Navigating Rates

Back to bonds? The new opportunity set in fixed income

Potentially improved yields and the prospect of peaking interest rates are boosting the appeal of bonds. While the near-term outlook is unpredictable – as the path of inflation and growth remains uncertain – we’ve identified four themes that may help investors build bond allocations and navigate volatile markets.

Key takeaways

- Higher bond yields than in recent years and fluctuating markets are making fixed income “investable again”, reintroducing some investors to a USD 127 trillion asset class.

- After a dramatic turnaround in the performance of fixed-income assets, we see potential ideas starting with core government bond markets and moving eventually into riskier credit.

- Markets may continue to be volatile in the near term, so investors could consider short-term debt instruments to be primed for opportunities in longer duration as macroeconomic data and market sentiment begin to stabilise.

- As different countries diverge from each other in economic and monetary policy paths, a flexible approach is key, selectively adding rates and spread risk in markets where inflation and interest rate rises may be closer to peak.

If 2022 marked a regime change in bond markets, with rising yields and elevated volatility, 2023 may be the year when investors can prepare for the opportunities that market shifts bring. In essence, given higher income from bonds than in recent years, fixed income is “investable” again. Rising consumer prices and an unusually rapid climb in interest rates meant inflation zoomed back into focus in the wake of the Covid-19 pandemic. This followed years in which the prospects for economic growth were the focus for investors. The result was that 2022 was one of the worst-ever years for fixed-income returns. Yields have since reset, and both upside and downside risks to inflation and growth have become more symmetrical, making bonds a potentially appealing asset class to navigate a volatile environment.

Worth an astounding USD 127 trillion globally, the fixed-income market offers myriad opportunities. Where should investors start? While bond yields may be higher, the challenge is that a clouded and data-dependent economic outlook lingers around the course of inflation, employment numbers, and overall growth – and therefore the implications for monetary policy. Market sentiment indicators are also sending mixed signals. This year started with a strong rally in global equity and corporate bond markets. But according to the February Bank of America Global Fund Manager Survey, most fund managers remain broadly bearish, albeit less than they have been in recent months. This mixed backdrop will likely foster continued market volatility, at least in the short term. We think opportunities will evolve at different times as markets shift. These ideas can be grouped into four compelling themes to help reset bond allocations and inform portfolio positioning:

