Embracing Disruption

From pause to progression: renewable energy to regain ground?

Last year’s COP 28 pledge to triple renewable energy capacity globally, and to double the global average annual rate of energy efficiency (from 2% p.a. to 4% p.a.) improvements by 2030¹ , has primed the substantive and speedy further development of energy efficiency and sustainable energy solutions.

Key takeaways

- 2023 has been a challenging year for renewables, marked by subsidy and supply uncertainty, high interest rates and steep cost increases deterring necessary investments.

- The cancellation of major offshore wind projects led to temporary slowdown for the wind industry, jeopardising climate goals.

- Despite these setbacks, in 2023 worldwide additions to renewables were up 50% compared to 2022 helping it to keep track with COP 28’s goal of tripling global renewable energy capacity by 20302.

- In addition, the short-term reduction of overproduction and overcapacities can further boost the price advantages of renewable energy sources in the future.

Concluding with the first-ever global “stocktake,” an accurate inventory of how country-level climate efforts are advancing to achieve the climate goals set at COP 21 in Paris in 2015 (“Paris Agreement”), COP 28 in Dubai also launched an unprecedented call for “transitioning away from fossil fuels in energy systems, in a just, orderly and equitable manner”3 .

Despite these substantial concessions, renewable energy in 2023 faced a challenging environment, characterised by high and rising costs of capital which deterred investment. Subsidy and supply uncertainty, as well as the publicised cancellation of major offshore wind projects in the US, additionally contributed to the negative sentiment on renewables. In parallel to these setbacks, global coal demand in 2023 increased by 1.4%, reaching a new record high of over 8.5 billion tonnes4.

Cutting through the noise, we not only see a glimpse of hope but rather robust and resilient processes that point to an inversion of current developments. This should pave the way for the further proliferation of more sustainable energy production and storage solutions.

