Stewardship Principles

Gender diversity: fixing the pipeline

Gender diversity is not a new topic, but the focus on its integration into investing continues to accelerate because of client and regulatory expectations. Our experience of active engagement with companies tells us that efforts to increase female representation must be holistic rather than solely focused on leadership roles, and that investors have a meaningful role to play in strengthening the pipeline of female talent.

Key takeaways

- Through active engagement, investors can help drive sustainable change on gender diversity at investee companies.

- Gender diversity is a complex issue and there is no one-sizefits-all approach; investors need clear proof points to measure companies’ progress.

- We use both bilateral and collaborative engagement, coupled with the exercising of voting rights, to influence investee companies.

- In our view, representation in senior roles is critical to gender diversity; the more women occupy executive positions, the more female candidates there will be for board positions.

As an engaged and active investor, Allianz Global Investors (AllianzGI) is committed to driving gender diversity and equality through active stewardship.1

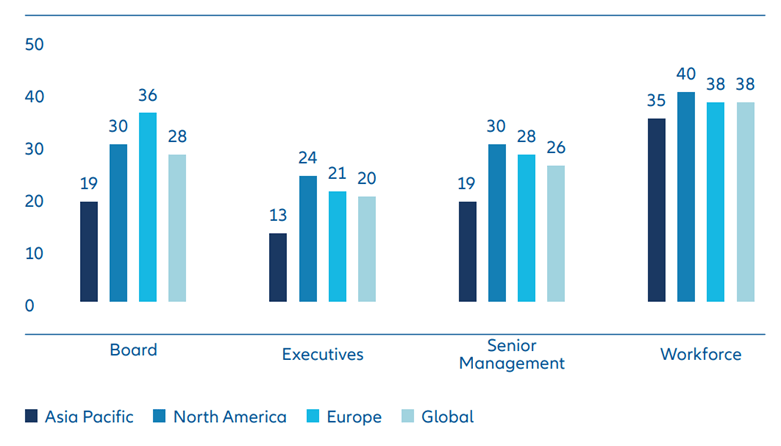

As Exhibit 1 demonstrates, female representation steadily declines in more senior roles, with Asia typically trailing Europe and North America for executive and senior management positions. There are increasing societal expectations around addressing this inequality, both in terms of fairness and future aspirations for younger generations. With women less likely to serve in executive positions, this can result in lower pay and lower pensions over time, and therefore greater inequality.

Ensuring equality of opportunity has become an important element in protecting business resilience and performance. First, most regions continue to face labour constraints2 – they struggle to fill available vacancies – and an inclusive culture can maximise a firm’s reach for labour attraction and retention. Second, academic research demonstrates that companies with greater inclusion and cognitive diversity (in part achieved through greater diversity) typically outperform. A Harvard Business Review study has shown, for example, that women in leadership roles tend to be more focused than their male counterparts on the long-term, resilient growth of their firm over short-term goals.3 The same report showed female CEOs are more likely to implement environmental, social and governance (ESG) or non-financial practices and policies, often tending to result in better ESG performance.

Policymakers and regulators are trying to tackle the gender diversity issue, but the “how” varies across the globe. In regions without specific regulation, we observe that corporations and investors are supporting initiatives aimed at increasing gender diversity in the boardroom.4

Against this backdrop, we believe that as stewards of companies, investors have a genuine role to play in driving change on gender diversity. Given the potential performance benefits improved diversity can bring, investors have the opportunity to pursue financial return alongside a positive social and environmental impact.

For these reasons, it was important for AllianzGI to develop a comprehensive engagement strategy on gender diversity, to help enhance diversity despite the many obstacles that exist.

Exhibit 1 – Female representation by region in %

Source: Equileap Gender Equality Global Report & Ranking 2023

The pipeline problem: our “ask”

We advocate for at least 30% female representation on our investee companies’ boards and executive leadership teams, because we believe this is the critical mass at which minority voices become heard. That said, we are aware that we need to consider the local context and each company’s starting point. There is no one-size-fits-all approach.

