Sustainability

Human rights – the weakest link in supply chains?

Prompted by a combination of global crises, high profile worker rights violations, and law changes, companies are in the spotlight to ensure workers are protected throughout the supply chain. What are the issues for investors?

Key takeaways

- Worker rights crises in sectors ranging from mining to fashion have highlighted the financial risks of poor human rights practices.

- Such controversies, combined with new regulations, are driving greater transparency around human rights throughout supply chains.

- Protecting these rights can mitigate financial, legal and reputational risks while also ensuring companies contribute to the UN Sustainable Development Goals (SDGs).

- As an investor, we identify worker rights issues and encourage companies to align with important benchmarks such as the UN Guiding Principles on Business and Human Rights.

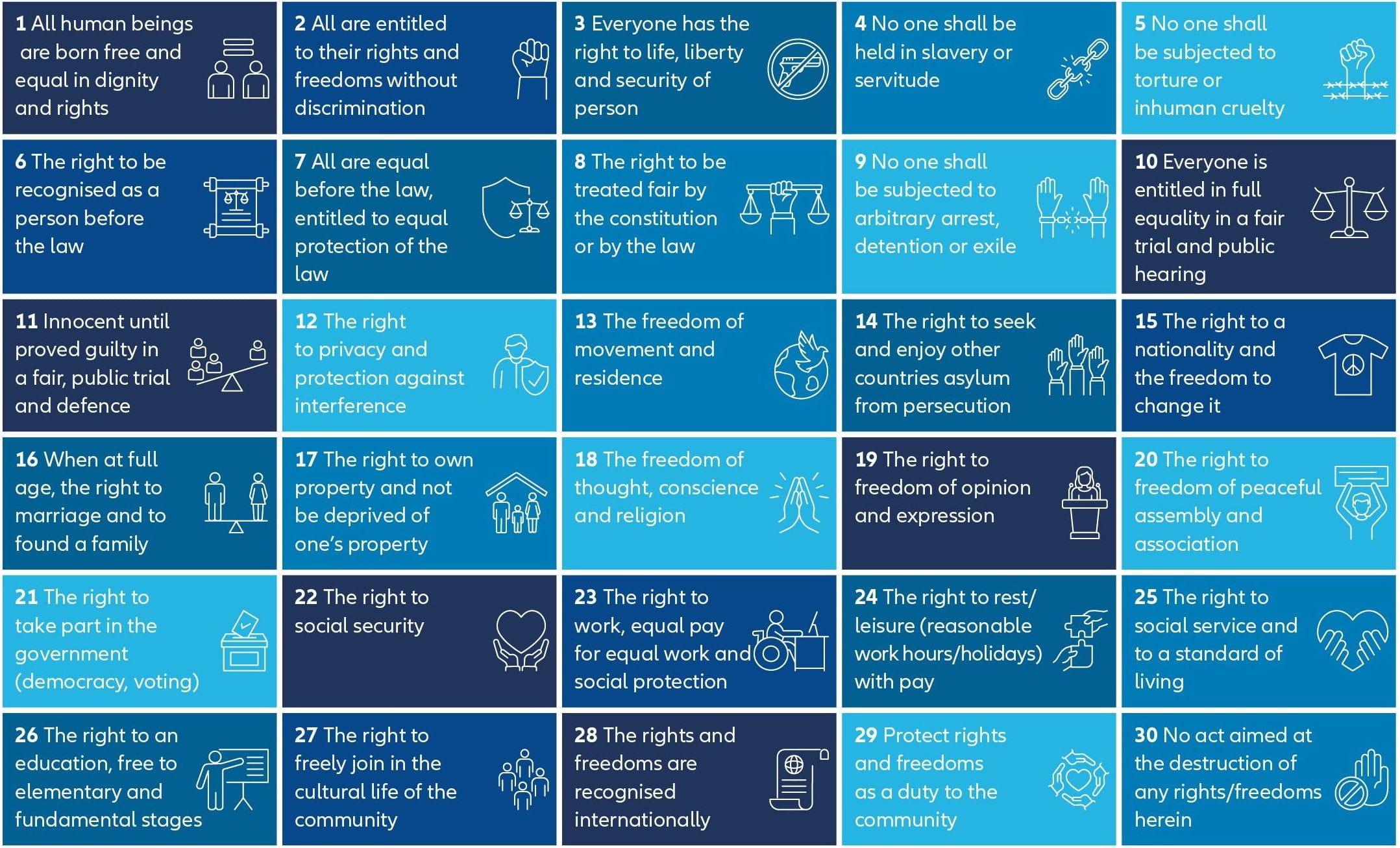

Protecting human rights in the workplace is both an important and complex topic. After World War II, commitments to human rights evolved significantly with the United Nations General Assembly adopting the Universal Declaration of Human Rights in 1948. A milestone document, it comprises 30 “articles” outlining the responsibilities of states and companies towards individuals (see Exhibit 1).

