Embracing Disruption

China’s pragmatic sustainability development

While the importance of ESG and sustainability-focused investing has been called into question in the US and more broadly since the start of the new Trump administration, we see a different picture in China. Despite all the global challenges, the country continues to invest in and steadily advance its sustainability agenda.

Part of the reason is that, whereas in the West where there are often trade-offs between sustainability and economic growth, in China they have always been two sides of the same coin. Sustainable development in China focuses on industrial upgrades and technological progress, aiming for greater self-reliance, enhancing the global competitiveness of Chinese companies, and improving resilience against negative impacts of climate change.

In this article, we aim to illustrate the Chinese approach to ‘pragmatic sustainability’ through our first-hand observations. We argue that strong integration of ESG research with fundamental analysis can pave the way for enhanced investment returns in China. Indeed, for ESG-aware investors, we believe China is a market that cannot be ignored.

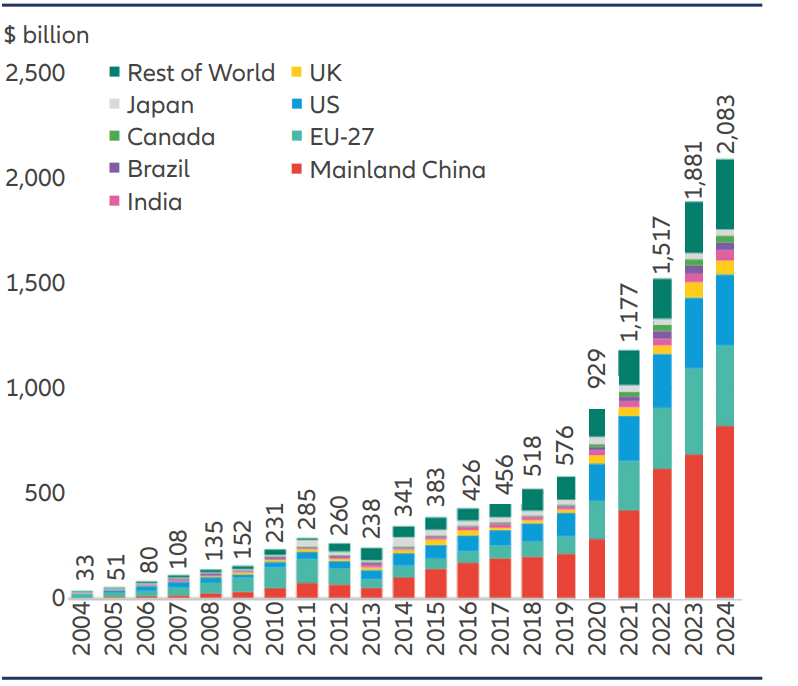

Chart 1: Global energy transition investment, by economy/bloc

Source: BloombergNEF. Note: Start-years differ by sector, but all sectors are present by 2020. The step-change in 2020 is caused in part by the addition of power grids into the scope from that year onward.

Green economy – establishing the new

In China, a well known phrase “先立后破” (xian li hou po) translates to “establishing the new before abolishing the old”. It signifies a strategic approach where new systems are put in place before dismantling the old ones. No other phrase describes the Chinese way of green transition better, in my view.

Let’s do a quick progress check on China’s energy transition. In 2024, China invested around USD 818 bn into green sectors such as renewables, energy storage, nuclear, EVs, and hydrogen. This accounted for almost 40% of total global investment, more than double any other country1. Six out of the top 10 EV battery makers are Chinese, with CATL and BYD taking more than half the market alone and far outpacing others2.

