Achieving Sustainability

Renewable energy: the 2050 remix

Last year was transformative for renewable energy. War in Ukraine escalated the urgency of finding alternatives to fossil fuels, while new renewable energy capacity additions and clean energy output peaked.1 But with fossil fuel subsidies reaching a record USD 1 trillion2 and higher interest rates threatening investment, is the clean transition still on track? And what will the future renewable energy mix look like?

Key takeaways

- Amid the challenges of 2022 there was significant progress in renewable energy capacity and clean tech solutions.

- We expect progress to accelerate following the positive policy developments of the US Inflation Reduction Act and European Green Deal Industrial Plan.

- Solar and wind will replace hydro as the dominant sources of power in a renewable energy mix that will have to grow its proportion of the total global energy mix from 15–20% today to 60–80% by 2050.

- Expansion of renewable energy remains dependent on investment in solutions and enabling technologies in critical areas such as key materials, grids and mass storage.

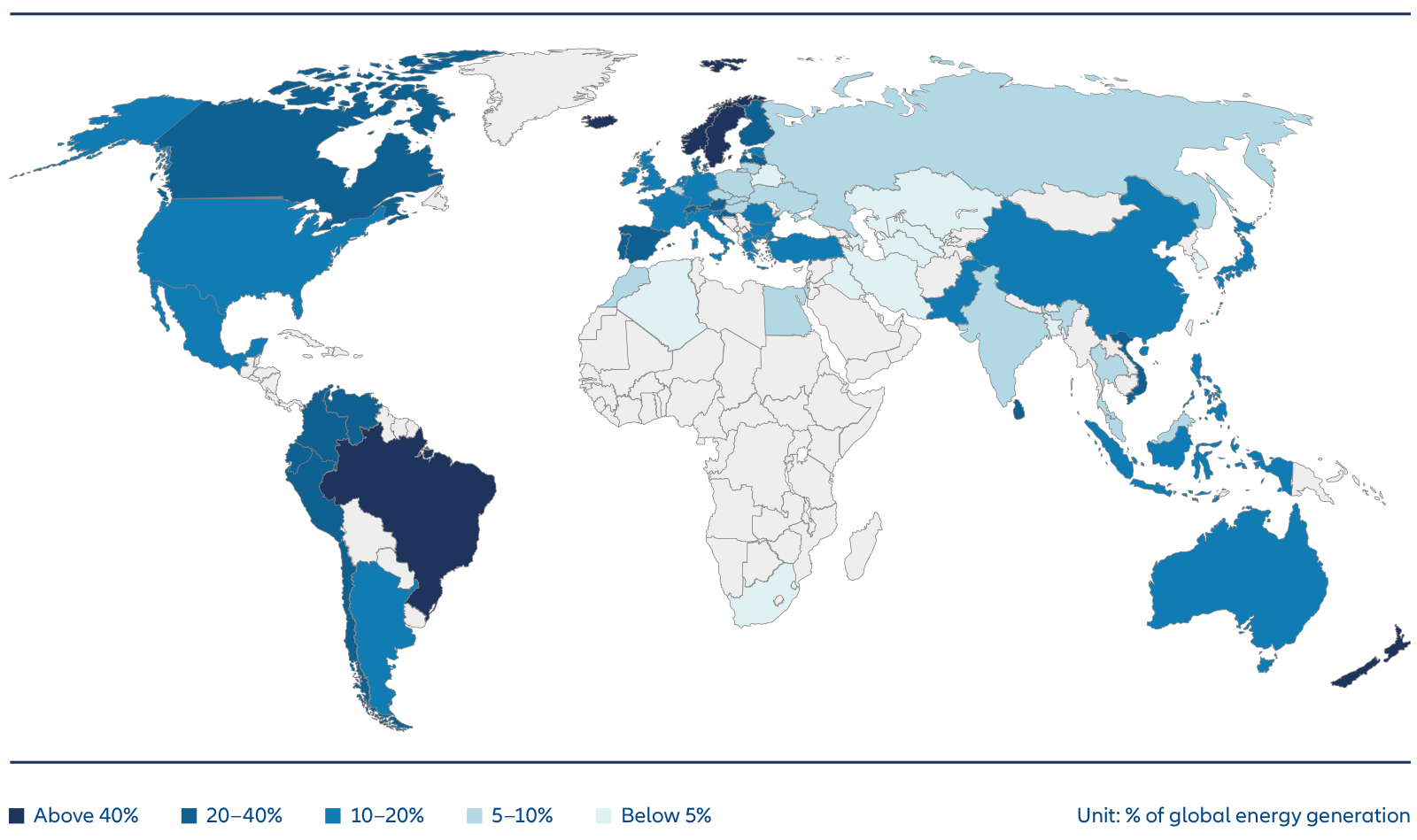

In 2022, when fossil fuels appeared to be at the centre of energy availability, affordability and security, growth in renewable energy capacity and output hit record levels. Over 80% of new installed power generation capacity was renewable3 (dominated by solar and wind as indicated in Exhibit 1) and grew by 300GW year-on-year.4 Considering these trends, the International Energy Agency (IEA) now estimates that renewable energy capacity will account for 90% of global electricity expansion5 which means growth of 2,400GW in the next five years – equivalent to all the capacity added in the last 20 years. The IEA also forecasts that renewable energy will be the leading source of electricity by 2025, mostly driven by China but also by contributions from the European Union, India and the US.

Yet, despite this progress, it is surprising to see long-term targets and forecasts have not changed6 , which means the world is still not on track to meet the 1.5°C scenario of the Paris Agreement.7 To align with this goal, capacity needs to triple by 2030 and rise 10-fold by 2050 (versus a 2021 baseline).8 This equates to 8,000–10,000GW by 2030 and over 20,000GW by 2050.

Exhibit 1: Current and forecast renewable energy power generation

*BECCS = Bioenergy with carbon capture and storage.

Source: IEA World Energy Outlook 2022 and Allianz Global Investors.

