Achieving Sustainability

From just a transition to a just transition?

Since emerging more than 40 years ago, the term “just transition” has become synonymous with a socially fair transition to a low-carbon economy. Many think the concept only relates to climate, but it also affects issues of planetary boundaries and social development.

Key takeaways

- Climate transition involves challenges in managing the social impacts of tackling climate change. But as well as challenges, there are opportunities for sustainable and inclusive economic growth.

- A focus on a “just transition” may be the key to unlock lagging actions on climate adaptation.

- To achieve a just transition, the consideration of social factors should permeate all aspects of climate strategies. At AllianzGI, we put the theme at the centre of our in-house research and stewardship toolkit.

- “Just transition” is an increasingly important topic for investors due to inclusion in climate planning and incoming regulation.

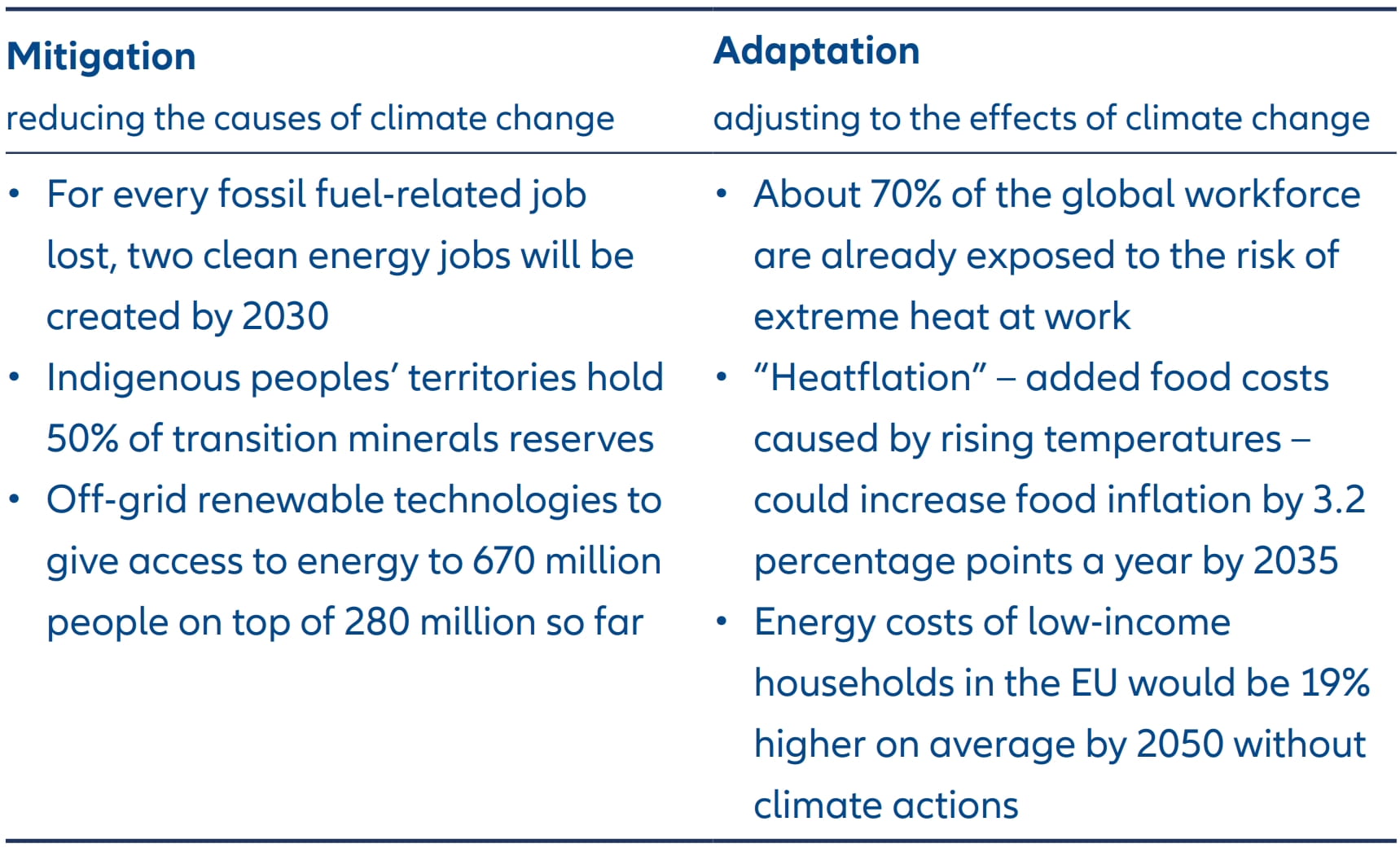

Unless the global population adapts to climate change, almost all of life’s essentials are at risk – energy, food, clean air, water, health, homes. Yet the attempt to mitigate or adapt to climate change will itself affect livelihoods (see Exhibit 1 for some impacts). In fact, the social repercussions from tackling climate change are likely to impact 14 of the 17 UN Sustainable Development Goals (SDGs). These include, for example, the SDG8 (“to promote decent work and economic growth”) and the SDG10 (“to reduce inequalities”).

