Embracing Disruption

The emancipation of Europe – opportunities for stock pickers

While Donald Trump’s victory in the November 2024 presidential election was greeted with euphoria by American stock markets, investor sentiment seems to have since soured. US markets took a particular hit in early March, as controversial statements by the US administration with regards to the Ukraine war, as well as seemingly erratic tariff announcements and counterannouncements, raised the prospects of increased uncertainty in the US.

In contrast, European stock markets have enjoyed somewhat of a renaissance, rising significantly since the start of the year. In this article, we look at the reasons for this sentiment shift towards Europe, what fundamentals underpin it, and why Europe offers interesting long-term opportunities for equity investors.

Valuation gap – US exceptionalism for how much longer?

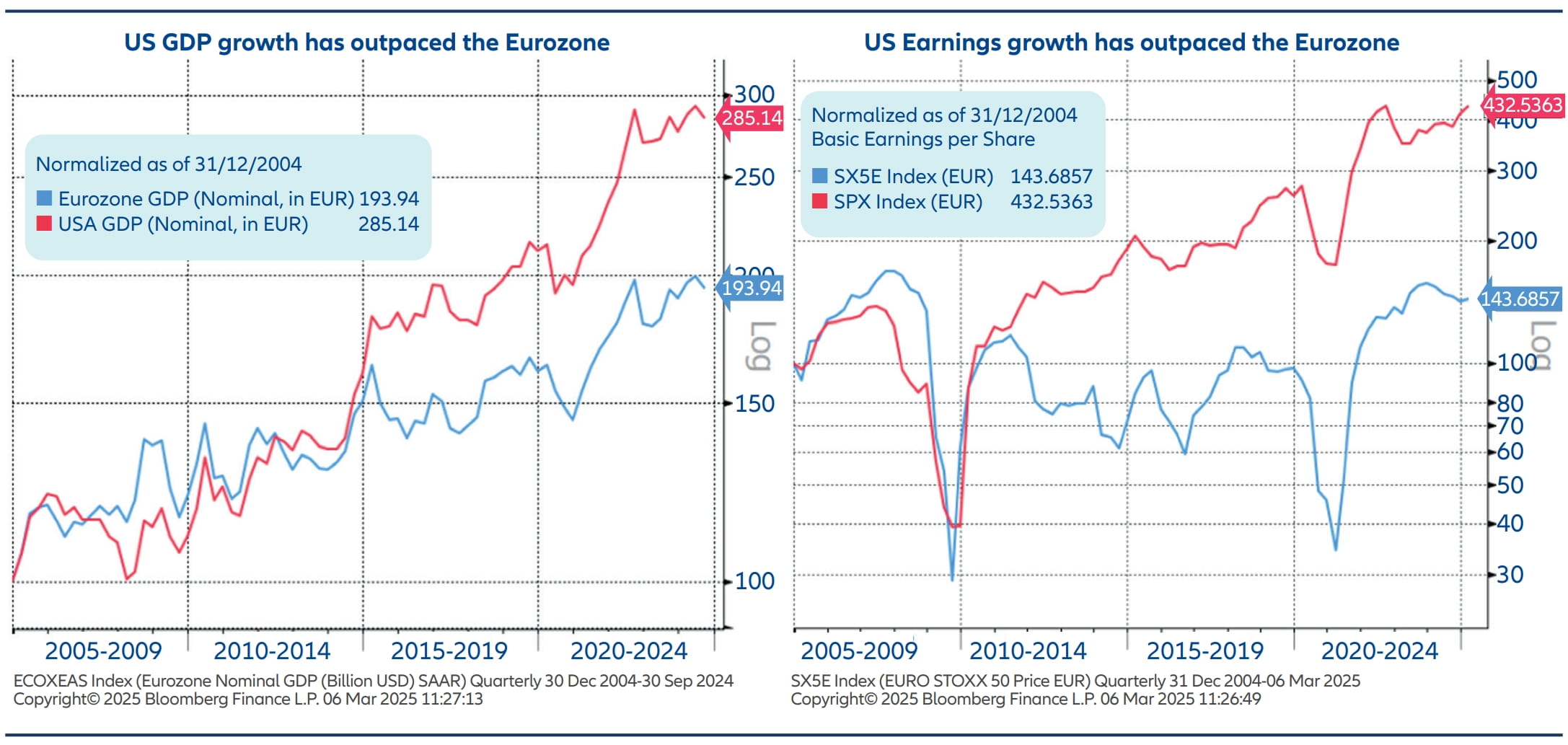

For the past two decades, the US economy has widely outpaced Europe’s. While the Eurozone’s GDP doubled (in nominal terms), the US’s almost tripled. This showed the astonishing resilience of the US economy, which surpassed challenges like the 2008-2009 financial crisis or Covid-19 in better form than European economies. The difference in economic growth was also mirrored on the corporate side: earnings per share rose 43% over the past two decades in the Eurozone, but quadrupled in the US (see Exhibit 1). No wonder investors flocked to US stocks.

Exhibit 1: US and Eurozone economy comparison

Source: AllianzGI Economics & Strategy

