Power of 3: why Scope 3 emissions matter

What are Scope 3 emissions? In simple terms, they are the greenhouse gas emissions generated across a company’s value chain – both before and after its own operations. They include the emissions produced by suppliers as well as those generated by customers when using the company’s products or services. Though complex, measuring and managing Scope 3 emissions is – in our view – essential if net zero by 2050 is to be achieved. The good news? Solutions exist.

Key Takeaways

- Tackling Scope 3 emissions is necessary for all stakeholders to move the economy further towards net zero.

- Mounting pressure from regulators and other stakeholders should help corporates to better understand and address their Scope 3 emissions.

- The complex cascading system of emissions throughout the layers of the economy brings challenges as well as solutions.

- Financed emissions are those linked to investment activities, and asset managers should look at efficient ways to manage these as part of their net-zero commitments.

US President Theodore Roosevelt famously said that “nothing worth having was ever achieved without effort” – an axiom that could be applied to the measurement and management of Scope 3 emissions. This will undeniably involve hard work on the part of stakeholders but will pay dividends on the way.

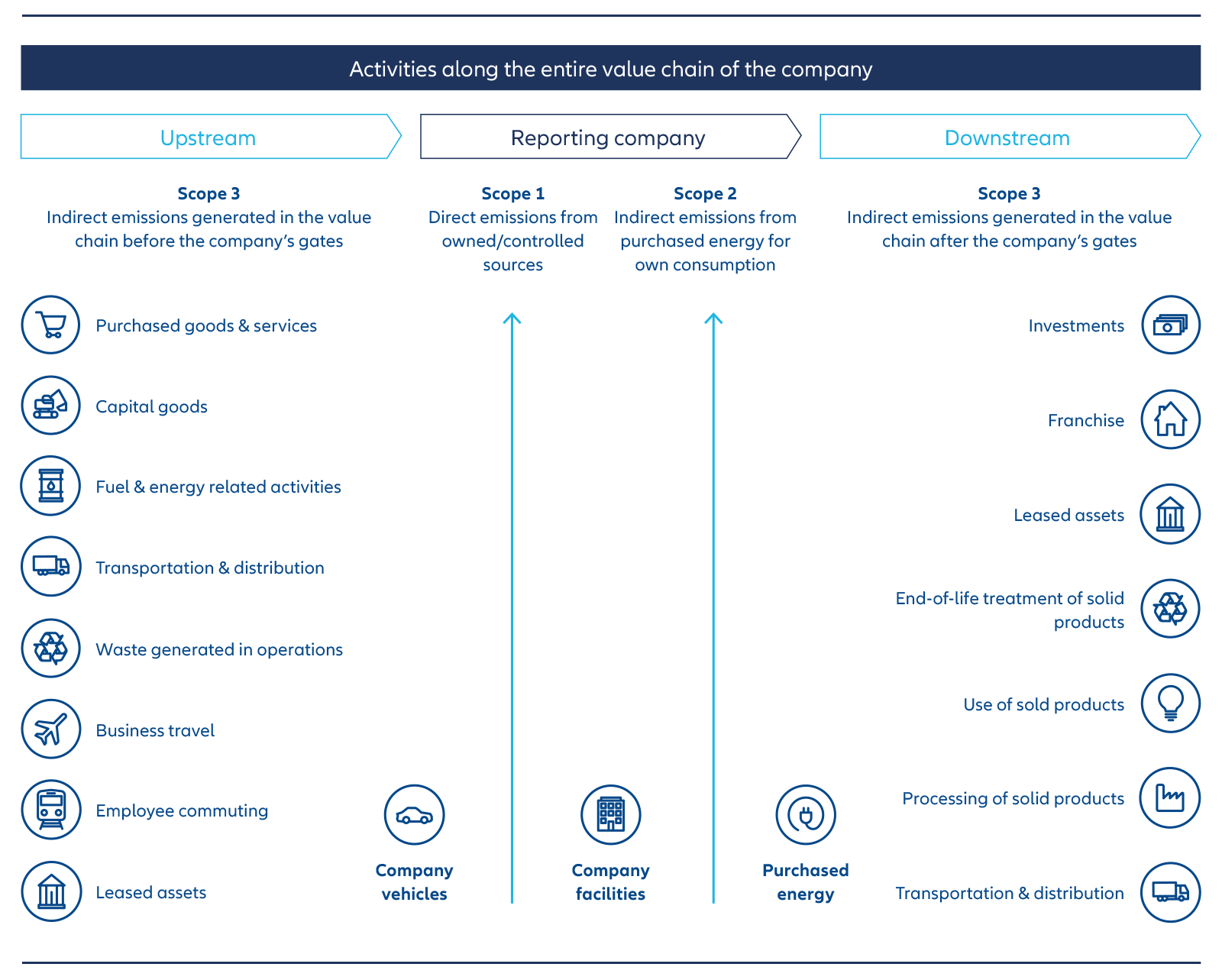

How are the different types of emissions categorised? The Greenhouse Gas Protocol Standard classifies a company’s greenhouse gas (GHG) emissions into three scopes (see Exhibit 1). Scope 1 emissions are the direct emissions from a company’s owned or controlled activities, while Scope 2 emissions are indirectly generated from purchased energy consumed by a company.

Scope 3 goes a step further to address indirect emissions – both “upstream” and “downstream” of the company’s own activities. Upstream emissions might include those generated in producing the raw materials (eg, metals and rubber) required to manufacture a car. Downstream emissions are those generated after the car is produced, such as waste management or the emissions generated by the car when driven. In summary, the value chain may

consist of multiple stages of a product or service’s lifecycle which contribute to Scope 3 emissions, including material sourcing, distribution, and end-of-life-treatment.

The GHG Protocol Corporate Standard1 has developed a detailed accounting system that includes 15 categories of Scope 3 emissions covering business activities along the entire value chain (see Exhibit 1).

Exhibit 1: Overview of GHG corporate value chain accounting

Source: Allianz Global Investors and Global GHG Corporate Value Chain (Scope 3) Accounting and Reporting Standard (page 5)

