Achieving Sustainability

Carbon metrics: why many are better than one

Mastering a range of carbon metrics is crucial for investors to assess the climate impact of their investment decisions, and to monitor carbon targets.

Key takeaways

- Carbon metrics aim to measure greenhouse gas emissions associated with an investment portfolio.

- There are various carbon metrics to choose from, depending on factors such as an investor’s share of equity ownership and the size of the portfolio.

- The choice of carbon metric can have a significant effect on the emissions estimate, which means a range of metrics should be used to ensure a balanced analysis.

How emissions are measured

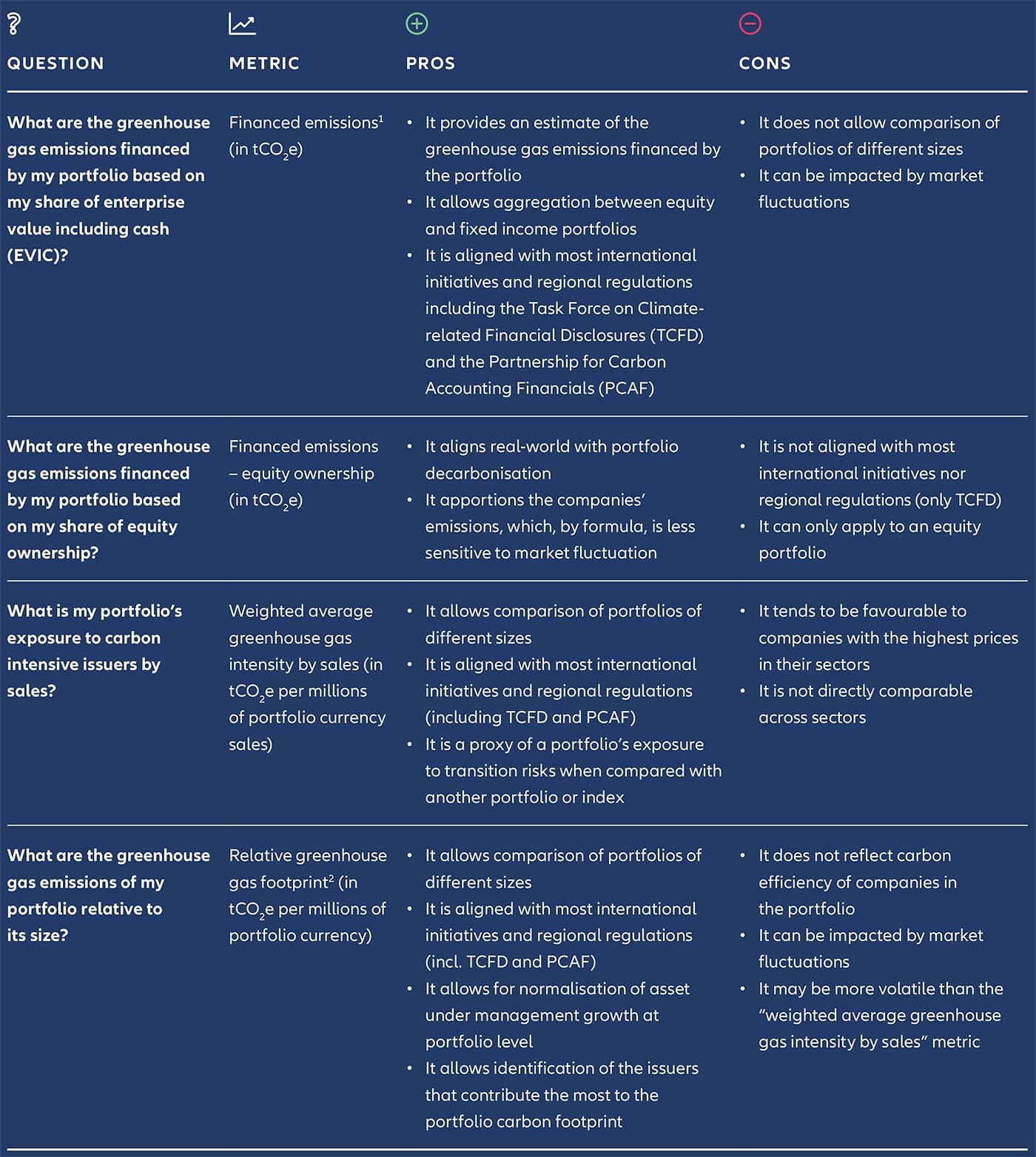

Exhibit 1: Comparison of some key carbon metrics

Why the choice of carbon metric matters

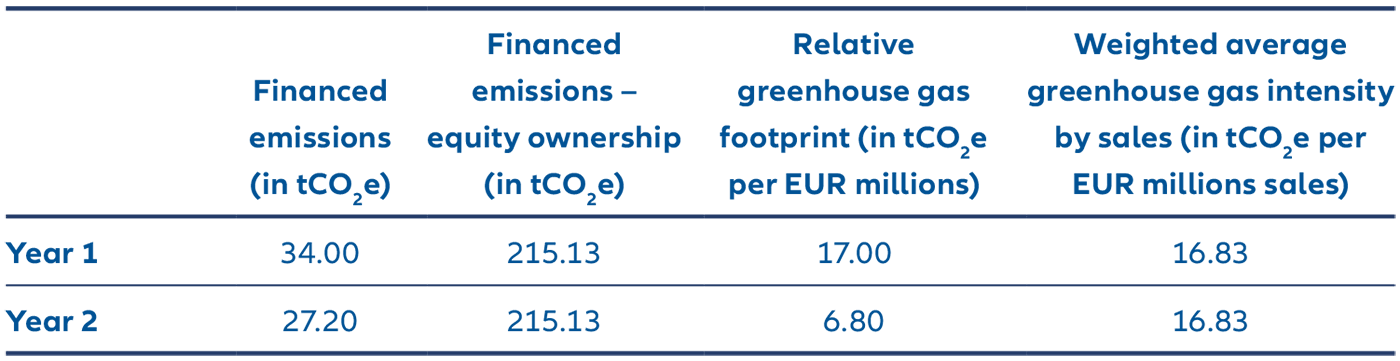

Let’s consider a portfolio making a single investment in an automaker and see how it performs at two different points in time (see Exhibit 2).

We assume that over a one-year period, the market capitalisation of the automaker has doubled, and the enterprise value including cash (EVIC) has increased by 2.5 times, all other factors remaining equal. In this case, the “weighted average greenhouse gas intensity by sales” and “financed emissions – equity ownership” metrics would remain unchanged, while the “relative greenhouse gas footprint” and “financed emissions” would experience a notable decrease. However, this decrease would not be related to any real-world decarbonisation.

This is just one example of how complex metrics can be, and why relying on a single metric can potentially lead to misleading results.

Exhibit 2: Emissions comparison for a sample portfolio

Source: MSCI ESG, AllianzGI. Data are provided for indicative purposes only.

What are the implications for investors?

As there is no “one size fits all” when it comes to measuring the emissions performance of investment portfolios, we suggest using multiple metrics simultaneously. Different metrics may yield different results depending on factors such as market capitalisation and total debt, which can vary with shifts in market valuations, earnings and debt financing choices.

When comparing carbon metrics, it is important to keep in mind the ultimate aim of this analysis, which is to drive credible portfolio decarbonisation. Carbon metrics are an important tool to assess the transition pathway of underlying companies – and to help reduce emissions in the real economy

