Stewardship Principles

Say on Climate: does it measure up?

While take-up has so far been patchy, Say on Climate is a helpful tool for holding companies accountable for their climate ambitions. We think these resolutions should be advisory rather than binding, as ultimately management should be accountable for a company’s climate transition plan.

Key takeaways

- Say on Climate is one tool among many to help investors influence companies’ journey towards net zero.

- The momentum for Say on Climate campaigns varies across different countries due to the roles of boards of directors and shareholders’ convictions.

- There are similarities to the “Say on Pay” initiative, but these are limited since “no one size fits all” for Say on Climate.

- We favour advisory, rather than binding votes on Say on Climate resolutions – ultimately management should be accountable for company strategy.

The “Say on Climate”1 initiative was launched in 2020 to promote board-sponsored resolutions aligned with supporting the transition to net zero. The initiative sought improved climate transition disclosures and associated action plans from companies, to be voted on at annual general meetings (AGM). Here we explore the lessons learned over the past two years, clarify the distinction with “Say on Pay”, and set out our approach to the initiative, which has gained momentum across Europe.

A major Spanish airport operator was the first to be approached by the initiative and agreed to submit its net-zero transition plan at its 2021 AGM. Since then, several global large-cap companies have tabled a Say on Climate resolution across sectors including consumer discretionary, energy and financials.

Separating Say on Climate and Say on Pay

While there are overlaps between Say on Climate and Say on Pay, the voting aspect is different. Say on Climate puts a specific strategic climate plan to a shareholder vote, whereas with Say on Pay investors cast a vote on executive compensation at an AGM. Furthermore, they differ in the following ways:

- There is no “one size fits all” approach to Say on Climate, as there will be very specific elements to each climate transition plan – such as starting point, pathway and targets – and differences between how each plan aligns with achieving net zero by 2050.2

- The advisory or binding nature of a Say on Pay vote differs across countries. France has a strong stance, with the vote being binding, and some French investors have called for a binding vote on Say on Climate aligned to Say on Pay.

- We are cautious on this strong stance given the distinct differences between the two initiatives. Say on Climate is a strategic vote, while Say on Pay considers whether executive compensation is appropriately aligned with the company’s long-term performance.

Voting in support of Say on Climate

Allianz Global Investors voted on 30 Say on Climate resolutions in 2021, rising to approximately 50 in 2022. The rise in resolutions included submissions from high-profile oil and gas companies, as well as market leaders in financials, building materials, mining and retail.

Last year, we noted a clear bias for resolutions raised in sectors that are now in scope for the EU Taxonomy Climate Delegated Act3 (applicable from 1 January 2023). The Act aims to support sustainable investment by making it clearer which economic activities most contribute to meeting the EU’s environmental objectives. It covers the economic activities of approximately 40% of all listed European companies, which are responsible for almost 80% of direct greenhouse gas emissions in Europe.

However, Say on Climate resolutions extend beyond taxonomy target sectors like banking to include activities such as agriculture and forestry.