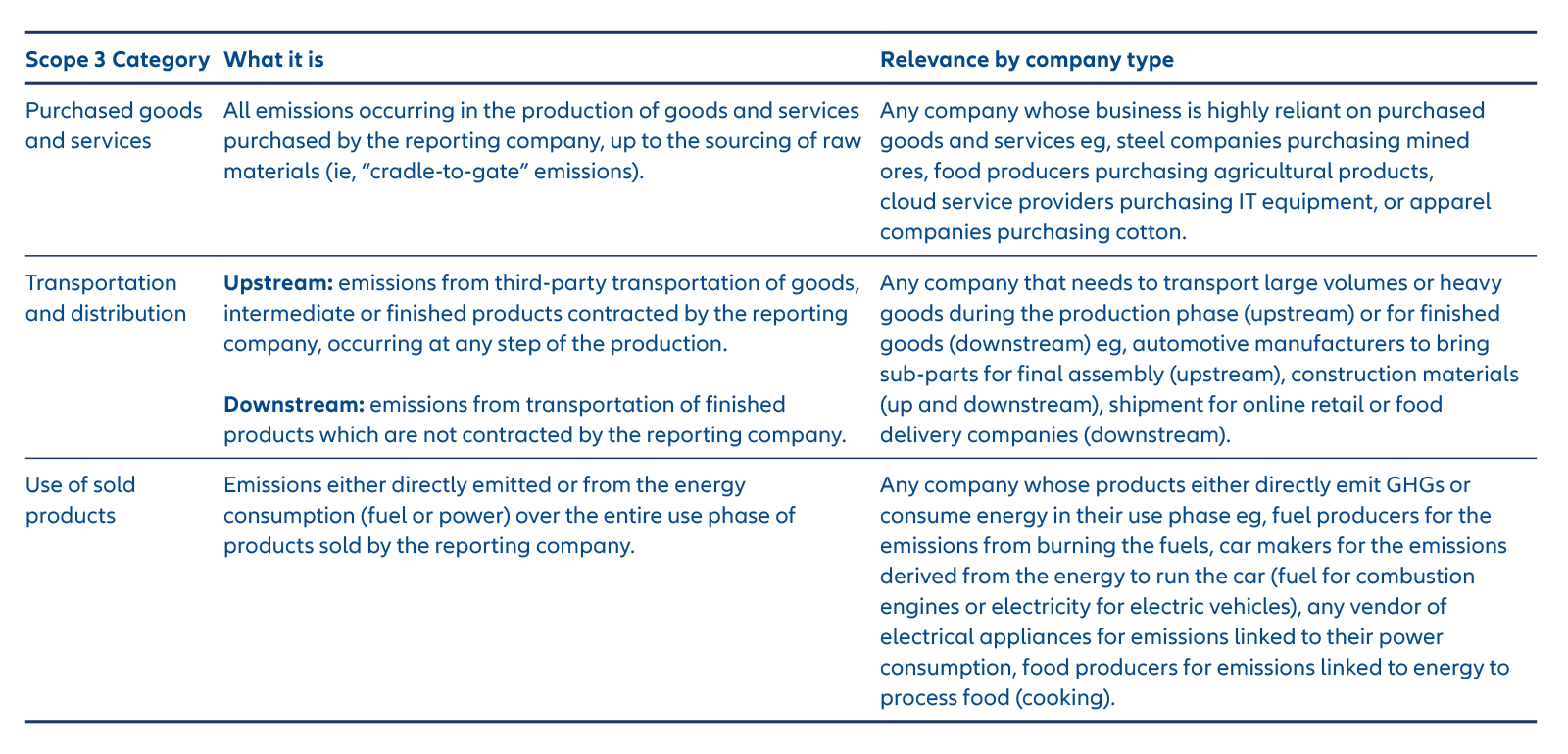

Exhibit 2: Defining selected Scope 3 emissions categories and examples of target companies

Source: Allianz Global Investors and GHG Corporate Value Chain (Scope 3) Accounting and Reporting Standard

Why do Scope 3 emissions matter?

Scope 3 emissions account for over 70% of the average company’s total emissions.2 This highlights why, in our view, addressing Scope 3 is key to reaching net zero by 2050,3 thus limiting global warming to 1.5°C. Furthermore, we believe that addressing Scope 3 emissions will help individual companies better mitigate the risks and seize the opportunities of the climate transition. Take the example of a car manufacturer. The emissions generated by the cars it sells are its largest source of Scope 3 emissions. By considering the market opportunity to produce lower-emissions vehicles the manufacturer may appeal to increasingly eco-conscious drivers while meeting more stringent regulatory requirements.

Regulators across the globe are steadily pushing for mandatory climate disclosures, which would include material Scope 3 emissions. Leading this charge are the EU Commission,4 the US Securities and Exchange Commission,5 and the Hong Kong Stock Exchange.6 Each is looking to leverage existing standards like the Taskforce for Climate-related Financial Disclosures7 and emerging standards like the International Sustainability Standards Board (ISSB).8

Furthermore, widely recognised initiatives such as the Science Based Targets initiative (SBTi) have very specific requirements for validation of Scope 3 emissions reduction targets. These requirements include a full GHG inventory of emissions, including Scope 3 emissions coverage of at least 67% for any near-term targets9 and 90% for long-term targets.10 With more than 5,600 companies looking to take action in line with SBTi,11 there is clear momentum to tackle this topic.

