Transforming Infrastructure

How institutional investors can play an important role in promoting sustainable infrastructure

Institutional investors have been playing an increasingly important role in the financing of infrastructure for some time now. Therefore, it is only logical that they also make a significant contribution to the sustainability transformation. In particular, the provision of debt capital in the infrastructure sector can play a decisive role in supporting or even shaping this transformation.

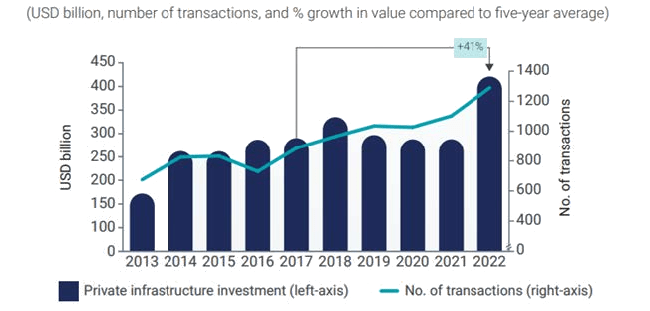

Private investments in infrastructure projects in primary markets:

After eight years of stagnation, private markets investments in infrastructure rose significantly in 2022 for the primary market - with a total value of 41% above the five-year average.1

Private investment in infrastructure projects in primary markets.

Figure : Global Infrastructure Hub based on Realfin data, Infrastructure

There is no alternative to sustainability.

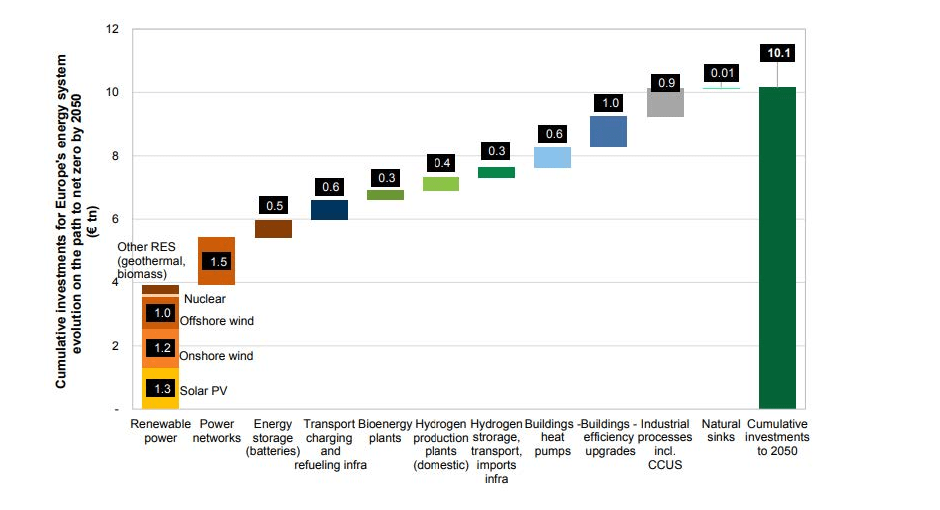

Infrastructure projects can be of central importance for achieving global climate targets, greater sustainability, and the creation of resilient, sustainable, and future-proof societies. Particularly with regard to future generations, it is essential to set the course now, which is already happening in many areas and companies. Achieving these goals also involves numerous changes and adjustments within the economy and society. In the infrastructure sector, this specifically involves projects in the areas of renewable energies, energy efficiency, fossil-free and environmentally friendly transportation, as well as water and waste management. Furthermore, digital transformation is also a focus to enable smart grids and new working models such as working from home. Additionally, this topic is relevant for all infrastructure sectors, as decarbonisation and responsibility for the entire value chain are becoming increasingly important for all infrastructure companies. By 2050, there is an estimated investment opportunity of 10 trillion euros in the infrastructure sector for the transformation of the European energy system to net zero.2

Cumulative investments for Europe’s energy system evolution on the path to net zero by 2050 (EUR tn)

Source: Goldman Sachs Global Investment Research, Carbonomics: Re-Imagining Europe's Energy System, 2022.