Adoption is not widespread

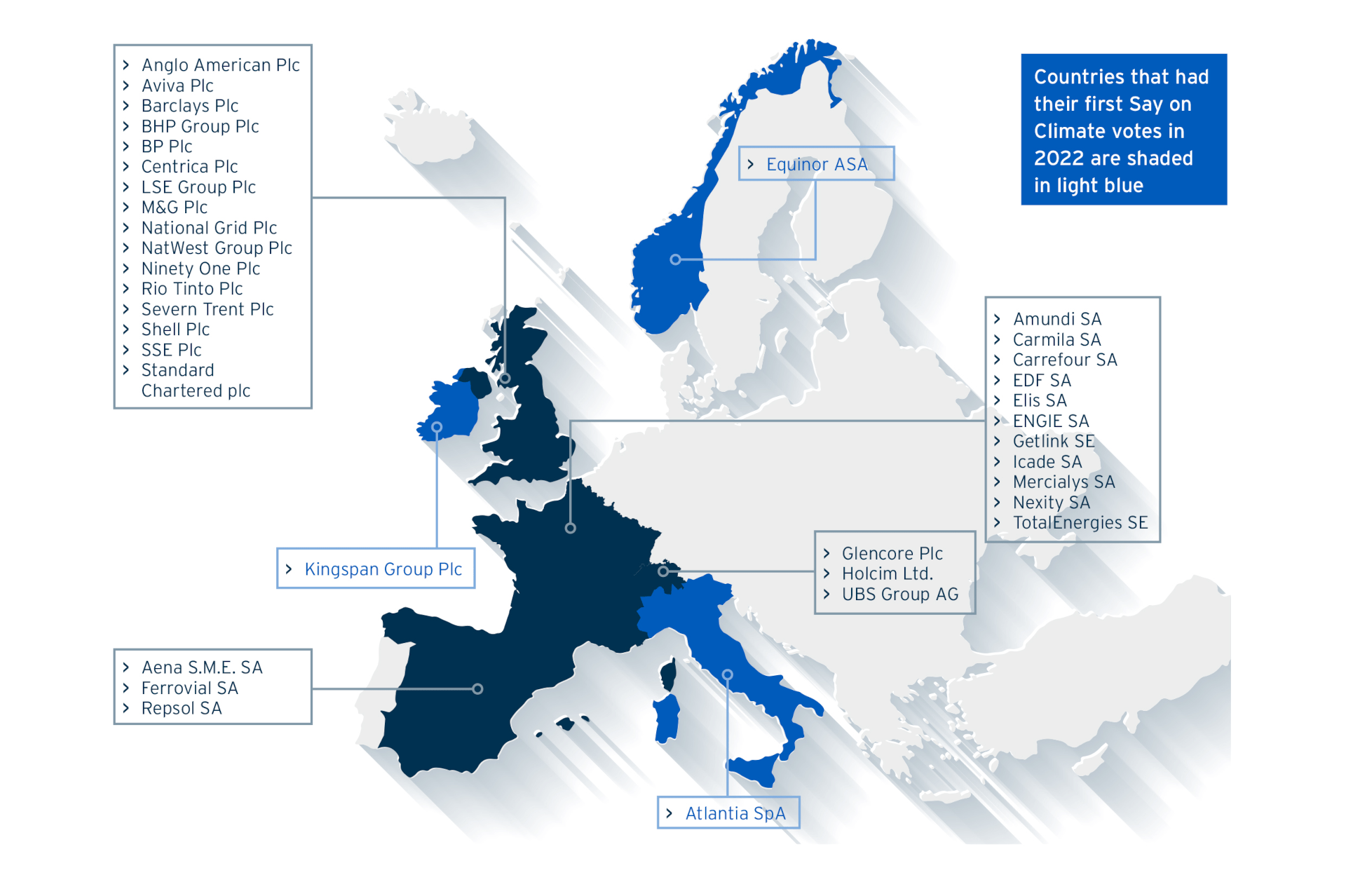

The initiative has gained traction in parts of Europe like the UK, France, Switzerland and Spain. Together these countries account for over two-thirds of Say on Climate resolutions in Europe. However, uptake has been more limited in Germany, Italy, the Netherlands and Nordic countries, where incorporation laws present meaningful hurdles. One such hurdle is the mandatory division of duties, which states that shareholders cannot interfere with an (executive) board’s responsibility to set and manage company strategy.

Exhibit 1 – Say on Climate votes in Europe in 2022

Source: Georgeson’s 2022 AGM Season Review, www.georgeson.com/uk

Opinion on Say on Climate is similarly divided in North America. One supporter is the California-based activist initiative, As You Sow4, which sent letters to companies in 2020 requesting net-zero transition plans and Say on Climate votes. It then followed these letters with the filing of shareholder resolutions at several AGMs in 2021, including at the meetings of high-profile companies in the transportation, leisure and beverage sectors.

However, some notable institutional investors have resisted Say on Climate on the basis that management, rather than investors, should be accountable for climate strategy, while also being mindful of the resources needed to assess the merits of each Say on Climate resolution. We therefore do not expect Say on Climate to gain traction in the US.

Mitigating climate change takes time and effort

Robust engagement in the absence of a vote

Where companies are not submitting a Say on Climate resolution, there should still be rigorous engagement to understand their climate transition plans. Investors should pressure boards and managements to be accountable for climate-risk assessment and strategy.

While it is disappointing that the Say on Climate campaign has not gained traction in all jurisdictions, a combination of further climate regulation and investor pressure could help increase participation and progress towards a level playing field globally.

Allianz Global Investors seeks to influence companies to actively plan for climate transition and a net-zero future through risk mitigation and adaptation but also by seizing the significant climate investing opportunity set. This process starts with high-quality dialogue but extends through to exercising our ownership rights to exert the influence afforded to us.

Allianz Global Investors’ perspective on Say on Climate

We view Say on Climate as a tool to hold companies, their boards and management accountable for climate ambitions. Furthermore, it acts as a potential escalation tool for investors. The ability to assess progress over time should be clear, while companies should avoid frequent changes to long-term strategies, unless there is evidence of misalignment.

Each company’s climate transition plan is specific and often involves confidential and competitive information. As such, we believe the board is best positioned to set policy and oversee its implementation and progress by the management team. This responsibility should remain within the board’s remit – not shareholders.

The board should be accountable for the company’s climate transition plan and investors should have clear escalation mechanisms in place to protect alignment. We therefore support Say on Climate resolutions being advisory rather than binding.

We encourage high-emitting investee companies to put their climate strategy to a shareholder vote. In addition, we seek evidence of progress in the following areas to inform our voting:

- Assessment of the extent to which companies’ climate disclosures and ambitions are comprehensive and consistent, including accountability of the board and appropriate governance oversight. Boards should commit to annual progress reporting in line with established reporting frameworks – this allows for company and sector-wide peer analysis.

- Ambitious climate strategies with clear and credible targets and milestones (across near- and longer-term horizons) – but with evidence of their not compromising a company’s medium or long-term operating and financial performance. These should include details on any necessary investment or financial commitments.

- Where shareholder concerns remain unaddressed, despite significant shareholder dissent, or we are dissatisfied with a company’s responsiveness to implementing Say on Climate, we generally vote against the chairman, or board member responsible for sustainability and climate matters.

We reiterate our view that a Say on Climate vote should remain advisory. It is a tool whereby companies can demonstrate leadership and accountability for climate transition plans. There is an opportunity for the campaign to normalise strong investor engagement on climate strategy and performance, which could help raise investor confidence in corporates or sectors approaching the topic seriously.

That said, the initial uptake of the initiative has been mixed. It will need to extend beyond a limited number of jurisdictions to scale up the alignment of disclosures and governance with net zero to have a meaningful impact on climate change. However, if Say on Climate can demonstrate progress on stewardship outcomes in Europe in the coming years, this may encourage or embolden other jurisdictions to join.