The Big Question

How is digitalisation shaping wealth management?

The way individuals manage their wealth is changing.

In years gone by, more people met with their wealth managers face-to-face before investing in a fund without checking its performance for months, or possibly years, to come. Today, mobile phone apps and other digital experiences can complement or even replace the old ways of working. Checking portfolio performance – and even re-positioning – is often done in real time.

The Covid-19 pandemic accelerated the move towards digitalisation as more people sought out ways to manage their money digitally. So, too, has the transfer of wealth from older to digital-savvy younger generations.

And unlike in previous eras, financial returns are no longer the sole objective for retail investors. They want more customisation and transparency across the investment offering – driven in part by a more ecologically and socially conscious mindset. Here, technology and the massive increase in data availability can help, providing tailored solutions and information available at an individual’s fingertips.

Trends transforming wealth management

We believe the following four trends will significantly transform the wealth management industry:

1. Embracing the shift to digital

Younger generations are digital natives and expect wealth management solutions to be as simple as an app. Generations Y – aka millennials – and Z prefer digital communication for advice, planning and service, according to J.D. Power, a market intelligence firm. However, even older generations are showing a similar preference for digital interactions. Wealth managers must decide whether to focus on fully digitalised user journeys for a self-led approach or traditional adviser-led sessions. The answer may be a hybrid approach in which the efficiency of digital tools is combined with the personal touch of human advisers, providing specific advice where needed. The shift to digital can thus cater to a broad range of retail investors’ preferences.

2. Democratising institutional offerings

Retail investors are increasingly moving into different areas of investment, such as private markets, previously reserved for only the wealthiest investors. According to Oliver Wyman and Morgan Stanley, retail wealth investors are expected to allocate around USD 5.1 trillion to private markets by 2025, more than double the level of 2020 – and we anticipate further growth in the coming years.

3. Supplying tailored solutions

Hyper-personalisation is a big trend in the retail market, with retail investors demanding solutions tailored to their individual needs rather than standardised off-the-shelf products. Customisation can range from providing greater transparency on an overall portfolio to setting up a dynamic investment strategy tailored to an individual’s needs.

4. Investing with impact

Historically, sustainable investing was viewed as corporate altruism. However, this perception has evolved: more investors view sustainability as integral to their investment strategies. Although economic growth and inflation concerns are top-of-mind for many investors in the current environment, sustainability-related considerations are becoming more pressing and are likely to have significant implications for the wealth industry over the mid-to-long term. The key to meeting investor expectations will be access to comprehensive, transparent, granular and standardised sustainability data.

Combined, these market trends are challenging traditional wealth managers to sharpen their offerings for clients and rethink their digital infrastructure, including how they collaborate with their external partners.

Deploying technology to improve the investment experience and offering

Technology can enable wealth managers to provide personalised investment solutions at scale. That is the theory. How can wealth managers use technology in practice?

- Offer holistic advice and customised asset allocation: Traditionally, sales efforts were focused on the distribution of individual products. Today a fully integrated digital solution is becoming popular, tailored to the investment needs of the client, taking account of their risk and return aspirations or liquidity needs. Solutions should be able to dynamically adapt as an investor’s needs and preferences change over time. The goal is to provide advice via a digital service. Some wealth managers may need to consider partnering with an external partner with a track record of using technology to provide advisory solutions.

- Think innovatively about product offering: The move towards customised asset allocations requires innovation across the product range. For example, this may mean giving retail investors access to a broad range of private market investments to improve diversification and enable them to participate in higher-yielding asset classes. Or it may mean structuring complex and tricky to manage investments in a straightforward and accessible way. As wealth management firms digitalise and automate their processes, they’ve been able to increasingly provide investment strategies tailored to each client’s goals on a single account basis (a single trading account which the client can access).

- Integrate investor and adviser experiences: As retail investors and their advisers work closely together, their digital experience should be seamless and fully integrated. Digital tools can help investors map their investment plans and provide information curated to their circumstances. As retail investors expect these tools to be intuitive, their design and ease of use are crucial to their success.

- Harness analytics: Retail investors want greater visibility of their portfolio. One way of providing this is a “look-through” of their holdings to get a better understanding of the actual positioning in different sectors or regions. Another way would be the provision of forward-looking statistics, projecting how a portfolio may perform in the future, giving investors a better grasp of their investment’s risks and returns and the likelihood of achieving their goals.

- Improve educational value: Educating a client about products gives them an understanding of how different strategies can help in achieving their financial goals, boosting their confidence in portfolio choices. A digital format for this product information is key and may include digital learning paths, interactive learning sessions and gamification.

Helping an adviser of retail clients create resilient investment portfolios

GOAL

GOAL

Bringing institutional advice and investment opportunities to the retail market to provide:

- Better client understanding of expected market opportunities and risk provided in a retail format.