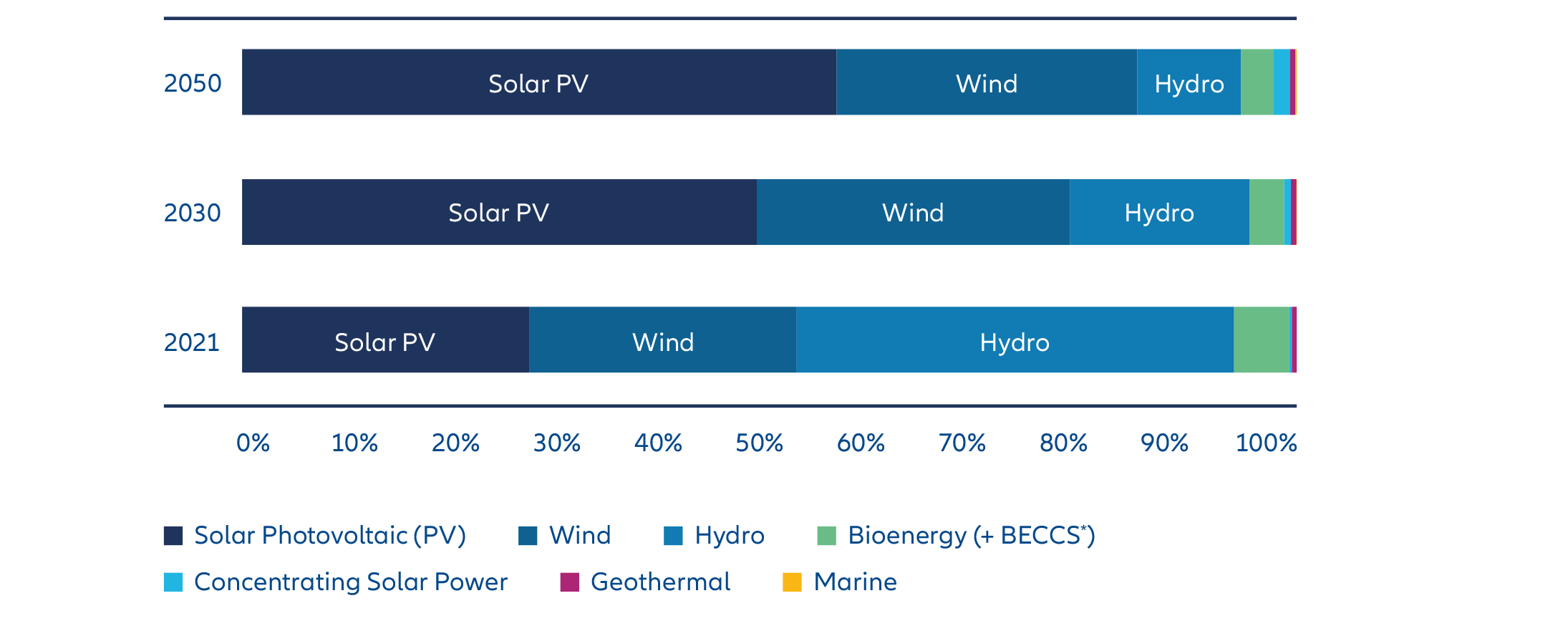

Renewable energy is cost competitive, but still vulnerable to inflation

Exhibit 2: Levelised cost of energy* (USD/MWh)

*Levelised cost of electricity: the long-term offtake price on a MWh-basis required to recoup allproject costs and achieve a required equity hurdle rate on the investment, Bloomberg.

Source: Bloomberg NEF and Allianz Global Investors.

There will be significant demand for specific components and materials for the build-out of clean energy networks and the events of 2022 exposed supply chain vulnerability in meeting the demand for these components. Not only do these factors risk decelerating progress but they also risk significant inflation. This highlights the need to increase the scale and reach of circularity in the economy (especially e-waste) to fulfil climate mitigation and adaptation goals. The European Central Bank (ECB) has recognised the challenges that inflation and economic uncertainties present for the expansion of renewable energy.9

Lastly, there is the structural factor of intermittence.10 Fluctuations in output can result in additional costs incurred due to energy-balancing measures required in the decoupling of energy production and consumption. To date, intermittence has been mainly balanced by gas power plants. Mass storage is the solution to ensure cost-effective upscaling of renewable energy, countering marginal cost impacts from gas price inflation and lowering any association of clean energy growth with an increase in gas demand to address intermittency.

