European Equities Outlook Q4 2024

Resilience in the face of geopolitical uncertainty

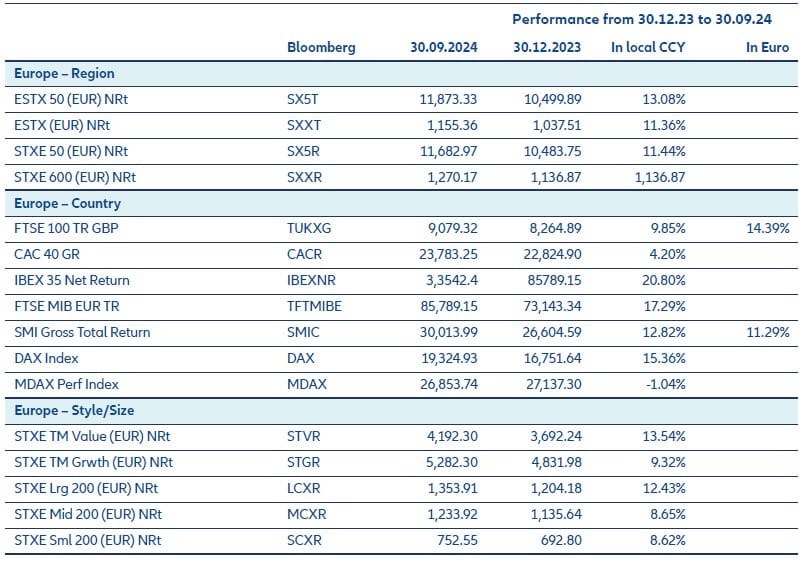

European markets have, to some extent, decoupled from a weak news flow; despite mediocre Purchasing Managers Indexes (PMIs) and political uncertainties after the French snap election and ahead of the US election in November, European equity markets have delivered double digit returns year to date, with the MSCI Europe NR up 11.6%.

Looking in more detail, several recent events are of note. First, in the US, the Fed’s first rate cut decision was expected, yet its scale took some by surprise – without the market taking it as an alarming signal. Indeed, recent economic data have reinforced the idea of a soft landing: the economic surprise indicator is back on the rise; manufacturing output may continue to be weak (Institute for Supply Management Index – ISM at 47.2), but industrial production is not collapsing; the services ISM (54.9) rebounded strongly in September; and employment data are resilient, with the unemployment rate receding slightly and nonfarm payrolls remaining strong, especially in the cyclical segments. Overall, the Fed now has less reason to again cut rates aggressively: recent hard data point towards GDP growth of around 2.5%; the price component of the ISM is climbing again slightly; and core Personal Consumption Expenditures (PCE) inflation is stable at 2.7%.

In China, the PBoC announced a monetary stimulus plan that took the market by surprise: it cut its policy rate, the RRR and the outstanding mortgage rate (-50 bps, lower down-payment), and announced an CNY 800 billion support for the stock market. This was followed two days later by an unusual Politburo meeting which took a more vocal approach on potential fiscal stimulus to maintain social stability. All of this has amplified a massive short covering by hedge funds. These announcements signal a significant change in political direction, underlining China’s economic problems. Indeed, the clear focus on growth and deflation explains the positive market knee-jerk reaction to these announcements. Indeed, this was very much a reflection of glass half full sentiment, as it largely ignored less supportive macro and social indicators such as PMI data, youth unemployment rates, and PPI in negative territory for two years in a row.

In Europe, September’s PMI indicators marked a return to contraction territory. The manufacturing PMI was once again very weak at 45.0 (and has been below the 50 threshold for last 27 months) and services PMIs (still expanding) are slowing down, driven by Germany and France. We notice some positives like a consumer which is holding up well, no sign of job market deterioration (for the moment), and the ECB being more relaxed on inflation.

Taking a more granular look at market segments, large caps continue to outperform small caps and value has outperformed growth year to date. From a country perspective, Spanish and Italian equity markets developed strongly – also helped by the good performance of Southern European banks. German equity slightly outperformed European markets, while France not only suffered from the inconclusive snap election, but also from weaker global demand for luxury goods after many years of very strong performance of this segment.

