Putting the “active” into active stewardship

Investors can play a big role in addressing some of the challenges the world faces. This extends beyond simply investing money in companies with the “best” sustainability credentials. The most impact may come from investing in those companies that have more work still to do. Through engagement, investors can help guide those firms towards a more sustainable future. In other words, our preference may be to engage rather than exclude.

Promoting change is part of our mission at Allianz Global Investors as we seek to be a sustainability shaper. Our active stewardship activities include proxy voting – where we exercise our voting rights at company Annual General Meetings (AGMs) – and engagement that involves ongoing discussions with companies covering a diversity of major sustainability themes.

These are some of the ways we seek to influence and support the firms we invest in to help them achieve their sustainability goals. And over the past year, we have expanded our engagement activities to become even more active.

Here are four ways we aim to put the “active” into active stewardship:

1. Expanding the breadth and depth of our engagement activity

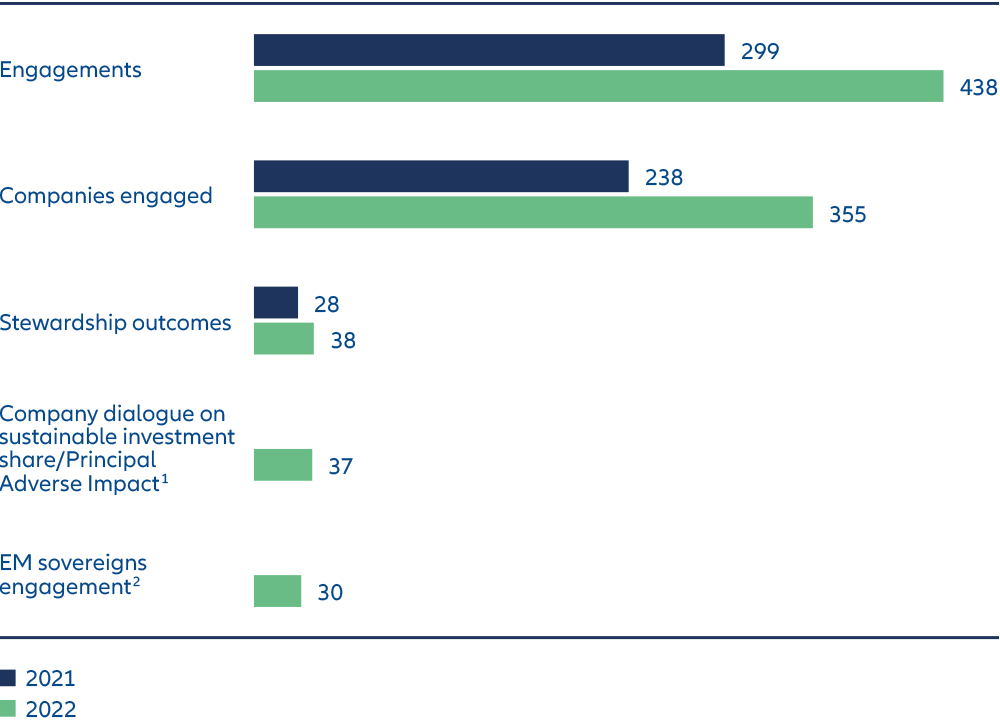

Over the past year we have increased our engagement activities in line with our priority themes. This includes expanding our climate engagement programme to encompass the highest emitters in portfolios, such as utilities companies. In total, our number of engagements increased to 438 in 2022 (up 46% year-on-year) with a commensurate rise in the number of engagement topics – from corporate governance and business strategy topics to environmental and social impacts.

Our engagement also sought to understand whether and how companies are taking action to protect and enhance biodiversity as part of our thematic focus on planetary boundaries. Biodiversity was discussed as a topic in 36 engagements with investee companies in 2022. We began a series of pilot in-depth thematic engagements on biodiversity with five companies in sectors with high biodiversity impact and dependency, such as paper and forestry products, construction, and chemicals. We are looking to expand this approach in 2023.