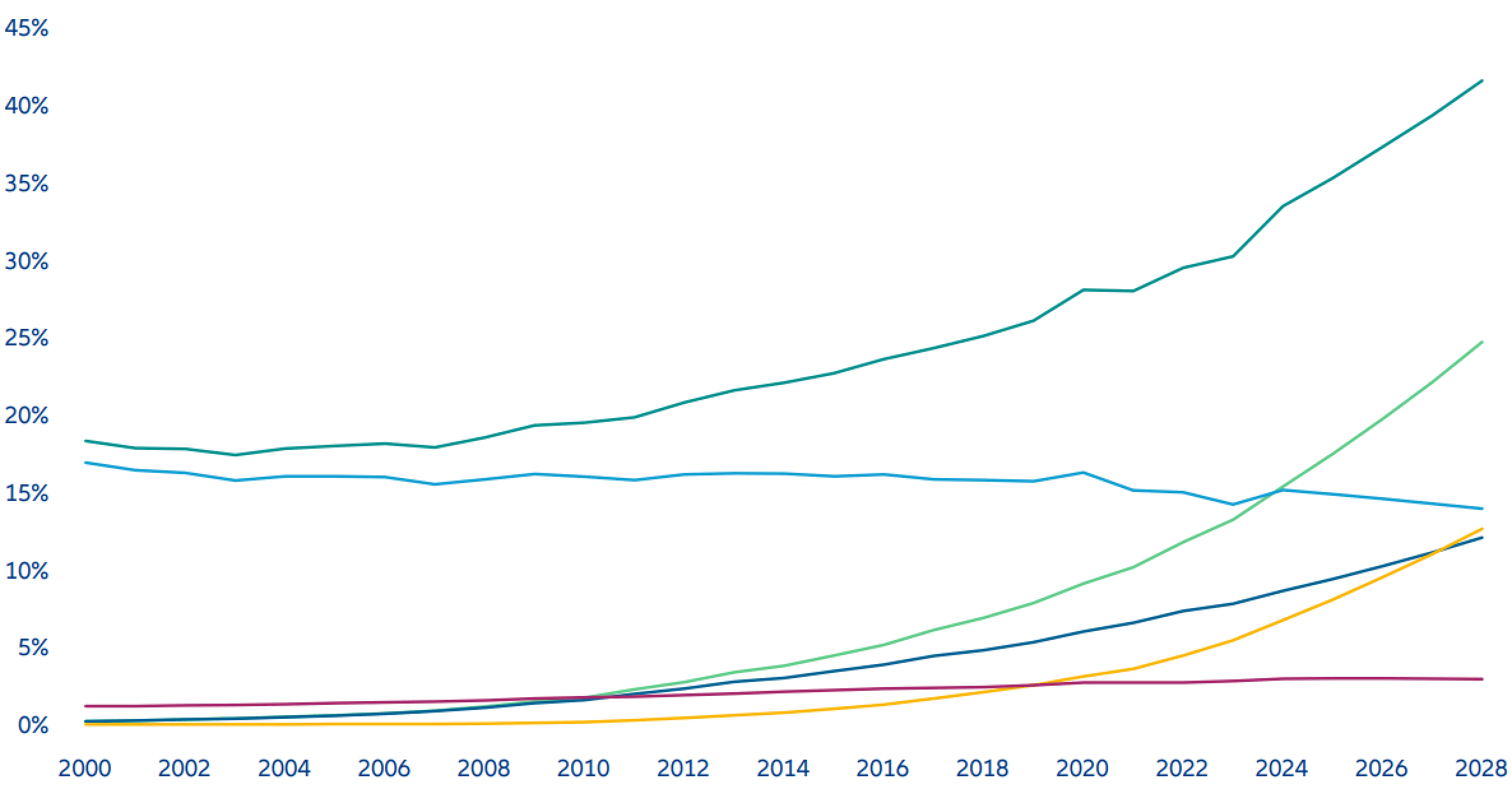

Exhibit 1: Share of renewable electricity generation by technology, 2000–2028

Source: IEA (2024), Renewables 2023, IEA, Paris https://www.iea.org/reports/renewables-2023, License: CC BY 4.0. As of January 2024.

Milestones in the renewable energy mix

According to recent analysis of the International Energy Agency (IEA)5 , the global power mix will undergo a fundamental transformation, with renewables accounting for over 42% of global electricity generation by 2028. This trend is accompanied by the growth in renewables exceeding that of overall electricity demand, and is underpinned by recent data showing that, in 2023, the global additions to renewable energy capacity will reach a record high, soaring by 107 gigawatts (GW) and reaching 440 GW (and, in an accelerated case, over 500 GW), the highest increase ever and equivalent to the installed power capacity of Germany and Spain combined6.

Exhibit 2: Net renewable electricity capacity additions by technology, historical, main and accelerated cases

Source: International Energy Agency: Renewable Energy Market - Update Outlook for 2023 and 2024. As of June 2023

• Pushing permitting processes

The considerable additions to new renewable capacities are, at least in Europe, also a result of the revision of European Commission’s Renewable Energy Directive. This “fast-tracking of permitting procedures” that came into force on 30 December 2022 for a period of 18 months, aims at significantly speeding up the rollout of renewables and grids7.

• Falling prices for renewables, a catalyst for largescale investment and a boost for green energy’s competitiveness

In conjunction with this policy support, high prices for electricity generated from fossil fuel have contributed to the growing financial attractiveness of renewables. This in parallel to falling producer prices in key sustainable energy technologies and markedly lower costs for energy from sustainable sources.