Climate transition also has the potential to boost progress on specific SDGs. For instance, on the SDG7 (“ensure access to affordable and clean energy”), a shift towards renewable energy is likely to expand access to electricity and potentially drive down costs (see Exhibit 1 for more impacts). Yet, even though organisations such as the Network for Greening the Financial System have recognised the long-term economic benefits of climate action,1 there can be geographic, timeline and socioeconomic discrepancies – on skills, pay or social protections, for example – which can undermine broad-based support for the transition. As the OECD puts it, “High-skill green-driven jobs usually pay higherthan-average wages, but low-skill green-driven jobs tend to have worse job quality than other low-skill jobs.”2

Exhibit 1: Some social impacts of climate actions

Source: IEA , Business & Human Rights, IRENA, ILO, WEF, Institute for European Energy and Climate Policy.

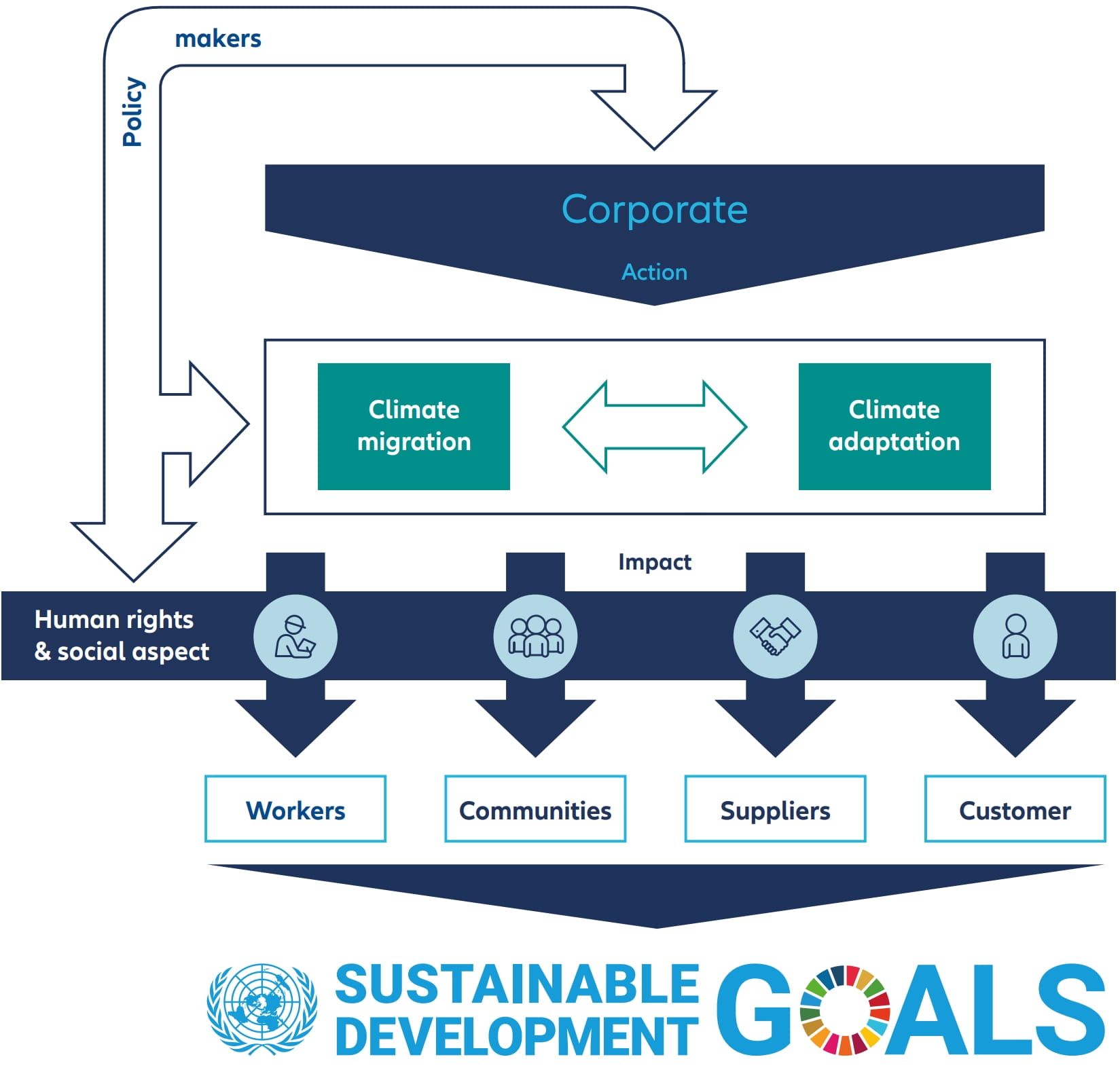

The social and financial consequences, either negative or positive, need to be considered by policymakers and businesses across the full spectrum of stakeholders (as shown in Exhibit 2).

Exhibit 2: Overview of “just transition”

Taking a whole picture of just transition

The International Labour Organization (ILO) defines “just transition” as “greening the economy in a way that is as fair and inclusive as possible to everyone concerned, creating decent work opportunities and leaving no one behind”. In other words, the focus is on ensuring fairness and equity in the transition to a warmer world and a low-carbon economy. The term should not be confused with “climate justice”, which seeks to address the inequality of climate change impacts.3

In the past, the focus of climate transition has centred on higher emitting sectors and their ability to contribute to climate mitigation. However, no sector is spared from the consequences of future higher temperatures – and the need to adapt. The impact on individual stakeholder groups varies by sector and location, and we have identified significant blind spots in the social approach of climate adaptation.

