Transforming Infrastructure

How infrastructure investors can navigate the secondaries market

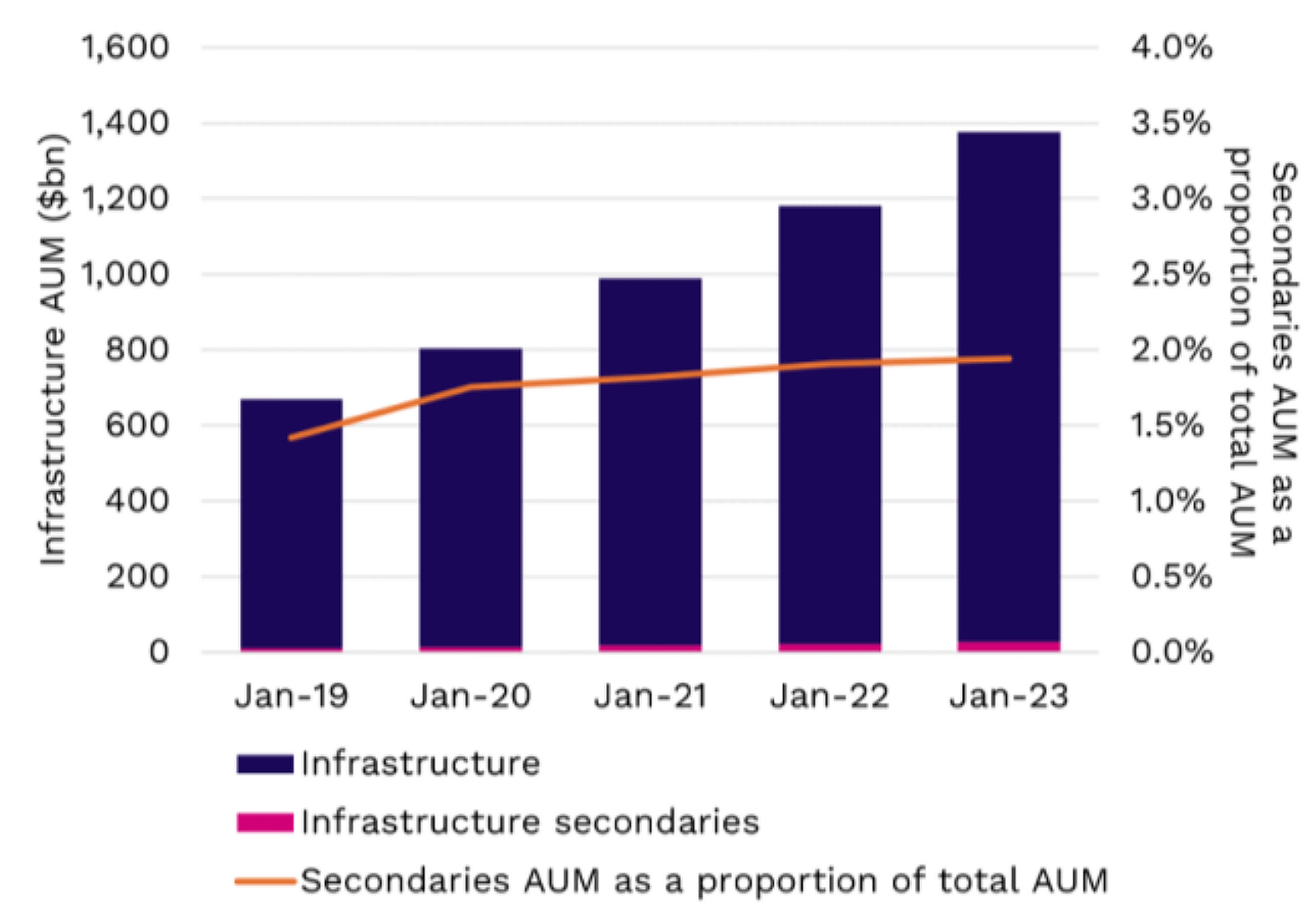

While secondaries have long been commonplace in the private equity sector, the secondary market in infrastructure equity is still in its early days but evolving rapidly. As the private infrastructure asset class has grown to more than a trillion dollars of AUM and is now starting to mature, we are witnessing a strong growth in the infrastructure secondaries market.

Secondary market transactions (secondaries) are emerging as a pivotal tool for managing private market portfolios for both GPs and LPs. Secondaries encompass a broad spectrum of deal types geared at addressing the specific liquidity and capital needs of LPs and GPs. While LPs in infrastructure funds can generate liquidity and rebalance their portfolio exposures by selling specific fund or asset stakes in the secondaries market, GPs are increasingly looking to partner with potential secondary buyers in order to craft bespoke solutions aimed at generating liquidity or raising follow-on capital for high conviction assets that they already own. As a result of these benefits for both LPs and GPs, secondaries are increasingly seen as a valuable addition to private markets, especially in today’s market environment where distributions have slowed down across private portfolios because of a more subdued exit environment, with LPs and GPs looking for alternate ways to generate liquidity.

For buyers, infrastructure secondaries represent an attractive investment proposition by combining the resilient features of the infrastructure asset class with the uniqueness of the secondary transaction dynamic. Firstly, secondaries enable buyers to buy into more mature portfolios where the assets are potentially more de-risked and seasoned. Secondly, these deals allow investors to potentially take advantage of market dislocations and idiosyncratic seller dynamics to buy into infrastructure assets at potentially attractive prices.