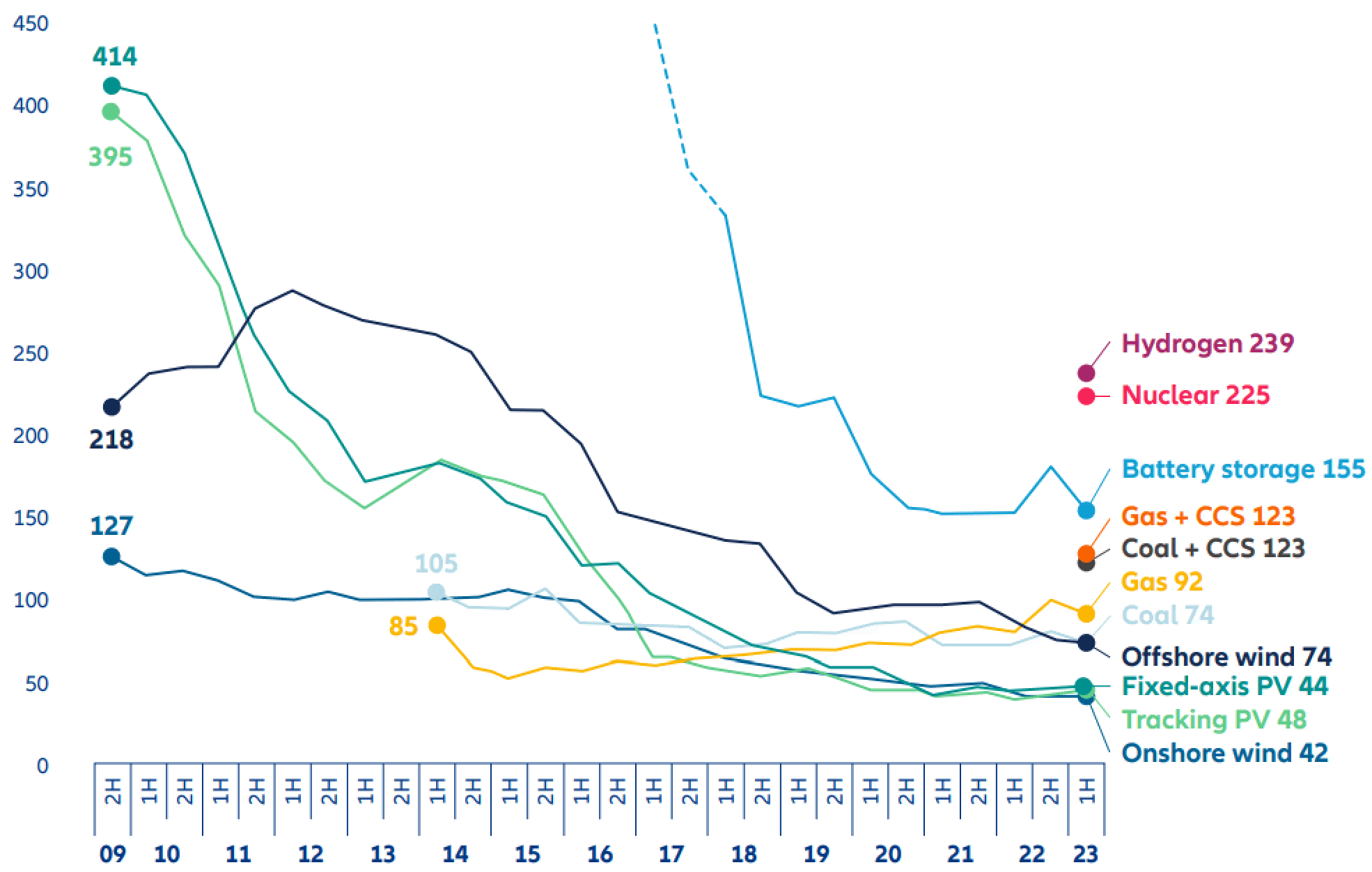

Exhibit 3: Global levelised cost of electricity benchmarks, 2009–2023, USD/MWh (real 2022)

Source: BloombergNEF. As of June 2023.

This cost reduction, not least a consequence of the greater penetration of renewable energy, will boost large-scale investment into renewable technologies and strengthen their competitiveness in the long run.