Substantial expansion of our stewardship activities in 2022

1. Engagements began in 2022 per regulatory requirements.

2. Not reported in 2021.

We have also expanded our coverage across asset classes. While the bedrock of our engagement activities comes from our heritage as an active equity manager, we are also now anchoring our engagement more specifically in fixed income and labelled debt, and facilitating dedicated dialogues for our corporate credit strategies. We have also stepped up engagement activities dedicated to our investments in Asia.

2. Driving collaborative engagement

Our goal is to shape pathways towards real-world transition. Sometimes the most effective way to increase our impact and achieve engagement objectives for our clients is to engage collaboratively with other investors. This approach can be particularly useful in cases where we have major concerns but only a limited investment in a company.

Examples of the investor groups we work alongside include Climate Action 100+, Ceres Food Emissions 50, the 30% Club France Investor Group, and the PRI Advance Coalition on Human Rights. Topics for collaborative engagement have included climate change, gender diversity and human rights.

3. Voting on behalf of our clients at AGMs

Voting on management and shareholder proposals is a key part of our stewardship programme. It enables us to have a say on critical sustainability issues across our three priority themes of climate change, planetary boundaries and inclusive capitalism. Our size and reach as an asset manager mean we can influence the companies in which we invest.

In 2022, we participated in more than 10,000 shareholder meetings and voted against, withheld or abstained from at least one agenda item at 69% of those meetings.

We opposed more than one-fifth of all resolutions, which are mainly tabled by management, reflecting our willingness to vote against proposals that do not meet our expectations. Putting our commitments into practice, we consistently vote on shareholder resolutions, resulting in 2,600 votes in 2022. For example, we supported a climate-lobbying shareholder resolution at a US airline. We also voted against the approval of an Australian oil and gas company’s climate report as it did not contain any Scope 3 emissions targets (ie, those related to indirect emissions across its value chain).

4. Raising our voice through clear communication and thought leadership

We openly communicate our stance on sustainability in several ways.

First, we have started making pre-AGM voting announcements on high-priority topics to ensure our intentions are transparent and to aim to persuade other investors to adopt a similar approach. Preannouncing our voting intentions reflects an escalation around themes that are important to us and where our stake or engagement experience means escalating in this manner is appropriate. Examples include announcing that we would support a shareholder resolution at Chevron’s AGM urging the company to extend its climate action plan to cover Scope 3 greenhouse gas emissions, and our support for a resolution on workers’ rights at Starbucks’ AGM.

Second, we publish a range of thought leadership articles on sustainability issues. These include our “Stewardship Principles” series, which covers topics such as why German companies should embrace the role of lead independent director and how client and regulatory expectations are driving a focus on gender diversity.

Third, we provide extensive details of our stewardship activities and outcomes in our annual Sustainability and Stewardship Report.

Why this matters

We believe our active approach to stewardship provides some important benefits for clients.

One is that the outcomes of our engagements are linked to our proxy voting approach, ensuring that our clients have full transparency of how we act as stewards of assets on their behalf. In cases where companies are still lagging in certain areas even after we have engaged with them, our voting position is likely to reflect these shortcomings.

Of course, the opposite may be true: after recording an engagement outcome, we are more likely to support the company management at the AGM. This transparency is important in ensuring our clients can be confident that we are meeting our fiduciary duty as manager of their assets.

Another point is that engagement informs our investment decisions. Our investment professionals are becoming ever-more involved in our engagement dialogues, and portfolio managers can integrate the insights derived from this process into their management of clients’ assets. The goal is betterinformed sustainability-related investment decisions and the potential to enhance risk-adjusted returns.

Along similar lines, our engagement and monitoring provide more information and data that can complement sustainability data and ratings available to our investors. This information plays an important role in our portfolio construction process and in how we develop investment ideas and make investment decisions across asset classes.

This is another way we aim to put the “active” into active stewardship, as we continue to align with changing regulation, an expanding set of priority topics, and evolving expectations from our clients.