1. View volatility as a potential opportunity

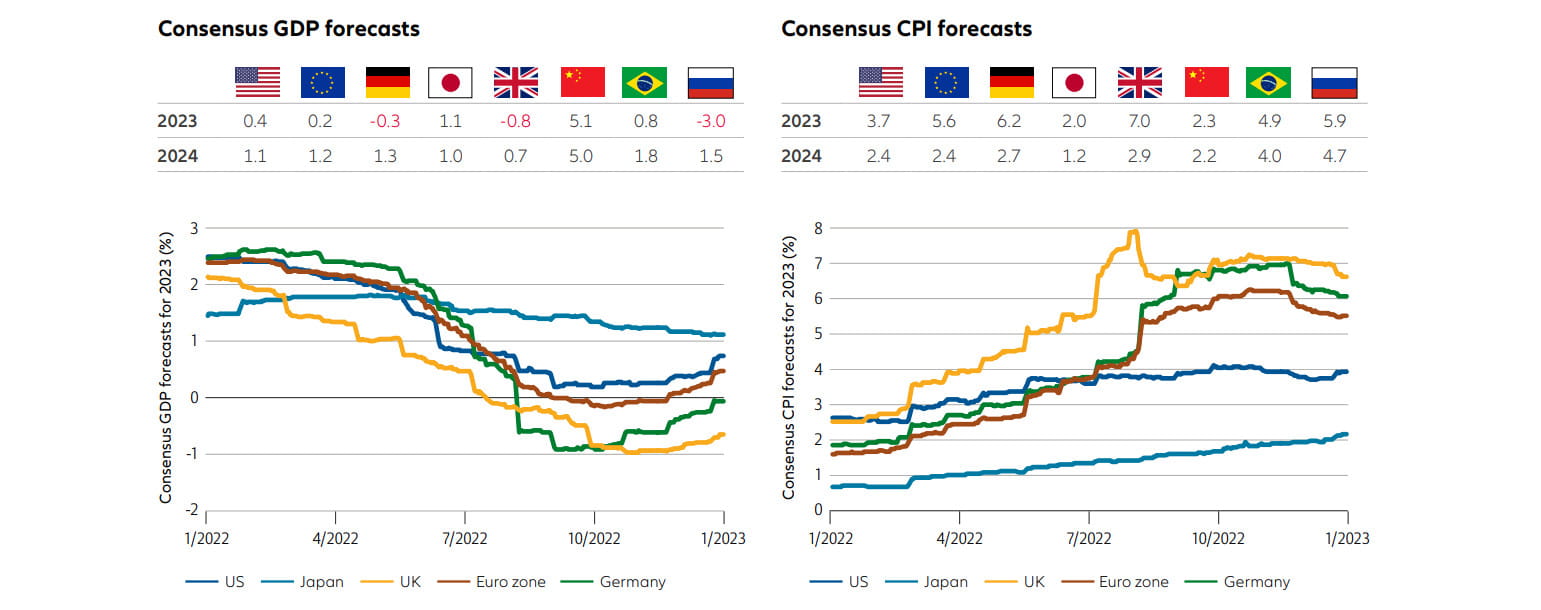

Starting from elevated levels, consensus consumer price inflation (CPI) forecasts for many economies have gradually improved over the last few weeks (see Exhibit 1). However, markets may have been over-optimistic about the speed of decline in inflation and therefore underestimated how long central banks will have to keep interest rates elevated to tackle it. There are near-term signs of stickiness in some underlying price measures. In the US, prices of energy and durable goods are falling, but inflation in services is stubbornly higher. Underlying CPI numbers in the euro zone remain at elevated levels.

A key driver of high inflation has been strong labour markets, particularly in the US, despite slower GDP growth over the past few quarters. Without weakening employment data, it is hard to pinpoint whether the normalisation of inflation back to low single-digit figures will be fast or slow. It is equally challenging to forecast the timing and depth of an economic recession (see Exhibit 1).

This latest reset in economic expectations does not necessarily guarantee a mild recession. Another scenario is that central banks may be forced to steer economies into a deeper slowdown to bring about the necessary slack in labour markets required to mitigate wage pressure and help dampen cyclical inflation.

Exhibit 1: expectations for economic growth and inflation have gradually shifted

Source: Consensus Economics, Allianz Global Investors. Data as at 6 February 2023.