- Investment portfolios aligned with a client’s long-term goals and regulatory requirements.

- Allowing the adviser more time to focus on providing advice to clients rather than manual processes such as printing, signing and scanning contracts.

OUR IDEA

OUR IDEA

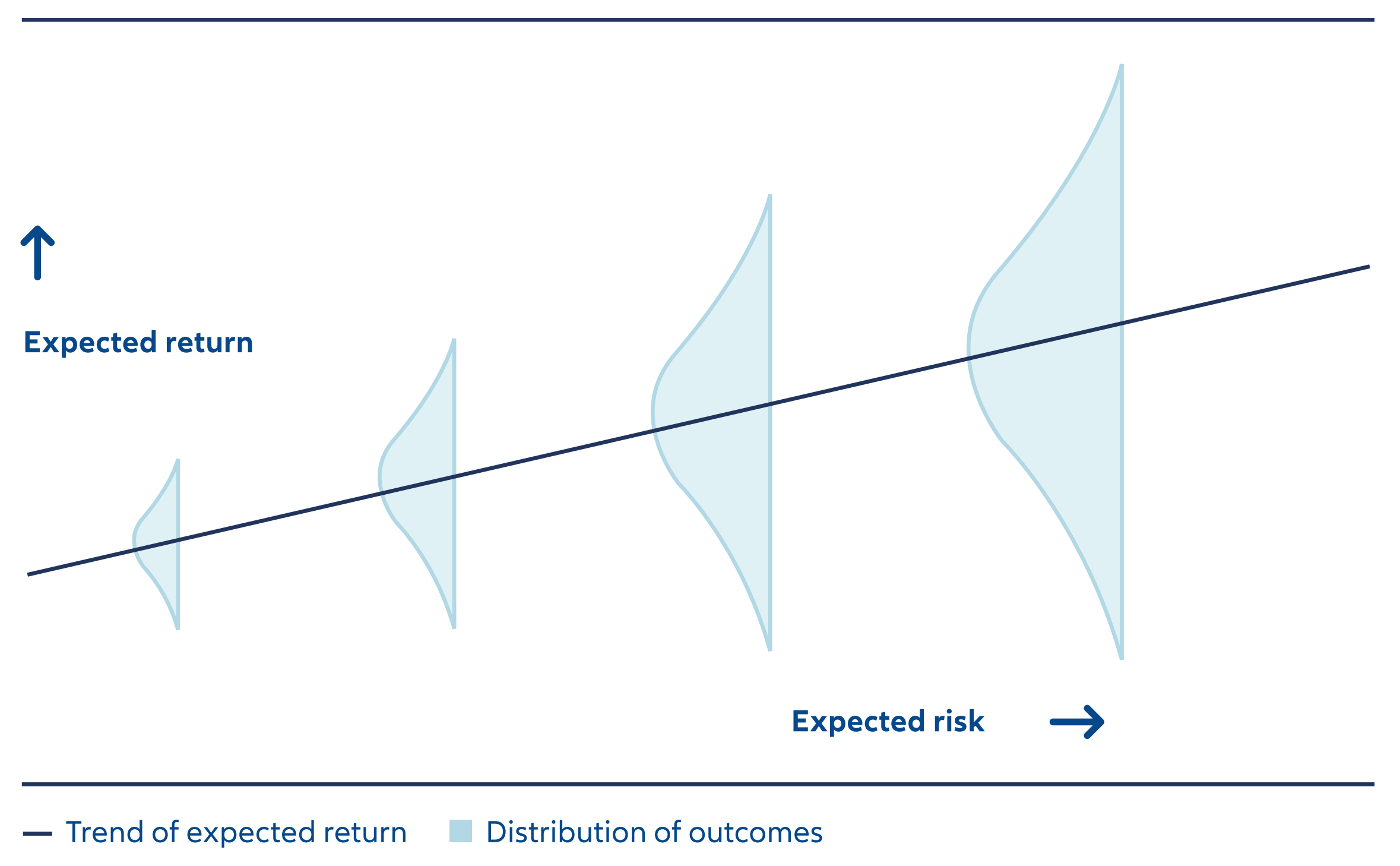

We use data analysis to help illustrate the risk-return profile of different asset allocations available to a client. The data visualisation can help the adviser to build investment portfolios tailored to a client’s needs, helping individuals understand the trade-off between a higher expected return and an increase in risk and providing a clearer understanding of potential outcomes (Exhibit 1 shows the type of visualisation that might be possible).

This case study is for illustrative purposes only and the adviser cited is not a client of Allianz Global Investors.

Exhibit 1: Higher risks tend to lead to higher returns but not always

Source: Based on an illustration from Ruminating on Asset Allocation, Oaktree Capital, 22 October, 2024