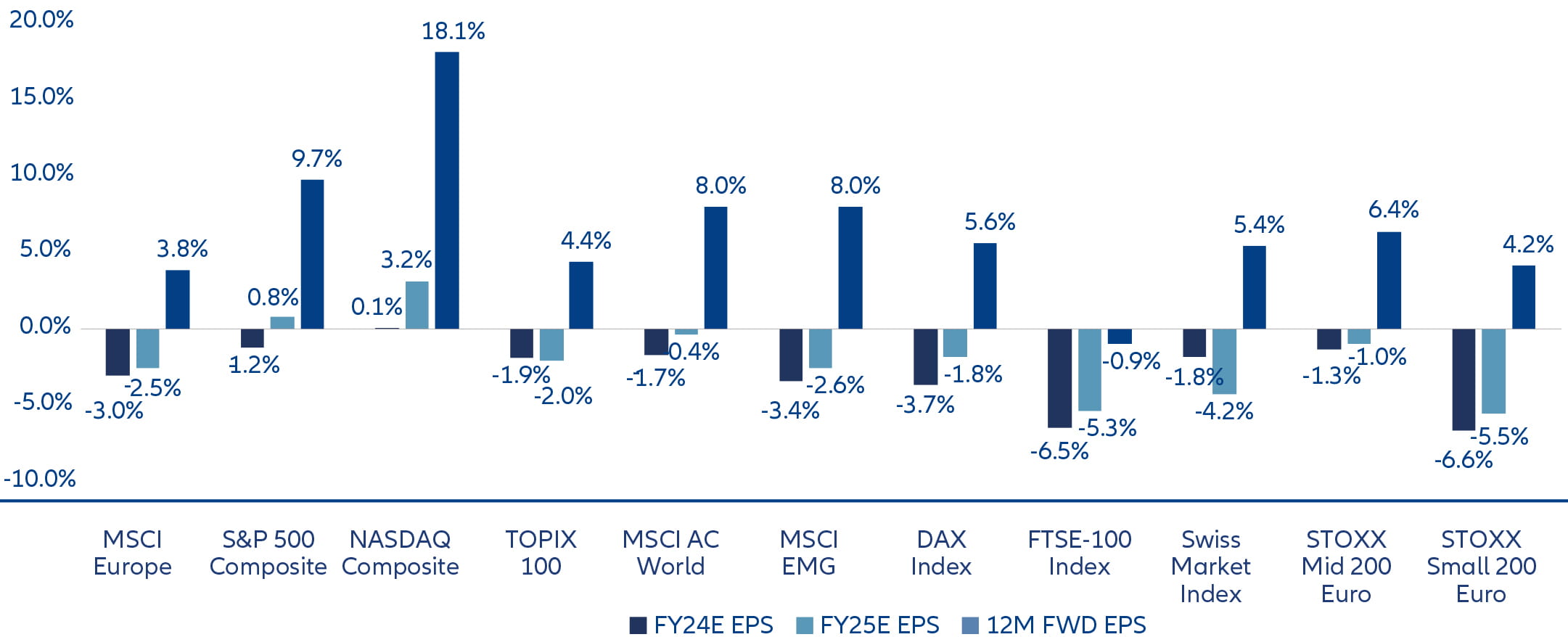

Source: Bloomberg/Consensus estimates, 31.09.2024.