Exhibit 1: Summary of the 30 articles of the Universal Declaration of Human Rights

Source: United Nations, 1948 Universal Declaration of Human Rights

Even earlier, in 1919 after World War I, the International Labor Organization (ILO) was created which sets minimum standards for decent work covering remuneration, workplace safety and freedom for individual representation among other areas.1 These standards now extend into areas of work related to social media and artificial intelligence, and play a role in emerging issues, eg, mental health concerns for employees whose skills may be rendered redundant in a just transition.2 The rights of workers in global supply chains are also now covered by these ILO standards.

From commitments towards compliance

These developments and standards were the start of an evolution from broad commitments around human rights to compliance with specific laws. However, the sustained period of globalisation and technical advances of recent decades has arguably not been mirrored by an equal focus on stakeholder protections. The extended scope and reach of human rights regulations has been relatively recent, prompting consumers and corporates to become more aware of how well aligned (or not) products and services are with fair rights and conditions for workers. Additionally, there is increased understanding that failure to consider and protect these rights can result in companies facing reputational, legal and financial risks.

Human rights due diligence regulations in the last decade include:

- United Kingdom Modern Slavery Act 20153

- French Duty of Vigilance Law from 20174

- EU guidance on forced labour risks in operations and supply chains from 20215

- US Tariff Act of 1930, Section 307, updated version 20236

- German Act on Corporate Due Diligence Obligations in Supply Chains from January 20237