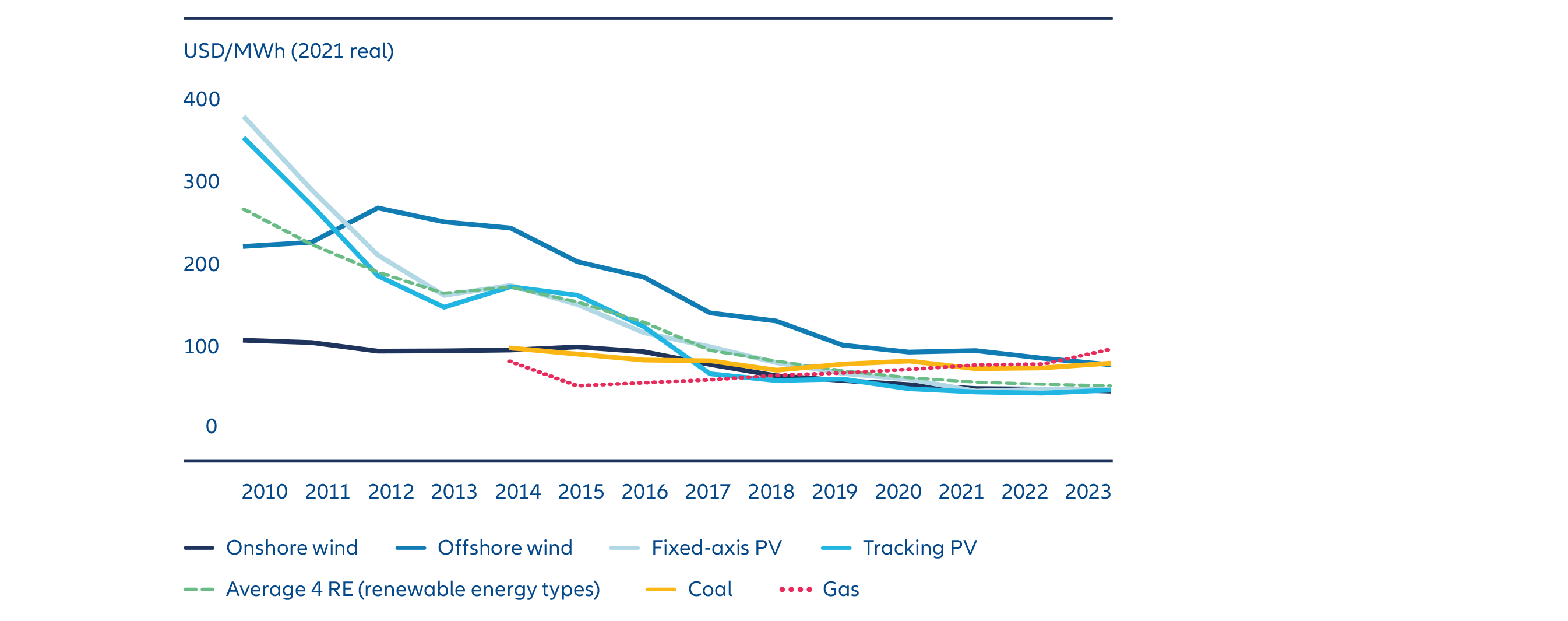

Developed countries have directed policy support to renewable energy through subsidies and fiscal stimulus packages like the Inflation Reduction Act in the US and the European Green Deal Industrial Plan. However, most developing economies do not have the same fiscal tools at their disposal. To address this point, the International Renewable Energy Agency (IRENA) has proposed the idea of a transfer mechanism, whereby developed countries can support developing countries. Exhibit 3 shows the concentration of renewable energy capacity globally.

Exhibit 3: Share of primary renewable energy in the energy mix by location in 2021

