Achieving Sustainability

Scaling up stewardship – the Chinese way

China has a distinctive corporate landscape. Most of the

Key takeaways

- The Chinese regulatory environment for stewardship is generally supportive and as sustainable investments increase in China we expect more policy-level clarity to encourage further progress.

- A customised stewardship approach combining engagement and proxy voting can enable minority shareholders to influence sustainability agendas typically dominated by management and significant shareholders.

- Shareholder activism on sustainability proposals could gain traction in the future but requires collective efforts from both domestic and global institutional investors.

The regulatory environment for stewardship is generally supportive in China. Over the past year, the revised Company Law has added new provisions to strengthen corporate governance rules and protect shareholder rights. Additionally, the Asset Management Association of China published guidance on proxy voting1 as early as in 2012, and new stewardship guidelines are being finalised by the Insurance Asset Management Association of China,2 both of which can encourage domestic institutional investors to adopt a more proactive stewardship approach. However, there is no formal stewardship code in place in mainland China; while in Hong Kong the Principles of Ownership guidance3 have been in place since 2016.

Regulatory momentum is encouraging Chinese institutions to sign up to the UN Principles for Responsible Investment – China is one of the UN PRI’s fastest-growing markets globally in recent years4 – and to participate in collaborative investor initiatives such as Climate Action 100+ and the newly established China Climate Engagement Initiative.

It is also positive to see more domestic investors publicly announce votes against management – evidence of a more “activist” mindset. But challenges exist. Domestic and global investors have different priorities on material sustainability topics, which can limit collaboration on stewardship practices, resulting in less effective communications with management teams.

Unique corporate environment

We explore four unique characteristics of the China A-shares market5 and how these call for a customised approach to stewardship:

State-owned enterprises play a big role

Central and local state-owned enterprises (SOE) represent 26% of all listed companies in China’s A-shares market, accounting for 51% of gross market capitalisation.6 However access to senior management of these SOEs can be challenging: they tend to be less present at investor roadshows and the collective roles minority shareholders can play are limited. Engagement with SOEs requires persistence and continuous dialogue to influence and build mutual trust. We focus on sharing best practices with SOEs and recognise the role they play in economic and social development.