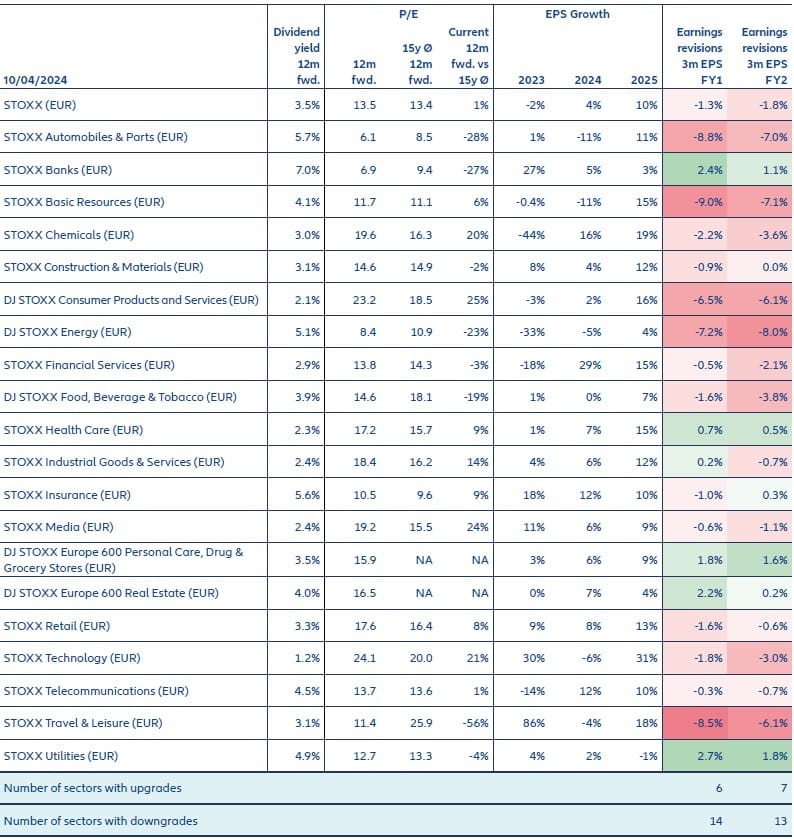

European earnings are, overall, quite resilient but there are some caveats to this statement. European car producers face challenges – most suppliers and OEMs have had to reduce profit guidance. Weak demand for electric vehicles in Europe, weak demand from China in general, and increased competition – especially in the mass segments – has resulted in pronounced guidance cuts. If we look at a three-month perspective, we observe the most negative revisions in automotive (-9% for 2024 and -7% for 2025), but also negative earnings revisions in the consumer sector driven by disappointing demand for luxury goods, especially from China. We also observe negative revisions for basic materials and energy as a function of weaker commodity prices. On a positive note, we have seen upgrades in banks, financial services, real estate, and utilities.