How the renewable energy mix is likely to transition

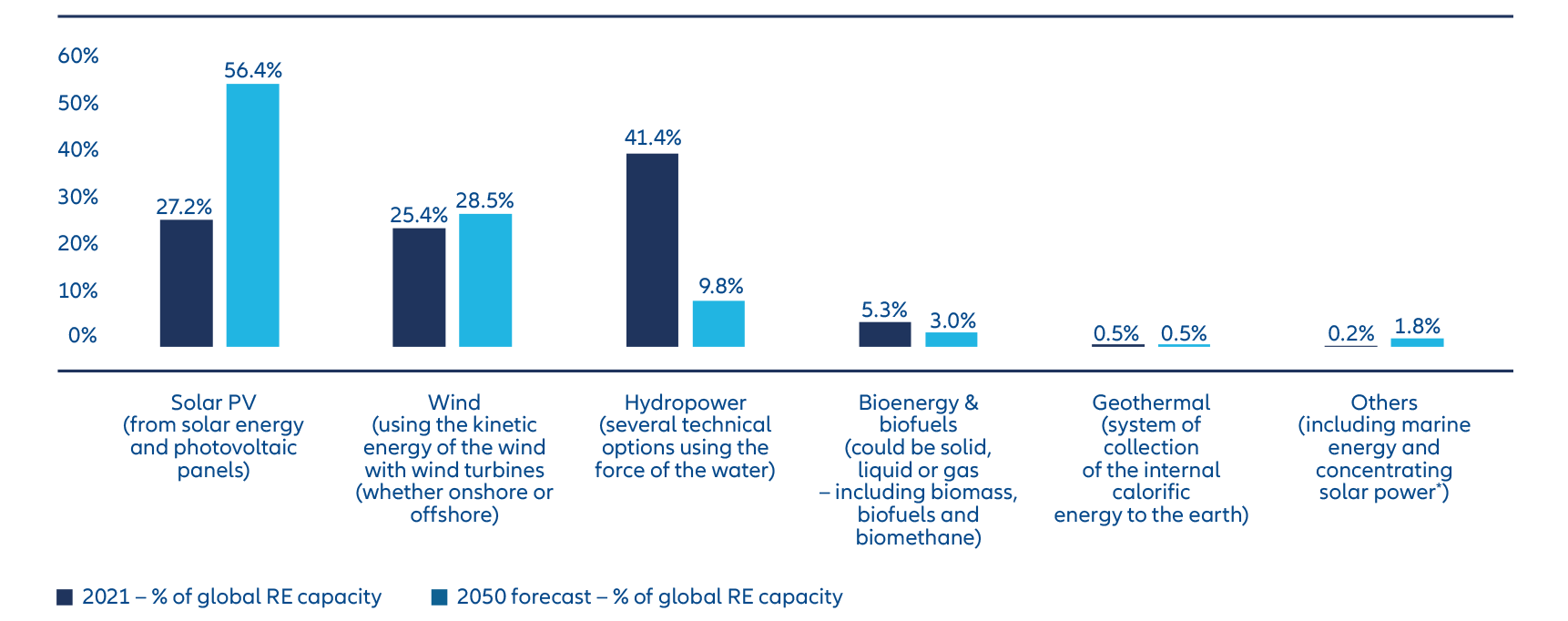

Renewable energy comprises a broad range of energy sources, each at its own stage of maturity, with its own future trajectory, risks and opportunities. Hydroelectric power is currently the world’s third-largest energy source and by far the largest renewable energy source. IRENA estimates that it will account for 37% of renewables, equal to 1,250GW, by the end of 2022 (solar: 31%; wind: 27%). However, by 2050 while we expect hydroelectric power to have increased slightly, its share of the overall and renewable energy mixes is expected to have fallen sharply. Solar and wind are expected to be the leading sources of energy in the renewables mix – see Exhibit 4.

