Navigating Rates

2024: a strong year for emerging market debt?

From the likely end of interest rate rises in the US to improving economic data – we see reasons to be bullish about the outlook for emerging market fixed income in 2024. We explain six reasons why we’re expecting double-digit returns for the asset class.

Key takeaways

- A major reason for our optimism: the US Federal Reserve is likely done with interest rate hikes, in our view, and emerging market bonds tend to perform well when the central bank ends tightening cycles.

- Falling inflation is allowing many emerging markets to press on with interest rate cuts, often ahead of developed market peers – a move that should boost economic growth prospects and pull local bond yields lower.

- Yields for emerging market hard currency sovereign bonds are still high despite the recent rally, and carry is compelling enough to offset US Treasury volatility.

- Improving fiscal and balance-of-payments dynamics and a steadying in China economic growth are also supporting the outlook for the asset class.

1. The end of Fed rate hikes may offer a buying opportunity for emerging market bonds

The US Federal Reserve’s (Fed) cycle of raising interest rates may be coming to an end. Relatively dovish recent remarks by Chair Jerome Powell have been reinforced by October’s US inflation data printing lower than expectations. US labour data still must show more evident signs of weakening, but we believe the Fed is already at the so called “pivot”, meaning the point of shifting from interest rate rises to cuts. If history is a guide, emerging market sovereign bonds tend to perform well in such an environment.