This preference, however, led some investors to build significant overweights in US stocks – in particular in the popular “Magnificent Seven” – overweights that led to buoyant valuations for US stocks. Europe, in contrast, has been underloved, underweighted, and consequently priced much more cheaply.

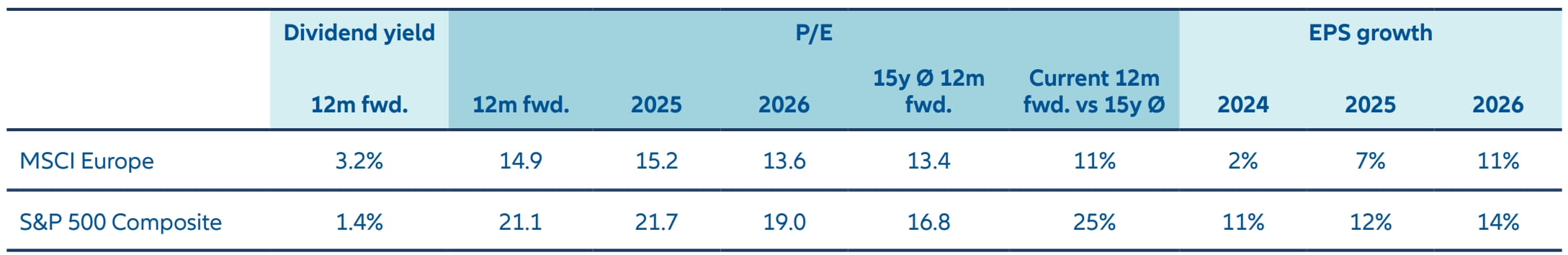

Exhibit 2: Valuation Europe vs. US

Source: L SEG Datastream as of 7 March 2025

The 12mth forward P/E ratio of 14.9x for European stocks compares to 21.1x for US names. The valuation gap has just started to narrow but the current discount (29.2%) is still much higher than the historic average (-18.5). Based on current consensus estimates for 2025 and 2026 earnings, the growth differential has also started to narrow.

Source: LSEG Datastream as of 10 March 2025. 2025 and 2026 data are estimates.

Investors are now reassessing the extent to which such a discrepancy is still justified in the new economic and geopolitical environment: with recession risks rising in the US, growth differentials could narrow, and valuation differentials should consequently narrow as well.

European sovereignty in a shifting world order

If in December 2024 investors and foreign governments alike expected a re-enactment of Donald Trump’s business-friendly first presidency, his administration’s antagonizing of its allies and on-again-off-again tariff announcements have led many to reassess the situation.

The shift in US foreign policy since President Trump’s inauguration, in particular, caught Europeans on their back foot.