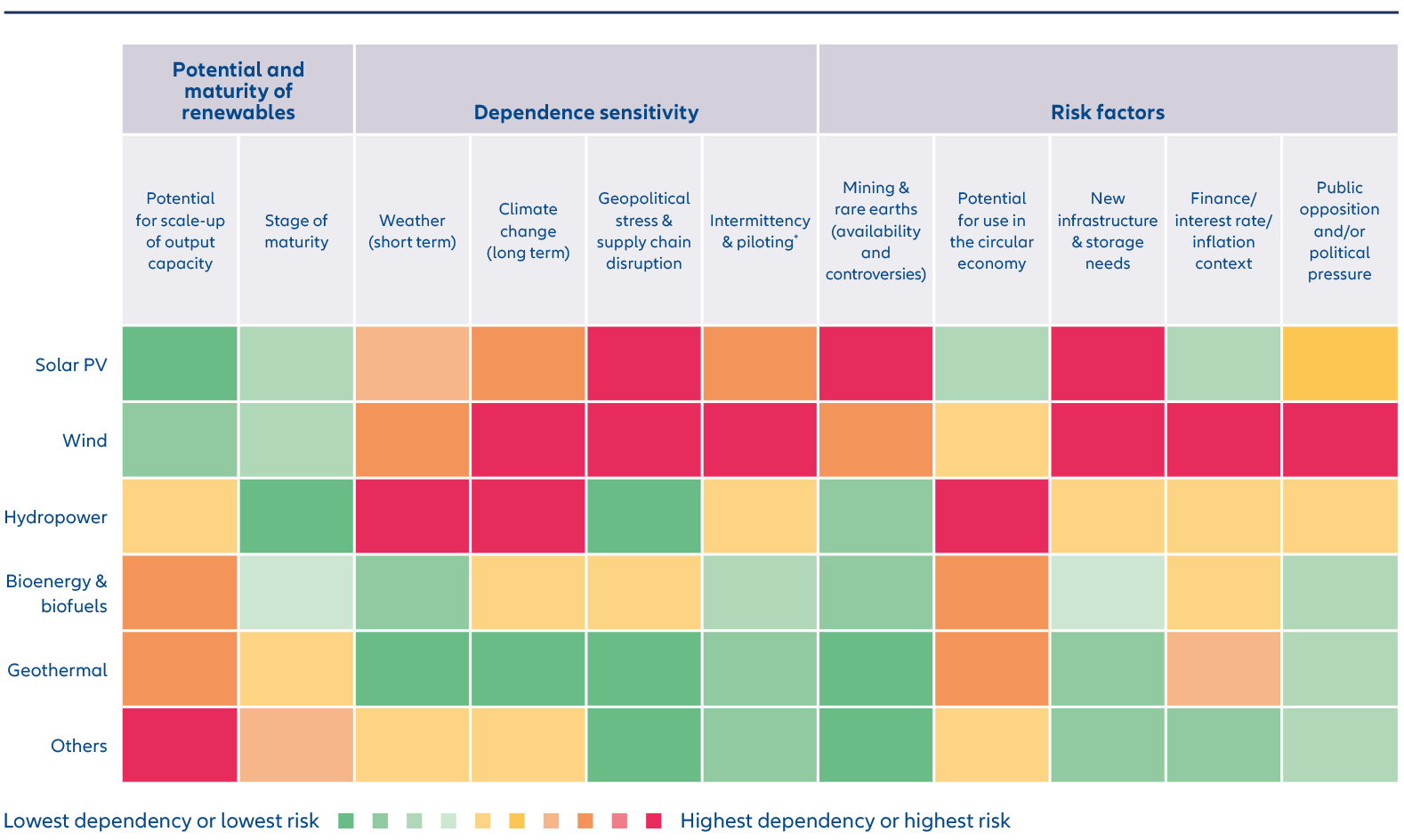

Our own renewable energy heatmap – Exhibit 5 – incorporates an assessment of the key areas of dependency and risk materiality. Some can be counterintuitive like climate change, where the very factor renewable energy is trying to solve, may also negatively impact its future adoption. It is also important to understand the extent to which future development is a function of processes, technologies and enabling infrastructure (grids and grid connections) that do not currently exist. Some of these factors may be subject to political volatility to the extent that progress may be policy-related (eg, reducing the delay on permits).

The heatmap reinforces the need for both in-depth analysis and targeted investor engagement to fully understand the risks and opportunities for the different renewable energy sources. These factors, even if sometimes highlighted less often and with more abstract modelling, are considered in the forecasts of the agencies (eg, IRENA in its World Energy Transition Outlook 202211 devotes a whole chapter to the problem of critical materials and the IEA12 also discussed this point in its Net Zero Emissions by 2050 scenario).

Exhibit 4: Renewable energy capacity expected growth

*Concentrating solar power = solar thermodynamic power.

Source: Allianz Global Investors, IEA, IRENA.

Record investments still falling short

While USD 1.3 trillion13 of energy transition investments in 2022 was a record, it falls significantly short of what is required. IRENA has estimated that at least USD 35 trillion needs to be invested by 2030 to meet the 1.5°C target14 – this means annual requirements of over USD 5 trillion15 globally. For renewable energies, this equals an uplift in annual investment from USD 500 billion to USD 1–1.5 trillion16. The rest (and bulk) of energy transition investments are focused on assisting adaptation within fossil fuels.