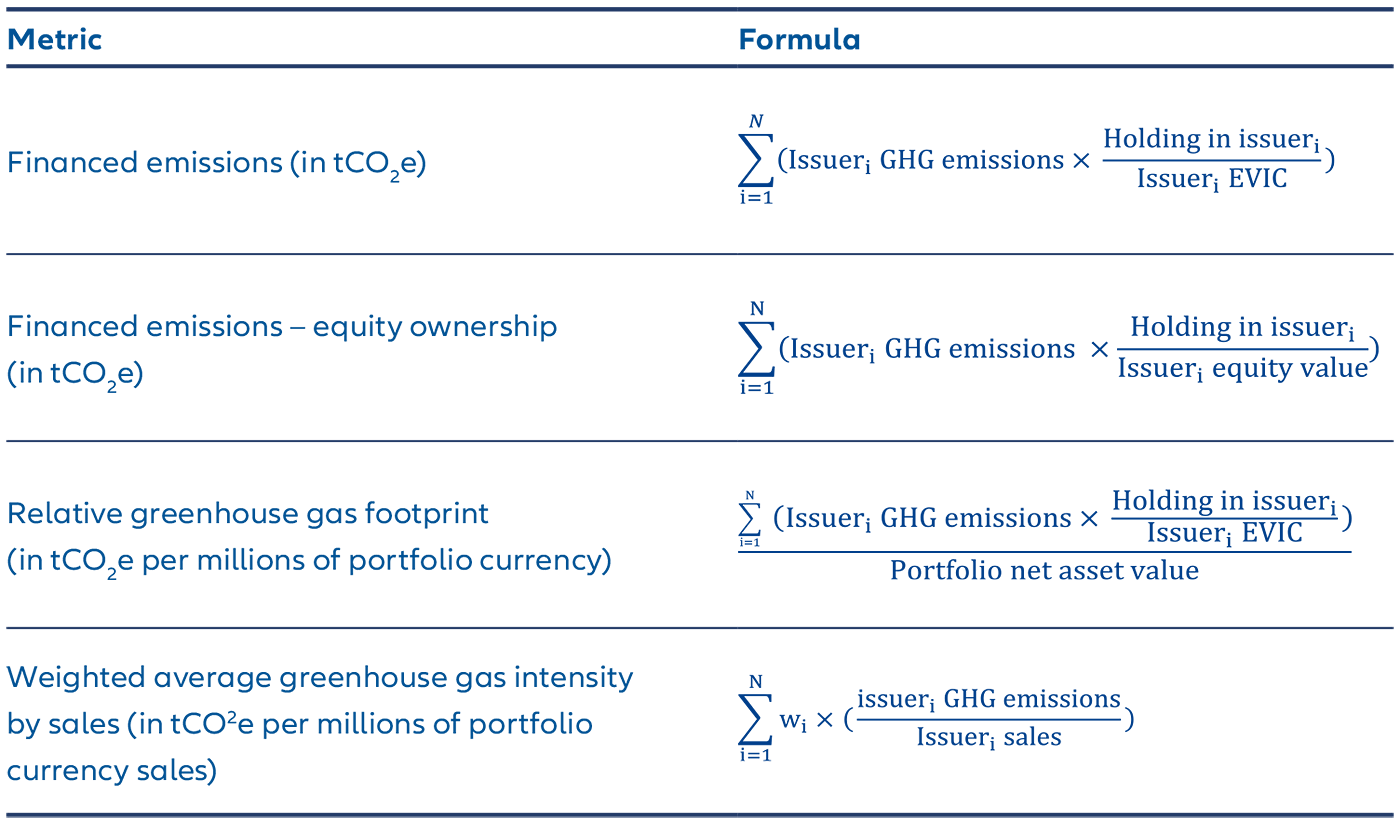

Exhibit 3: How the carbon metrics are calculated

1 Also referred to as “absolute greenhouse gas footprint”.

2 Also referred to as “carbon footprint”.

Measuring, monitoring and reporting on carbon emissions is essential for investors to track and improve their environmental impact. But with various carbon metrics in use, and considerable complexity, it can be hard to decide the appropriate approach.

In this guide, echoing the topic of climate impact to climate transition from our 2025 sustainability themes, we provide an overview of the main portfolio-level carbon metrics and explain why it is important to employ a range of these tools.