% of consumers, with this demographic being firmly in the sights of GLP1.

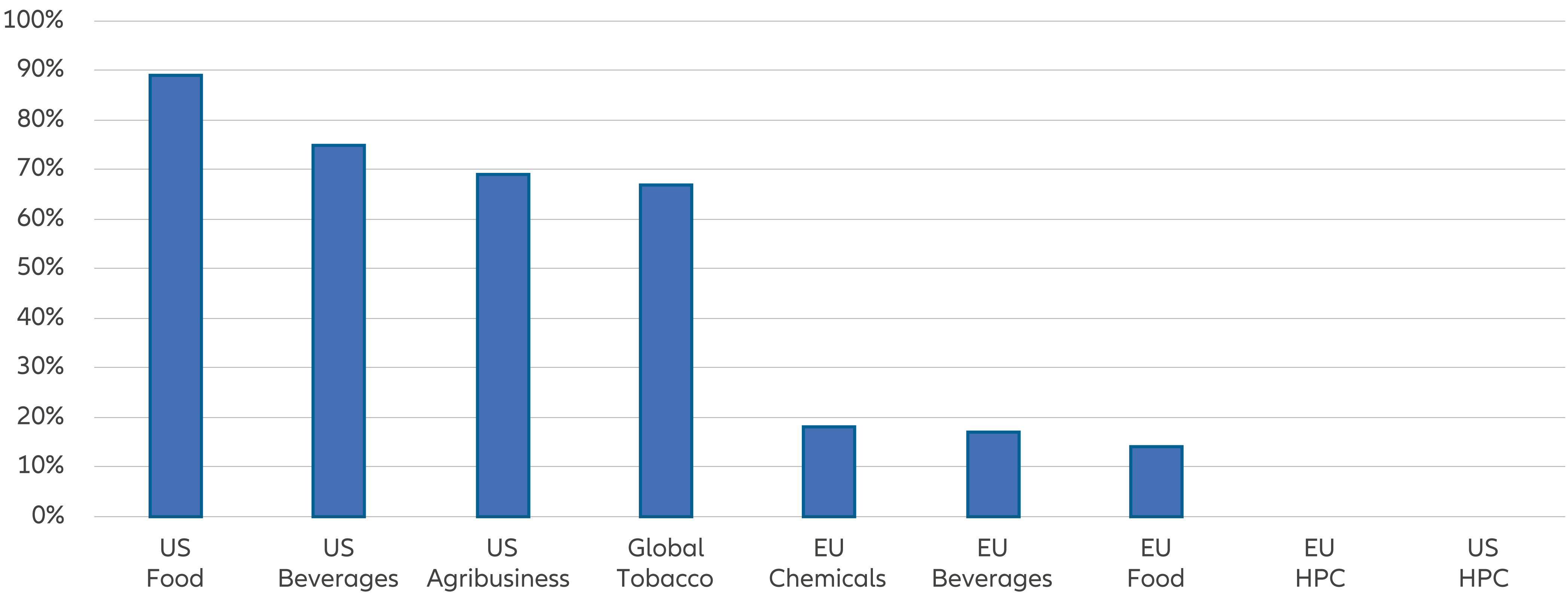

Exhibit 3: The proportion of names that are ‘highly exposed’ to GLP-1 drug penetration varies across staples sector

Percentage of companies within sector with a BMI Index value score of 27+ Source: World Health Organisation, company reports, Barclays Research

GLP1 drugs are having a material and disruptive impact not just across healthcare services and MedTech, but also a range of consumer sectors, especially snacks, soft drinks, and higher carbohydrate options. While we are in the early days of assessing and forecasting this impact, the coming months and years will bring further clarity, and maintaining an active approach to these sectors will thus be key. Indeed, while the future trajectory for these drugs is anything but clear or straightforward, we believe this breakthrough is well worth tracking as the disruptive effects of these drugs is likely to have a reverberating impact across the world – with notable winners and losers in the financial markets and beyond.