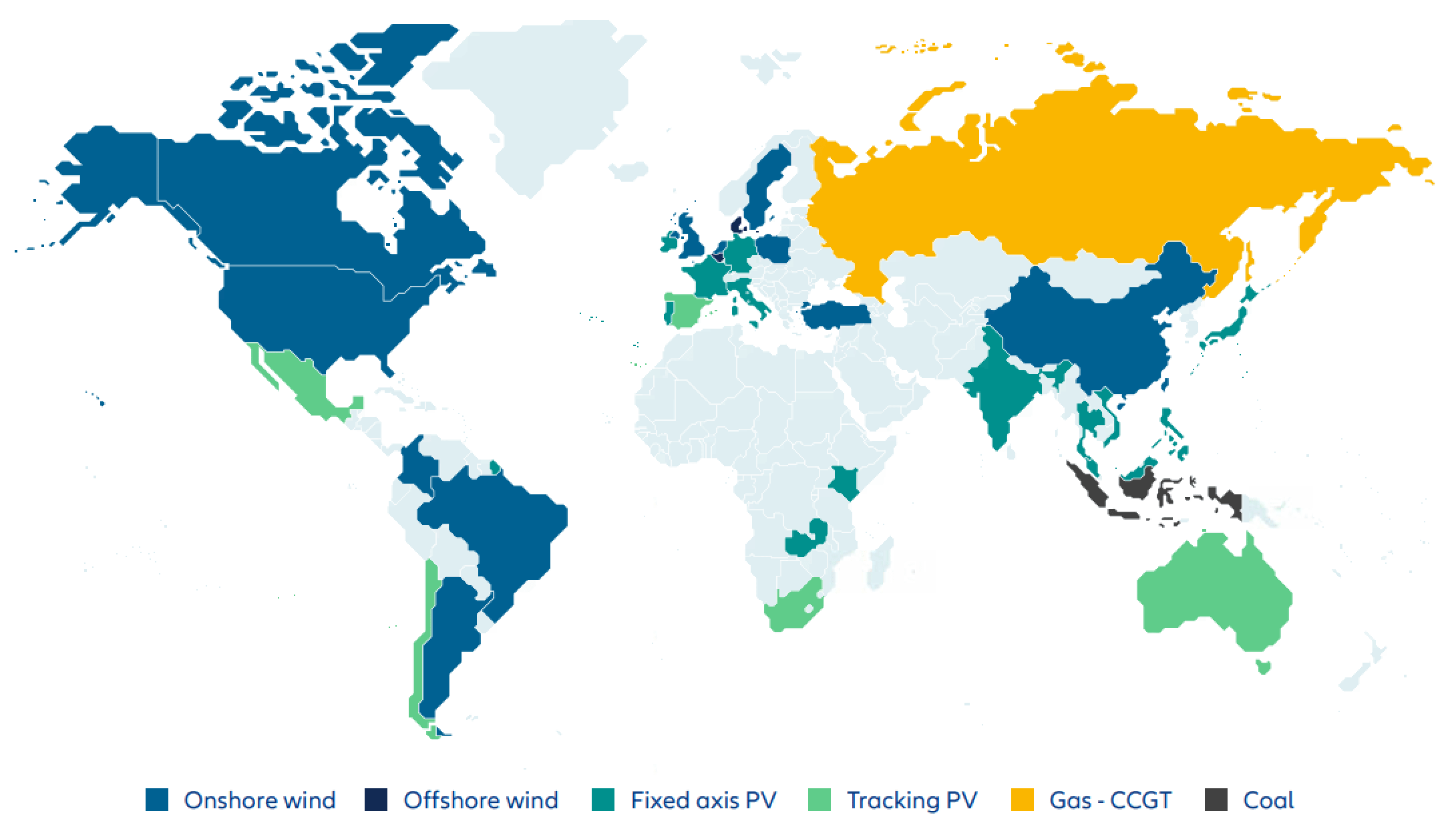

Exhibit 4: Markets where new-build solar and/or wind are cheaper than new-build fossil alternatives

Source: BloombergNEF. As of June 2023.

In addition, the widespread availability of cheap energy from sustainable sources can not only meet electricity needs from low- and middle-income countries, where most future demand for new electricity will come from (and where money is scarce and access to capital still limited), but also help boost economic growth as lower energy prices increase disposable income.

This benefit is expected to become even more evident as prices of conventional energy sources are rising, along with surging CO2 prices.

“88% of the growth in electricity demand between 2019 and 2040 is expected to come from the emerging markets. If they do not leapfrog to renewables, there will be no global energy transition8.”

