The Big Question

Is it time for LDI?

Pension plan providers face a challenge in preparing for the future. They need to ensure that their investments (including stocks and bonds) make sufficient cash to meet liabilities – in other words, the payouts guaranteed to retirees.

The task is made even tougher by variable factors such as interest rates, inflation and overall market performance that affect the value of these investments and the liabilities. In a worst-case scenario, a funding mismatch can occur when the amount to pay out increases due to changes in interest rates or inflation – but the plan assets do not match the increase in the liabilities.

Liability-driven investing (LDI) can help. LDI strategies protect the plan’s funding ratio – the value of its assets compared to liabilities – from adverse scenarios.

All pension providers strive to achieve above market returns. LDI helps to broaden the plan’s focus to include securing its funded status and reducing volatility. Together, all these factors can boost a plan’s long-term sustainability.

Why is LDI something to consider now?

We see two main risks in a shifting market environment – and LDI can minimise the impact of both:

Risk 1

A fall in interest rates will reduce funding ratios

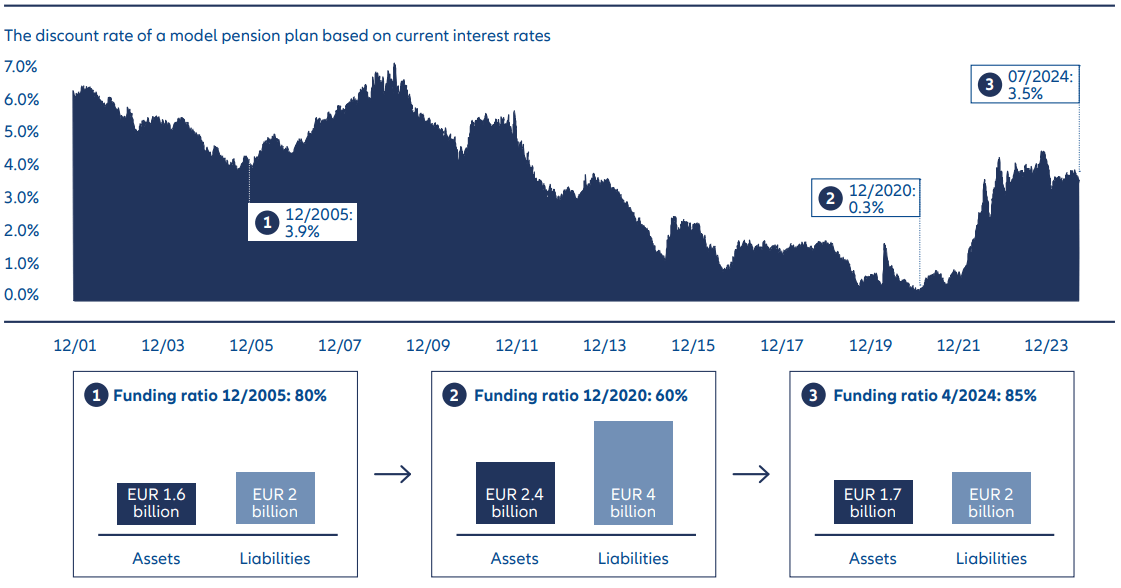

Interest rates have been around multiyear highs since 2022 – but central banks are now moving to lower them as inflation and growth has cooled. Falling interest rates can provide a headwind for pension plans as they raise the value of liabilities and can therefore lower funding ratios.

Such a challenge arose in the wake of the 2008 global financial crisis as rates fell across the entire fixed income yield curve. Pension plans – especially those whose payments were far in the future – faced a massive increase in the value of their liabilities as bond yields fell. The investment portfolios of many plans could not keep pace with this increase in value, especially as equity returns suffered, which led to falling funding ratios and negatively affected the equity of the plan sponsors.

Higher rates since 2022 have been helpful in repairing funding ratios (see Exhibit 1) by lowering the value of liabilities and boosting the expected returns that can be earned with an LDI strategy. The average yield to maturity for long-term EUR investment grade corporate bonds – which typically form the basis for an LDI portfolio – has risen from around +0.5% as of December 2020 to around 3.6% currently.1

As signs point to lower interest rates ahead, we think now may be the time to consider protecting funding levels by switching to a portfolio structure with a greater focus on hedging. Here LDI may help by protecting the funding ratio against changes in rates.

Exhibit 1: Pension plan funding ratios have improved – but interest rates may change that

Note: Calculated according to International Financial Reporting Standards (IFRS) methodology based on the yield of EUR AA corporate bonds with roughly 15 years maturity (reflecting an exemplary pension plan with roughly 15 years maturity). The IFRS discount rate reflects current interest rates. Source: risklab calculations. The representation of the funding ratio development is purely illustrative. Data as at 31 July 2024.