Challenges for corporates

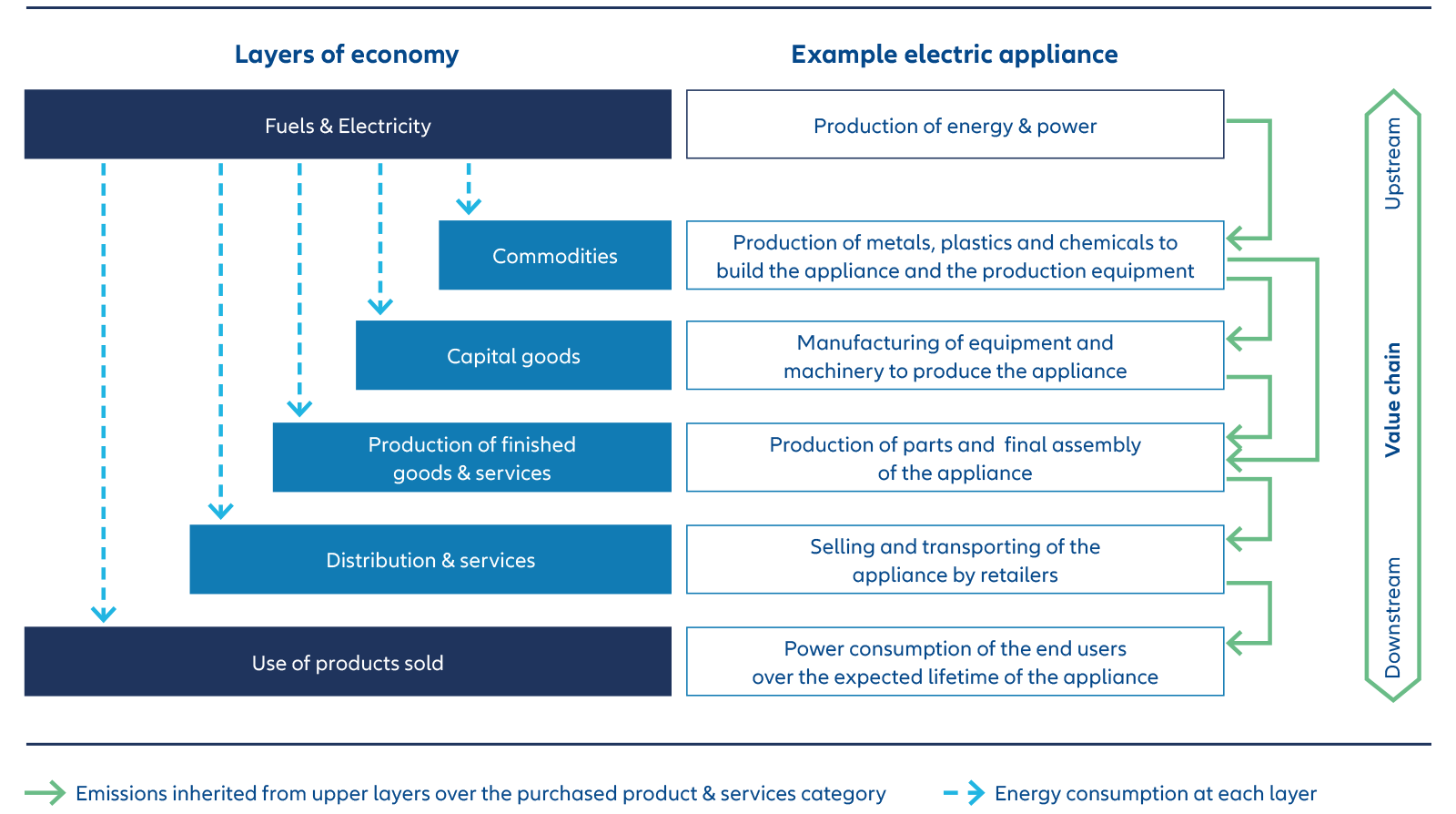

One key challenge for corporates is how to consider Scope 3 emissions in the wider economic value chain (see Exhibit 3). The energy to power the economy causes an estimated 73% of global emissions,12 and the starting point for any value chain is the energy already produced. Steadily, relevant emissions are passed down layer by layer through the value chain via products and services. These emissions combine with those caused by a company’s own operations.