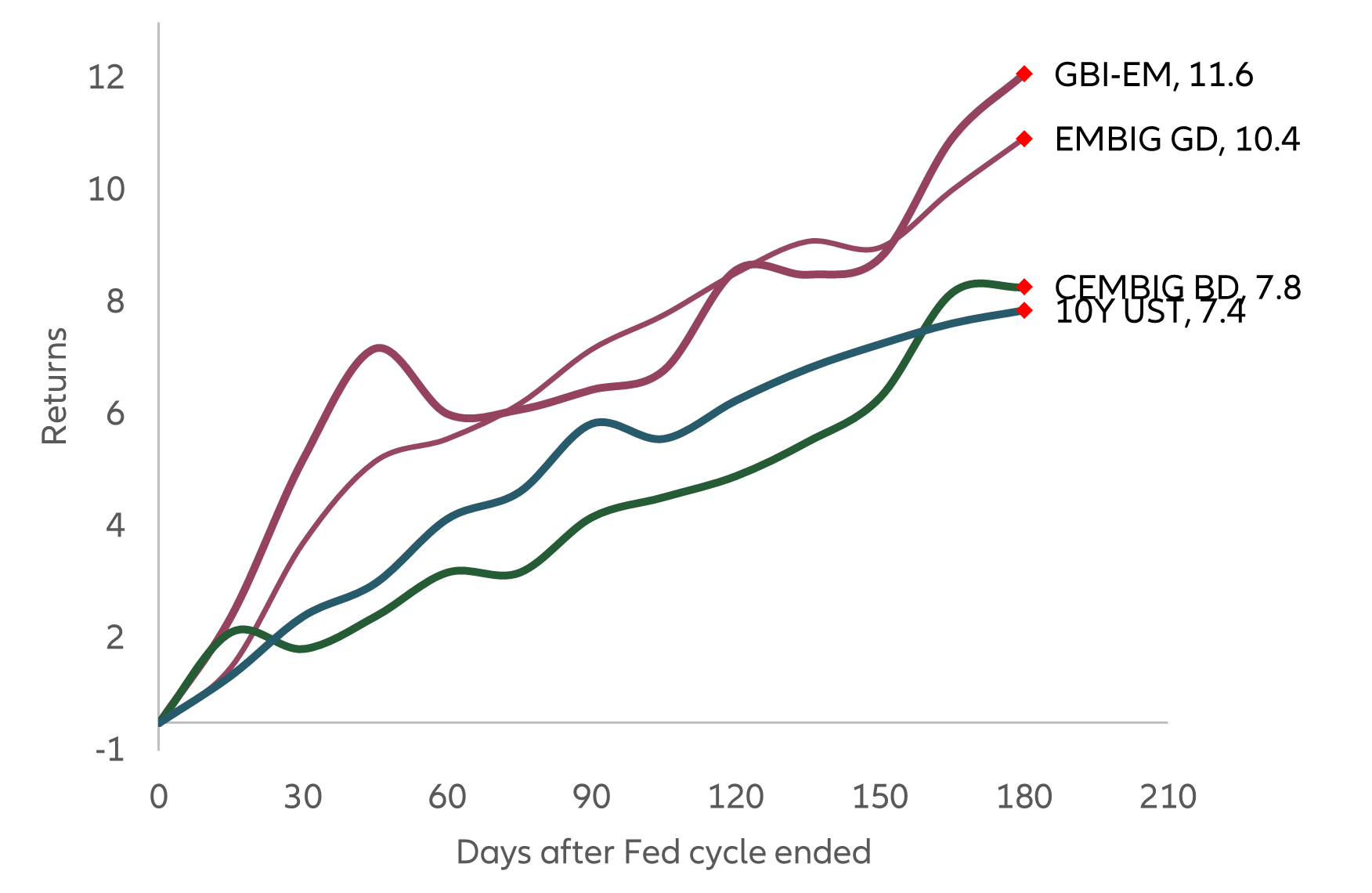

As rate cuts are increasingly priced into markets, US Treasury yields tend to drift lower and emerging markets may be able to offer extra yield. Emerging market sovereign bonds delivered double-digit returns in the six months following the end of the last two Fed tightening cycles. On average, local currency sovereign bonds returned 11.6% (total return including FX and rates), hard currency sovereign debt returned 10.4% and hard currency corporates returned 7.8% (see Exhibit 1). In all cases, the bonds outperformed US Treasuries which rallied 7.4%.

Exhibit 1: Performance of emerging market fixed income in the six months after the Fed ended tightening cycles

Total returns in percentage for the six months after the end of the Fed’s cycle of 2006 and 2018

Source: Allianz Global Investors, Bloomberg, JPMorgan, as of November 2023 Past performance, or any prediction, projection or forecast, is not indicative of future performance.

GBI-EM = JPMorgan Government Bond Index - Emerging Markets. EMBIG GD = Emerging Markets Bond Index Group - Global Diversified. CEMBIG BD = Corporate Emerging Markets Bond Index Group – Broad Diversified. UST = US Treasuries.

2. Emerging market disinflation persists, boding well for economies and investors

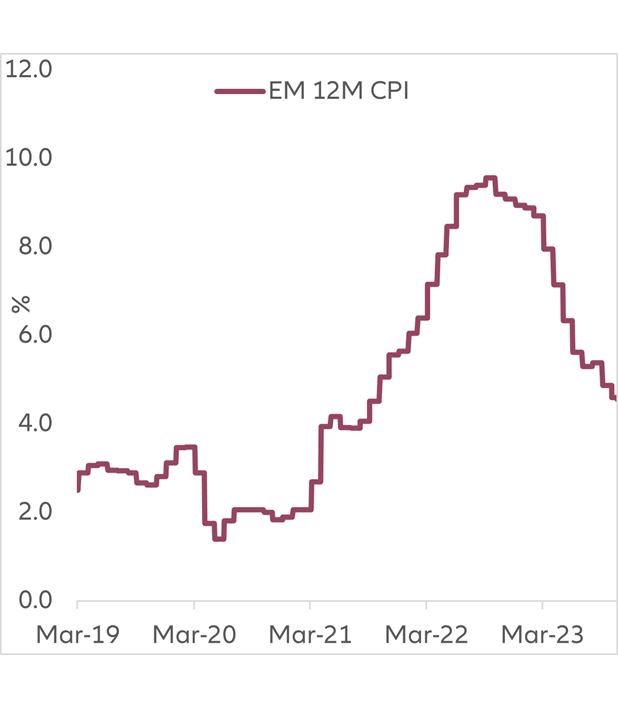

Inflation in emerging markets continues to move lower, a trend that bodes well for overall investment prospects. A look at the 12-month consumer price index (CPI) for 18 key emerging economies shows the 12-month level falling to 4.6% for October, down from the recent highs of 10% reached in October last year (see Exhibit 2).