Source: Bloomberg/Consensus estimates, 31.09.2024

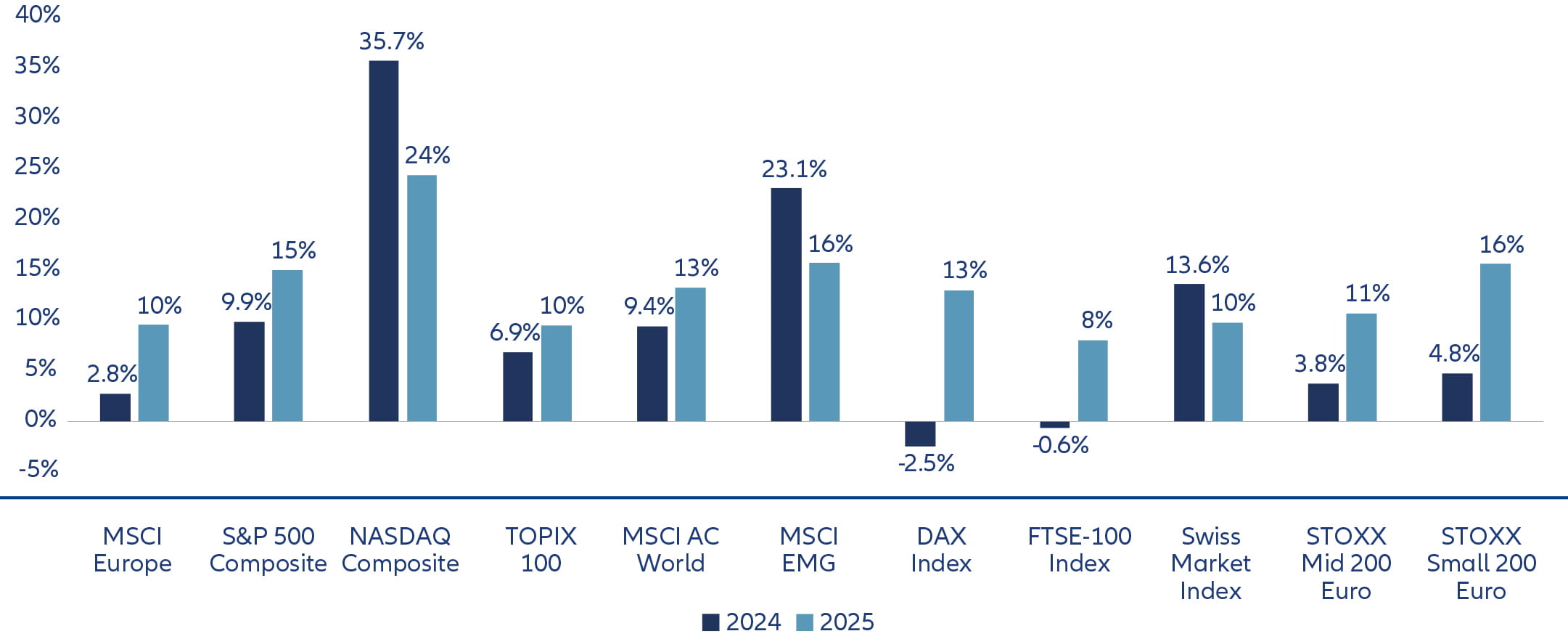

So the overall earnings outlook has slightly deteriorated – and, year-to-date, revisions for the MSCI Europe remain in negative territory (-3% for 2024 EPS). This is not a general concern and follows the usual pattern that earnings are slightly overestimated at the beginning of the year. MSCI Europe’s expected EPS growth is projected by market analysts at 3% for 2024 and, from a slightly lower base, at 10% for 2025. The S&P 500 is expected to see EPS growth of 10% in 2024 and 15% in 2025 according to consensus estimates.

We continue to believe that we need a macro improvement in 2025 in order to achieve 10% earnings growth. We assume that we will see improved earnings in the chemical sector due to a very low base that was also influenced by a prolonged destocking cycle. We also see some areas of growth that are less sensitive to the economic outlook – for instance, in sectors like healthcare, due to positive contributions from heavy weights such as Novo Nordisk. In the software sector, most corporates are now well advanced with SaaS/ Cloud transformation and are now benefiting from both an improved growth profile and higher margins. Other sectors will find opportunities for earnings growth in structural trends such as digitalization and decarbonization, while low inflation and rising real wages may lead to a recovery in consumer spending.

Key hypotheses:

