Embracing Disruption

How the trend to humanisation is shaping up Asia’s pet economy

Pet humanisation is fueling the demand for premiumisation of food, healthcare and services with especially the Asian pet market showing staggering growth.

Key takeaways

- Pet humanisation created a need for premiumisation for food, care, services and healthcare.

- Premiumisation brands in Asia offer interesting opportunities to participate in growth prospects that are likely to be seen independent by the economic situation.

- New markets such as premium healthcare and supplements are expected to grow and consolidate in the upcoming years.

Evolution of pet adoption

In the past decade, increasing loneliness levels across the population and lower birth rates have given rise to a surge in pet demand. Animal companions bridge the gap between the need for belongingness and companionship across all age groups. While for millennials – which in major pet care markets like the US, UK and China constitute a significant or even the largest proportion of pet owners1 pets serve to practice parenthood or even substitute it, older generations find solace in pets, coping with the empty nest syndrome left by their grown children2.

While initially more common in Western countries, the pet adoption phenomenon has gained significant traction in Asian countries as well, especially since the beginning of the Covid-19 pandemic.

Pet adoption has skyrocketed during the last decade in Asia, with a 60% of citizens having a pet at home, and 32% of the population declaring their cats and dogs as their best friends3.

From pet humanisation …

Pet humanisation, the trend of treating pets as family members or even children and applying human dietary and lifestyle trends to our furry companions, is rising in Asia-Pacific, especially in China, where over half of “pet parents” (55%) consider their feline and canine companions as their children, while a third views them as family members (28%) and 7.5% consider them friends4.

This shift from pet ownership to pet parenthood creates a high demand for premium products and services for pets, such as organic and locally sourced food, desserts, and supplements. The Asian demand for human-like accessories and services for pet is growing faster than the western one, as shown by the sales of pet strollers surpassing baby strollers in South Korea in 20235.

Following Japan´s example, an ageing population and an economic boom, combined with a falling birth rate, it is likely that the demand for premium products has still room for improvement, with possible developments in areas such as pet wellness, insurances and even pet funerals.

… to premiumisation

The Asian pet market also has a faster growth rate than its western peers. For instance, the US demand for premium products increased by 27% in 20235. In contrast, China’s demand is expected to grow by 38%6.

Research data show that in 2021, China produced 1.13 million tons of pet food, with a staggering growth of 17% compared to 20207.

With premium brands adopting human-like dietary labels such as “organic” or “locally sourced” products like pet desserts or protein supplements are becoming more popular in various markets.

Some of this demand comes from a more intriguing phenomenon: pet influencers, counting a million-fan base and hundreds of thousands of followers on popular social media platforms, resulting in numerous partnerships with brands8.