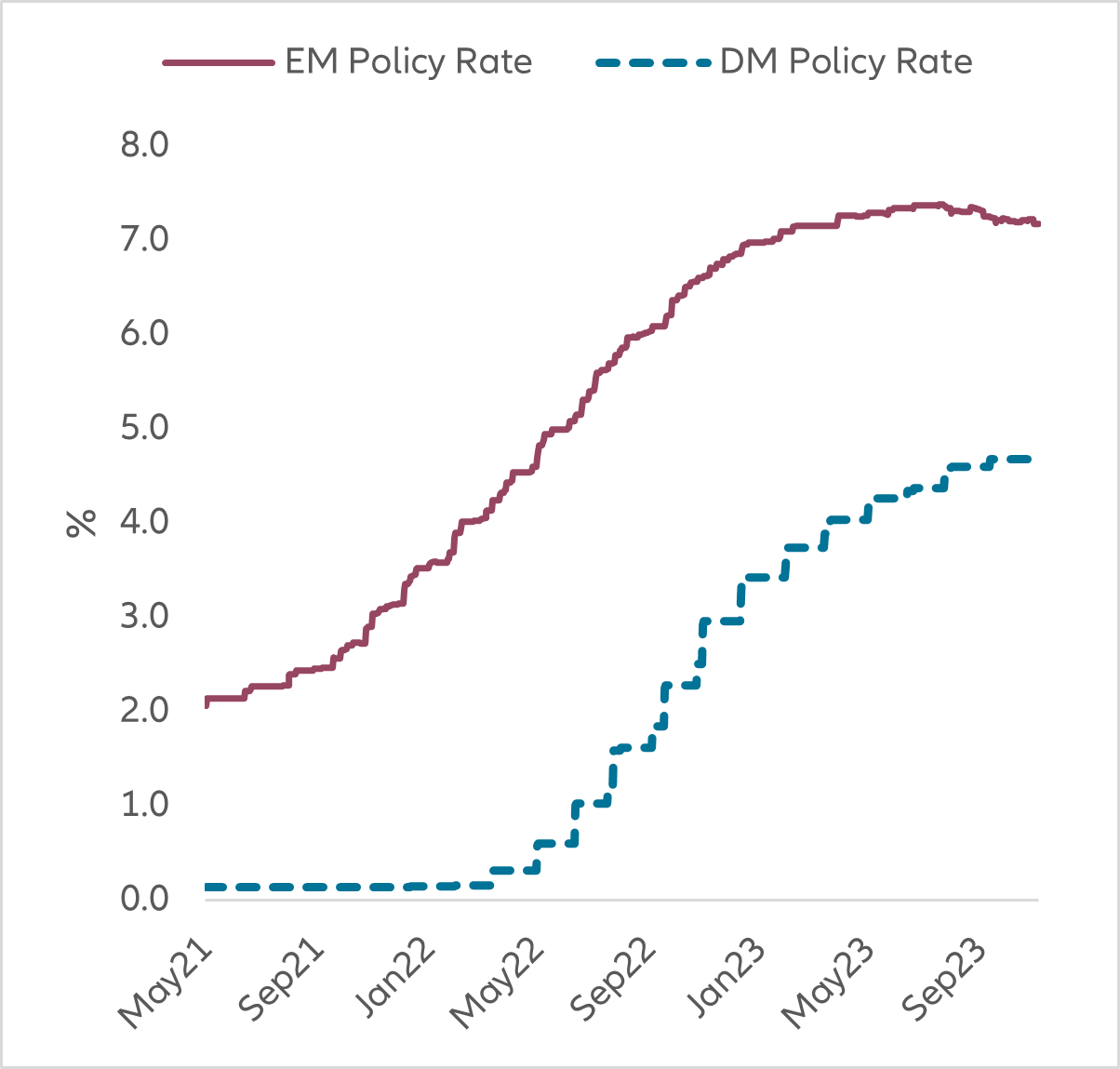

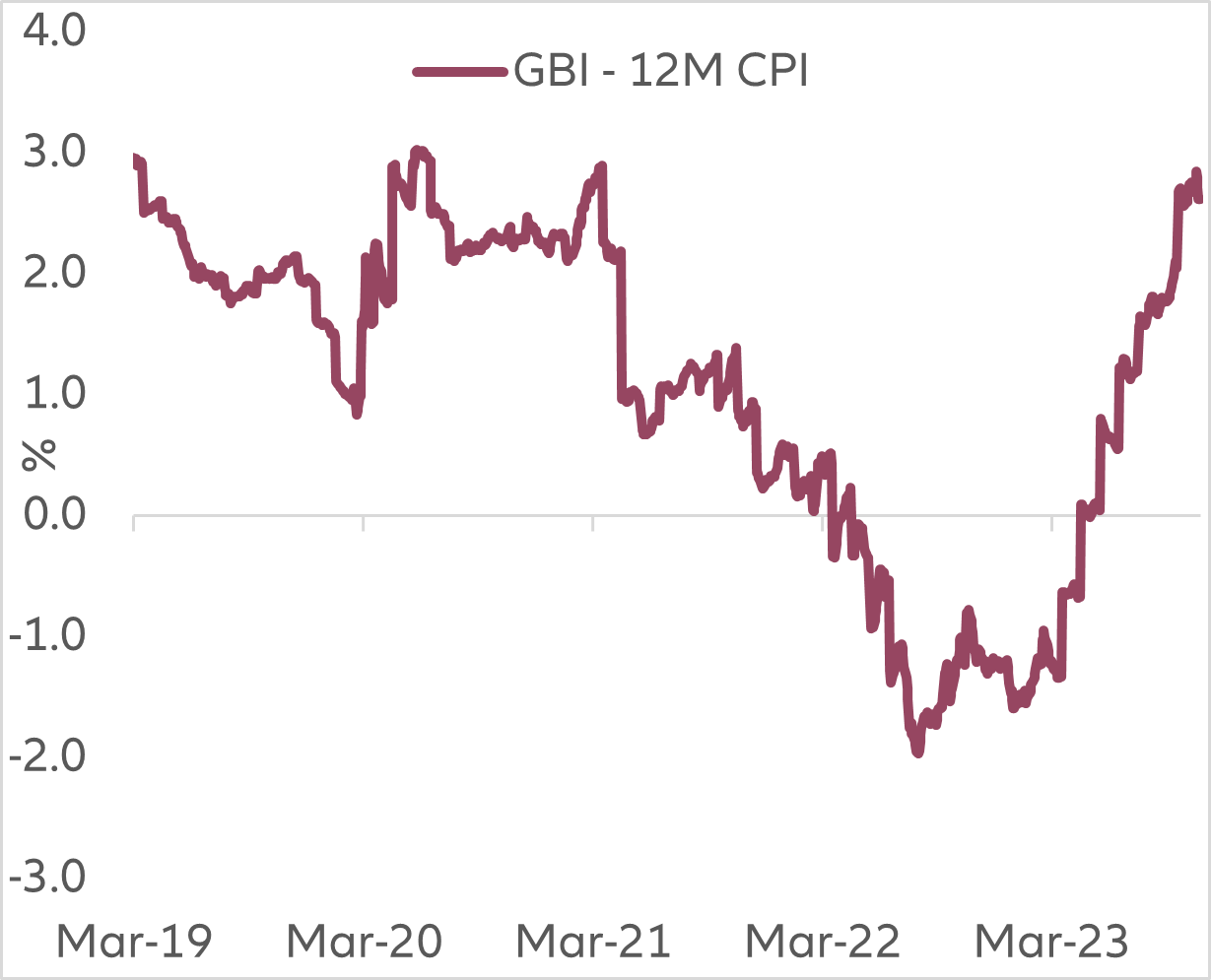

Core inflation – stripping out food and energy prices – continues to show signs of weakening as well. One reason for that was emerging market central banks overall were significantly more aggressive than their developed market policymakers in raising interest rates earlier and higher in response to inflationary pressures. As a result, many emerging market central banks have now been able to start cutting rates. But in general, the fall in inflation has been more pronounced than the central bank monetary policy cuts, which has improved the level of real rates, the real rate of interest adjusting for inflation. In our view, emerging market central banks have ample room to deliver policy cuts next year (Exhibit 3), which should boost economic growth prospects and pull local bond yields lower, meaning a rise in bond prices.

Exhibit 2: Emerging market inflation continues moving steadily lower

Weighted average of 18 EM countries for 12M CPI using JPMorgan GBI-EM index weights. Source: Bloomberg, JP Morgan, Allianz Global Investors, as of November 2023

Exhibit 3: Emerging markets have ample room for policy easing

EM policy rate calculated as the average with weights as of the JPMorgan GBI-EM index. DM average is US (55%), UK (6%), Japan (9%) and ECB (30%), with weights using 2022 GDP in USD billion. Source: Allianz Global Investors, Bloomberg. As of September 2023.

