Embracing Disruption

Red Sea disruption: impact by sector

Companies are facing the latest supply chain challenge as commercial ships are rerouted from one of the world’s busiest shipping lanes. We see an uneven impact across sectors and think those companies that learned from other recent trade disruptions may be better able to ride out the current upheaval.

Key takeaways

- In the short-term, shipping firms may benefit from the disruption as increased demand for vessels due to longer transport times helps push up container rates.

- Many retailers depend on sea freight for their stock and may be vulnerable to delays, while a greater use of air freight means the technology sector appears largely unscathed.

- We think quality companies that have adapted their operations after other recent supply chain shocks (such as from Covid-19) are likely to be better able to withstand the latest disruption.

Many companies are closely tracking events in the Red Sea as attacks on commercial ships by Houthi rebels in Yemen prompt shipping firms to reroute vessels away from one of the world’s busiest shipping lanes (see Exhibit 1). The attacks, in response to Israel’s war in Gaza, pose a grave threat to global trade – around a third of global container ship cargo flows through the Suez Canal route connecting Europe and Asia. Vessels have been targeted further south on the route as they move through Bab al-Mandab Strait, the narrow channel that divides Africa and the Arabian Peninsula.

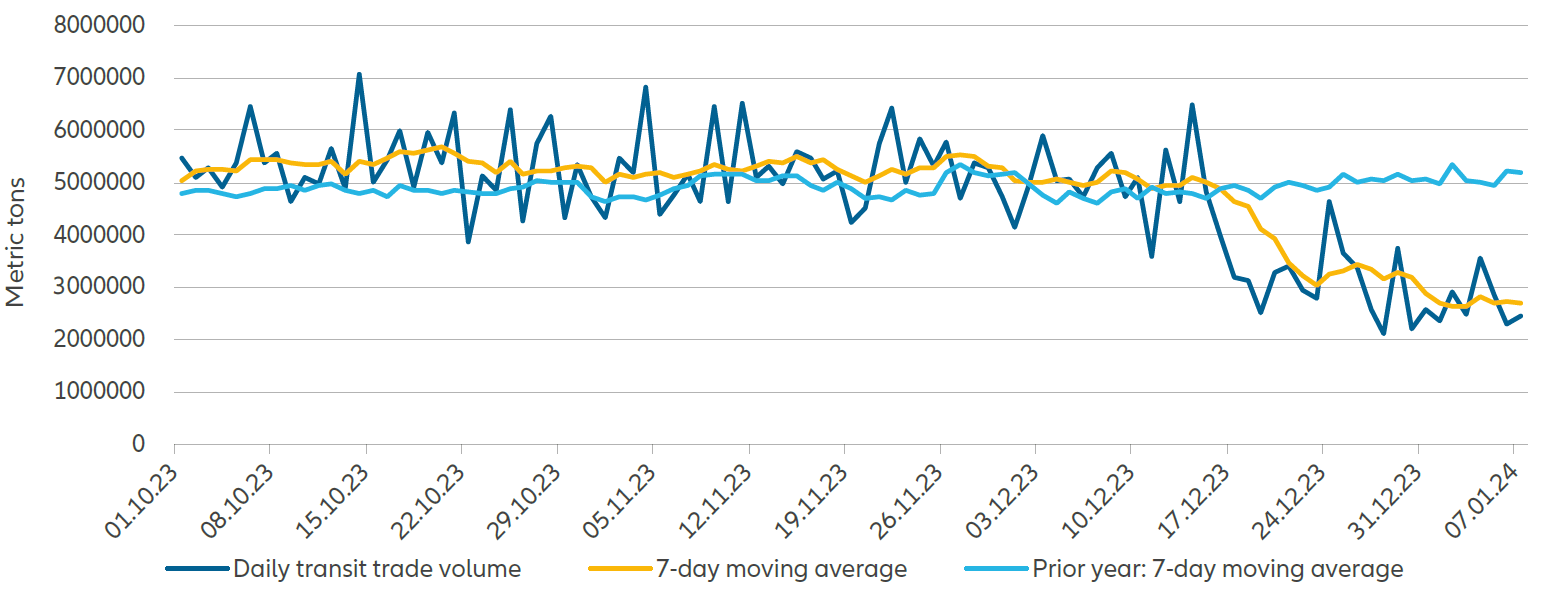

Exhibit 1: Daily transit volumes through the Bab al-Mandab Strait have dropped dramatically in recent weeks

Sources: Global Platform; PortWatch. Data as at 7 January 2024.

