Growth. The China Way.

Why it’s just the beginning for China’s RMB bond market

Summary

China’s efforts to provide greater access to the renminbi bonds market – work that began more than a decade ago – is giving international investors the confidence to increase their holdings.

Key takeaways

|

The following article is a summary of insights from our 2021 Asia Conference.

In the world of fixed income, China is quickly drawing international interest and investment. Its bond market has been steadily opening up, which has led to the inclusion of China “rates” bonds – a category consisting of government bonds (CGBs) and policy bank bonds – in a number of major international bond indices.

As a result, many investors are rapidly building their China exposure, albeit from a low base. Foreign ownership in China’s “onshore” bond market – bonds denominated in renminbi (RMB) – has doubled in less than three years, according to Yin Liu, who spoke at the Allianz Global Investors 2021 Asia Conference in June. Mr Liu is a senior director of international cooperation at China’s National Association of Financial Market Institutional Investors (NAFMII)1. At the end of 2020, according to Mr Liu, foreigners owned RMB 3.25 trillion of the bonds traded on the China Interbank Bond Market (CIBM). That is equivalent to 3.23%,2 up from the June 2018 figure of 1.5%.

What is attracting so much international investment? Some of the top factors are the attractive yield pick-up of Chinese bonds versus other markets, alongside ample monetary policy flexibility from China’s central bank. But the international investors recently drawn to Chinese bonds would not even be considering this asset classes without the steady stream of reforms that recently opened up the market.

“This influx of foreign flows has been happening for two or three years,” explained Mr Liu. “It’s very profitable to invest in China. Further, the economy is stable, monetary policy is normal and we have ample tools to take care of any market turmoil. That’s the main backdrop for the foreign inflow of money. But we do a lot of work to support the foreign investors coming into the market.”.

Opening up of the onshore bond market

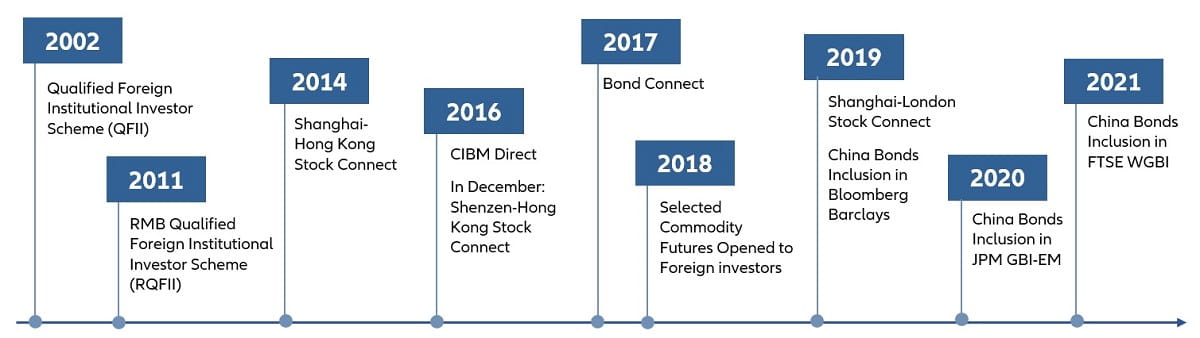

The work to make China’s onshore markets more accessible started over a decade ago (see accompanying timeline).

- Since 2011, a series of reforms allowed foreign investors increasing access to a wider range of fixed-income instruments in China’s onshore bond market.

- A milestone event was the introduction of China Interbank Bond Market (CIBM)3 Direct in 2016, which allowed foreign investors quota-free access to CIBM. All that was required was registration with the People’s Bank of China (PBoC) and the appointment of an onshore custodian bank.

- Separately, in 2017, the introduction of the Bond Connect programme enabled trades to be settled via custodian banks in Hong Kong, further liberalising foreign investors’ market access to the mainland bond market through Hong Kong.

As the market opened up, major global bond indices began to include CGBs and policy bank bonds, which further encouraged international investors. Most recently, FTSE Russell completed the inclusion of CGBs in its flagship FTSE World Government Bond Index (WGBI). The initial inclusion came in March 2021, at a 5.25% weighting.

Market access regulations have relaxed in recent years

Source: IPECapital, Data as of 30 September 2019. The above is for illustrative purposes only and is not a recommendation or advice to buy or sell any security. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

Looking forward

Even as foreign investment has ramped up, some foreign investors have become worried about rising credit defaults and poor liquidity in corporate credit bonds in particular. On both topics, Mr Liu stressed that the regulators are alert and taking action. In the case of credit ratings, he cited the enforcement actions taken against local rating agencies, as well as the issuance of licences to international agencies S&P Global and Fitch Ratings. He also said that NAFMII was examining ways to improve liquidity in areas such as government bonds and repurchase agreements (repos).

What Mr Liu made clear was that the regulators, led by the PBoC, were committed to continuing improving the market, listening to investors as they go.

Giving an international investor’s view, David Tan, CIO Fixed Income Asia Pacific at Allianz Global Investors, said: “Recently, we've seen Asia grow tremendously and become a big part of most global equity portfolios. As a bond market investor myself, I see this trend also happening for the RMB bond market. I think it's just the beginning.”

1 NAFMII was founded under the approval of the State Council of China to aid the development of China’s over-the-counter (OTC) financial markets. These OTC markets include China’s inter-bank bond market and foreign exchange market, among others.

2 Sources: China Central Depositary & Clearing Co. Ltd.; Shanghai Clearing House.

3 CIBM is the main trading venue for Treasury, policy bank and commercial bank bonds accounting, accounting for 85% of the entire onshore bond market. Originally, foreign investors were allowed to invest in the CIBM under the QFII/RQFII market access schemes, following certain quotas.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Credit risk reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. Foreign markets may be more volatile, less liquid, less transparent, and subject to less oversight, and values may fluctuate with currency exchange rates; these risks may be greater in emerging markets. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

1750276

Summary

Plastics – and especially plastic packaging – play an essential role in the global economy, as they prevent products from being spoiled, and significantly extend the shelf-life of food. Additionally, the comparatively low weight of plastic packaging contributes to energy and fuel savings, and to reducing greenhouse gas emissions from freight transport. However, the advantages of plastics have to be set against a number of drawbacks, particularly for the environment. The absence of a circular plastic economy, and the leakage of millions of tonnes of plastic material, not only contribute in large part to marine pollution, but also trigger immense economic costs, and billions of USD in negative externalities. Fostering the further development of sustainable packaging therefore not only helps to limit the volume of plastic waste, but also offers attractive opportunities to participate in a market that is predicted to show a double-digit percentage growth rate within the next five years.

Key takeaways

|