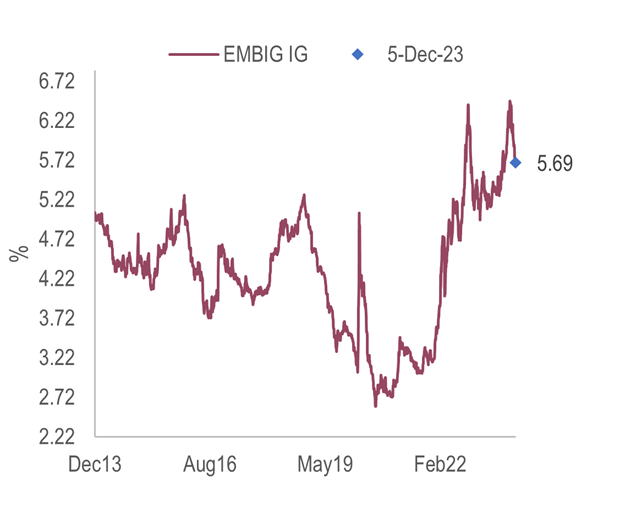

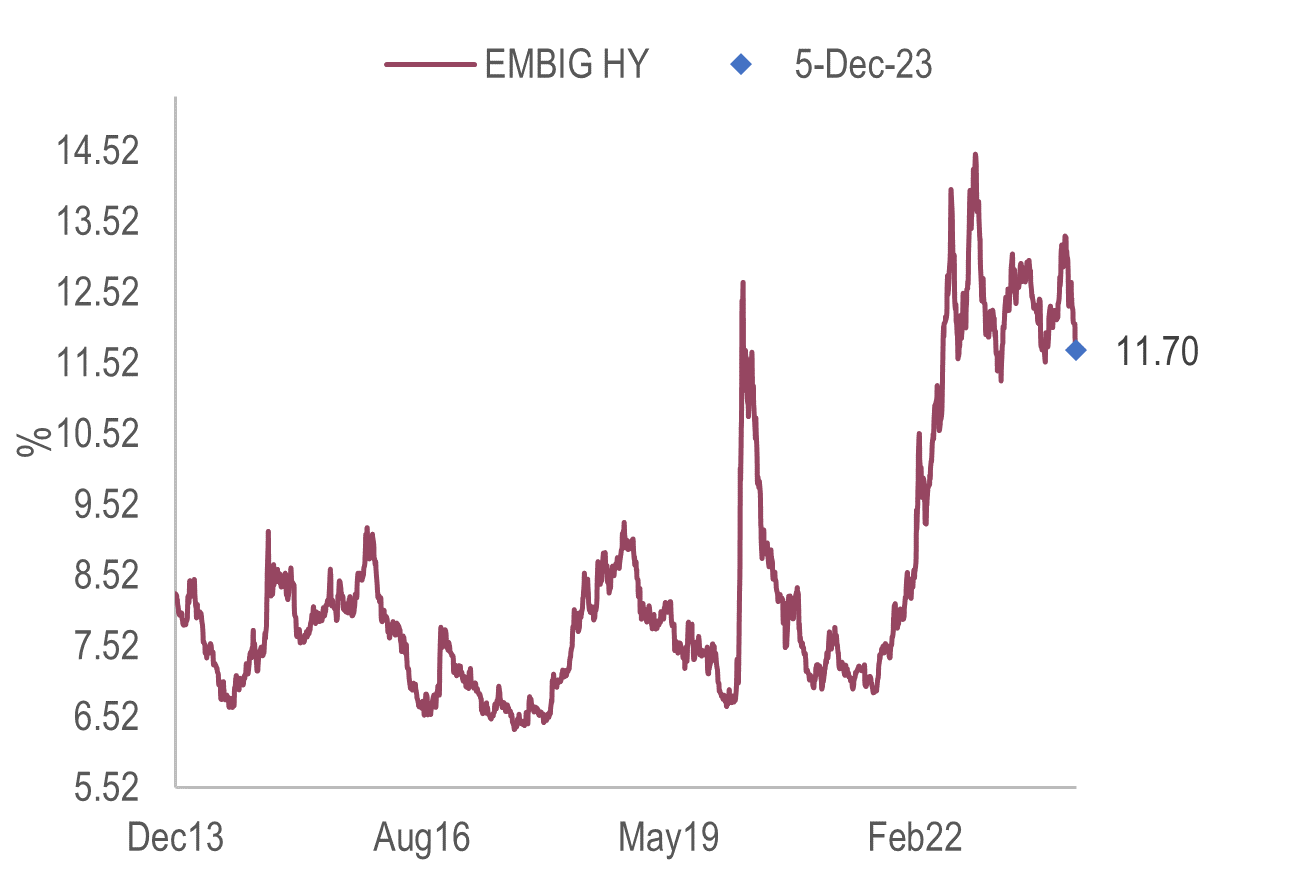

3. In our view, yield levels look competitive and carry is compelling

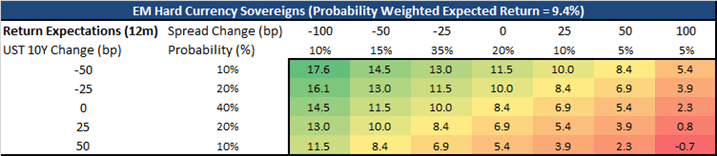

Yields for emerging market hard currency sovereign bonds are still high despite the recent rally, offering a significant carry buffer. Even without duration gains, there may still be reward available from an increase in the value of an investment over time. Emerging market sovereign investment grade bond yields are close to 5.69% (see Exhibit 4), while high yielders are at 11.7% (see Exhibit 5). The assets are split evenly between investment grade and high yield sovereign credits, so the average yield at the index level is 8.4%. Although the spread versus US yields remains relatively tight for several countries, the overall level of yields offers a compelling bond carry, in our view.

At current levels, we believe bonds yields are high enough to offset any potential volatility in US Treasuries and other potential shocks. In our base case scenario, we expect double-digit returns for emerging market sovereign bond yields in 2024, as shown in the top left quadrant of Exhibit 6. In our view, negative returns only occur in the unlikely scenario where US Treasuries sell-off 50 basis points (bp) from current levels and spreads widen 100bp (see the bottom right square of Exhibit 6).

Exhibit 4: Investment grade sovereign bond yields nearing 10-year highs

Source: JPMorgan, Bloomberg, Allianz Global Investors, as of November 2023. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

Exhibit 5: High yield sovereign bond yields offering a significant carry

Source: JPMorgan, Bloomberg, Allianz Global Investors, as of November 2023. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

Exhibit 6 : Potential returns for emerging market sovereign bond yields under different US-Treasury and emerging market spread scenarios

Source: JPMorgan, Allianz Global Investors. Data as at November 2023.

Exhibit 7: Real yields are wide as inflation lowered faster than local bond yields

Weighted average of local bond yields (using JPMorgan GBI-EM sub-indices and weights) and 12-month PCI. As of November 2023. Source: JP Morgan, Bloomberg, Allianz Global Investors, as of November 2023.