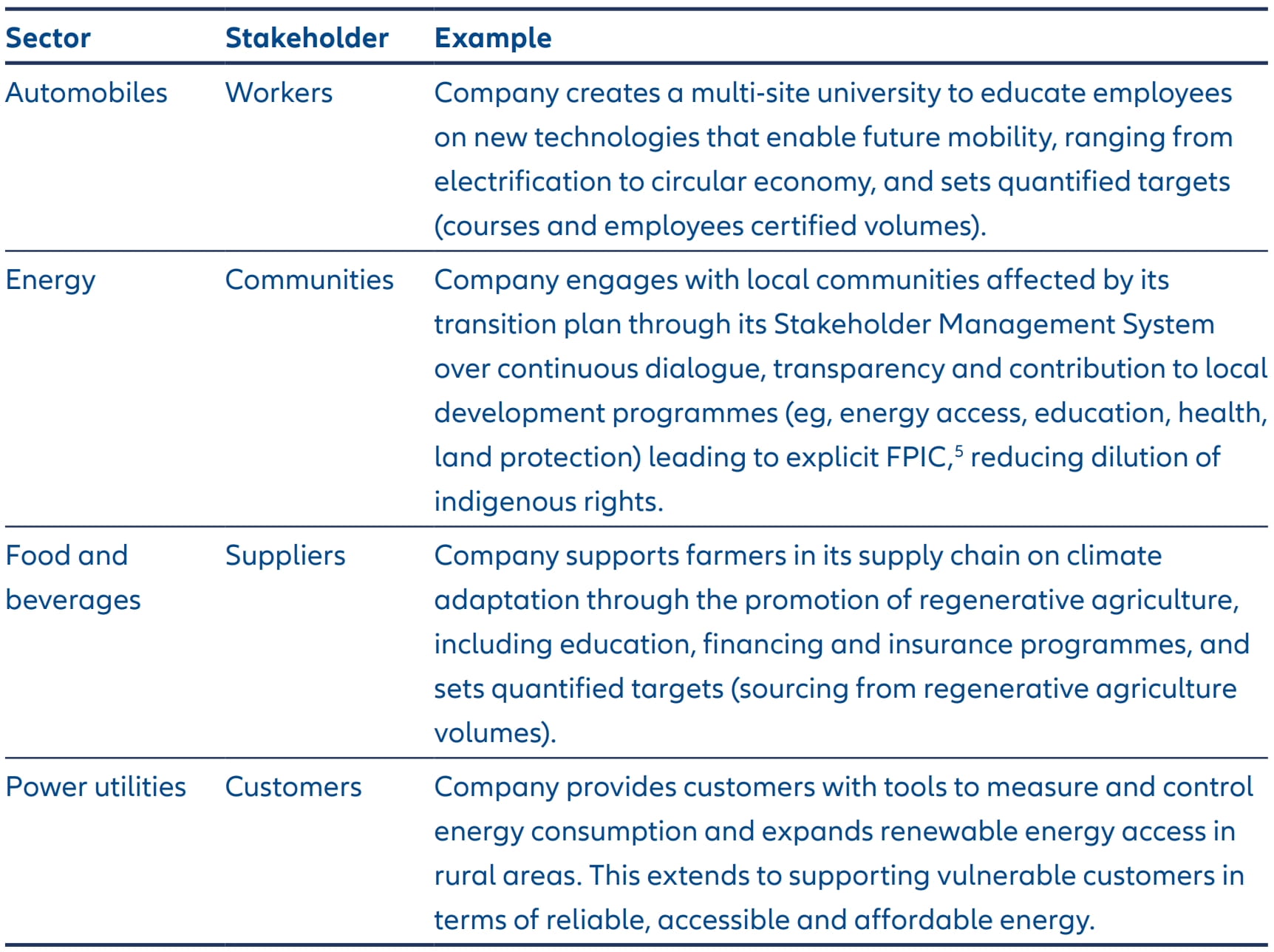

To focus on workers, for example, factors such as heat and physical risk must be addressed to ensure no disruption in operations, and to preserve productivity. The ILO has estimated that, by 2030, up to 3.8% of total working hours may be lost to high temperatures.4 Failing to consider the effects of heat in a transition plan would significantly undermine its credibility and could result in negative social and financial consequences. A resilient and well-scoped climate transition plan would also include measures to reskill, upskill or redeploy affected workers, while attracting and retaining new expertise (see Exhibit 3).

Exhibit 3: Examples of corporate actions to support a just transition

Source: IEA , Business & Human Rights, IRENA, ILO, WEF, Institute for European Energy and Climate Policy

How to measure for a just transition at the company level

Company key performance indicators (KPIs) relating to a just transition are still at an early stage of development. Typically, they focus on the existence of policies and some workforce measurements, such as training hours or participation rates, and major redundancy data. Reporting initiatives such as the General Reporting Initiative, Transition Plan Taskforce and International Sustainability Standards Board provide guidance on which transition-related metrics to disclose. These may include the number of jobs created or lost, and the sites or communities impacted by a transition plan.

Investment and regulatory needs are helping to push for improved transparency. For investments, the UN has highlighted the significant investment opportunity for the private sector in addressing the adaptation finance gap.6 The Just Transition Finance Lab and the Climate Bonds Initiative have both highlighted how green, social, sustainability and sustainability-linked (GSS+) bonds can support a just transition.7 There is also the EU Just Transition Fund, which is part of the EU Just Transition Mechanism.