Exhibit 3: Cascading model of energy related emissions in the economic value chain

Companies in each layer of the economy pass down the total carbon footprint of their products through emissions inherited from their suppliers in the layer above, combined with those caused by their own value-adding operational activities.

Source: Allianz Global Investors

The complexity of this flow of emissions through the economic value chain explains why the most significant of the 15 categories are, “purchased goods and services” and “use of products sold”. Together these represent over 70% of all reported Scope 3 emissions.13 Both categories are highly complex as they are difficult to measure and manage, and challenging to decarbonise.

What are the solutions for corporates?

We believe there is a solution to these obstacles. As companies increasingly set targets for reducing their Scope 3 emissions (or set general SBTi targets) they will engage collectively through the entire value chain, including with suppliers and customers. Over time, this may solve Scope 3 data and complexity issues, and drive decarbonisation in the real economy. Achievement of a company’s Scope 3 targets depends on its suppliers’ and customers’ attitudes towards decarbonisation and their own progress towards it. Therefore, creating direct interdependencies for emissions reduction targets and collective engagement through the layers of a sector’s value chain is critical to ensuring long-term alignment.

Help is at hand through initiatives like the Carbon Disclosure Project (CDP) Supply Chain Program14 and supplier engagement guidance from SBTi15 to help companies collaborate with suppliers in a structured way. Industrial associations – like the Cargo Owners for Zero Emission Vessels16 – can help companies in hard-to-abate sectors know where and how to start managing emissions.

By the end of 2022, more than 16,400 suppliers were participating in the CDP Supply Chain Program17 following customer requests, resulting in collective reported emissions savings of 70 million tonnes of CO2e.18 While this is a good start, momentum needs to accelerate as reducing Scope 3 emissions will take time because it often requires changes in business models and product design, and investment in the transition.