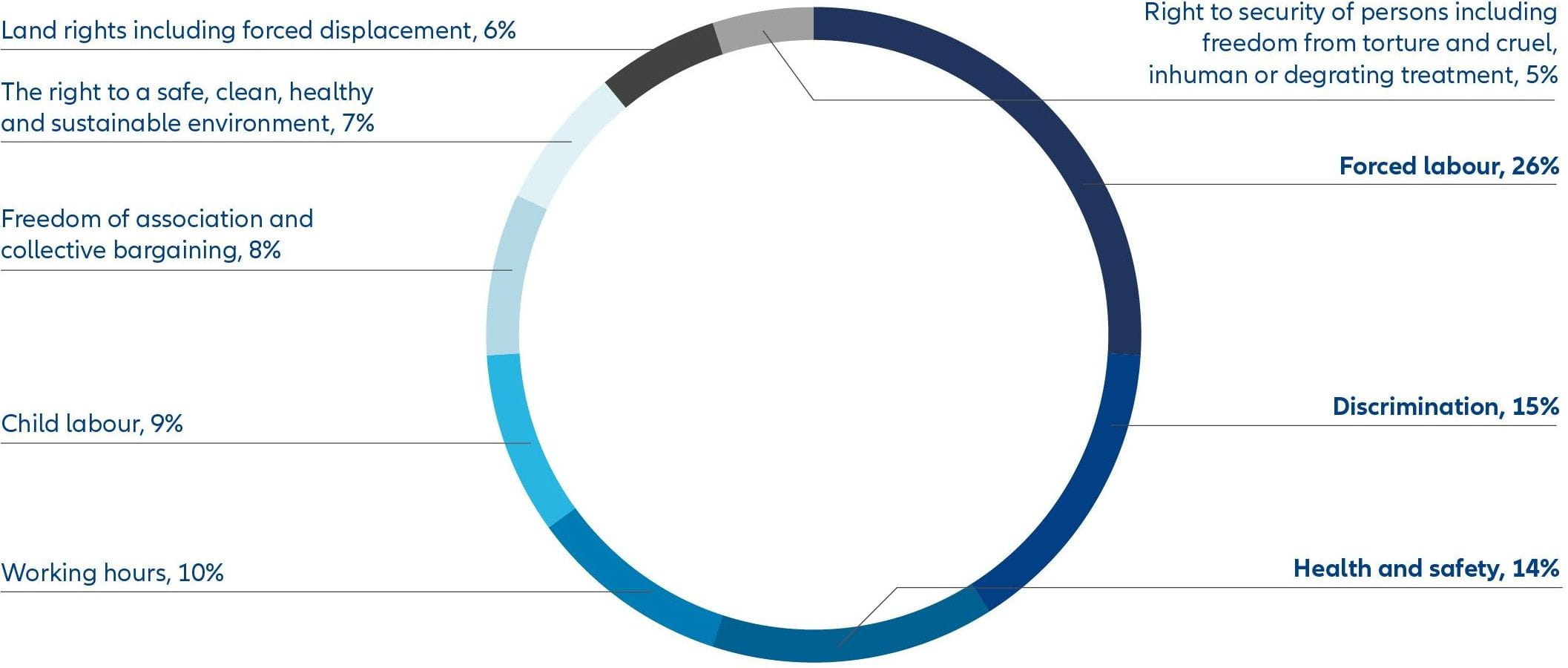

Exhibit 2: The most prevalent types of allegations against human rights

Source: World Benchmarking Alliance, November 2022 CHRB-Insights-Report_FINAL_23.11.22.pdf, p.26

How should worker rights issues in supply chains be addressed by investors? A specific approach is required, and we view engagement with corporates as a critical tool given the complexity of this topic. Highlighting these complexities, the World Benchmarking Alliance (WBA) reports that over half of alleged human rights controversies relate to supply chains rather than companies.8 The WBA also confirms that benchmarking companies on their worker rights performance is helping to drive change. Further performance improvements will require senior-level responsibility for human rights, with resources and expertise allocated for the day-to-day management of human rights within companies’ operations and supply chains.

Our structured approach

What are the main risks for companies? A poor human rights performance can expose them to both financial risks and values-based risks – known as dual-materiality.

- We consider the risks around human rights in our sustainable investment strategies.9 As the first part of this dual-materiality approach we remove stocks from our investment universe, in line with our exclusion policy, for companies that have severely violated international standards and/or regulations. This includes, but is not limited to violations against the Principles of the UN Global Compact, the Organisation for Economic Cooperation and Development (OECD), Guidelines for Multinational Enterprises, and the UN Guiding Principles for Business and Human Rights.

- In addition to exclusions, assessing companies’ human rights record is a key element and the next step, led by our Sustainability Research team. They first screen for human rights controversies within both a company and its supply chain.