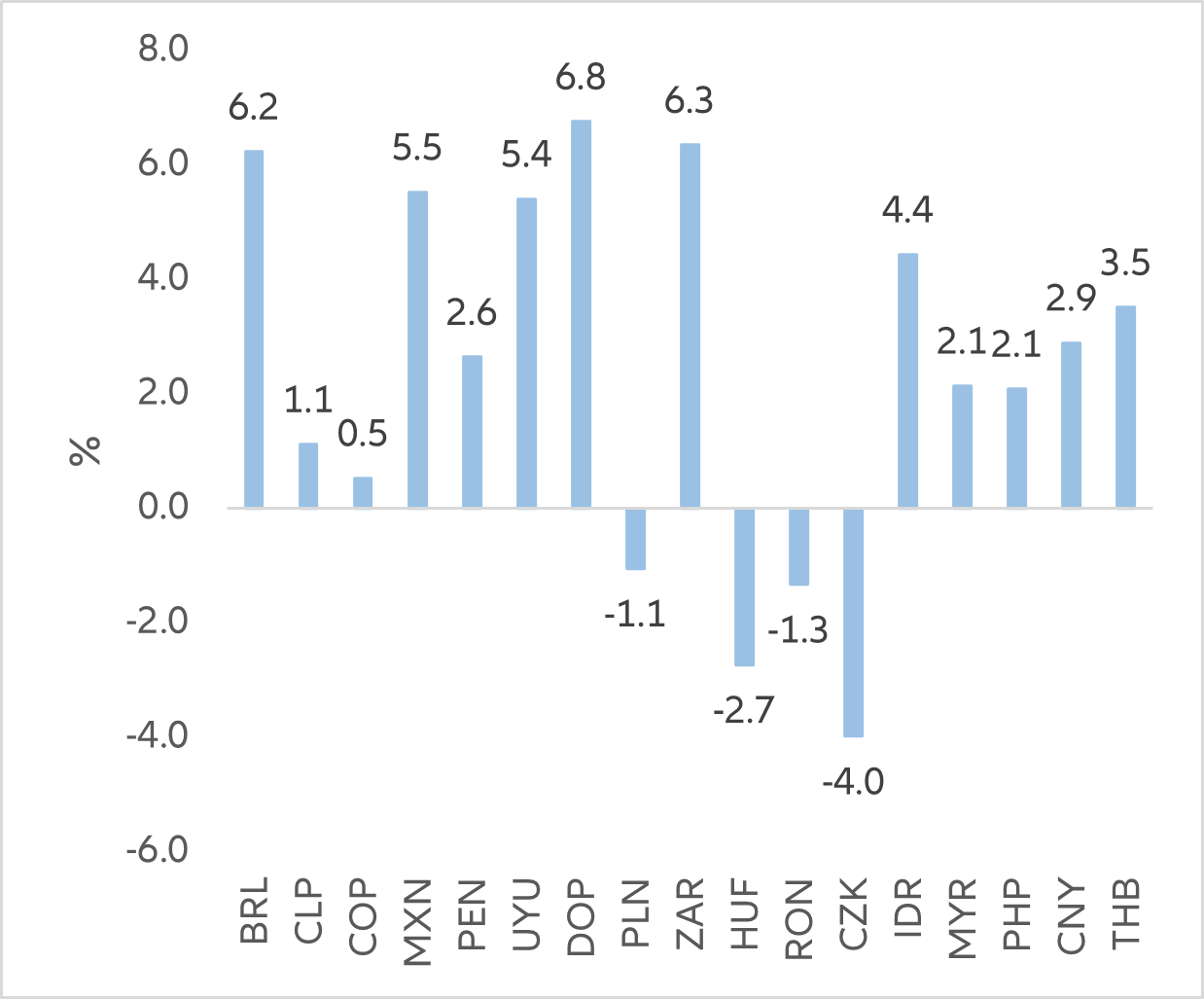

Exhibit 8: The gap between emerging market local bond yields and 12-month CPI is still wide

Source: JPMorgan, Bloomberg, Allianz Global Investors, as of November 2023.

BRL = Brazilian real bonds, CLP = Chilean peso bonds, COP = Colombian peso bonds, MXN = Mexican peso bonds, PEN = Peruvian sol bonds, UYU = Uruguayan peso bonds, DOP = Dominican peso bonds, PLN = Polish zloty bonds, ZAR = South African rand bonds , HUF = Hungarian forint bonds, RON = Romanian leu bonds, CZK = Czech koruna bonds, IDR = Indonesian rupiah bonds. MYR = Malaysian ringgit bonds, PHP = Philippine peso bonds, CNY = Chinese renminbi bonds, THB = Thai baht bonds.