Millennials and Gen Z fuelling growth potential of pet health care market

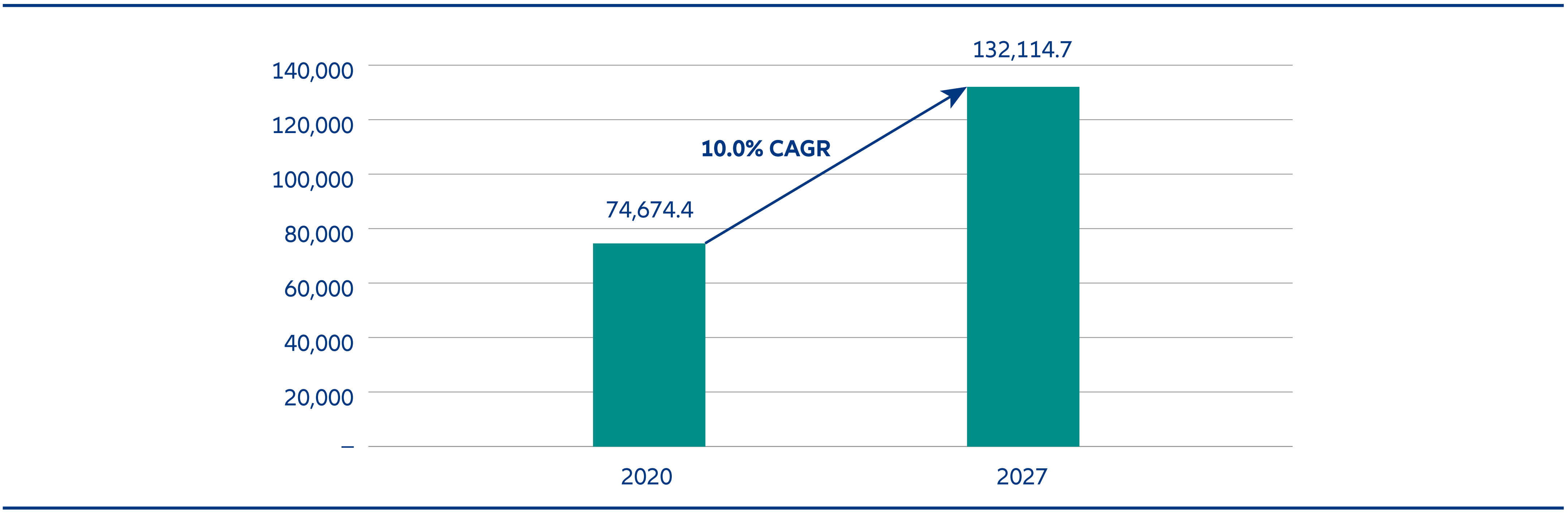

The pet health care market in Asia is projected to witness a double-digit growth, expanding by 10% and reaching a value of over USD 132 bn by 2027.

Asia Pacific Pet Care Market, 2021 & 2027 (USD Million)

Source: Graphicalresearch.com. Asia-Pacific pet care market. As of January 2021

This growth potential is, amongst others, fuelled by:

- China’s Millennials and Gen Z that constitute 50% of China’s pet owners7, have higher educational degrees, dispose of higher incomes, spend between 50 and 100 USD per month for their pet(s)8. In addition, over 60% of this generation born after 1990 wants to keep pets in the future while less than 10% already have one. These growth figures are in line with a rising number of pets in China, estimated to reach between 170-200 million in 2024, up from less than 100 million in 20199.

- India’s growing middle-class driving a growing pet market that has seen a rise in pet dogs from 19.4m in 2018 to 31m in 2023 and a value-growth to USD 890 million in 2021, with estimates projecting its size to nearly triple over the next ten years10.

- Niche segments like the nutraceuticals (nutrition” and “pharmaceutical”) market with a projected growth rate of 6.4% from 2017 to 202311. Here, China has the biggest market share (30%), but Vietnam is expected to expand the fastest, with an estimated growth rate of 16.7% until 202912.

Investment Implications

Our conviction is that the pet economy will continue to flourish, fueled by the deepening bond between pet owners and their animals. As the market expands into various areas, it presents enticing investment opportunities in premium pet products.

As people consider their pets as family members, this industry is expected to be fairly resilient even during times of economic downturns, as owners will keep seeking the best quality products and will be hardly compromising on their animal´s wellbeing.

1 HealthforAnimals: Global State of Pet Care, July 2022

2 Pet ownership, loneliness, and social isolation: a systematic review | Social Psychiatry and Psychiatric Epidemiology (springer.com). As of July 2022

3 UBS: China 360: Tracking the themes that matter. As of February 2023

4 Petfood packaging.com: China pet statistics report. As of 2020

5 Koreatimes: Sales of pet strollers surpass baby strollers for 1st time. As of February 2024

6 China-Briefing.com: Investing in China’s Multi-Billion-Dollar Pet Industry. As of 2023

7 PwC: Finding opportunities in China’s fast growing pet industry, September 2020

8 Jefferies Thematic Research Gen Z: Global Purchasing Power and Influence, August 2022

9 PwC: Finding opportunities in China’s fast growing pet industry, September 2020

10 The Economist.com: Indians are going gooey over dogs. As of December 2023

11 Mordorintelligence.com: Asia-Pacific Pet Nutraceuticals Market Size & Share Analysis - Industry Research Report - Growth Trends. As of August 2023

12 Ibid.