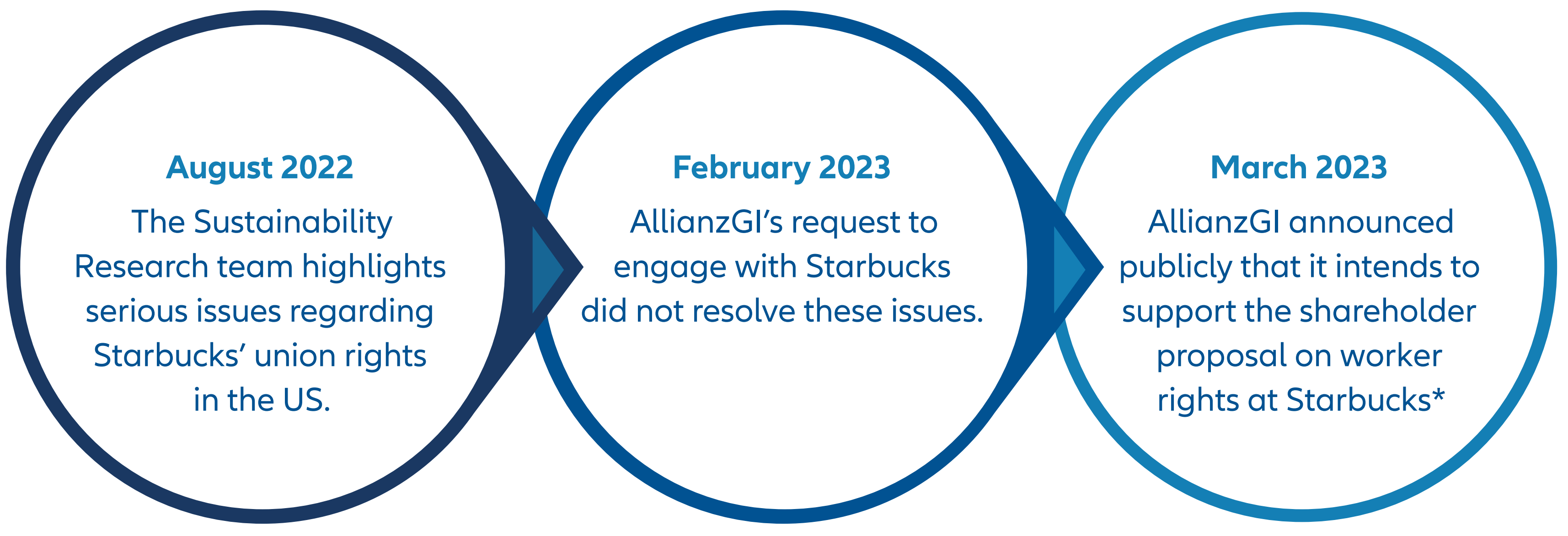

- Any issues identified by the team trigger a thorough analysis and targeted engagement by our Stewardship team. Following the engagement process, if a company is flagged for poor human rights performance, we may exclude it from selected investment strategies. Alternatively, we might use our proxy voting rights to vote against the company’s management at the annual general meeting. This process is illustrated through one recent high-profile example in Exhibit 3.

Exhibit 3: Escalating human rights issues at Starbucks

Source: Allianz Global Investors, March 2023

*Read more on this engagement case

Did you know?

The issue of human rights is captured in the Principal Adverse Impacts (PAI) for Mandatory Adverse Sustainability Indicators defined by the European Union’s Sustainable Finance Disclosure Regulation. Two PAIs relate to the UN Global Compact, the OECD, and the Guidelines for Multinational Enterprises. PAI 10 addresses violations, while PAI 11 focuses on companies with a lack of processes and compliance mechanisms to monitor compliance with each of these standards.

For more details, please see: Allianz Global Investors Principal Adverse Impact Statement, June 2023

Shaping human rights engagement

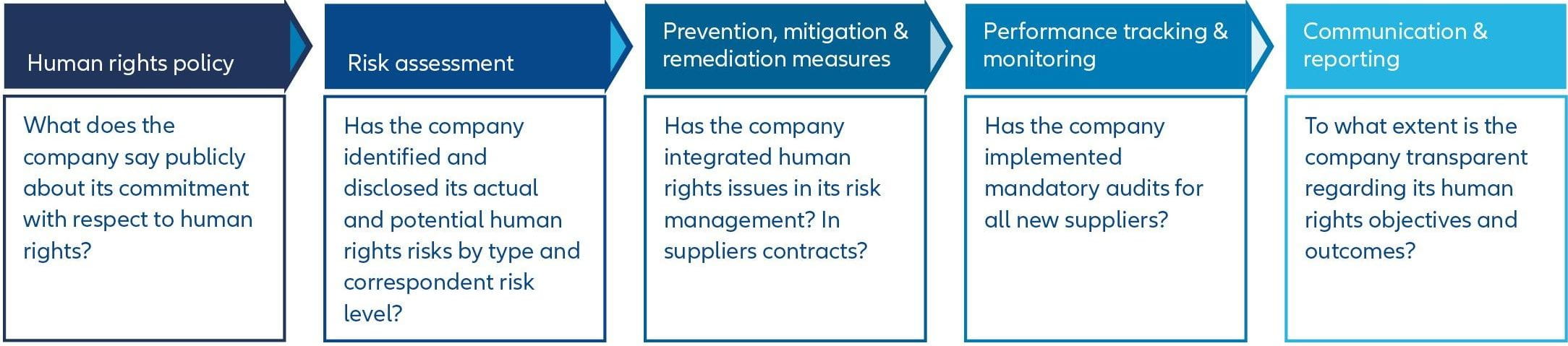

Our proprietary framework for engaging with companies on human rights in supply chains draws from the OECD due diligence guidance for responsible business conduct, 2018 and is based on the five pillars of human rights action that we look for in companies:

- Human rights policy: a clear commitment regarding the respect of human rights at the company and across the supply chain, with a clear governance structure.

- Risk assessment: a detailed and quantified risk assessment by country, organisation, activity and product.

- Prevention, mitigation, and remediation measures: these measures should be clearly identified in the risk assessment.

- Performance tracking and monitoring: periodic audits of human rights performance using specific key performance indicators.

- Communication and reporting: a full disclosure on human rights due diligence including results of audits and remediation measures implemented.