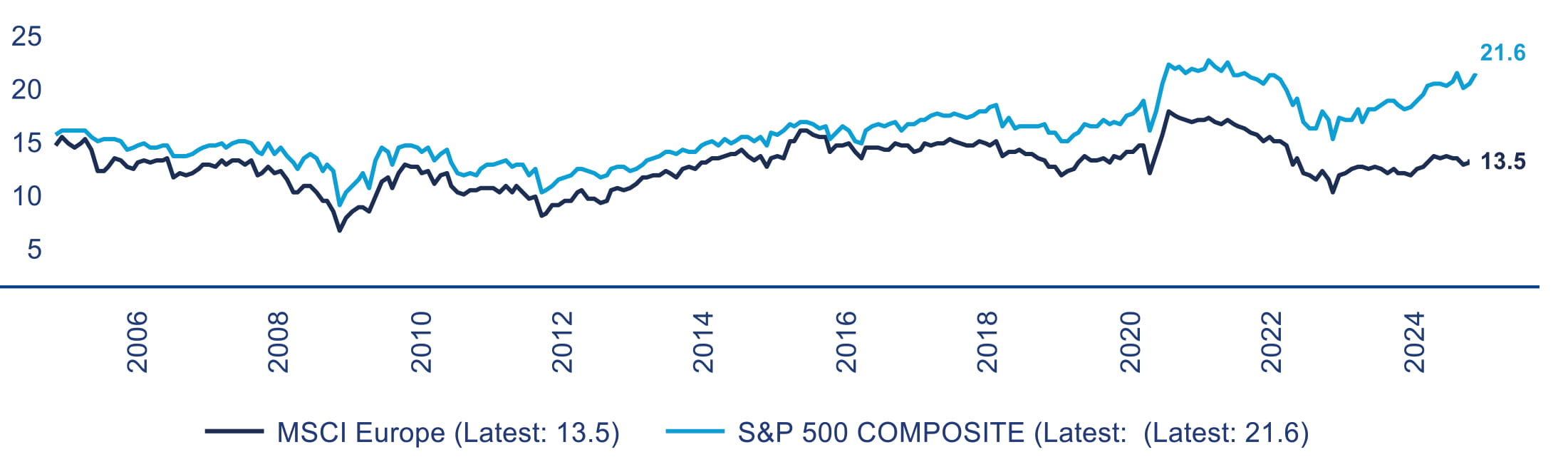

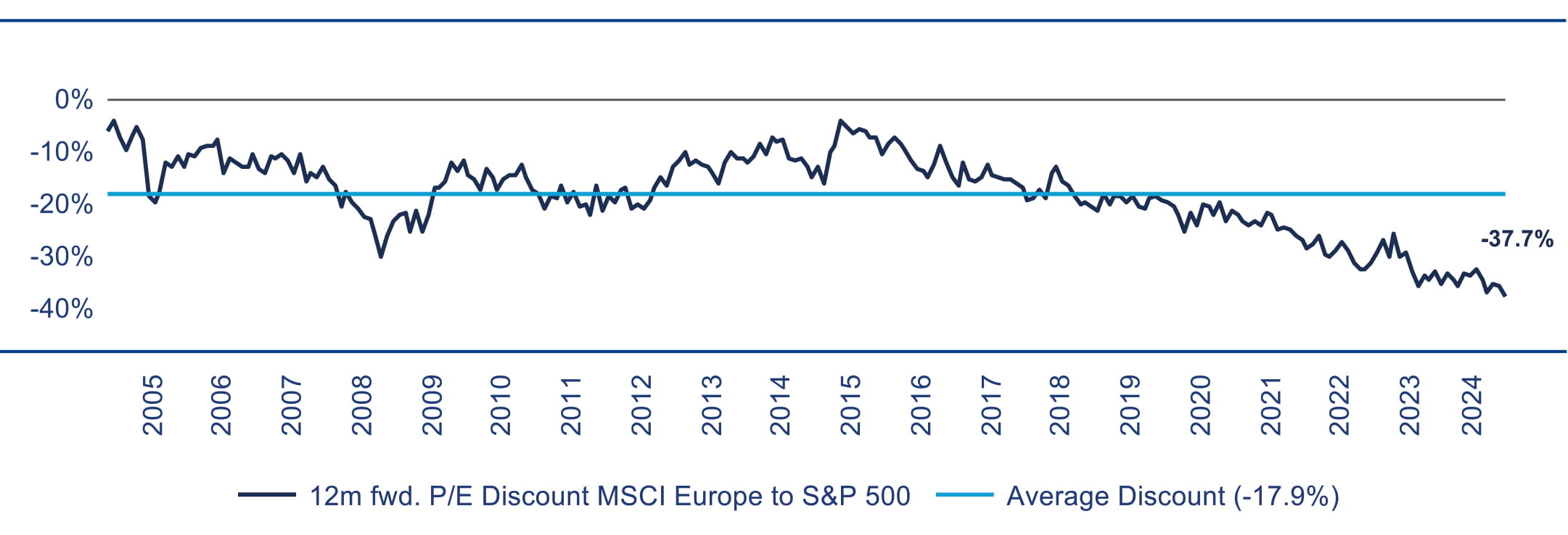

- For 2025, the earnings growth differential between US and Europe will narrow (S&P 15% growth vs. Europe 10% growth based on current consensus estimates, see chart 1) – in this context the valuation gap could narrow or at least stop widening further (see Chart 2A/2B).

- We continue to believe that we need some macro improvement in 2025 to achieve 10% earnings growth but, on the other hand, we see “manageable” downside risks for 2025 earnings estimates due to potential trade conflicts and a weakish economic outlook, not least given the benefits to the economy from the rate cut cycle which has just begun and will support with a certain lag.

- Despite some sector and country specific challenges, European earnings are overall quite resilient. The earnings outlook has slightly deteriorated. Year-to-date revisions for the MSCI Europe remain in negative territory (-3% for 2024), but this is not a general concern and follows the usual pattern and behavior that earnings are slightly overestimated at the beginning of the year (see chart 3).

