Investing in the energy transition: what institutional debt investors should consider

The global shift toward sustainable energy has sparked a need for investments in energy transition assets. What types of assets and investment opportunities are available for institutional debt investors?

Key takeaways

- Investing in energy transition assets offers institutional debt investors an opportunity to actively contribute to the global shift towards sustainable energy sources.

- Investment opportunities are extensive: covering both the investment in transitioned assets but also the provision of capital to allow for the transition of existing assets.

- For investors, the benefits include the potential for stable cashflows and yield, as well as strong demand for clean energy and a favourable policy environment.

- Energy transition assets carry risks, but financing structures include mechanisms that can serve as safety nets, securing debt investors’ interests.

Institutional investors who provide debt capital are central to funding renewable projects and decarbonisation initiatives. When the complexities of investing in these assets are understood, investors can help steer countries towards a low-carbon economy, generate potentially attractive risk-adjusted returns, and access a healthy pipeline of investment opportunities.

Energy transition involves redirecting capital towards these assets – ranging from renewable energy and energy storage to electricity infrastructure and transport decarbonisation (see box) – and away from fossil-fuel investments. As such, investing in energy transition should include both the investment in transitioned assets but also the provision of capital to allow for the transition of existing assets. This can include financing capital expenditure investments to reduce the carbon footprint of existing fossil-fuel systems. An example of this is the retrofitting of high-emitting power plants with carbon capture and storage, cofiring or conversion. Heating plants may be replaced by large-scale heat pumps, allowing for economies of scale compared to individual household solutions.