For each of these five pillars, we developed relevant questions that all companies should be able to apply (see examples in Exhibit 4). These ensure a framework that enables companies to demonstrate the materiality of human rights in their supply chains.

Exhibit 4: Sample questions from our human rights engagement framework

Source: Allianz Global Investors, October 2023

Our engagement is focused on sectors that have a high impact on the rights of workers, and is guided by the European Directive on Corporate Sustainability Due Diligence (see Exhibit 5). Using this sector analysis, we map our holdings across all asset classes to a combination of metrics (eg, severity of human rights incidents, number of supply chain incidents and controversy flags) to identify which of our investments are flagged for most extreme controversies.

Exhibit 5: Sector segmentation of targeted high-impact companies for our engagement campaign on human rights in supply chains

The figures indicate the number of companies engaged on this topic from each industry sector

Source: Allianz Global Investors, October 2023

To ensure specific, targeted outcomes of engagements, we thoroughly analyse companies’ business practices, compare them with industry best practices, and identify specific questions to be discussed with each company. We request appropriate disclosures and milestones to help monitor their progress towards meeting our expectations for the expected outcomes of our stewardship work.

Besides this deep-dive analysis, our engagement campaign around human rights has two key drivers: benchmarking and sharing best practices. These are critical to a quality dialogue with investee companies. In particular, we use the following tools for engagement: the Corporate Human Rights Benchmark10 – part of the World Benchmarking Alliance – and KnowTheChain11 which supports companies on the issues and risks of forced labour in their supply chains.

Presenting evidence of best practices can encourage other companies to take specific and similar actions to improve their approach to human rights. One example is a German textile and apparel company that publicly discloses a social audit manual for third-party auditors. The manual clearly defines the scope of audits, audit coverage policies, and protocols for their conduct. This allows the company to show that audits are conducted in line with its standards. We view this disclosure as advanced because it challenges industry standards, and we recommend that other companies adopt this practice.

Together we go further

The final element of our approach is collaborative engagement. To reinforce our engagement approach on human rights, in 2022, we joined the PRI Advance12 stewardship initiative for investors to act on human rights and social issues. During this year, we worked jointly with other investors on engaging companies across Europe and Asia. The overall objective of the initiative is to advance human rights and positive outcomes for people through investor stewardship. The following three expectations have been set by PRI Advance for companies that are in focus for these engagements:

- Full implementation of the UN Guiding Principles – the guardrail of corporate conduct on human rights.

- Alignment of their political engagement with their responsibility to respect human rights.

- Deepening of progress on the most severe human rights issues, in their operations and across their value chains.

Looking ahead

In summary, the protection of human rights in supply chains remains a challenge requiring more focus from corporates – and investors. This is why we launched an engagement campaign dedicated to this specific issue earlier this year. Although at an early stage, progress has been steady and we have noted some early trends across firms:

- An increasing number of Chief Human Rights Officers appointed by companies.

- Human rights risk assessments becoming standard practice, even if disclosures vary.

- An advanced level of supply chain disclosures by European companies compared to other locations.

We will share further insights on both this engagement campaign, when it is concluded, and to what extent our engagement framework will continue to evolve.

Read more about Allianz Group’s commitment to human rights: Respecting human rights.

1 International Labor Organization 2023, The benefits of International Labour Standards (ilo.org)

2 UN PRI, 2023, Just transition

3 legislation.gov.uk, Modern Slavery Act 2015

4 European Trade Union Institute, The French ‘duty of vigilance’ law 2017

5 European Commission, 2021, New EU guidance helps companies to combat forced labour in supply chains

6 Congressional Research Service, Section 307 and Imports Produced by Forced Labor - Update, October 2023 (congress.gov)

7 Federal Ministry of Labour and Social Affairs, 2023 CSR - Supply Chain Act (csr-in-deutschland.de)

8 World Benchmarking Alliance, 2023 Corporate Human Rights Benchmark

9 Sustainable investment strategies refers to investment funds issued and managed by Allianz Global Investors categorised as: Multi asset sustainability strategy or SDG-aligned strategy

10 Corporate Human Rights Benchmark, 2023 https://www.worldbenchmarkingalliance.org/corporate-human-rights-benchmark/

11 Know the Chain, 2023 https://knowthechain.org/

12 PRI Advance, 2023 https://www.unpri.org/investment-tools/stewardship/advance