Large single shareholders dominate

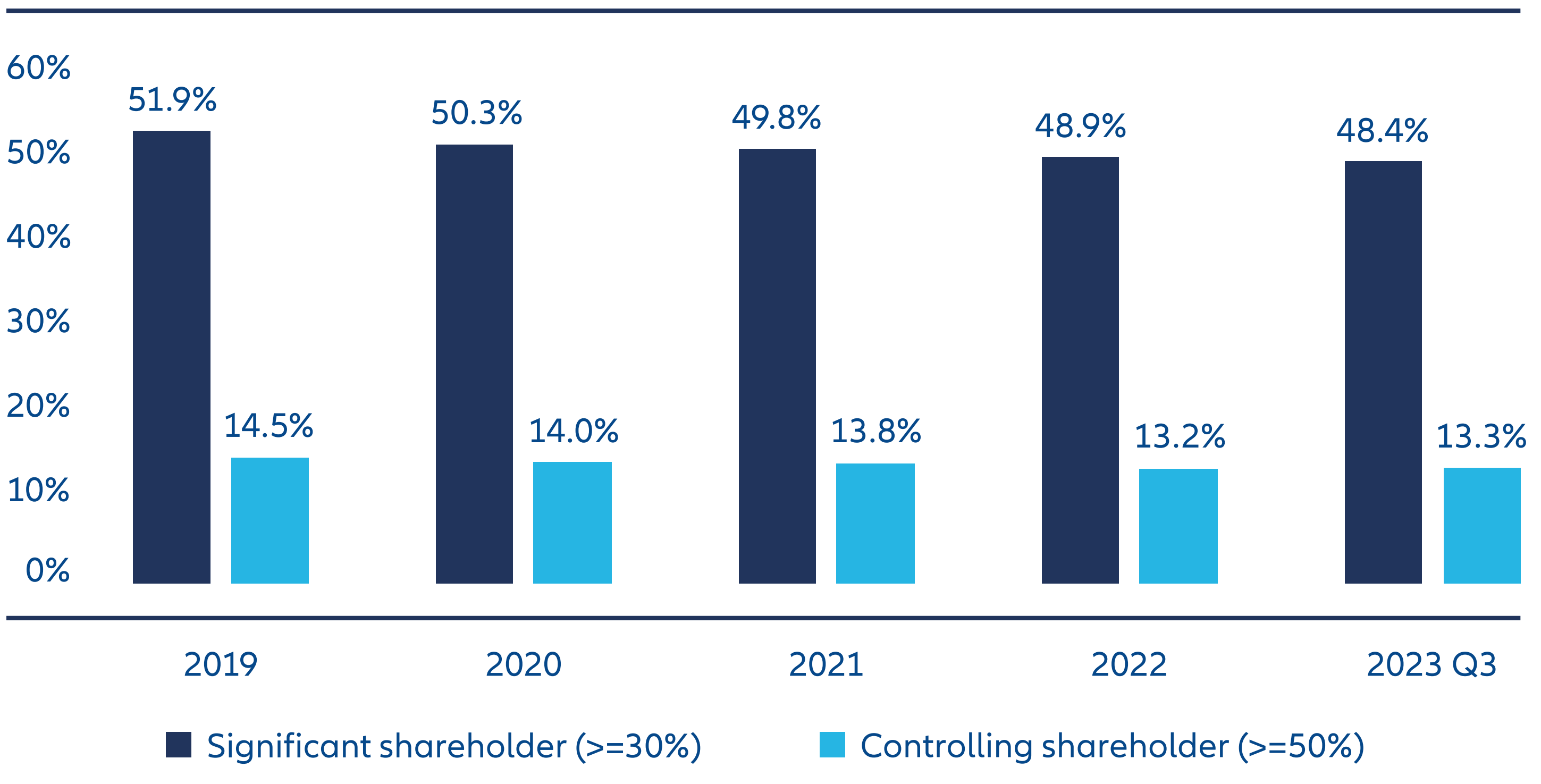

The number of controlling or significant shareholdings among A-shares companies has gradually declined in the last five years – see Exhibit 1. However, large single shareholders holding over 30% of shares continue to dominate. This can crowd out institutional investors who want to exercise influence via proxy voting approaches in general meetings. We actively monitor shareholder proposals that could give controlling shareholders undue influence, including items such as providing loans and guarantees to affiliated companies, related party transactions and capitalisation proposals. We seek to engage with listed companies ahead of annual general meetings (AGMs) and extraordinary general meetings (EGMs) if contentious agenda items are tabled, and we use our engagement findings to feed into subsequent proxy voting decisions.

Exhibit 1: High proportion of listed A-shares companies with controlling or significant shareholders