So far, the disruption has not affected supply chains and companies to the same extent as the Covid-19 pandemic. But continued upheaval may lead to delays in shipments and higher costs for businesses – and ultimately consumers – potentially fanning fresh inflationary pressures.

Our Equities teams see a mixed picture for companies across different sectors:

- Shipping firms: in the short-term, we see a potential boost in profitability for shipping companies. Container rates have risen 61% over the past two weeks, according to the World Container Index.1 Many firms are diverting ships from the Red Sea to the longer alternative route around the Cape of Good Hope at the southern tip of Africa for the foreseeable future – adding approximately 10 days to the journey. The upheaval should help to absorb some of the excess capacity of vessels as longer journey times require more ships. Longer transport times should also help support growth of working capital. But we remain cautious about the outlook for shipping firms. Once hostilities ease, we think container rates will fall and the excess capacity will again prove a challenge. In the short-term, air freight operators may benefit too as companies who would normally have shipped goods by sea seek to ensure swifter delivery for select goods.

- Retailers: many retail firms are on the front line of the disruption. Most rely on the movement of goods from manufacturers in Asia to consumers in the rest of the world, and longer shipping times may lead to delays in getting stock and higher costs. For fashion retailers, freight costs account for around 4% of the cost of goods sold and 2% of sales, according to JPMorgan estimates.2 Delays to maritime trade may prompt some retailers to switch higher-value items to air freight – but that will incur higher costs. A mitigating factor is that existing inventory levels are generally high and many retailers’ freight rates are usually contracted over longer-term periods, so the impact on spot rates may take time to be fully reflected. But if freight rates from Asia to Europe double or triple for a prolonged period, these additional costs will likely erode profit margins.

- Technology and car makers: the impact on the sector will be uneven as most technology items (including semiconductors, smartphones and laptops) are shipped by air rather than sea. Companies reliant on larger items shipped by sea, such as TVs, machinery and vehicles, are more vulnerable. We think car makers may be affected as inventories have come down over recent months. Even before the latest disruption, daily charter rates for transoceanic car carriers had reportedly surged to USD 105,000.3 Only two years ago they were just USD 16,000. Suppliers of semiconductors for the car industry could be affected if shipments of cars are severely disrupted. Elsewhere, technology firms exposed to defence and cybersecurity could benefit in the event of increased conflict in the region.

- Oil and gas companies: energy stocks are positively valued, in our view, given strong balance sheets and free cash flow. Therefore, we are expecting double-digit percentage distributions to shareholders at current oil prices. Such numbers may move higher still if the war in the Middle East escalates. According to the US Energy Information Administration, 12% of total seaborne-traded oil passed through the Bab al-Mandab Strait, the SUMED pipeline (in Egypt) and the Suez Canal in the first half of 2023. The equivalent figure for liquid natural gas was 8%.4 Oil tankers have so far appeared unaffected and oil and fuel tanker traffic in the Red Sea was reportedly stable in December.5 In our view, the biggest catalyst for oil prices – and possibly energy stocks – would come if the rebels turned their focus to the Strait of Hormuz, the narrow stretch of water between Oman and Iran through which around a fifth of the volume of the world's total oil consumption passes every day.6

Conclusion: quality matters

We draw optimism from the lessons many firms have learned in response to recent upheavals to global trade – from the Covid-19 pandemic to the Russia-Ukraine war and US-China trade tensions. We think the Red Sea situation may hasten the regionalisation of some supply chains previously underway. Many firms had already been exploring nearshoring – the process of transferring manufacturing or supplier business to a nearby country closer to the location of demand for its manufactured products. And many more businesses are investing in technology to give them a better overview of their supply chains and management of inventory to avoid delays and shortages caused by disruptions.

We think quality companies that have built more resilience into their operations since the pandemic can ride out the current challenges and better deal with any higher costs – by offering essential products at prices that do not incur a meaningful loss to their market share.

1 Source: Drewry's World Container Index, 4 January 2024

2 Date: as of January 2024.

3 Source: Red Sea Attacks Leave Shipping Companies With Difficult Choices, The New York Times (nytimes.com), 6 January 2024

4 Source: Red Sea chokepoints are critical for international oil and natural gas flows - U.S. Energy Information Administration (EIA), US Energy Information Administration, 4 December 2023

5 Source: Oil tankers continue Red Sea movements despite Houthi attacks, Reuters, 9 January 2024

6 Source: Strait of Hormuz: the world's most important oil artery, Reuters, 20 October 2023