We have observed over the years that many companies have failed to build a sound pipeline of female talent up to the executive level. The pipeline of female talent isn’t being filled up, and it is leaking; not enough women are promoted from entry-level roles to manager positions in the first place, and women leaders are also leaving companies at a much faster rate than men.5 Both mean a more limited pool of women candidates for senior leadership positions.

Therefore, we make better participation of women in leadership positions across the hierarchy an engagement priority. We aim to support a just and orderly transition towards gender equality and a level playing field between women and men to ensure equal career opportunities.

We want to understand what bottlenecks investee companies encounter and help them develop their female talent pipeline from entry positions to the top. As such, we do not focus solely on female representation at more senior levels, but encourage companies to address gender diversity more holistically. Executive women act as role models for their female colleagues, but we also seek sustainable change at all levels.

If you treasure it, measure it

We articulate our engagement around a list of key performance indicators (KPIs) to hold companies accountable and to monitor progress over time. These KPIs include the following:

- State of play and targets: What is the gender breakdown of the workforce at different hierarchical levels? Has the company set ambitious but achievable targets for each of them?

- Governance and oversight of strategy: Who on the board is accountable for the strategy? How are the executives and managers incentivised to advance women in leadership roles?

- Inclusion and culture: What quality of jobs is available on a full-time basis versus part-time and temporary contracts? What is the gender breakdown of staff turnover? Are flexible work solutions and measures to prevent moral and sexual harassment in place? Do programmes and policies exist to increase gender inclusion, such as paid maternity/paternity and parental leave and mentoring programmes to break down psychological barriers?

- Pay gap: Do firms disclose their gender pay gap and any required mitigation plans?

- Third-party certification: Does any gender diversity audit or certification process exist? Is the company a signatory of the Woman Empowerment Principles?6

Our rules of engagement

Active engagement helps to inform our investment strategies as required by regulation. Under the European Sustainable Finance Disclosure Regulation (SFDR)7 investors must report on potential harm by investee companies, typically referencing Principal Adverse Impacts (PAI). Of the 14 mandatory PAI disclosures,8 two relate specifically to gender diversity – PAI 12 (Unadjusted gender pay gap) and PAI 13 (Board gender diversity). Companies failing to disclose or meet defined thresholds will find that their investor base will likely narrow, especially in Europe, and we seek to raise awareness on this point.

While we mostly engage bilaterally on gender diversity, in certain instances we think we can have a greater impact when engaging collaboratively with other investors. Our highest-profile collaborative engagement body is the 30% Club;9 AllianzGI was honoured to chair the 30% Club France Investor Group in 2022 and is co-chairing this year. We are also partnering with other investors to launch 30% Club Investor Groups in other countries.

How do we escalate matters in the apparent absence of progress or corporate responsiveness? We may use our voting rights to influence change at investee companies by voting against the chair of the nomination committee or by supporting resolutions filed by other shareholders. We consider this an important tool for making our engagements impactful and escalating issues where necessary. We have also been top-ranked in a study for the incorporation of diversity criteria in our voting guidelines.10

As a sustainability shaper, we consider our active engagement on gender diversity to be our contribution to United Nations Sustainable Development Goal 5 (Gender Equality) and UN SDG 10 (Reduced Inequalities).11

Hiding the gap: lessons from engagement

We observe that disclosure levels on gender diversity are closely linked to the level of legislation and regulation in the company’s country of incorporation, which acts as a driver of awareness and can be a catalyst for change or improved practices.