Instruments to promote sustainable investments.

There are various ways to promote investment in sustainable and green infrastructure or its transformation. Green bonds have already been in use for some time but are subject to strict requirements to ensure that the funds are used for specific “green” purposes. The Green Bond Principles (GBP) of the International Capital Market Association (ICMA) have provided a framework for the issuance of green bonds for more than ten years. The GBP aim to promote transparency and disclosure in the green bond market, reduce “greenwashing,” and increase the allocation of capital to environmental projects. The use of funds is the cornerstone of the GBP and should have a clear positive environmental impact that is assessed and, where possible, quantified by the issuer. While there is no global consensus on how exactly projects should be categorised for green bond financing, the GBPs provide a list of potential categories. Green bonds often finance projects in the areas of renewable energy, energy efficiency projects, and the promotion or development of the decarbonisation of the transport sector. Green loans are a variation of green bonds. The Green Loan Principles (GLP) were established in 2018 by the Loan Market Association (LMA), among others, with a focus on reporting and external verification. The loan documentation should reflect the “green” nature of the loan and also define the consequences of non-compliance with the green criteria.

However, green bonds and green loans only have a limited scope of application when it comes to projects and companies that are in a transition phase. designed to encourage the borrower to achieve ambitious, pre-defined sustainability targets.

In those cases, Sustainability-linked bonds (SLBs) and sustainability-linked loans (SLLs) can be a financing option. In 2019, the LMA published its Sustainability Linked Loan Principles (SLLP) for the first time, which define SLLs as instruments The borrower's sustainability performance is measured using Sustainability Performance Targets (SPTs), which are based on key performance indicators (KPIs), external ratings and/or equivalent metrics and can demonstrate improvements in the borrower’s sustainability profile. These instruments are not tied to a specific use of proceeds, so they can also be used by borrowers who still need to make concrete improvements in terms of sustainability. In a typical structure, the interest rate is reduced if the borrower achieves certain KPIs, such as a reduction in energy consumption. Alternatively, higher interest rates are also conceivable if KPIs are not achieved. The positive or negative adjustment is usually between 5 and 10 basis points.

Green bonds and green loans focus on ecological aspects. SLB/SLLs, on the other hand, increasingly include other criteria, such as diversity in management roles or fair remuneration. However, there are other instruments that address social issues directly. These so-called social bonds or social loans are becoming increasingly popular. Analogous to GBP/GLP, corresponding Social Bond Principles and Social Loan Principles have been developed. The ICMA's Sustainability Bond Guidelines, for example, provide guidelines for instruments with mixed use of funds from green and social causes. These instruments are known as sustainability bonds or sustainability loans.

5 ways how infrastructure debt investors can influence sustainable behavior:

Infrastructure projects can be of key importance for achieving global climate targets and greater sustainability. Although sponsors and equity investors generally have a more direct opportunity to influence projects and companies, debt investors also have various levers to incentivise sustainable behaviour on the part of their borrowers:

1. Financing documentation: The inclusion and definition of sustainability clauses and criteria in loan agreements that can oblige borrowers to comply with certain ESG standards is key. Compliance with environmental standards, social responsibility and good corporate governance can be stipulated here. Outside of special financing frameworks, such as green bonds or sustainability-linked loans, such clauses are currently still relatively generic and are usually limited to compliance with applicable laws and regulations, particularly with regard to environmental protection.

2. Monitoring and Reporting: This involves regularly reviewing the ESG performance of borrowers and requesting specific information or detailed sustainability reports. The initial focus here is on providing lenders with the necessary information so that an evaluation can take place. As a side effect, this also creates an awareness among borrowers of the need to deal (more) intensively with the topic and to implement the means for measurement and reporting. In practice, however, it is clear that even more than ten years after the introduction of green bonds, there is unfortunately still a lack of willingness or ability on the part of some project developers and companies to engage intensively with this issue and provide the relevant data.