Source: Wind data, compiled by Allianz Global Investors, 30 September 2023

Individual investors weigh heavily

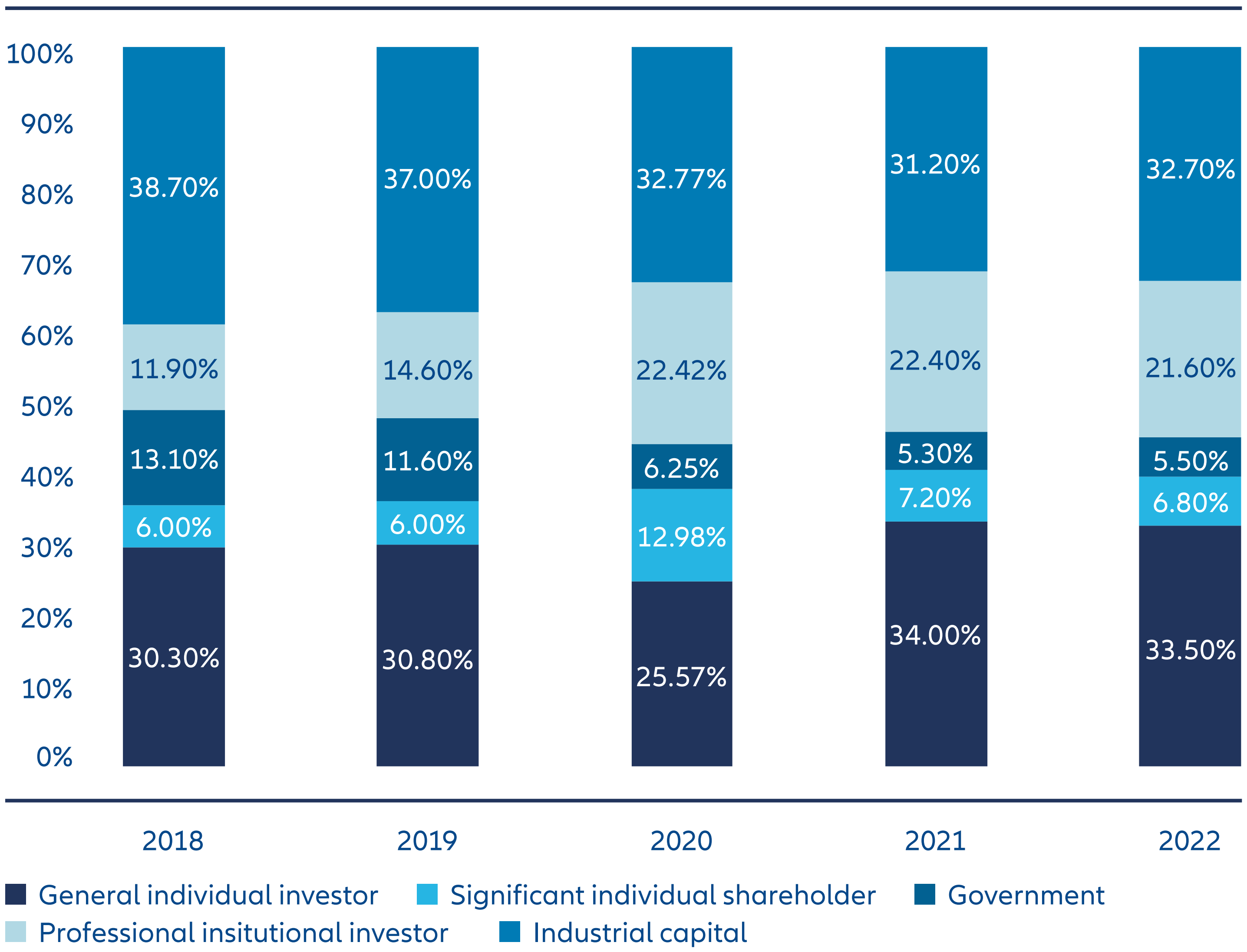

Over the past five years, general individual investors7 have held an average of more than 30% of the total shares in the China A-shares market (see Exhibit 2). However, without the resources of institutional investors, they may struggle to access companies’ published materials in a timely way or speak with companies on topics of concern. To allow more investors to make informed decisions on companies’ actions, we encourage firms to publish proxy voting materials in advance and with granularity, such as providing comparison tables on key company by-law amendments. Additionally, we require virtual general meetings to be easily accessible to all investors.

Exhibit 2: Shareholding structure of the China A-shares market

Source: Wind data, compiled by SWS Research, June 2023

There’s only a low penetration of foreign investments

Foreign investors continue to own only a fraction of China A-shares companies. Over the last five years, China A-shares assets owned by foreign entities have remained below 5% (as a percentage of market capitalisation).8 Additionally, foreign shareholdings are capped at 30% and some strategically important companies are not accessible to foreign investors. With the accelerating opening-up of the China equity market, sustainability leadership could be achieved, and we actively participate in regulatory consultations and collaborative initiatives to drive measurable outcomes.

Our approach

Our stewardship approach for the Chinese market leverages our global stewardship strategy, combining engagement activity focused on clear outcomes with thorough proxy voting analysis.