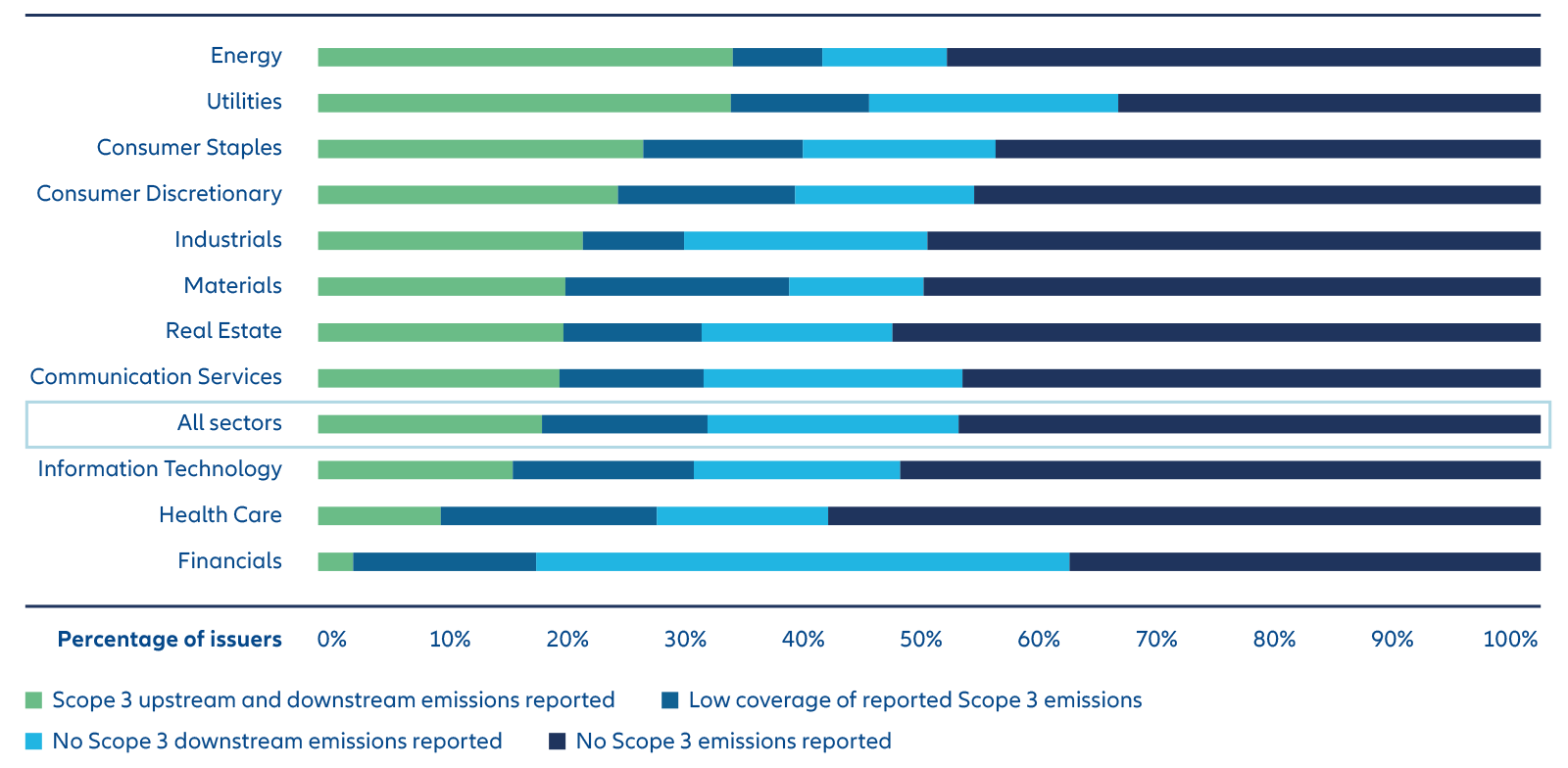

Exhibit 4: Limited disclosures of Scope 3 emissions across sectors

*Low coverage of reported Scope 3 emissions means less than half of the MSCI estimation.

Source: Emissions data from MSCI as of 7 June 2023 applied to MSCI ACWI Index by GICS® sectors

How can investors contribute to solving Scope 3 challenges?

This topic becomes more complicated when considering Scope 3 “financed emissions” – those that are linked to the investment and lending activities of financial institutions (such as investment managers). Significant resources are required to aggregate and report financed emissions, as evidenced by the fact that less than 20% of companies in the MSCI ACWI Financials sector report Scope 3 downstream emission categories and even fewer report financed emissions (see Exhibit 4).

Given these challenges, we have identified the following potential ways forward for investors seeking to capture and reduce Scope 3 emissions:

- Seek guidance from initiatives and standard setters

We welcome last year’s finalisation of the Partnership for Carbon Accounting Financials Global GHG Accounting and Reporting Standard19 which provides accounting standards for financed emissions. Additionally, in December 2022, the ISSB decided on a core requirement for financial firms20 to report financed emissions.21 Lastly, the European Union Sustainable Finance Disclosure Regulation22 requires financial institutions to report quantitative metrics on the carbon footprint of their investments in their Principal Adverse Impact (PAI) statements.23 Within firms’ PAI statements, even with little data coverage, it is good practice to be transparent by disclosing the level of data coverage and quality. Allianz Global Investors’ (AllianzGI) PAI Statement 2022 is available on our website.The discussion on financed emissions invariably ends up with the question of whether Scope 3 emissions metrics include double counting, which occurs when GHG emissions are counted more than once in the financed emissions calculation.24 It is true that different companies within a value chain can claim the same emissions in their respective Scope 3 accounting. However, the GHG accounting system was designed to represent each entity’s emissions responsibility, and aggregated numbers are not meant to estimate emissions of the global economy but can help investors to steer their climate strategies.