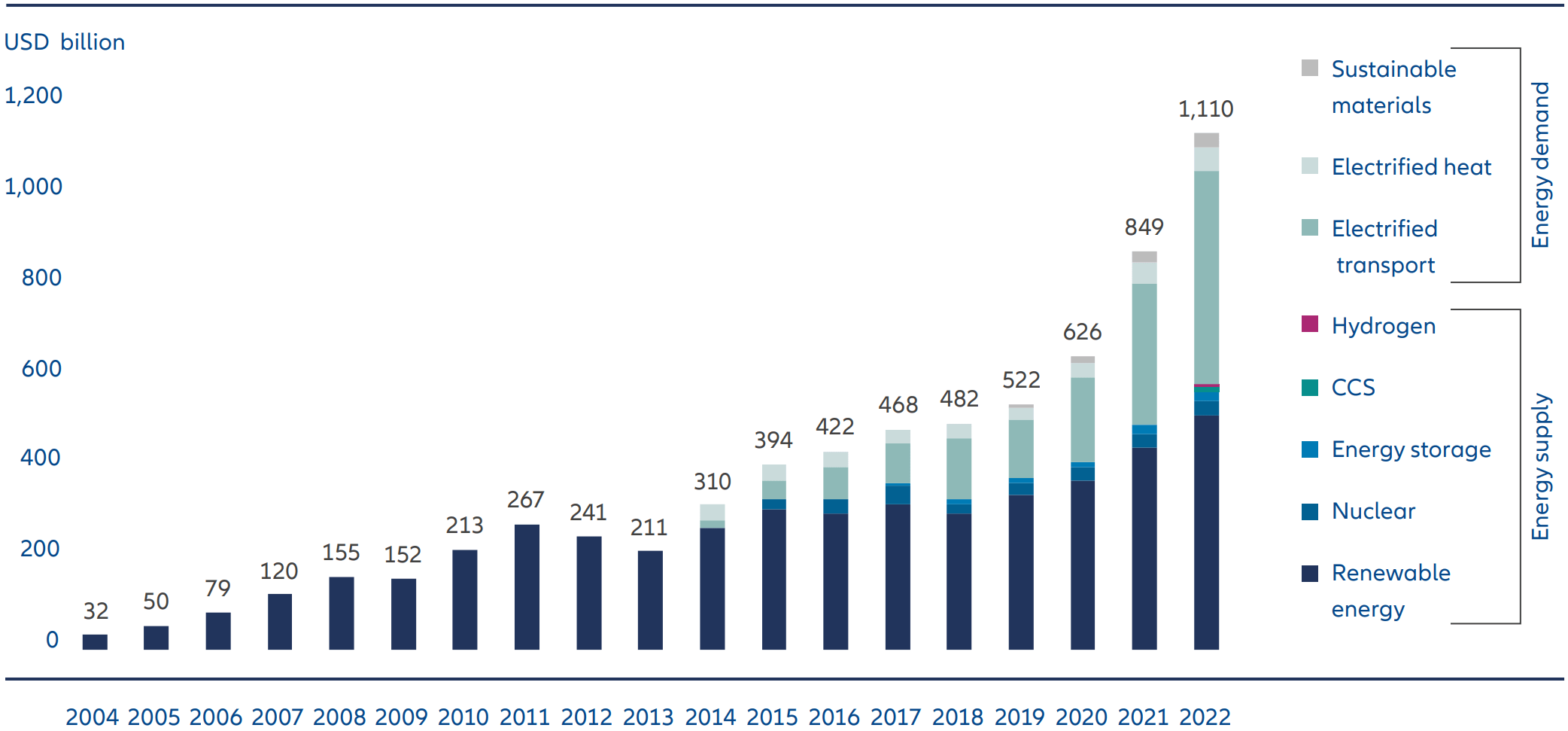

Exhibit 1: Global investment in energy transition by sector (USD billion)

Source: BloombergNEF. Note: start years differ by sector but all sectors are present from 2019 onward. Nuclear figures start in 2015

As Exhibit 1 illustrates, investment in energy transition has accelerated in recent years. The current opportunity to invest in energy transition is attractive for several reasons:

- Investors can lead the way in climate change mitigation – Investing in energy transition assets enables debt investors to support the reduction of carbon emissions and actively combat climate change. Funding renewable energy and clean technologies is instrumental in promoting environmental sustainability. It is key to transitioning from fossil fuels to renewable sources, cutting greenhouse gas emissions, and achieving global climate targets. Institutional investors have a responsibility to support the fight against climate change and to facilitate the decarbonisation of the economy. Moreover, investing in energy transition assets offers debt investors an opportunity to align their portfolios with sustainability objectives. Such investments send a strong message about the investors’ commitment to environmental stewardship, fostering positive relationships with stakeholders who are increasingly prioritising sustainable practices.

- Demand for clean energy is rising and the policy environment is favourable – The global transition towards sustainable and renewable energy sources, driven by ambitious emission reduction targets set by countries worldwide, is leading to a surge in demand for clean energy technologies and infrastructure. This growth, coupled with the supportive policy environment established by governments through measures like feed-in tariffs, tax credits and renewable portfolio standards, opens up substantial potential investment opportunities in the form of a strong deal pipeline.

- Energy transition assets can combine stable cashflows with yield upside – Energy transition assets may provide stable revenue streams through power purchase agreements or regulated revenues. These revenue sources can secure a steady and predictable cash flow stream. Investors can combine these with projects exposed to changes in electricity prices (ie, merchant risk) or even the geographical or temporal difference in electricity prices. Volume risk can be introduced through electric vehicle (EV) charging or electric ferries. By strategically investing in these riskier assets, investors can tap into a potential for higher margins, thereby creating a blend of impact and return by boosting the overall yield of a portfolio.

Energy transition: what types of assets are in scope?