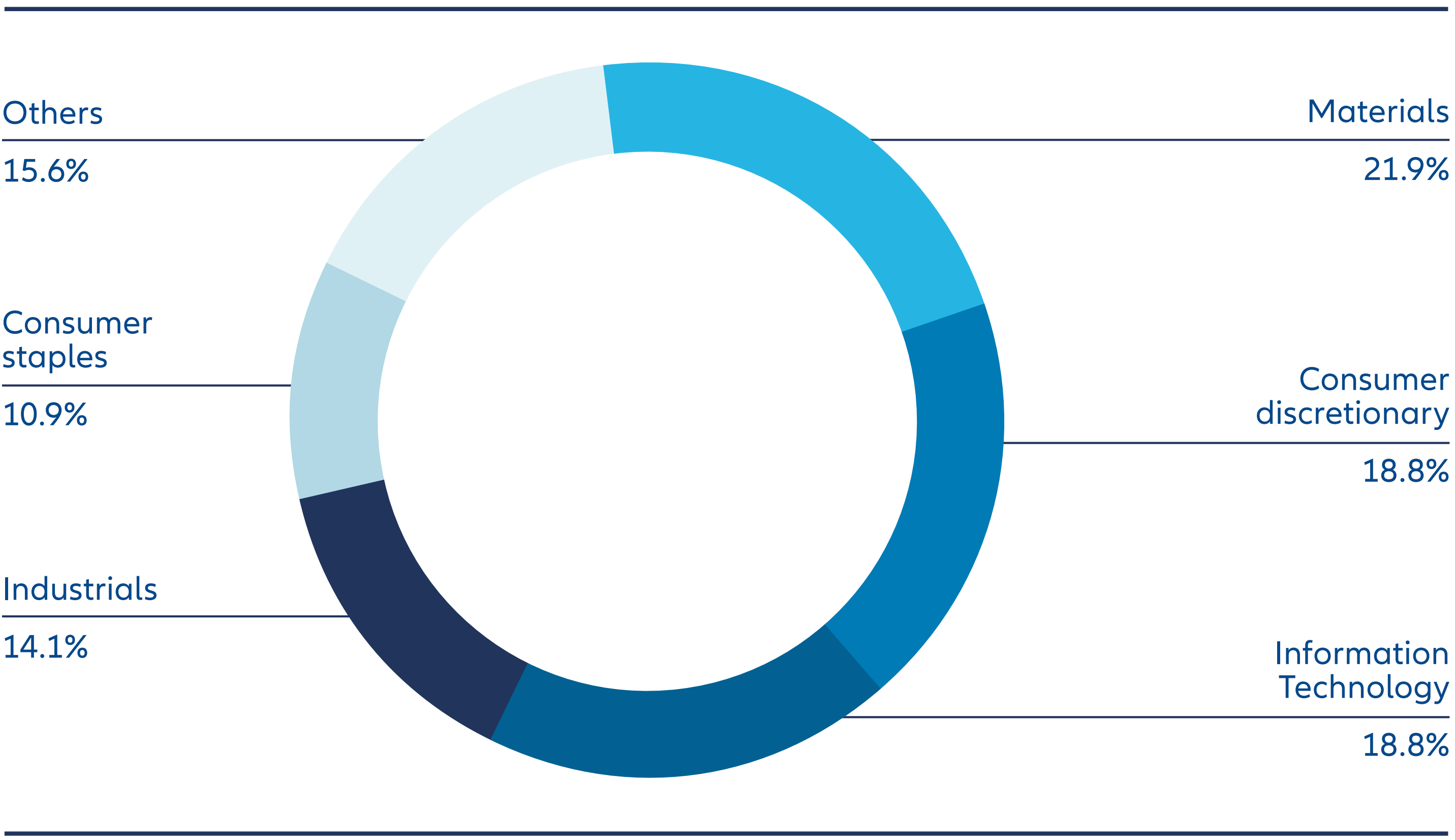

In 2023, we conducted 64 deep-dive discussions with Chinese companies across a wide range of sectors. Climate change and greenhouse gas emissions, corporate governance practices and executive compensation were the top three topics for our engagements. Human Rights & Community Relations, and Transparency and Disclosure have also accounted for a significant proportion of our engagements.