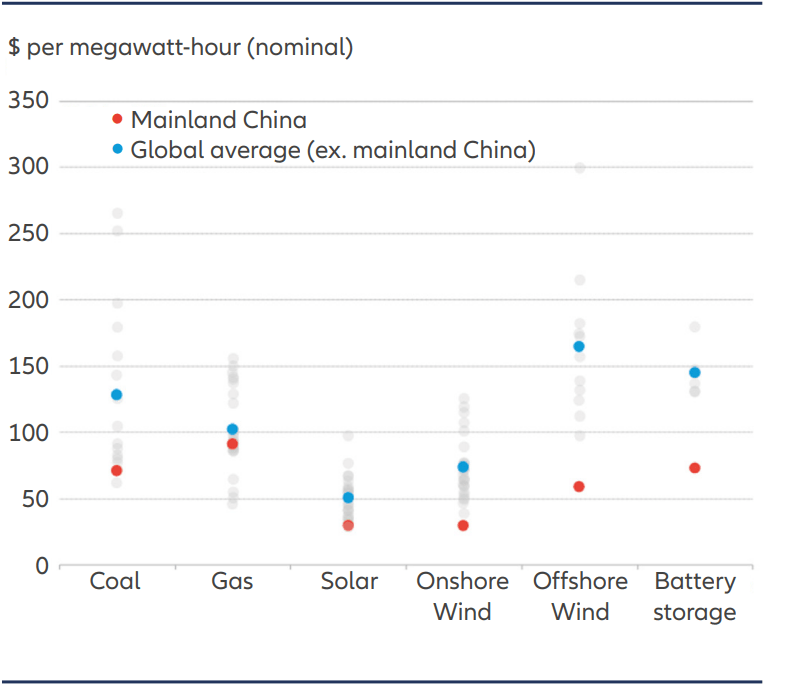

Fierce domestic competition in renewable materials has also pushed down green electricity costs. China now offers the cheapest electricity prices globally across solar, wind, battery and battery storage. More often than not, replacing coal fired power with green electricity often helps enterprises better manage their energy costs. With 56% of installed electricity capacity now being renewable and ongoing continuous investment into upgrading the national power grid, previous complaints about energy scarcity and high costs of green power are already mainly in the rear view mirror in China3.

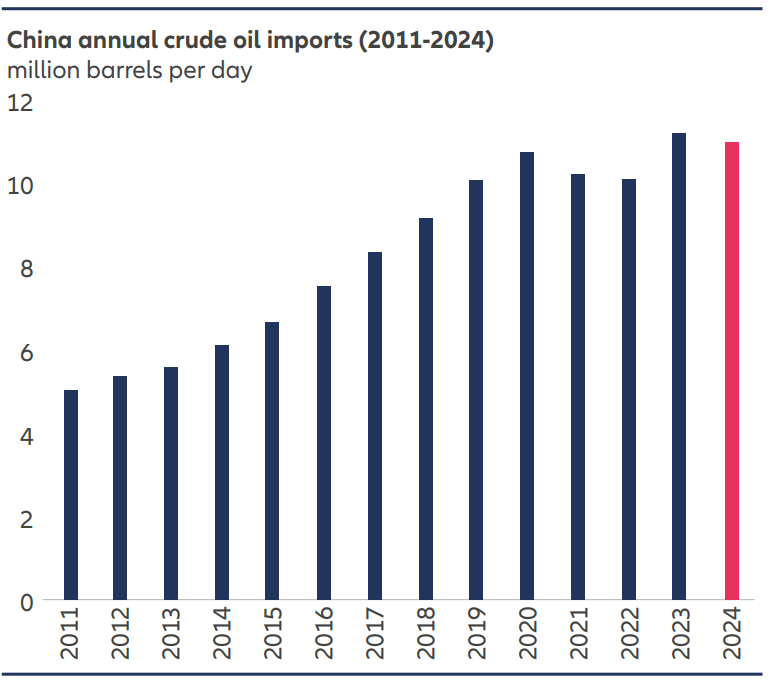

Admittedly, the renewables build-out has not always been purely driven by commerciality – wind and solar power have at times been wasted due to over-capacity and grid bottlenecks. However, the sheer scale has cultivated technological upgrades and cost leadership while enhancing China’s energy security, especially when the rest of the world is hungry for power in the AI era. In fact, in 2024, China’s crude oil imports saw the first year of decline in history, excluding the impact of Covid4. This is at least in part attributable to China’s move towards green electrification.

It is also worth noting that China understands the need to mitigate and adapt to the new realities of climate change, especially given the country’s vulnerability to extreme weather events such as sea level rise, heat waves, etc. Climate adaption started top down – China published National Climate Change Adaptation Strategy 2035, emphasizing on climate change monitoring, warning, high-quality water resource utilization, and terrestrial and coastal biodiversity construction. The Strategy also promotes the buildout of high-standard farmland and climate resilience infrastructure, among other measures.