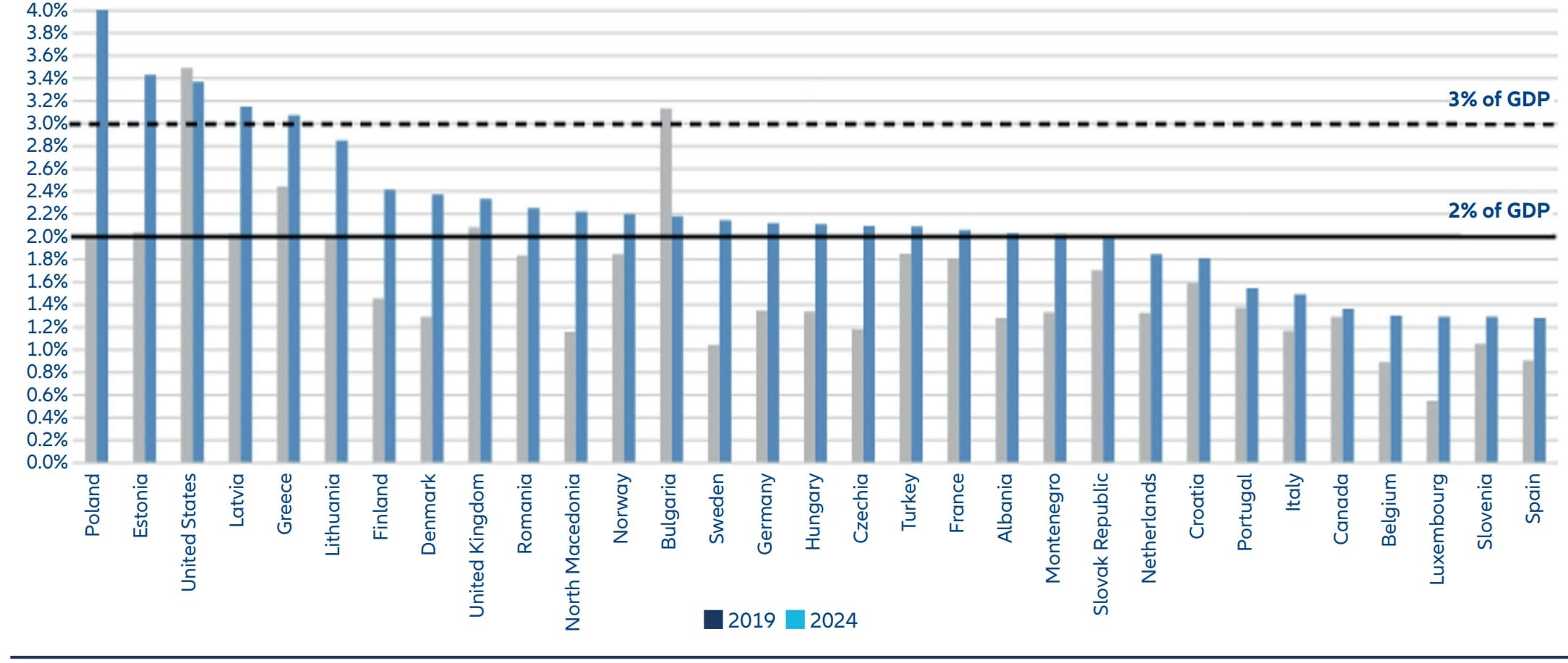

Yet, surprisingly to many, Europe quickly managed to pull together and put measures in place to shield itself from the most severe repercussions of a disengaging US. Most significant have been the announcements on defence. The first Trump presidency, as well as the Russian invasion of Ukraine, had already jolted most European NATO members to raise their military spending to the 2% of GDP goal recommended by NATO (see Exhibit 2). Now, they are ready to go much farther, with NATO Secretary General Mark Rutte positing a “3% of GDP or more” target (a figure that would imply at least an additional 250 bn USD in spending). Prime Minister Sir Keir Starmer announced that the UK would increase spending to 2.6% of GDP by 2027 (2024: 2.3%).

The likely next German Chancellor, Friedrich Merz, alongside his probable SPD coalition partners, stated his intention to reform the country’s debt brake by exempting defence spending above 1% of GDP from the brake, and by launching a “special vehicle”, 500 bn EUR strong, to invest in infrastructure over 12 years. There is now an agreement between the incoming coalition and the Greens, and we can assume that this package will pass the parliament with the required supermajority – EUR 100bn will be dedicated for investment to protect the climate

French President Emanuel Macron, meanwhile, has openly mused about extending France’s nuclear shield to other European countries. And the European Union, finally, announced its “Rearm Europe” plan, aiming at unlocking EUR 800 bn in member state defence spending through various measures.

Irrespective of how the actual numbers and agreements end up, the trajectory is clear: Europe is finally taking defence seriously, it’s willing to spend more on it, and it is open to deeper collaboration within the Union as well as with non-member states (the UK, Norway, Turkey). With relatively low debt levels (88% of GDP for the eurozone, and 62% for Germany, compared to 122% for the United States), Europe also has enough fiscal dry powder to bring these plans (and others, e.g., on infrastructure) into fruition, and potentially boost overall economic growth rates.