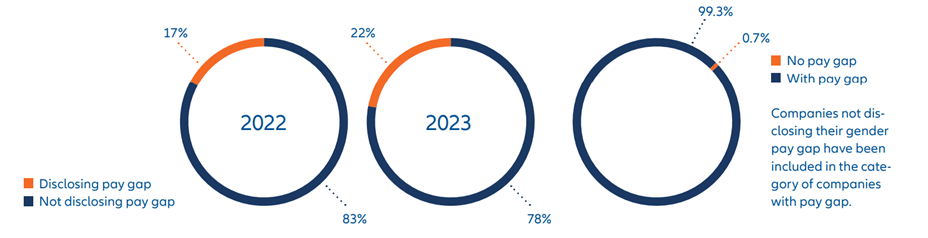

There is still a long way to go in terms of transparency in many respects, but the issue is more acute with respect to disclosing the gender pay gap. We sense some executives may be confused about the concept of “equal pay for same work”, or they may be uncomfortable about discussing this notion as it captures many inconvenient realities, such as the glass ceiling prevailing in many industries and companies and the disproportionate use of partial employment by women who still shoulder the majority of household responsibilities.

The gender pay gap reflects the poor performance of companies in the past but its impact can be long-lasting, such as through a trickle-down effect on pensions.12

Exhibit 2 – Companies disclosing gender pay gap

Source: Equileap Gender Equality Global Report & Ranking 2023

Opportunities ahead

The journey towards gender equality is bumpy, but our experience of active engagement on this topic tells us investors have a meaningful role to play in strengthening the pipeline of female leaders. As women are underrepresented in executive positions, it is more challenging for them to be considered for board positions that typically require prior executive positions. The more women with executive positions, the bigger the pool of legitimate female candidates for board positions will be.13

For companies, we see a particular window of opportunity: baby boomers14 are retiring soon, offering firms an opportunity to bring on-board more young women and transition to a more gender-balanced workforce.

1 We are interested in all forms of diversity, but this paper focuses on gender diversity and the lessons we can draw from over two years of active engagement on the topic. Having reflected on the importance of diversity in a post-pandemic world in our June 2022 research paper Diversity comes of age as an investment theme, this paper explains how we want to drive sustainable change on gender diversity through active stewardship.

2 The post-COVID-19 rise in labour shortages | en | OECD

3 https://hbr.org/2021/04/research-adding-women-to-the-c-suite-changes-how-companies-think

4 The EU is leading the pack with the Gender Balance on Corporate Boards Directive requiring publicly listed companies to ensure at least 40% of non-executive board members were women by 2026. While specifically targeting board representations, the EU also took steps to promote gender equality in executive leadership teams by launching the Women in Business initiative. In the United States, there are currently no federal laws or regulations but there have been several initiatives at the state and corporate level aimed at increasing gender diversity on corporate boards. Similarly, in Asia, there are very few examples of legislation or regulations, except for Taiwan and Singapore. In Hong-Kong and Japan, initiatives exist at the corporate level to increase gender diversity in the boardroom.

5 McKinsey’s Women in the Workplace 2022 report showed that for every 100 men promoted from entry-level to manager, only 87 women are promoted, and for every woman at the director level who gets promoted to the next level, two women directors are choosing to leave their company

6 About | WEPs

7 https://www.eurosif.org/policies/sfdr/

8 P60-62, https://www.esma.europa.eu/sites/default/files/library/jc_2021_03_joint_esas_final_report_on_rts_under_sfdr.pdf

9 https://30percentclub.org/

10 https://investors4diversity.org/wp-content/uploads/2023/02/I4D_Trendanalyse_Investoren_2023_final-compressed.pdf

11 The United Nations Sustainable Development Goals are seventeen interlinked objectives designed to serve as a shared blueprint for peace and prosperity for people and the planet.

12 According to the EU Commission, in March 2021 the gender pay gap was 14.1% and the gender pension gap was 30%.

13 The percentage of female board members with previous executive experience (49%) is lower than the percentage of male board members with executive experience (56%). Yet, these averages may vary depending on the region and the country.

14 The “baby boomers” generation is often defined as people born between 1946 and 1964, during the mid-20th century increase in birth rates.