Embracing Disruption

Has the change in momentum put active investing back in the driving seat?

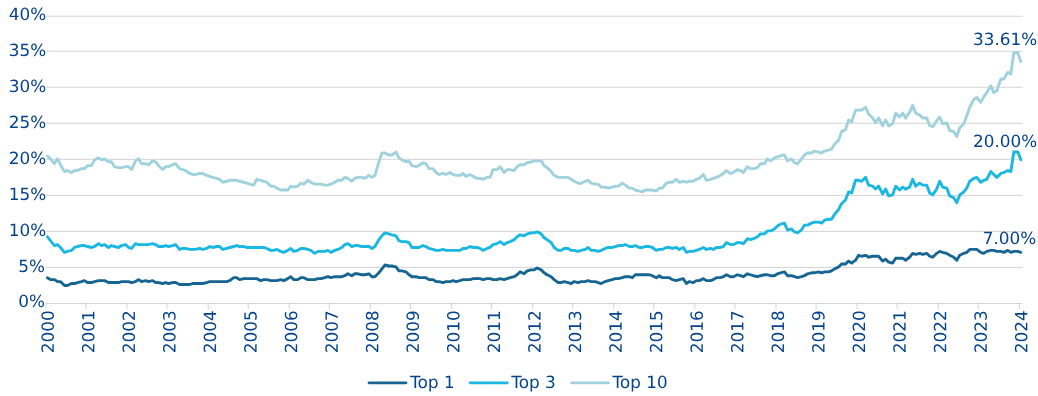

Stock market concentration, particularly in the US, has risen sharply over recent years, driven in part by the rise and growing dominance of the “Magnificent Seven” tech stocks – Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla. Indeed, these stocks currently make up around 30% of the S&P 500’s total capitalization, while accounting for nearly two-thirds of the index’s returns in 2023.

Looking a little more broadly and taking, for example, the MSCI All-Country World Index – which consists of around 3,000 stocks from across emerging and developed economies – we see that, even with a global perspective, this index has around 20% of its value in the 10 largest US stocks (which, of course, include the Magnificent Seven). To put this into perspective, 10 years ago the market capitalization of these stocks would have represented about half the combined value of listed UK, France, Germany, and Japan companies – today, it is roughly equal.

Exhibit 1: Stock market concentration in the US, 2000-2024

Source: Datastream, S&P500 as of 13 August 2024

Concentration, volatility, and risk

The rise in concentration poses several problems for asset managers and investors across the board. For passive managers and investors – those that seek to track a market weighted index or portfolio – as concentration increases, diversification decreases, meaning portfolio outcomes become increasingly reliant on the performance of a small number of stocks. A cautionary tale, albeit an extreme example, comes with the case of Nokia – a company that once accounted 70 percent of the Helsinki stock exchange’s market cap and now trades around 95 percent down on its all-time high. Furthermore, as a result of increasing concentration, passive investors face growing exposure to systemic risks – the growth of ETFs has coincided with a sharp rise in stock correlation, as the prices of largest US stocks show an increasing propensity to move together.

For active managers, basic risk controls mean that replicating concentrated indices such as the S&P 500 is impossible. And most active managers would, of course, baulk at the thought of relinquishing control of around 30% of their portfolio – which is what would be required to take a neutral stance on the top 10 US names. Indeed, concentration is now reaching such high levels that even some passive managers are now restricting their exposure to the ultra-caps.

To compound the problem, eight of these top 10 names are essentially the same bet – artificial intelligence – and all but one feature volatility higher than the market average. Looking at prior decades, we find that market concentration featured sectors such as groceries and pharmaceuticals, with the occasional oil company and large industrial. These sectors have very different correlations to both each other and the broader economic cycle.

Yet the recent change in momentum means we are beginning to face a different landscape for investors, with active management now coming to the fore. By definition, active managers invest based on conviction and correlation to indices is a secondary consideration, if it features at all. Moreover, more concentrated markets are historically linked to greater volatility – a particular risk for passive investors – and, as momentum unwinds, generating predictable returns will entail finding uncorrelated sources of alpha in the markets.

Active management resurgent?

Asset allocation decisions for investors necessarily entail a broad range of considerations. Indeed, even those adopting a passive approach will need to make initial choices regarding allocation decisions before they “set and forget”. Yet more highly concentrated markets are less efficient and this – coupled with the recent change in momentum – presents greater opportunities for active management strategies.

Where previous decisions may have been based on perceived value or growth, perhaps today’s key decision is the level of passive over active, and this may be a good time to think about these ratios in the ever-present search for alpha.