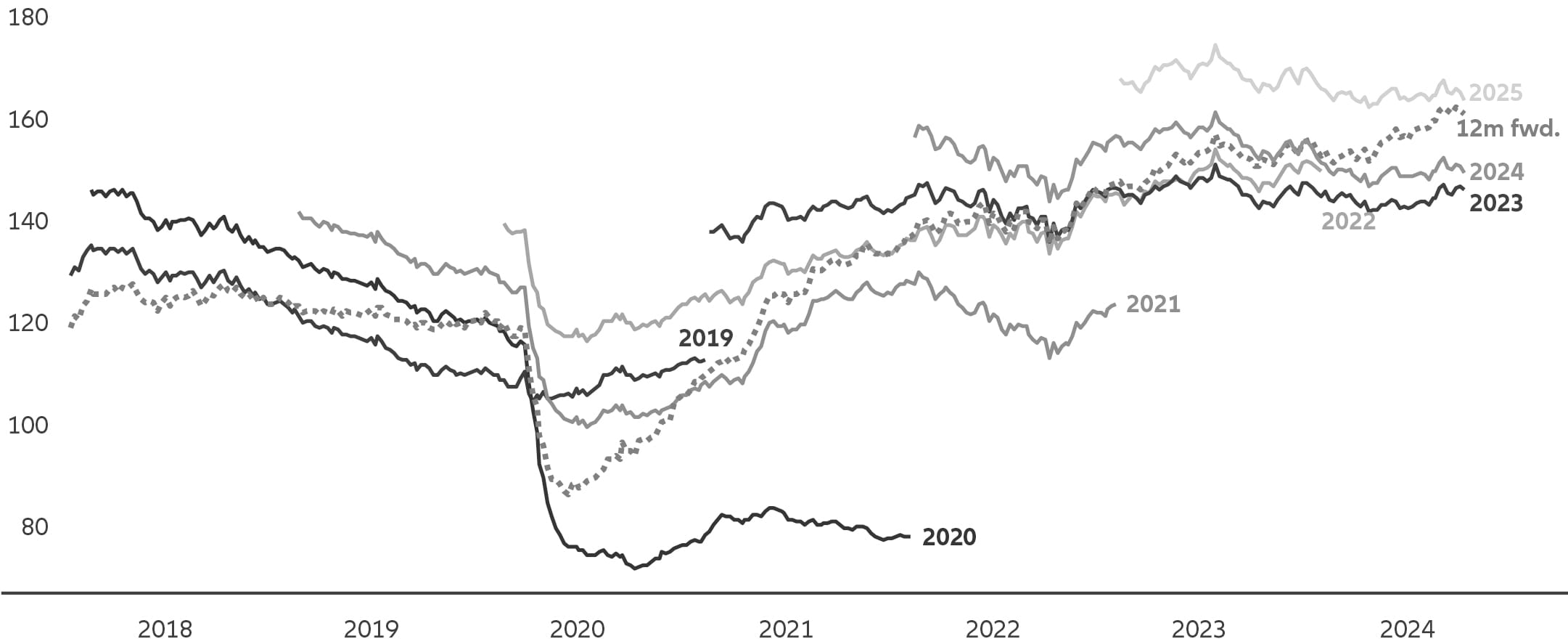

- Equity market returns will follow earnings growth, with negative revisions overcompensated by the “roll effect” for 12 months forward earnings to higher 2025 earnings (see chart 4).

- This translates into highly attractive valuations. Attractive valuation alone is not a reason for a strong conviction call on European Equities, but we point to the combination of attractive mid-term earnings growth – as demonstrated by the steady rise of 12 months forward earnings for the MSCI Europe, a narrowing of the growth differential between Europe and US, and the pronounced valuation discount versus the US.

- Risk factors include higher corporate taxes in France and potentially also in Italy, the high costs for corporates to comply with EU and local and regulatory frameworks, the rise of populist political parties, and a competitive disadvantage for energy intensive industries. The coming weeks will be dominated by US election headlines, meaning a heightened risk of disruptive announcements.

Chart 1: EPS growth (local currencies)

Sources: LSEG Datastream

Chart 2A: Valuation Europe vs. US (12m forward P/E)

Sources: LSEG Datastream as of 03/10/24

Chart 2B: Relative Valuation

Sources: LSEG Datastream as of 03/10/24

Chart 3: Consensus EPS change YTD (local currencies)

Sources: LSEG Datastream

Chart 4: Earnings trends Europe (MSCI Europe consensus EPS)

Sources: LSEG Datastream as of 03/10/24