For example, China planted 4.45 million hectares of trees in 2024, raising the country’s forest coverage to over 25 percent6. Companies level climate adaption discussion is still in early stage, but should improve over time. As investors we continue to use active engagement as a tool to push for higher awareness, planning and disclosure.

Chart 2: Market-level levelised cost of electricity, 2024

Source: BloombergNEF. Note: Grey dots are the latest estimates. Solar is the cheapest of either our fixed-axis or tracking market-level estimate.

Heavy manufacturing – transforming the old

Compared to the rapid build out of green infrastructure, government restrictions on more carbon intensive industries seem to have been more carefully paced. Over the years we have seen a combination of energy controls, capacity caps, and other administrative moves to combat emissions. These have deliberately not been overly restrictive so that they threaten the survival of the old industries. It is indeed “transforming the old” rather than “abolishing the old”.

Why? The reality is that many upstream industries are not as ‘villainous’ as their carbon footprint might suggest. Some are, in fact, key enablers of a greener future. For example, the green electrification process cannot proceed without copper and lithium. The trend towards EV lightweighting in driving is a significant increase in aluminium content per car. And greener production processes for these strategic metals position China competitively, even when faced with high green trade barriers in developed markets.

The transition of traditional industries started slowly but is now accelerating. For example, 24.4% of China’s primary aluminium production capacity is now powered by green electricity7. The figure for leading aluminium producers is getting close to 50%8. In the last five years, early movers have already started relocating production plants closer to provinces rich in hydropower. As renewable equipment prices drop, captive power plants have been shifting from coal fired plants to solar and wind farms. With a strict capacity ceiling set for aluminum production and the introduction of a mandatory emission trading system which puts a price on carbon, firms are increasingly prioritizing production quality over quantity.

The transition process for heavy manufacturing has undoubtedly been painful. It would not, however, even have been feasible without China’s pragmatic policy backdrop.

Chart 3: China’s crude oil imports decreased from a record as refinery activity slowed

Source: China General Administration of Customs, Bloomberg L.P.

Do more, talk less

During our research and engagement process with Chinese companies, we have noticed that ESG disclosures are often much more conservative compared to their actual progress. In fact, Chinese firms, especially state-owned enterprises, typically prefer to discuss backward looking achievements rather than set forward-looking goals, such as decarbonization roadmaps. The reasons vary, but most are pragmatic. They include a conservative “do more, talk less” attitude, fear of embarrassment if targets are not met, misalignment with national targets, and concerns about revealing sensitive business details.

As a result, many Chinese companies are disadvantaged when compared to global peers in disclosure-based ESG ratings system. As an example, the MSCI ESG scores of Chinese aluminium companies are below the global industry average. In our view, such quantitative ratings often fail to reflect the true level of sustainability practices of many Chinese firms.