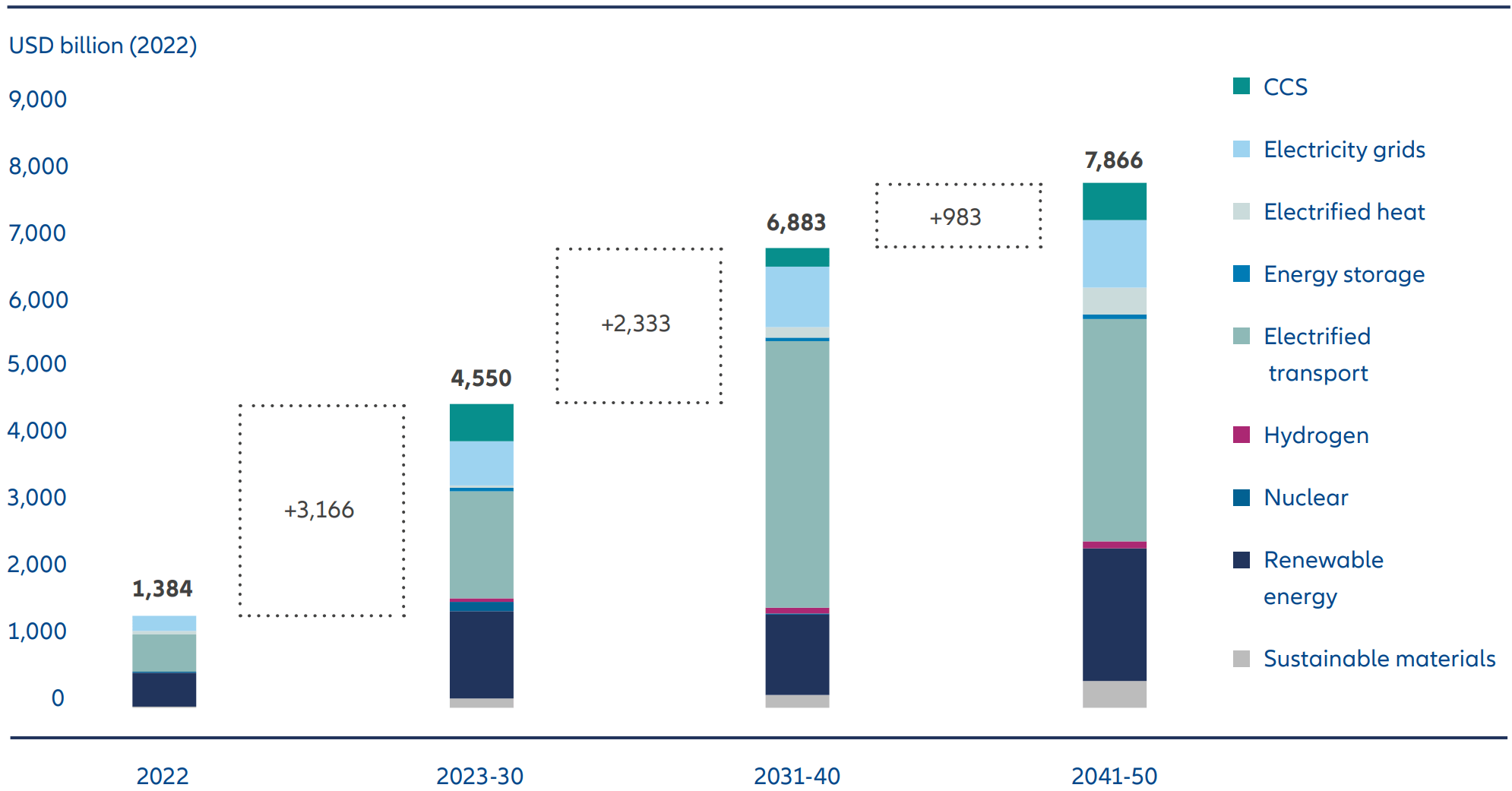

Energy transition specifically relates to the global shift from fossil fuel-based energy sources to more sustainable and renewable sources. To get on track for global net zero, energy transition and grid investment needs to average USD 4.55 trillion from 2023-2030, according to data from BloombergNEF (see Exhibit 2). This is more than three times the total spent in 2022.

Exhibit 2: Comparing the 2022 energy transition and grid investment versus required annual investment in 2023–30, 2031–40 and 2041–50 in a net-zero scenario

Source: BloombergNEF. Note: future values are from the New Energy Outlook 2022, except electrified transport, which is from the Electric Vehicle Outlook 2021 Net-Zero Scenario. The Net-Zero Scenario target global net zero by 2050 in line with 1.77 degrees Celsius of warming. Investment includes electricity grids. The New Energy Outlook (NEO) is BloombergNEF’s long-term scenario analysis on the future of the energy economy covering electricity, industry, buildings and transport and the key drivers shaping these sectors until 2050.