• More installations translate into significant savings

The installation of new PV and wind capacity in Europe has led to estimated savings of EUR 100 billion since 2021.

Regional Focus India

According to a recent report by the Global Energy Monitor, a US-based non-governmental organisation that provides open access information on renewable energy projects worldwide, India can save up to USD 19.5 billion, and avoid the use of around 78 million tons of coal annually, if it adheres to its plan to add 76 GW of utility-scale solar and wind power by 20259 .

“[…] without [photovoltaics] PV and wind capacity growth in 2021-2023, average wholesale electricity prices would be higher by about 3% in 2021, 8% in 2022 and 15% in 2023, raising the cost of electricity supply for the entire European Union by roughly EUR 100 billion10.”

Growth momentum for offshore wind despite recent setback

Beginning November 2023, a Denmark-based global market leader in offshore wind energy decided to cease development of two major projects in New Jersey. Similar to its close competitors’ planned projects of a comparable size, the company attributed its decision to “adverse developments” ranging from supply chain challenges to growing inflationary pressures11. The firm thus added its voice to the chorus calling for a fully aligned policy and regulation framework to increase investment.

Despite the hardships the offshore wind industry went through in the past year, there are evident, near- and long-term signs of recovery for this segment that is so crucial to the energy transition.

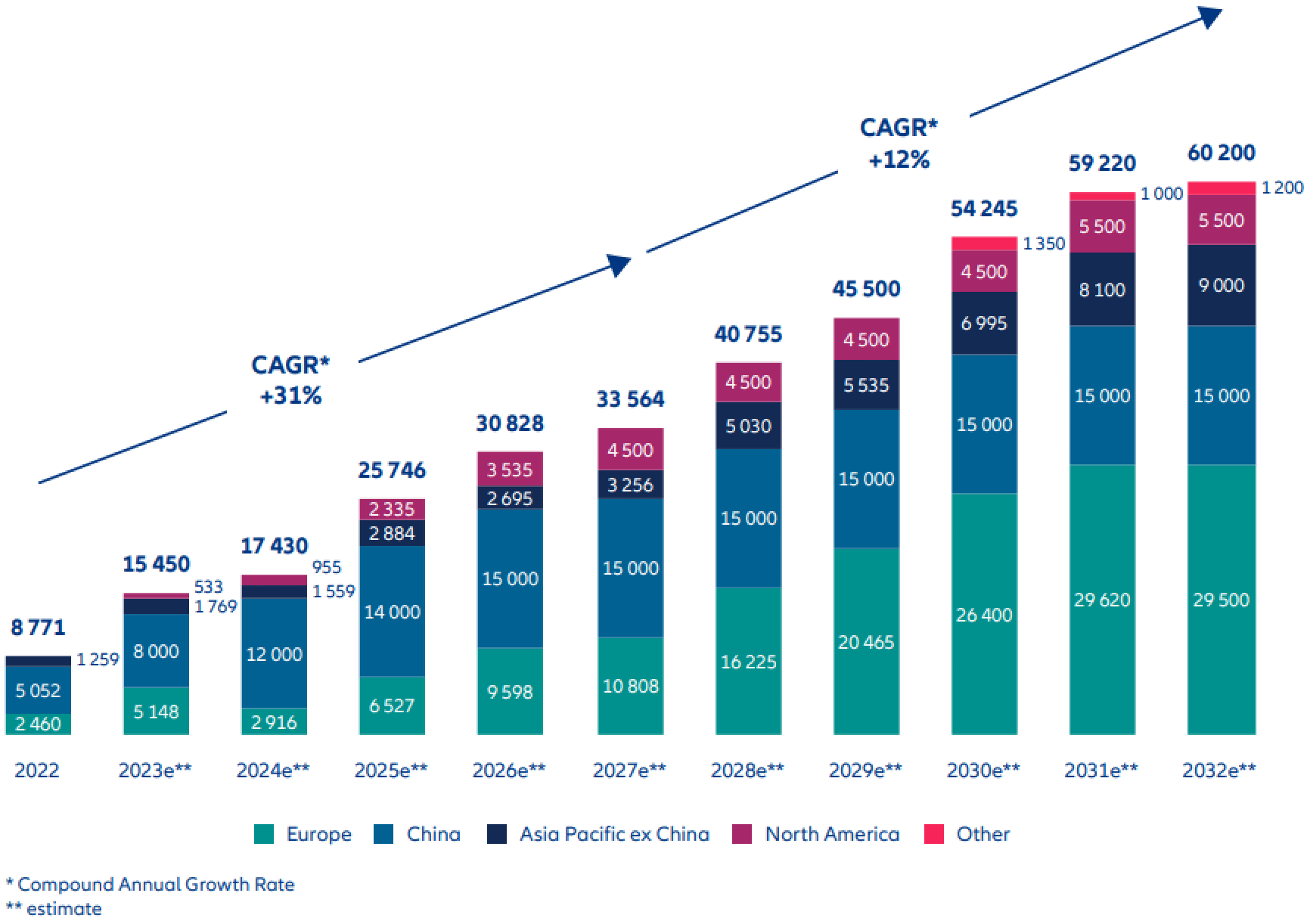

Following recent estimates, within the next years global new offshore wind installations will be driven by double-digit growth surpassing the 50-GW mark by the beginning of the next decade.