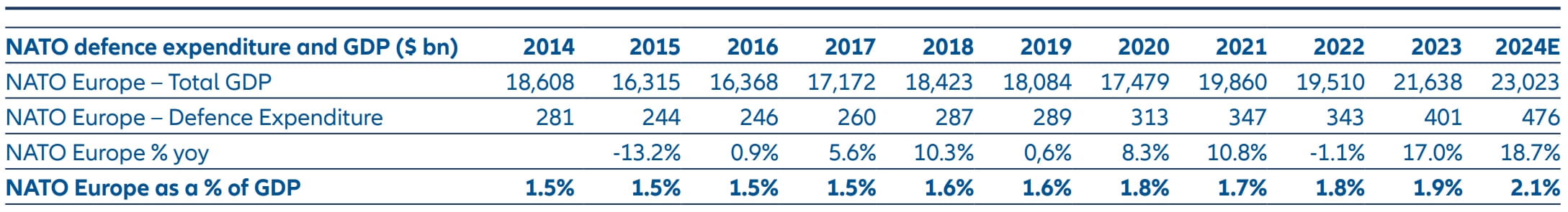

Exhibit 3:

Source: NATO Defence Expenditure report (June 2024); data is based on current prices and FX rate

Source: NATO Defence Expenditure report (June 2024)

The implications for investors are deep. European defence stocks have already rallied since the start of the year. But in 2025, defense goes beyond tanks, airplanes, rifles and submarines. As the war in Ukraine has shown, satellite imaging and communication systems, drones, cyber-security systems are just as important, if not more. Indeed, the military sphere has often been intimately linked to progresses in technology – nuclear, space, and the internet were all developed in close proximity to the men in khaki. And while Europe may lag the US in consumer digital services (e.g., social media platforms), it does have its own technological assets when it comes to defence. European politicians were quick to point out its Eutelsat satellites and Ariane space rockets when the US briefly interrupted information sharing with Ukraine.

European tech – could the “ugly duckling” turn into a swan?

This highlights a broader issue investors have had with Europe: its lag in the development of the hottest new technology, AI. US companies have long dominated the headlines on AI; China recently surprised investors and commentators alike with the unveiling of DeepSeek’s newest GPT program. It would be wrong, however, to assume that Europe has no cards to play in the tech sector – on the contrary. Europe, too, hosts major IT companies operating in various sectors, from ASML, the Dutch supplier to the semiconductor industry, to SAP, the Germany-based leader in ERP software. These two companies exemplify two areas where Europe is poised to play a role in the further development of AI: AI enablers, and AI adopters.

AI enablers encompass the various companies involved in the AI hardware supply chain, from semiconductor foundries and their suppliers to datacenters, as well as sectors such as cybersecurity, which are essential to ensure trust in AI applications. The European Union’s moves towards less bureaucracy and alleviated sustainability reporting requirements, as well as German (and other) investments in infrastructure, could boost this sector in the years to come.

AI adopters, on the other hand, comprise companies down the value chain, from software companies (such as the above-mentioned SAP) implementing AI to improve their products, to traditional industrial manufacturers harnessing AI to make their production processes more efficient. Financial companies, too, could benefit from AI adoption as digital finance becomes ever more prevalent. While Europe wasn’t at the forefront of the emergence of AI, it is well positioned as we enter into an era of the democratization of AI. Digital Darwinism will furthermore nudge established industrial behemoths into adopting AI to remain competitive on the global stage.

The European renaissance – more beehive than phoenix

Investors have seized on the turn-around in Europe’s fortunes to re-engage with it in their portfolios. But while it is easy to look at the flurry of announcements in the European political sphere and declare that, like the phoenix rising from its ashes, Europe has risen from its lethargy, a more realistic assessment would rather compare Europe and its institutions to a bee hive: assuming they all work together, they can build impressive results, but it takes some time. European politicians will have to heed the wishes of their electorates, and navigate internal politics that have become more adversarial in the recent past. As investors, we therefore approach Europe with a stock-picker mindset, assessing companies on an individual and longterm basis to identify the most promising opportunities.