4. Steadying China economic growth removes a significant headwind for emerging markets

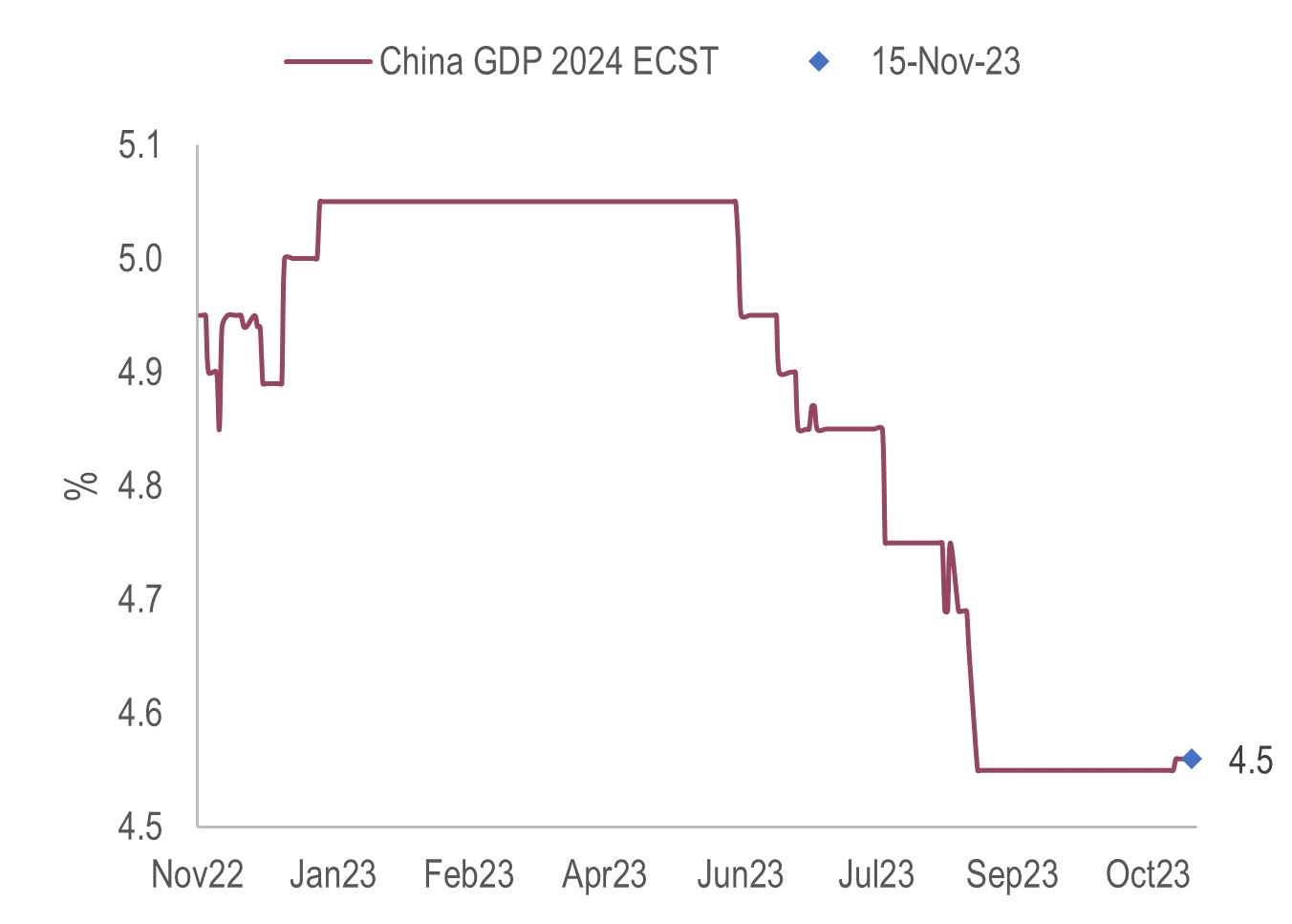

The year 2023 was marked by emerging market growth slowing down, with a few exceptions like Brazil or Mexico. In particular, the slowdown in China and concerns about the real estate sector have been a main drag for emerging market sentiment. After a period of lower growth, we have seen signs of economic activity in China stabilising in recent months and think that overall gross domestic product (GDP) stability going forward removes a significant headwind for emerging market bonds.

China’s real estate sector continues to undergo adjustment, but we believe the challenges should be contained to the sector – and shouldn’t hold back overall economic performance in 2024. Bloomberg consensus GDP estimates for 2024 have steadied in September (Exhibit 9).

Exhibit 9: China GDP growth consensus estimates have stabilsed

Source: Bloomberg, Allianz Global Investors, as of November 2023

Note: ECST = economic statistics

5. Geopolitical risks should be contained in 2024

We expect limited fall-out for emerging market fixed income from the three key geopolitical risks heading into 2024:

- Conflict in the Middle East: emerging market bonds have not seen outflows in response to the war between Israel and Hamas, suggesting markets appear priced for the conflict to remain regional. Emerging market currencies have appreciated, the opposite to what historically happens during “risk-off” periods.

- Russia-Ukraine war: investor positioning surrounding the conflict is relatively light as investor flows have already adjusted to the sanctions and index exclusions imposed in the aftermath of the conflict.

- US-China tensions: in our view, the recent meeting between US President Joe Biden and Chinese President Xi Jinping shows signs of cooperation and suggests a thawing of relations between the two most powerful economies.

In our view, any de-escalation in geopolitical tensions should be supportive for emerging markets.

Contagion risks across emerging markets have generally fallen in recent years, partly due to an increase in the number of investable countries, allowing for broader diversification. The other reason helping to moderate contagion has been a broader set of investors as the development of domestic pension funds, insurance companies and banking systems have widened the investor base.