Exhibit 3: AllianzGI engagements with Chinese companies by sector

Source: Allianz Global Investors, as at 31 December 2023

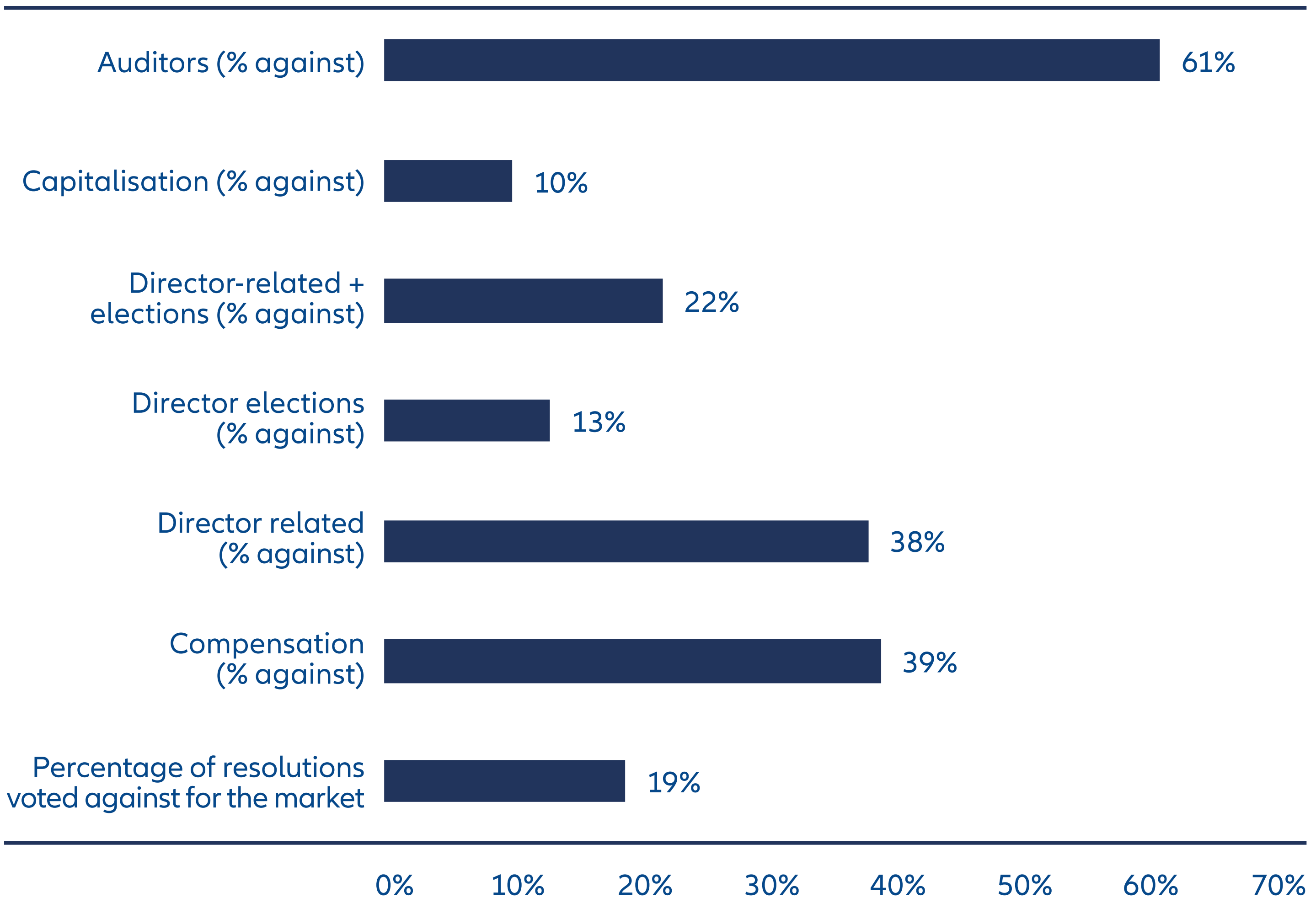

We voted in 100% of the 1,320 meetings in the Chinese market, where we are qualified to vote as a minority shareholder. The total number of proposals totalled over 10,500. We voted against management or abstained in 19% of these meetings, demonstrating how we use proxy voting to take a stance on important issues as part of our fiduciary duties. Most votes “against” related to electing auditors, director-related proposals, and incentive plans. The complete records of voting results and rationales are publicly disclosed on our website. Notably, our comments left through custodian systems are conveyed to the listed companies and we proactively announce our voting rationales to these entities.