In addition to expanding the scale of investment, there is a need to increase the reach. Most renewable energy investment flows will go to solar photovoltaic and wind in the key markets of China, Europe, and the US. However, there needs to be greater allocation to developing markets – Africa accounted for a mere 1% of new renewable energy capacity installations globally last year.

The private sector has a major role to play. Public finances have been challenged by successive crises, and ongoing economic uncertainty could threaten the ability of governments to meet such enormous financing needs. The depth and breadth of the private sector can also ensure the fullest investment across renewable energy sources across the world.

Exhibit 5: The future potential for each energy source and their risks measured by key indicators

*Piloting: controlling the generation of electricity according to demand.

Source: Allianz Global Investors, IEA, IRENA.

Investment implications of the future renewable energy mix

The gap between current and required investment is significant and the expectations of both public and private investments are very high. What is the answer? There are different ways to support the depth and breadth of investment required:

Financing renewable energy: this can be achieved either through direct investment in projects in the private markets or through investment in companies looking to significantly expand their renewable energy infrastructure.

Investing in supporting infrastructure: similar to above, this can be achieved through both private and public markets to support the necessary infrastructure required for renewable energy expansion – such as connection to the grid and pipelines. It is worth noting the potential to invest in private equity, which has been very involved in this segment.14

Considering energy enablers: Exhibit 5 highlights the areas of key dependency, and significant potential investment opportunities exist, for example:

- Development of mass storage solutions for solar and wind energy.

- Grid adaptation.

- Sourcing of critical minerals and metals – including local, more sustainable mining, but significant opportunities also could also arise in the circular economy and e-waste solutions.

Monitoring the evolution of disclosures: the past year has seen increasing company disclosures on the contribution of renewable energy to total energy consumption and, renewable energy targets, and even greater granularity on location-based versus market-based scope emissions. Improved disclosure will assist further refinement of key investment reporting requirements like “sustainable investment share”15 and Do No Significant Harm17, which should bring benefits. Similarly, it will assist the alignment of activities to the UN Sustainable Development Goals18, specifically SDG 7: affordable and clean energy and, even more specifically, SDG 7.2: focused on increasing the renewable energy share of the global energy mix.

View our guide to investing in the energy transition:

https://www.allianzgi.com/en/home/insights/outlook-and-commentary/energy-transition-infographic

Learn more about Allianz Global Investors’ expertise and activity in the renewable energy sector through Allianz Capital Partners:

https://www.allianzcapitalpartners.com/en/our-business/renewables

1 Record Growth in Renewables Achieved Despite Energy Crisis (irena.org)

2 Fossil fuel consumption subsidies soared to record heights in 2022

3 Renewable Capacity Statistics 2023 and the report Highlights. (irena.org)

4 Record Growth in Renewables Achieved Despite Energy Crisis (irena.org)

5 The faster than expected drop in gas supply (eg, in Europe -13% YoY) has played a role in the expansion of renewable energy, but it is mainly

the 2022 hydro and nuclear power deficits (lowest level since 2000) in Europe that pushed growth in solar and wind (as well as coal – but rather

stockpiles oriented than switching gas-to-coal)

6 To date, only a few scenarios have been marginally updated, eg, a parameter adjustment for the BP forecast

7 United Nations Climate Change – The Paris Agreement

8 Renewable Capacity Statistics 2023

9 A new age of energy inflation: climateflation, fossilflation and greenflation (europa.eu)

10 What is “Intermittency” in Renewable Energy? – EnergyX | Energy Exploration Technologies, Inc.

11 World Energy Transitions Outlook 2022

12 Net Zero by 2050

13-15 Investment needs of USD 35 trillion by 2030 for successful energy transition

16 Global landscape of renewable energy finance 2023

17 Sustainable activities must Do No Significant Harm to environmental objectives of sustainable activities as set out in the EU taxonomy

18 United Nations Sustainable Development Goals