Assets furthering the energy transition include:

- Renewable energy – Renewable sources of energy include onshore and offshore wind farms, solar power, hydro power and geothermal energy facilities. A particular sub-sector of this category are the facilitators of renewable energy generation such as offshore wind vessels. Electricity generation from sources such as biomass may also be considered but these need to stand up to strong scrutiny in terms of sustainability of sources of biomass and net carbon emissions.

- Energy storage and intermittent generation – With the intermittent nature of two of the key renewable energy sources (wind and solar), energy storage and intermittent generation are essential. Pumped hydro and batteries are foremost among energy storage solutions. Several other technologies, such as thermal storage and compressed air to name just two, can be used to store energy. Intermittent generation, such as fast-response gas peakers, can support the energy transition by generating electricity rather than just time-shifting the use of electricity.

- Electricity infrastructure – Electricity grids and smart meters are critical components of the energy transition. Transmission and distribution system operators will need to make significant investments to accommodate distributed generation as well as the electrification of transportation (EV) and of heating (heat pumps). Investment is also needed to connect offshore and low-density areas of generation with high-density centres of consumption such as large metropolitan areas and industrial centres. Interconnectors take a special role in balancing supply and demand across borders. Further, smart meters allow for more accurate and timely billing, giving consumers more control over their energy use, and provide data that can be used to better manage and optimise the electricity grid.

- Decarbonisation of transport – EV charging stations and a stronger focus on investments in low-carbon public transport such as electric buses or EMU (electric multiple unit) trains are key to the effort to combat climate change. This can also include the electrification of more unique transportation assets such as ferries and airport ground support equipment.

Other assets that will play a crucial role in the energy transition include energy-efficient solutions (eg, tailored decentralised energy solutions and LED streetlighting programmes), energy-efficient buildings, carbon capture technology (CCS), green hydrogen, green steel and sustainable fuels.

Investments may cover different segments of the value chain of the above-mentioned businesses. Indeed, these investments can extend beyond pure infrastructure assets to cover industrial companies active in this space as well. An example of this would be battery deployment versus battery production or offshore wind farms versus offshore service providers, where the former represent infrastructure assets while the latter are other businesses in the value chain that enable energy storage or generation.

Risks to consider

Energy transition assets include a broad spectrum of investment opportunities, each carrying a unique set of risk profiles and market dynamics. Cash flow profiles may vary widely, ranging from guaranteed feed-in tariffs/purchase power agreements (PPAs) or regulated revenues allowing for investment grade structures to potential high yield structures with fully merchant offtakes and additional supply risk. This diversity of energy transition assets underscores the importance of analysing each investment individually.

Being part of the infrastructure asset class, energy transition assets share many of the same risks such as construction risk, which can include delays, cost overruns and contractor counterparty risks. However, energy transition assets may also be more exposed to:

- Technological risk – Certain sectors may involve rapid progress in clean energy technologies. Investors must evaluate the maturity, reliability and scalability of new technologies to make adequate investment decisions. Focusing on bankable technologies which are proven and commercially viable reduces these technological risks.

- Market risks – Energy markets can be volatile, which can affect the profitability of energy transition assets. This includes zero or even below-zero electricity prices. Investors should think about the potential impact of changes in energy prices or demand on their investments. Exposure may not only be purely to prices as a whole but also prices at certain times of the day and the ability to arbitrage between prices at different times or in different regions. Building strong risk models that account for market uncertainties can help investors navigate these risks effectively. This should typically include a robust scenario analysis including downside sensitivities and a thorough understanding of the market dynamics.