Exhibit 4: AllianzGI votes against management by proposal category

Source: Allianz Global Investors, proxy voting in China, as at 31 December 2023

We align our engagement approach and priorities with proxy voting decisions. This ensures an effective stewardship approach and provides a basis for potential escalation actions, such as collaborative engagements, pre-announcing votes, and votes against relevant board appointments.

CASE STUDY

Engaging with a SOE on related party transactions with its group finance company

In China, it is common for central state-owned enterprises to establish a group finance company (GFC) subsidiary to facilitate deposits and loans between affiliated companies. While in theory this can promote capital efficiency and save commission costs, it can harm listed companies by offering lower interest rates on their deposits and compromising their capital liquidity. After learning that such a proposal was being voted on at an upcoming AGM we initiated a pre-AGM engagement with the company to ensure the return of deposits, evaluate the GFC’s risk management system’s robustness, and examine the policies and disclosure of deposit usage.

After an in-depth evaluation and meeting, we concluded that returns on deposits were above market levels and the transactions could mutually benefit the SOE and its parent group subsidiaries if managed effectively. Furthermore, the tracking record with the GFC was satisfactory. Therefore, we decided to support the resolution and will continue to monitor the company’s transactions with the GFC throughout the financial year to ensure that the commitments align with progress. The findings from our review will inform our future proxy voting decisions.

Future expectations

Notwithstanding the unique characteristics of the Chinese market, we believe effective investor stewardship is possible. The key is to follow a customised and active approach that drives improved risk materiality and sustainable outcomes. This includes the careful scoping, preparation and conducting of engagements aligned to proxy voting, and a commitment to building trust and sharing insights.

Can shareholder activism make a difference in China? Looking back at 2023, we voted on 10,515 proposals, most of which were tabled by management. Fewer than 5% came from shareholders and mostly controlling shareholders, predominantly focusing on the election or removal of board directors. This highlights the need for more institutional investors to take an active approach in the stewardship of their assets. Furthermore, there are no examples of shareholder proposals on environmental or social topics. This could be attributed to the historically high regulatory threshold set, which allows only shareholders individually or collectively holding more than 3% of common shares to raise proposals, subject to approval by boards of directors. In the latest revised Company Law to come into effect in July 2024, the threshold is reduced to 1%. Collaboration among institutional investors could lead to more opportunities to push for shareholder activism - particularly for environmental and social themes.

We believe the power of policy-level clarity on stewardship activities and incentives passing from domestic asset owners to institutional investors could be the ultimate catalyst for collaborative stewardship efforts in the Chinese market.

Key sustainability goals on the agenda for China are decarbonisation, biodiversity, and social resilience, which are needed to support long-term economic growth, development and stability. Investor stewardship with even more ambitious goals and robust implementation can help expedite this trajectory. With a clear and strategic focus on the Chinese market, we will continue to embrace shareholder activism in further strengthening our approach to stewardship in China.

1 Asset Management Association of China, 2012

2 Insurance Asset Management Association of China, 2022

3 UN Principles for Responsible Ownership, 2016

4 David Atkin, CEO of the PRI, reflects on a recent visit to China – one of our fastest-growing markets in recent years | PRI (unpri.org)

5 The China A-shares market accounting for 85% of the total market capitalisation of China’s listed businesses is defined as the fair universe for analysis in this article

6 Wind data, compiled by Allianz Global Investors Date, 31 December 2023

7 General individual investors are defined as individual shareholders who are not top 10 significant shareholders of the floating shares

8 Money and Banking Statistics, PBOC, compiled by AllianzGI