According to data from Preqin, the potential total size of the secondary market for infrastructure could see a massive increase from USD 26.7 billion AUM to USD 158.0 billion AUM by 2028.1

Infrastructure secondaries: room to grow

Source: Preqin Pro. Data as of May 2024

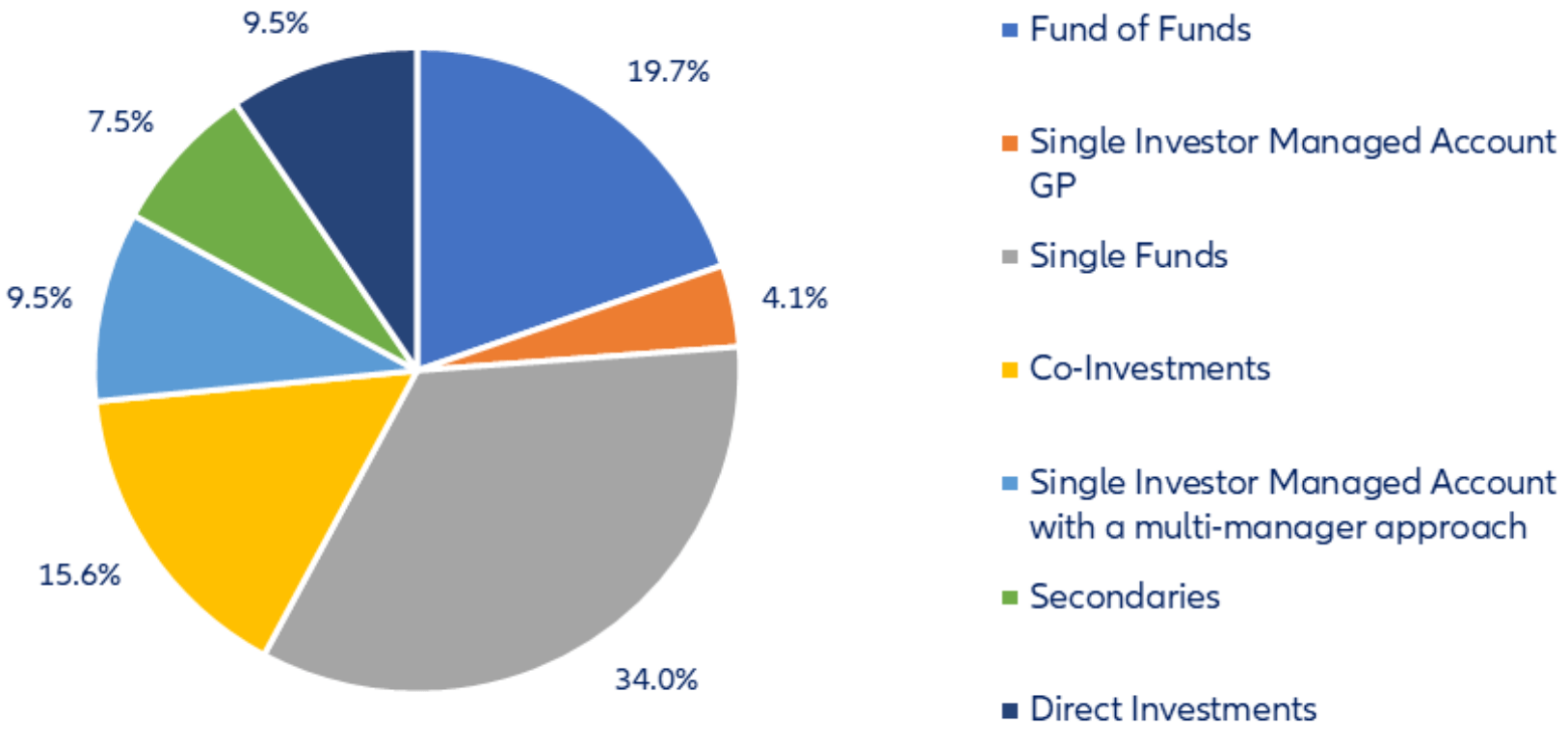

German institutional investors' access to infrastructure equity

Source: BAI

German institutional investors' access to private equity

Source: BAI

According to a survey conducted by the BAI in June 2023, German institutional investors are taking various routes to invest in infrastructure equity. Over half of investors opt for fund and fund of fund investments to gain exposure to infrastructure. However, while almost 20% of investors gain access to private equity2 via secondaries, the figure for infrastructure equity only accounts for 7.5%.3

We believe that infrastructure secondaries are highly additive to investors’ private portfolios and will likely become an increasingly important component of investors’ infrastructure allocations. Given that secondaries allow investors to benefit from immediate diversification by manager, sector, geography, as well as vintage year, they can serve as a great way to build up infrastructure exposure for investors that are intending to get into the asset class as well as those who are looking to further scale up their allocations.

As institutional investors look to gain access to the growing secondaries market, it is important to partner with the right manager. The managers who will eventually emerge successful in this evolving market will likely be those with a broad and deep experience in the private infrastructure space. While it is important to have a strong reputation for cultivating multi-faceted relationships across the private infrastructure universe in order to source and secure these opportunities, it is also critical to have in-house infrastructure specific expertise in order to effectively underwrite these complex investments. Institutional investors who partner with the right manager will likely reap the benefits of gaining exposure to the infrastructure asset class through attractive secondary investments at compelling prices.

1 Infrastructure secondaries pred for rapid growth as GPs enter market (preqin.com)

2 Figure: BAI Fact Sheet Corporate Private Equity, Juli 2023.

3 Figure: BAI Fact Sheet Infrastrukturinvestments (Equity und Debt), Juni 2023.