- Regulatory and policy risks – These risks stem from potential changes in government policies or regulatory frameworks, which can directly influence a project’s profitability and viability. For instance, a sudden alteration in energy policy or incentives such as feed-in tariffs or tax credits can have substantial implications on returns. The introduction of subsidies may give one technology an advantage over another. Regulators may adjust policies to fit the stated goals, which can include retroactive changes, balancing mechanisms and capacity payments. Moreover, the uncertainty associated with changes in administration can lead to the reversal of supportive policies, adding another layer of risk. As such, a thorough understanding of the exposure at various stages of a project’s lifecycle, but also of the broader regulatory framework and policy aims is crucial for managing these risks.

Nevertheless, energy transition assets, much like their broader infrastructure counterparts, typically benefit from strong business models that are asset-heavy with robust earnings before interest, taxes, depreciation and amortisation (EBITDA) margins. Furthermore, they often operate within well-established and stable regulatory frameworks, which provide an element of predictability and resilience against volatile market dynamics. The stated policy goal to promote energy transition may provide certain protections against adverse changes. Lastly, debt financing for such projects usually comes with infrastructure debt market standard structures, entailing restrictive covenants, leverage tests, and security provisions, such as asset or company pledges. These mechanisms serve as safety nets, securing debt investors' interests. Consequently, energy transition assets echo the lower default probabilities and loss given default typically associated with infrastructure assets when compared to more corporate exposures. This is offering investors a potentially attractive risk-reward balance within a greener, more sustainable context.

Key factors for institutional investors

Investing in the energy transition sector offers compelling opportunities but also requires a comprehensive approach in terms of strategy, risk management and sustainability integration. The following key considerations can provide a framework for institutional investors seeking to navigate this landscape effectively:

- Sustainability integration – As the global economy increasingly aligns with sustainable practices, integrating environmental, social and governance (ESG) criteria into investment decisions is not just a matter of responsible investing but also a strategic necessity. Investors need to adopt clear sustainability metrics and use established frameworks to guide their investments. Furthermore, an active engagement approach with portfolio companies on sustainability issues can drive positive impact and enhance returns.

- Expertise and due diligence – As highlighted above, the energy transition sector is complex with a focus on specific types of risks. Investors need to either have in place in-house expertise or engage experienced partners to navigate this sector. This expertise should span across areas like project finance, technologies and regulatory environments. Thorough due diligence is a critical component of this process, helping investors evaluate project feasibility and cash flow stability.

- Portfolio diversification – The energy transition is driving numerous trends across different sectors and regions. By diversifying their portfolio across a variety of energy transition assets, investors can balance risk and return, capitalising on the opportunities emerging in different sectors and regions of the clean energy market.

- Risk management – Investors should leverage comprehensive risk assessment methodologies to identify and manage key risks. Strategies can include portfolio stress-testing and scenario analysis to enhance portfolio resilience. It's essential to constantly monitor and adapt risk management strategies in response to evolving market dynamics.

- Active asset management – Significant value is added through active asset management. This typically involves close monitoring of financial and operational performance, adherence to financial covenants, and ongoing risk management of the investment. Investors should establish regular reporting and communication with borrowers, ensuring timely updates on the project's performance, regulatory changes and any other significant events. Although debt investors may not have direct control over the operations, proactive oversight and engagement can facilitate prompt risk identification and mitigation, thereby protecting debt investor interests.

The considerations highlighted above provide a framework for investors, but they should be adapted to individual circumstances and investment goals. Every investment in the energy transition sector presents its own unique set of challenges and opportunities, and success will depend on a proactive, thoughtful and adaptable approach to investment strategy and management.

Seizing the opportunities of energy transition

Investing in energy transition assets offers institutional debt investors an opportunity to actively contribute to the global shift towards sustainable energy sources. By aligning investments with environmental goals, leveraging government support and diversifying their portfolios, investors can access a strong pipeline while supporting decarbonisation efforts. Considering the investment needs, institutional investors will play a key role in driving the energy transition and speeding up the global move towards a low-carbon economy. The additional level of potential diversification – which may increase further when these assets are mixed with other infrastructure assets – can enhance returns when adjusted for risk. As these assets may not be influenced in the same way by sovereign and regulatory risks, as well as market fluctuations, a diversified portfolio can be constructed even with a thematic focus on purely energy transition.