On the regulatory side, a general scrutiny on social aspects – under the Corporate Sustainability Reporting Directive, the Human Rights Due Diligence laws and EU Green Taxonomy safeguards – together with initiatives such as the Principles for Responsible Investment are pushing the agenda for reporting and best practices.

For the time being, engagement will be key for assessing whether transition plans are just.

Investing for a just transition

There is evidence of progress. As of June 2023, three-quarters of sustainability bonds issued to date were found to have “just energy transition” features, according to research by the Grantham Research Institute on Climate Change and the Environment alongside the Climate Bonds Initiative. This meant that issuers were using some of the proceeds for measures to advance renewable energy, employment, education or equality.8

However, there is clearly more to be done in terms of embedding social considerations in climate-related risk management – as well as in investment solutions oriented on climate transition.

Our research at AllianzGI has determined that a just transition touches on all three of our pivotal sustainability themes.

- Climate change – We consider “just transition” to be one of six elements needed to support climate transition.9

- Planetary boundaries – The question of what our planet can sustainably produce without losing its ability to self-regulate is tied up with the concept of a just transition. The social impact of climate change is nowhere as stark as when key resources such as food and water are under stress.10

- Inclusive capitalism – The drivers of a just transition are similar to those that underlie socioeconomic stability. These have repercussion on the healthcare system and the labour market.11

We continue to evolve our in-house research and stewardship toolkit to integrate the theme of a just transition:

- We embedded the concept of a “just transition” into our climate transition plan framework guide.12