-

Engage with investees collectively and individually

At a time when understanding the data can be challenging, collective engagement with companies covering every part (or most) of the value chain is a critical and powerful tool for investors. Collaborative bodies like the Ceres Food Emissions 50 Initiative, of which AllianzGI is an active member,25 produces comprehensive scorecards on Scope 3 disclosures and target setting. -

Vote at Annual General Meetings

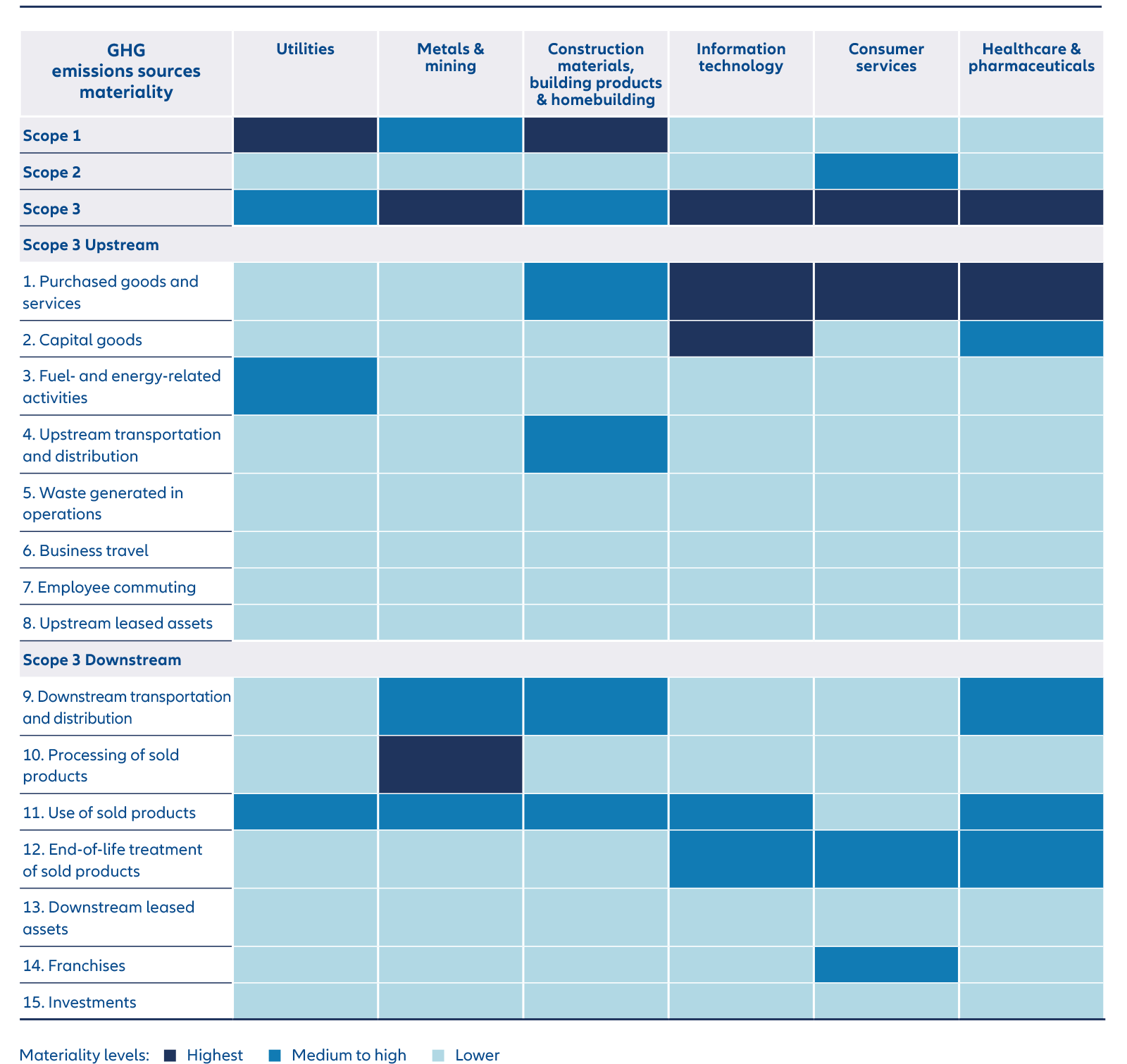

Beyond engagement, there are increasing options to escalate climate strategy and disclosure shortcomings through proxy votes. Last year, AllianzGI voted against the approval of a climate report by an Australian energy company because it lacked a Scope 3 emissions reduction target.26 Such stewardship requires a full understanding of value chain emission transmission mechanisms and hotspots. We have a tool to support this: our proprietary sector materiality matrix covers 24 industry sectors – illustrated in Exhibit 5.

Exhibit 5: Excerpt of AllianzGI emissions sources materiality matrix for six sectors

Source: MSCI ACWI as at 7 June 2023

In summary, we believe that investors and corporates should view measurement and management of Scope 3 emissions as an opportunity rather than a problem. The evolving standards and regulations can be met with a pragmatic approach of identifying and prioritising emissions categories to help promote a specific decarbonisation pathway. Detailed frameworks are evolving for the value chain of each sector. Over time, we believe this could allow for a genuinely connected alignment of emissions reductions targets from the top of the value chain to the bottom, which is critical to achieving net-zero goals.

1 Source: GHG Protocol Corporate Value Chain Reporting Standard

2 Source: https://sciencebasedtargets.org/, Scope 3: Stepping up science-based action

3 See: Headine statements from the Summary for Policymakers: Global Warming of 1.5C