3. Engagement: Lenders should actively engage with their borrowers and work towards the achievement or positive development of sustainability and ESG criteria. Even if equity providers have more direct control, borrowers are regularly dependent on the cooperation and support of their lenders. It is quite common for investors to carry out an internal assessment in order to monitor the "level of commitment" of their borrowers. This is used to underpin their active behaviour towards their own stakeholders, but also to better identify a lack of commitment on the part of certain companies in which they have invested. Although this might not have any immediate negative consequences for these companies, it is a first step to enter into targeted discussions on these points.

4. Incentivisation: The strategies for promoting more sustainable investments are often seen as an incentive mechanism for obtaining more attractive conditions or better access to investors. Investors already make a distinction through their own screening and allocations, which has a direct influence on the availability of capital and financing conditions. For example, an investor's endeavour to reduce the greenhouse gas emissions of its own portfolio means that, on the one hand, it has fewer funds available for other investments by investing in this goal, but on the other hand, it usually can also access more funds for and/or at more attractive conditions for investments that support “green goals”.

5. Selection: Internal screening and the categorical exclusion of certain projects and industries also influence the financing conditions. This creates an incentive for borrowers not only to review and possibly rethink their own activities, but also to take steps to be more attractive to lenders, who are often institutional investors. We can observe that companies from sectors such as oil and gas storage are increasingly endeavouring to diversify their business plans towards chemical products or biofuels or to switch completely in the medium term.

At present, however, there are still some investors that find it difficult to invest in "brown" companies that still have their green transformation ahead of them, as a corresponding investment could initially have a negative impact on their own investment portfolio. A rethink is needed here, as constructive support for decarbonisation and positive change from "brown to green" can often be more impactful.

Institutional investors are indispensable players for the green infrastructure transformation. Their long-term perspective enable them to make a significant contribution to this transformation. Debt investors too have various levers to incentivise sustainable behaviour on the part of their borrowers which they shouldn´t underestimate.

Regulatory frameworks

Even if institutional investors can and should realise the above-mentioned opportunities of their own volition, the regulatory framework should also be briefly outlined.

The European Union (EU) has taken decisive steps to promote sustainable finance, placing itself at the forefront globally, in particular through the introduction of the EU taxonomy and disclosure rules. These can serve as a blueprint for similar developments outside the EU.

The EU taxonomy is a classification system to create a uniform definition of “sustainable”. The EU Sustainable Finance Disclosure Regulation (SFDR) seeks to harmonise transparency rules for the integration of sustainability risks and negative impacts.

As both the EU taxonomy and SFDR focus on financial companies, there was a mismatch in the requirements applying to non-financial companies i.e. borrowers. This initially made meaningful implementation difficult. However, the EU Corporate Sustainability Reporting Directive (CSRD) came into force in January 2023. This now also requires large companies and small and medium sized enterprises with a public interest to disclose certain information on sustainability. This means that some nonfinancial companies now also need to take a close look at the issue. However, the challenge in the infrastructure sector remains that many of the companies and mostly all projects do not fall under CSRD.

Conclusion

Institutional investors are indispensable in the financing of sustainable infrastructure investments. Their financial strength and long-term view enable them to make a significant contribution to the sustainability transformation. At present, however, it can still be observed that some investors find it difficult to invest in “brown” companies that have their green transformation ahead of them, as a corresponding investment could initially have a negative impact on their own investment portfolio despite the company's significant potential for positive change. A rethink is needed here, as constructive support for decarbonisation and positive change from “brown to green” is often more effective and more targeted.

We already see many steps in the right direction in the market, but still potential for improvement, which institutional debt investors, together with the companies, are willing to realise and actively shape in a positive way.

1 Source: Global Infrastructure Hub, Infrastructure Monitor 2023.

2 Source: Goldman Sachs Global Investment Research, Carbonomics: ReImagining Europe's Energy System, 2022.