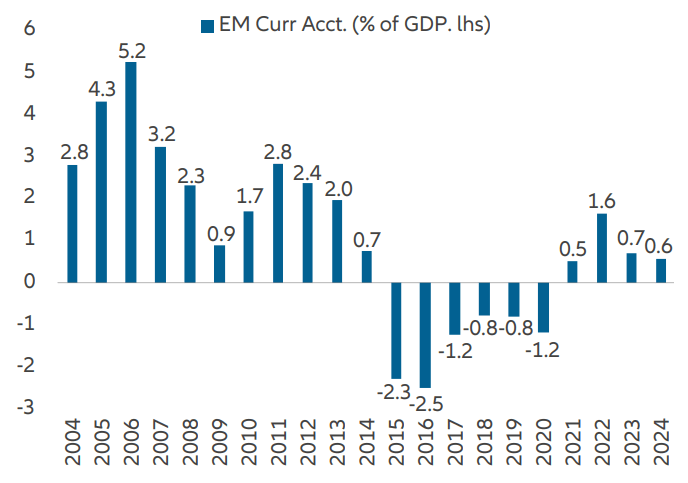

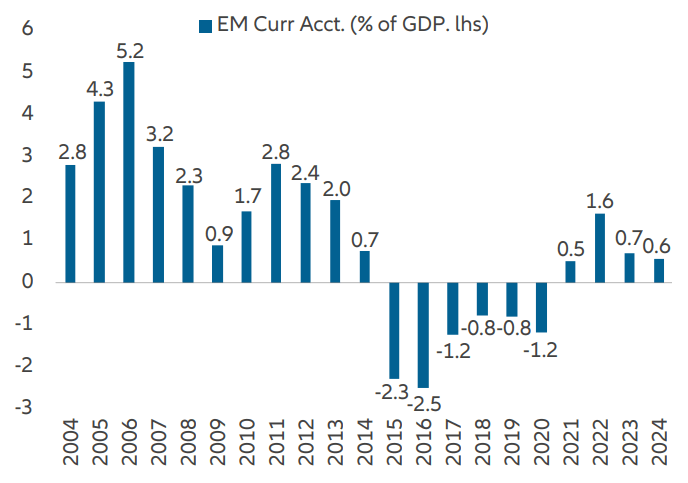

6. Macro data looks healthy for the emerging market aggregate

On average, emerging market fiscal deficits have narrowed since widening in the wake of the Covid-19 pandemic. In relative terms, the improvement has been larger than in developed markets. An average fiscal deficit of 2.8% of GDP for 2023 is down from the 3.7% reached in 2020 and lower than in developed markets (see Exhibit 10).

Current account balances remain healthy in the aggregate. The average current account balance for emerging markets for 2023 is currently at a 0.6% of GDP surplus, which suggests emerging markets are less vulnerable to external shocks than in previous years (see Exhibit 11). In our view, the recent strength in emerging market currencies reflects the healthy dynamics.

Another reason for our optimism: we only see a handful of potential default candidates in the coming years. Those default risks constitute a small proportion of the emerging market fixed income universe and are already trading at distressed levels. In our view, Egypt is the most at risk and any default has the potential to cause contagion within emerging markets. Turkey has the largest amount of Eurobond maturities across 2024 and 2025, but short-term securities remain well supported by a strong domestic investor base. The government’s recent move to economic orthodoxy may also imply Turkey can avoid a default. Pakistan, Ethiopia, and Tunisia have maturities in 2024 which can pose repayment challenges, but markets seem to be fully priced-in for these types of events.

Exhibit 10: Emerging market fiscal balance as % of GDP

Weighted average EM fiscal account using IMF’s WEO database and weights by JPMorgan EMBIG GD index. Source: IMF’s WEO database, JPMorgan, Allianz Global Investors. As of November 2023.

Exhibit 11: Emerging market current account balance as % of GDP

Weighted average EM current account using IMF’s WEO database and weights by JPMorgan EMBIG GD index. Source: IMF’s WEO database, JPMorgan, Allianz Global Investors. As of November 2023.

Upcoming elections may provide tactical entry points

So, how can investors prepare for possible investment opportunities in 2024? We see potential tactical investment opportunities opening up during a busy year for elections. The outcome of the US election in November may have a bearing on US policies towards key emerging markets and, consequently, overall investor sentiment about the asset class. For example, policies about trade and immigration may add volatility to Central American markets, and Mexico in particular. Elections in emerging markets should also be closely watched. A move to the centre-right in Mexico may be supportive for the country’s bonds, while a policy continuation will be neutral for assets. Elections in Panama may provide political shifts given high discontent and low approval for the incumbent. In South Africa, uncertainty remains high as it is unclear whether the current ruling party will gather the necessary 50 percent of votes needed to stay in power.

Overall, we think there are ample reasons to be bullish about the outlook for emerging markets in 2024. The combination of improving economic fundamentals and favourable valuations may create opportunities for investors willing to take a selective approach.