4 Source: Corporate sustainability reporting (europa.eu)

5 Source: SEC.gov | SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors

6 Source: HKEX, Exchange Publishes Consultation Paper on Enhancement of Climate Disclosure under its ESG Framework

7 Source: Task Force on Climate-Related Financial Disclosures, TCFD Recommendations

8 Source: IFRS, Exposure Draft IFRS S2 Climate-related Disclosures

9 Source: SBTi’s stated requirement for a Scope 3 target: If a company’s relevant Scope 3 emissions are 40% or more of total Scope 1, 2, and 3 emissions

10 Source: sciencebasedtargets.org, SBTi Corporate Net-Zero Standard

11 Source: sciencebasedtargets.org, Companies Taking Action - as at 25 July 2023

12 Source: Our World in Data, Emissions by sector

13 Source: sciencebasedtargets.org, Catalyzing Value Chain Decarbonization

14 Source: CDP - supply chain

15 Source: sciencebased targets.org, New Supplier Engagement Guidance: Unlocking the Power of Supply Chains for Decarbonization

16 Source: coZEV, About coZEV

17 Source: CDP, Scoping out: Tracking nature across the supply chain

18 For reference, we collectively emit around 50 billion tonnes of CO2e each year, Our World in Data, 2021

19 Source: GHG Protocol Corporate Value Chain Reporting Standard

20 The ISSB referred specifically to Asset Management & Custody Activities, Commercial Banks and Insurance

21 Source: IFRS, Climate-related disclosures - Financed and facilitated emissions

22 Source: European Commission, Sustainability-related disclosure in the financial services sector

23 Source: European Insurance and Occupational Pensions Authority, July 2022, Principal adverse impact and product templates for the Sustainable Finance Disclosure Regulation

24 Source: Global GHG Accounting & Reporting Standard, Financed Emissions Part A, page 41

25 Source: Food Emissions 50 | Ceres

26 Allianz Global Investors Sustainability and Stewardship Report, page 92