Exhibit 5: New offshore installations, global (megawatts, MW)

Source: Global Wind Energy Council: Global Offshore Wind Report 2023. As of 28 August 2023.

Global backup for wind power installations

Regional efforts and procurements to push offshore wind installations are backing the industry’s upward trend. For instance, New York State recently announced investment in three offshore wind and 22 land-based renewable energy projects, the largest state investment in renewable energy in United States history. Once completed, the projects will deliver 6.4 GW of clean energy, enough to power 2.6 million New York homes and equivalent to around 12% of New York’s electricity demand12.

The European Commission’s Wind Power Action Plan could also be another decisive driver, especially for Europe’s wind sector, a business that adds between EUR 36 to 42 billion to the EU’s GDP and has so far created 300,000 jobs for (highly) skilled workers13. To keep this momentum, the European Wind Power Action Plan foresees the implementation of dedicated measures to address the challenges faced by the European wind industry that, in 2022, provided 16% of electricity consumed in the EU14.

Looking in more detail, the six pillars of the European Commission’s Wind Power Action Plan aim at, among other goals:

• accelerating deployment by increasing predictability and faster permitting

• improving auction design

• facilitating access to finance

• creating a fair and competitive international environment

In this context, in December 2023 the European Investment Bank (EIB) approved a EUR 5 billion package of counter-guarantees to facilitate access to finance for wind energy equipment manufacturers15.