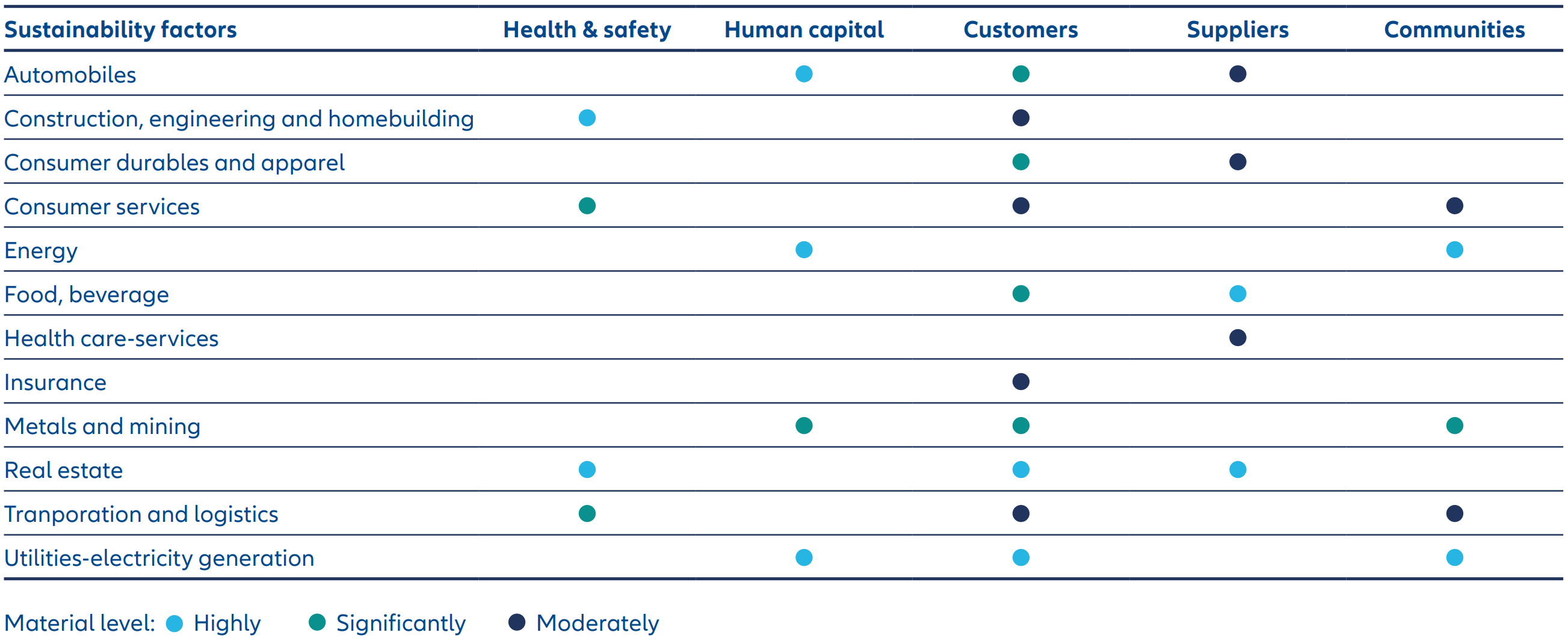

- We extended the assessment of “just transition” materiality across our 24 sectors (see Exhibit 4), allowing us to determine which sectors are highly, significantly or moderately impacted by this issue.

- For sectors in which “just transition” is highly material, we are creating “deep dive” analysis that explains the materiality in detail and outlines leading and lagging practices.13

- We developed new engagement guidance for investment personnel to help them conduct constructive dialogue with companies affected by “just transition”.

Exhibit 4: Extract of just transition materiality assessment by sustainability factors

Source: Allianz Global Investors, 2025

One transition towards a more sustainable future

“Just transition” is not a parallel track to the broader climate transition, but an essential feature of it, which should be recognised by all impacted stakeholders. Whatever the point of view – climate, planet or social – “just transition” is at the heart of a more sustainable and inclusive society.

1 Benefits of Accelerating the Climate Transition Outweigh the Costs, IMF Blog

2 OECD employment at record high while the climate transition expected to lead to significant shifts in labour markets

3 Introduction to Just Transition: A Business Brief (Climate Justice in glossary p. 19), UN Global Compact

4 Working on a warmer planet: The impact of heat stress on labour productivity and decent work

5 Free, Prior and Informed Consent, IHRB

6 Adaptation Gap Report 2024 (page 16), UNEP

7 See Could bonds hold the answer to investing in the just transition to a green economy?, Just Transition Finance Lab and Mobilising global debt markets for a just transition, Grantham Research Institute on Climate Change and the Environment

8 Mobilising global debt markets for a just transition, Grantham Research Institute on Climate Change and the Environment

9 Energy transition: time to clear the air, AllianzGI

10 See The crisis on our plates, AllianzGI and How investors should tackle the water crisis, AllianzGI

11 See Healthcare: how to live better, AllianzGI and 2025 theme 5: Working with the modern workforce, AllianzGI

12 When is a climate transition plan a real plan?, AllianzGI

13 Sustainability and Stewardship Report 2023 (p 23 – 02.2 Sustainability research), AllianzGI