Embracing Disruption

Renewables: navigating political waters

While public attention is focused on the very different personalities of presidential candidates Kamala Harris and Donald Trump, it should not be forgotten that these elections represent much more – in Congress, all 435 seats in the United States House of Representatives and 34 of the 100 seats in the United States Senate will be contested. Given the US’s system of government, the outcome will define the headroom the incoming presidential administration has for shaping legislation. As the camps are divided by a deep rift in terms of values, opinions and beliefs, the election results will have an impact on various areas.

Without a doubt, there is probably no area with less bipartisan agreement than clean energy and climate change. After the US withdrew from the Paris Agreement in 2017 under President Trump, in 2021 President Biden immediately changed course and rejoined. Consequently, the Biden administration made use of the Democrats’ majority in Congress to pass the Inflation Reduction Act (IRA) in 2022, a framework which shows a strong commitment to reducing carbon emissions. The IRA is designed to promote key initiatives (e.g. clean power generation) and at the same time ensure local employment by tax benefits or preferential access to funding. From financial markets, the IRA was seen as tailwind for “green” business models, hence shares of turbine makers, electric mobility players and hydrogen producers did well. Over the last two years, this trend has sharply reversed: clean energy stocks have been among the worst performers in the market. The clear message is that investors doubt that IRA is unlikely to survive this legislative period.

While it is likely that a Harris administration would only alter minor details of the IRA, if at all, former president Trump has labelled the IRA a waste of money. Nevertheless, it remains open what would happen to the IRA even if a Trump administration has the political leeway to change law. Indeed, some Republican strongholds in the South of the US – Texas or Georgia, for example – are strong beneficiaries of the rollout of green energy, as well as of manufacturing jobs linked to the energy transition and assisted by the IRA.1

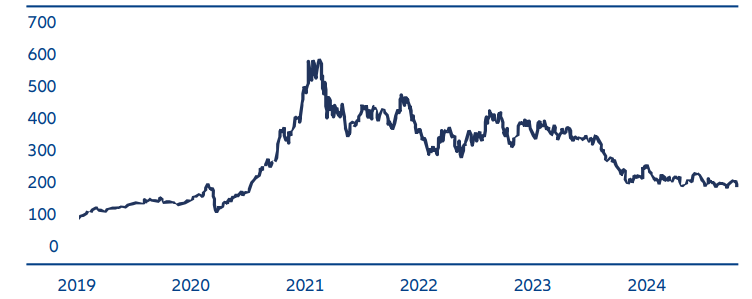

Stock markets, however, are pricing in the dilution, or even a repeal, of the IRA as the most likely outcome. IRA-sensitive stocks like the solar industry, which are at the mercy of political support, have suffered heavy losses since the introduction of the bill in 2022. In fact, the MAC Global Solar Energy Index has lost 85% of its value since the IRA was announced. The nomination of Vice President Harris as the Democratic candidate has had little impact in stopping that decline.

Having a closer look at predictions for the upcoming elections, Democrats seem to have improved their position with the nomination of Harris and her strong performance during the presidential debate. In terms of the fate of the IRA, it is important to note that only in case of a red sweep (Trump returning to the Presidency and Republican majority in both Houses of Congress) is a repeal of the IRA is likely

In the remaining scenarios the IRA is unlikely to incur significant change. In case of a blue sweep, it is presumed the IRA will survive, while in the scenario of a divided government (the most likely outcome) the changes are likely to be minor. Of course, the 2024 elections are on a knife edge in terms of the Presidency, but the survival of the IRA is far more likely than abolishment. Yet, this is arguably this is not reflected by stock markets – for example, the “MAC Global Solar Energy Index” has fallen to prepandemic lows on valuation levels such as price to book or price to sales.

MAC Global Solar Energy Index

Source: Allianz Global Investors, from 3 January 2019 to 11 October 2024.

The outcome of November’s elections remain to be seen, but there are many reasons for an optimistic assessment of IRA-sensitive stocks (such as, for example, clean energy). As fears of a reversal of the IRA seem to be overdone, falling interest rates could boost spending trends again as several companies previously abandoned projects due to rising rates and an uncertain economic recovery. And greater electricity demand will be driven by data centres and EV expansion, either way. Indeed, given the favourable economics of renewables compared to fossil fuels, sentiments may well change as headwinds abate and tailwinds emerge in the coming months.

1 The biggest winners of Biden’s green climate policies? Republicans. | CNN