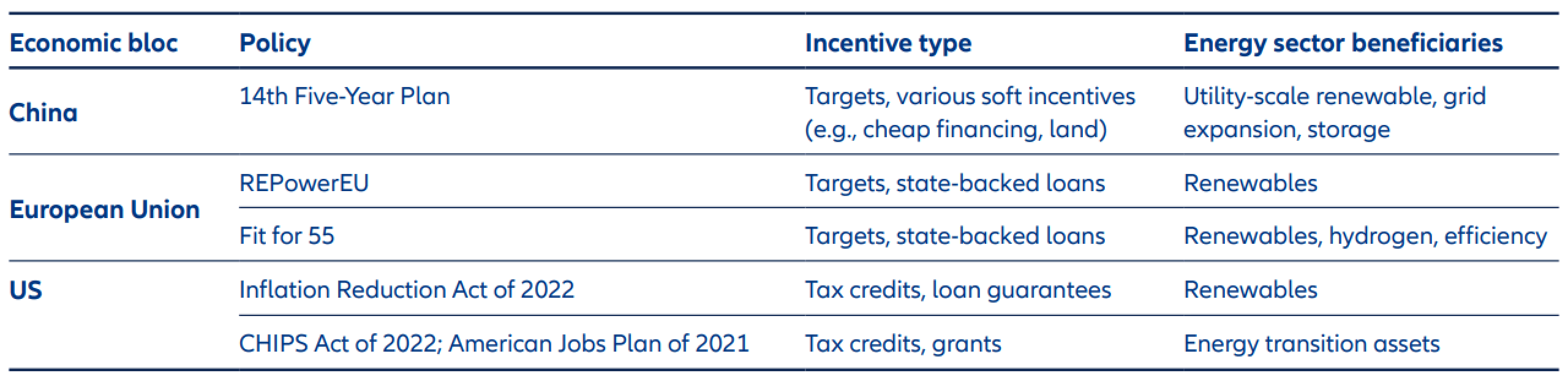

How different policy frameworks are promoting the energy transition

Source: S&P Global: Renewable Energy Funding in 2023: A “Capital Transition” Unleashed. As of September 2023.

How COP 28’s commitments could help narrowing the clean energy funding gap

Last year’s COP 28 in Dubai concluded with the first-ever global “stocktake”, an accurate inventory of how country-level efforts are advancing to achieve the climate goals set at 2015’s COP 21 in Paris (“Paris Agreement”). The proposal unprecedentedly calls for “transitioning away from fossil fuels in energy systems, in a just, orderly and equitable manner”, for a tripling of renewable energy capacity globally, and for a doubling of the global average annual rate of energy efficiency improvements by 203016.

To achieve both the transition in energy systems and the proliferation of renewables, it is crucial to redirect substantially more public and private funding towards sustainable solutions for producing, storing, and distributing energy.

Exhibit 6: Annual clean energy investment, 2015–2023e

Source: International Energy Agency (IEA): World Energy Investment 2023. As of May 2023.