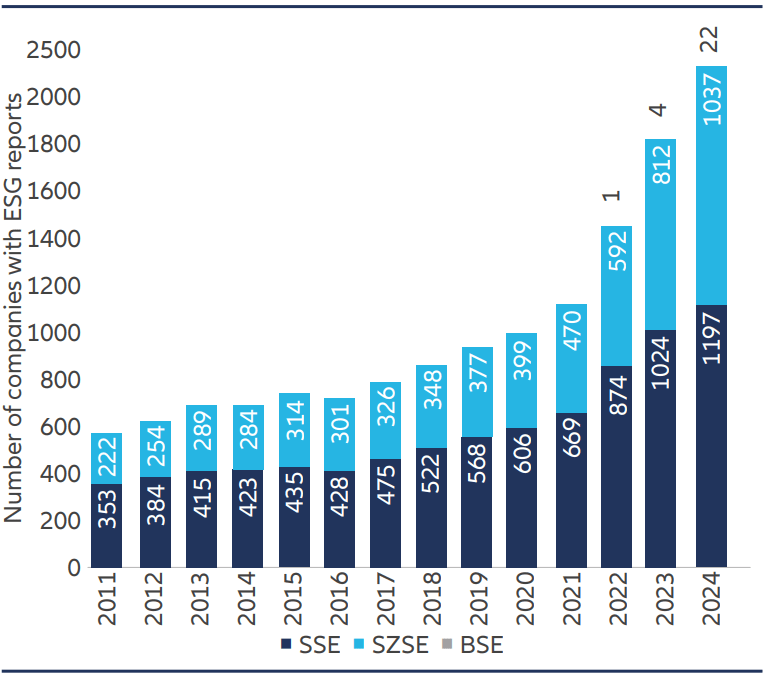

However, change is gradually underway. Under the guidance of the China Securities Regulatory Commission, the mainland China stock exchanges of Shanghai, Shenzhen, and Beijing officially released the “Guidelines for Sustainable Development Reports of Listed Companies” in 2024, which align with ISSB standards. We also see more companies starting to “talk more” about ESG with reference to new guidelines. This contrasts sharply with growing international skepticism about ESG disclosures and the decline in ESG targets.

Chart 4: Numbers of ESG reports by listed companies (2011 - 2024)

Source: SynTao Green Finance, as of 30 September 2024.

Beyond environment

Beyond environment, a financially material but lessdiscussed ESG topic is related to social aspects. A key focus now in China is providing workers with better and more secure working conditions. This is related to promoting China’s much-needed consumer power. “Common prosperity” is becoming more than a slogan; it is gradually being reflected in actionable policies.

For example, China has around 200 million flexible, or ‘gig’, workers10. This is equivalent to the combined populations of the UK, France, and Germany. These jobs include delivering food, mailing parcels, and driving ride-hailing cars, forming the backbone of the growing platform economy.

However, long working hours, high labour intensity, and low employment protection have become the norms as a result of platform algorithms which aim to maximize efficiency. Most gig workers are part of the ecosystem, but not the employees of any company. Financially, they are typically poorly covered in areas such as insurance and pension provision. In this environment, how should internet platforms balance the interests of shareholders and these other stakeholders?

We have seen early signs of change. In this year’s “Two Sessions”, where China’s political leaders set out the country’s forward-looking priorities, improving social security for flexible workers was repeatedly mentioned. Internet leaders such as JD.com and Meituan have also announced social security coverage plans for their platform riders11. And from an investment perspective, as part of our ESG approach, the potential impact of better worker welfare is already embedded into our bottom-up analysis.

Summary

Despite ongoing debates about the potential decline of ESG in more developed countries, China’s ESG-related development continues steadily. This is not driven so much by ideological values, but instead it is powered by the country’s objectives of sustained economic growth, industrial transformation, improved social equality, and stronger international competitiveness.

In our view, China’s approach to ESG is highly pragmatic and results oriented. The establishment of green infrastructure, for example, provides a solid foundation for ESG advancements across other industries.

We believe China’s ESG advances have not been fully captured in many third party rating agencies. As such, this can lead to pricing inefficiencies in financial markets. Identifying ESG improvers can therefore provide additional sources of return. And, more broadly, we expect China will see a bigger focus on ESG going forward.

1 and Chart 1: BNEF, Energy Transition Investment Trends 2025 Edition. Global Investment in the Energy Transition Exceeded $2 Trillion for the First Time in 2024, According to BloombergNEF Report | BloombergNEF

2 CnEVData. Global EV battery market share in 2024: CATL 37.9%, BYD 17.2% – CnEVPost

3 China National Energy Administration (NEA) Renewable energy accounts for 56 pct of China’s total installed capacity

4 and Chart 3: US Energy Information Administration. China’s crude oil imports decreased from a record as refinery activity slowed – U.S. Energy Information Administration (EIA)

5 Chart 2: BloombergNEF, Levelized Cost of Electricity Update 2025

6 CGTN, China’s forest coverage surpasses 25%, leading global green expansion – CGTN

7 S&P Global, China Nonferrous Metals Industry Association. Chinese aluminum smelters eye Inner Mongolia for low-cost, cleanenergy | S&P Global

8 Aluminum Corporation of China Limited, 2024 ESG Report. 2025032601542.pdf

9 Chart 4 – China SiF. China Sustainable Investment Review 2024

10 The State Council, The People’s Republic of China. https://www.gov.cn/xinwen/2021-05/20/content_5609599.htm

11 Yicai Global. China’s JD.Com, Meituan to Offer Social Insurance for Food Delivery Riders