Risk 2

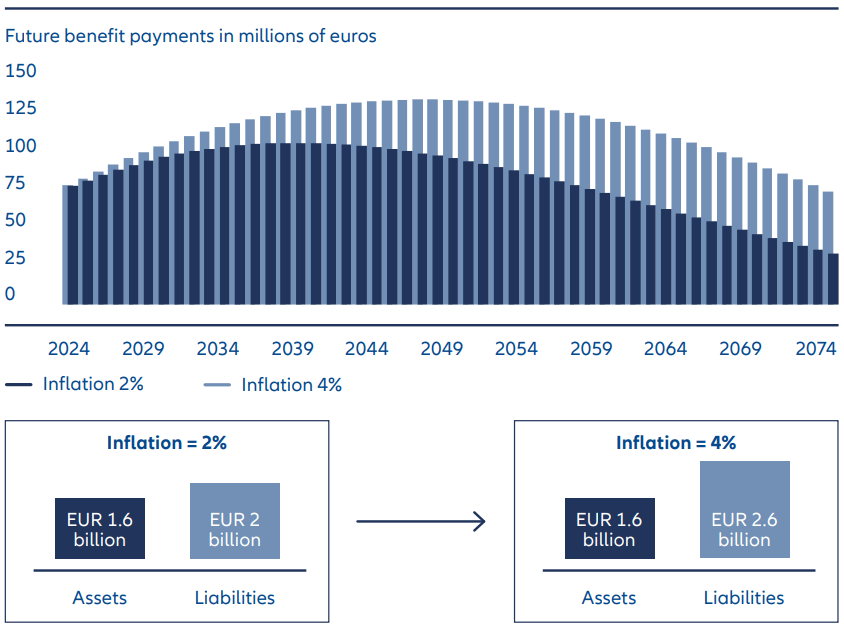

Lingering inflation raises future payments

Inflation can have a significant bearing on how much pension plans have to pay out in the future, particularly those plans where future payments are automatically adjusted to reflect inflation. Higher inflation can increase pension payments in the medium to long term (see Exhibit 2), burdening the funding ratio. To hedge the risk of higher-than-expected inflation, inflation swaps can be used as part of an LDI strategy.

Inflation has fallen since 2022 and markets are anticipating its downward path to continue in the long-term, sliding back to central bank targets of 2%. The implied inflation expectation for the euro zone for the next ten years is currently 2.1%.2 But we’re not convinced that inflationary forces will permanently fade. We think long-term factors like the regionalisation of supply chains, the drive to decarbonise the planet and ageing populations may keep inflation risks elevated.

Exhibit 2: Higher inflation could raise future obligations for pension plans

Source: risklab calculations. Representation of future pension payments is purely illustrative. Data as at 31 July 2024.

We think it’s worth carefully examining how inflation may affect future obligations. The risk of increased inflation can be hedged on the capital market at relatively low opportunity costs. If inflation exceeds market expectations in the next few years, hedging will pay off. The risk of increased inflation in the medium term is only priced in to a limited extent in the market. And market expectations have consistently underestimated inflation in recent years.

We acknowledge that the risks of lower rates and higher inflation may not both come to pass, at least not at the same time. But given the uncertain economic outlook and the longer-term view taken by many plans, we think it may be prudent to consider the risk of both scenarios.

Need to know

Q. What are the most common types of LDI strategies?

A. There are various ways to implement LDI strategies, but two are used most often. Cash flow matching strategies involve setting up a bond portfolio – typically without derivatives – with a maturity structure that best matches the profile of the liability. That way, each future annuity payment is matched by a bond with a similar maturity, so that the repayments from the bond portfolio can be used to service the annuity payments. For long-term plans with a duration of 10 years or more, this strategy is often difficult to implement due to an increasingly shrinking universe of available bonds.

Another option are immunisation strategies, which use derivatives to address interest rate or inflation risks. In such an approach, the risk factors of the liability side are replicated on the investment side, so that any increase in the liability value due to market factors is reflected in the assets. In addition to bonds, interest rate swaps are typically used to ensure efficient hedging of liability risks even for longer maturities in which the availability and market depth of physical bonds decreases.

Factors to consider when selecting an LDI strategy

Every pension plan is different. And the LDI needs of pension plans can vary according to the level of funding status, duration of the plan and how closely linked future benefit payments are to inflation. In our view, each plan requires a tailored approach, taking its individual characteristics into account to mitigate liability risks and optimally protect the funding level against unfavourable market movements. As a starting point, we think the following factors should be taken into consideration for all LDI strategies:

- Minimising mismatch risks:

examining the plan’s specific liabilities is an important first step to quantifying relevant risk factors.

To achieve the best possible hedge, it is important to address all risk factors and to continuously realign the portfolio to changes in capital markets. - Measuring performance transparently: defining a fair benchmark to measure performance can be a challenge given “non-market factors” outside the scope of an LDI portfolio, such as service costs and liability transfers. When setting up an LDI strategy, we think it’s sensible to clearly define the goals and agree metrics to measure success.

- Staying flexible:

LDI strategies often form the core of a pension plan’s asset allocation, so it is important to constantly monitor and realign the strategy to the plan’s goals and the market environment. One potential adjustment to consider is the use of leverage to adjust hedge ratios.

Once these factors are addressed it should be easier to build an LDI strategy to meet a plan’s needs. We think current interest rate and inflation levels make it a prime time to build upon investment gains and protect against future volatility by considering LDI strategies.

Helping a European pension plan use LDI to better match their assets to their liabilities

GOAL

GOAL

Closing the mismatch between the liabilities and assets, with a particular focus on easing funding pressure in the years to 2040 when a lot of payments to retirees are due.

OUR IDEA

OUR IDEA

Using a combination of long duration corporate bonds, interest rate swaps and cash (needed as collateral for the swap positions) to hedge risks and ensure the plan has sufficient assets to meet liabilities in the years to 2040 and beyond. The result would be a better alignment in the liability return – which measures the growth of liabilities due to market factors – and the LDI portfolio return which improves the funding ratio.

This case study is for illustrative purposes only and the company cited is not a client of Allianz Global Investors.

1 As of August 2024, based on the Bloomberg Barclays Capital Euro Aggregate Corporates 7+ Index (Ticker: H05453EU Index).

2 As of 31 July 2024