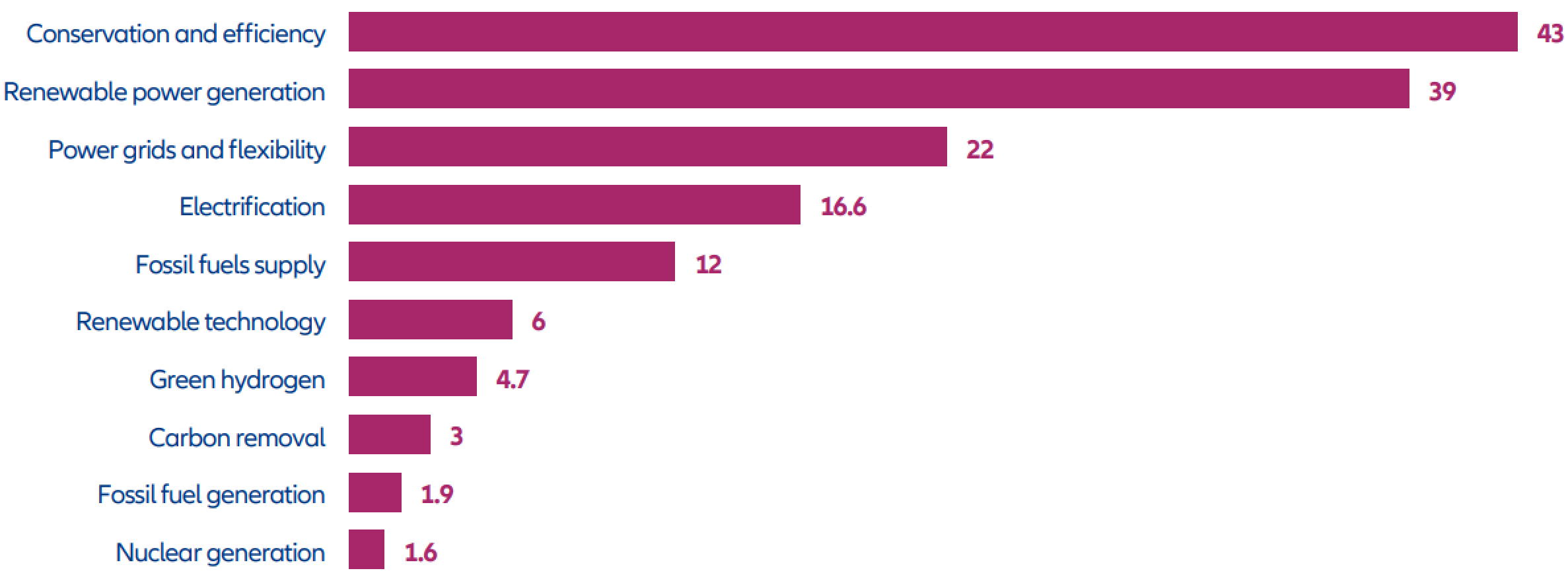

Notwithstanding the encouraging progress in clean energy investments, there is still a yawning trillion-USD-wide funding gap across key technologies that needs to be bridged within the coming decades to meet the 1.5° C scenario, as analysis from S&P’s research unit shows17.

Exhibit 7: 1.5°C scenario investment requirements, aggregate, 2023–2050 (USD tn)

Source: International Renewable Energy Agency (IRENA) World Energy Transitions Outlook 2023. As of July 2023.

“Energising” the enablers and beneficiaries of the energy transition

Despite the initially outlined setbacks renewables had to overcome within the last year, we remain constructive regarding the economic advantages that we believe are playing out well for the energy transition. Global political support remains intact, while companies need to reduce their overproduction and overcapacities in the short term. This will further boost the price advantages of renewable energy sources, as reductions in overcapacity often occur with discounts.

To help renewables to gain further ground, it’s vital to redirecting financial flows to cleaner solutions of energy generation, storage and consumption that can contribute to shaping more sustainable ways of moving, consuming energy, and generating power.

For instance, investment in companies looking to significantly expand their renewable energy infrastructure – such as connection to the grid and pipelines – or storage capacities can support the necessary infrastructure required for renewable energy expansion and availability.

In the same way, investments in companies that design innovative turbines can boost the efficiency of wind power. Not least, investments in firms that provide new capacities to supply lithium for the global electric vehicle (EV) rollout, or that produce powerful electricity-efficient traction motor systems, can help pave the way for more sustainable mobility solutions and the electrification of transportation.

1 COP28.com: Global renewables and energy efficiency pledge. As of December 2023.

2 International Energy Agency: Massive expansion of renewable power opens door to achieving global tripling goal set at COP28. As of January 2024.

3 United Nations Climate Change: COP28 Agreement Signals “Beginning of the End” of the Fossil Fuel Era. As of December 2023.

4 International Energy Agency (IEA): Coal 2023 Analysis and forecast to 2026. As of December 2023.

5 International Energy Agency: Massive expansion of renewable power opens door to achieving global tripling goal set at COP28. As of January 2024.

6 International Energy Agency (IEA) Renewable Energy Market Update. Outlook for 2023 and 2024. As of June 2023.

7 European Commission: Enabling framework for renewables. As of October 2023.

8 Council on Energy, Environment and Water: Reach for the Sun - The Emerging Market Electricity Leapfrog. As of July 2021.

9 Global Energy Monitor: India can save US$19.5 billion annually with shift from coal to clean power. As of January 2023.

10 International Energy Agency (IEA) Renewable Energy Market Update. Outlook for 2023 and 2024. As of June 2023.

11 Orsted.com: Ørsted ceases development of its US offshore wind projects Ocean Wind 1 and 2. As of November 2023.

12 New York State: Governor Hochul Announces Nation’s Largest-Ever State Investment in Renewable Energy is Moving Forward in New York. As of October 2023.

13 European Commission: Press remarks by Executive Vice-President Šefčovič and Commissioners Simson and Hoekstra on the EU Wind Power Package and the State of the Energy Union 2023. As of October 2023.

14 Ibid.

15 European Investment Bank: EIB commits €5 billion to support Europe’s wind manufacturers and approves over €20 billion in financing for new projects. As of December 2023.

16 United Nations Climate Change: COP28 Agreement Signals “Beginning of the End” of the Fossil Fuel Era. As of December 2023.

17 S&P Global: Renewable Energy Funding in 2023: A “Capital Transition” Unleashed. As of September 2023.