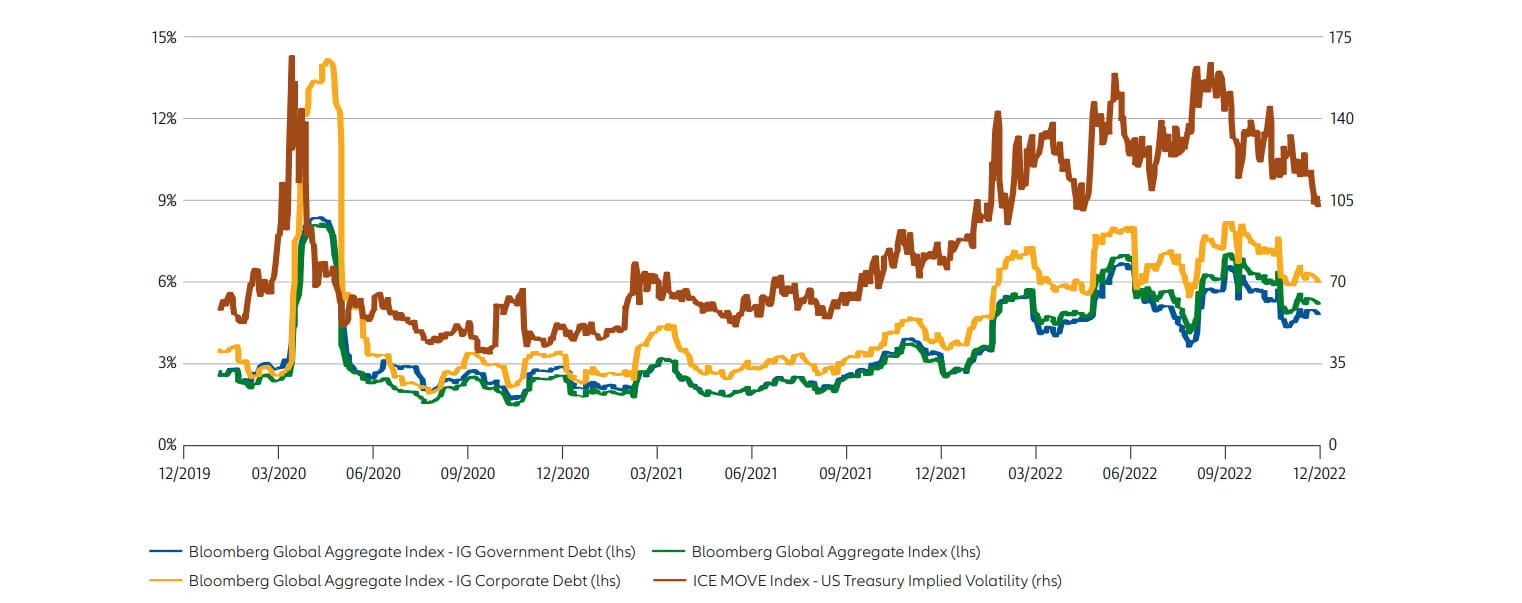

While bond volatility has eased from recent highs (see Exhibit 2), any change in market expectations around macro and policy scenarios may trigger fresh bouts of choppiness. In this period of likely continued volatility, what are some of the options for investors?

- Floating-rate notes, or so-called floaters, issued mainly by investment-grade-rated financial institutions and corporates, offer coupons that adjust with some periodic lag to shifts in short-term benchmark rates. Floaters also carry a yield premium over and above those reference rates to compensate for the possibility of floater prices falling due to credit risk. Even once interest rates seemingly peak, floaters can still form an important part of a fixed income toolkit in an uncertain environment where rate rises may have to return in the future.

- Short-maturity, highly-rated bonds issued by governments and companies are another option. Investors still need to bear in mind that the front-end of yield curves (debt securities that mature in the nearer term) remain vulnerable to further shocks from the repricing of terminal short-term interest rates.

- A combination of short-term, fixed-rate cash bonds with futures and options on interest rates and credit derivative indices can help limit rates and spread volatility. Actively managing hedge positions is key to limiting any risk of losses on the cash bond portion of a portfolio.

Exhibit 2: volatility has eased from recent highs, but market choppiness may persist

Source: Bloomberg and ICE BofA indices. Allianz Global Investors. Data as at 31 January 2023. Index returns in USD (hedged). Realised volatility (30 days trailing) is annualised. IG= bonds rated Investment Grade. lhs=left-hand-side axis. rhs=right-hand-side axis. The rhs axis represents the value of the MOVE. which is a yield curve-weighted index of the normalised implied volatility on 1-month Treasury options on the 2. 5. 10 and 30-year contracts over the next 30 days. A higher MOVE value means higher option prices. Past performance does not predict future returns. See the disclosure at the end of the document for the underlying index proxies.

2. Seek out real yielders as economies diverge

Global economies are moving at different speeds as inflation and growth begin to diverge. This means there is scope for greater dispersion in policy reactions by central banks globally.

Expectations for global interest rates suggest that many central banks will cease their rate increases in the second half of 2023 after some more monetary policy tightening in the early part of the year. But central banks will likely exit their current rate hike cycles at different times. For example, the US Federal Reserve may be closer to reaching its terminal rate – the expected end point for rate hikes – than the European Central Bank.

At the other end of the spectrum sits the Bank of Japan, which has maintained its key policy rate at -0.1%. Even as a new governor takes over, rising inflation expectations are likely to continue to add pressure to normalise monetary policy, including the further loosening of the bank’s policy of maintaining 10-year Japanese government bond yields within a 50-basis-point range of 0%.

Meanwhile, many emerging markets are further ahead in the cycle of rate rises. Central banks in emerging countries were forced to respond to a brewing cost-of-living crisis at an early stage. With food and energy prices typically accounting for a higher share of consumer price indices than in developed economies, the inflation alarm bells rang sooner.

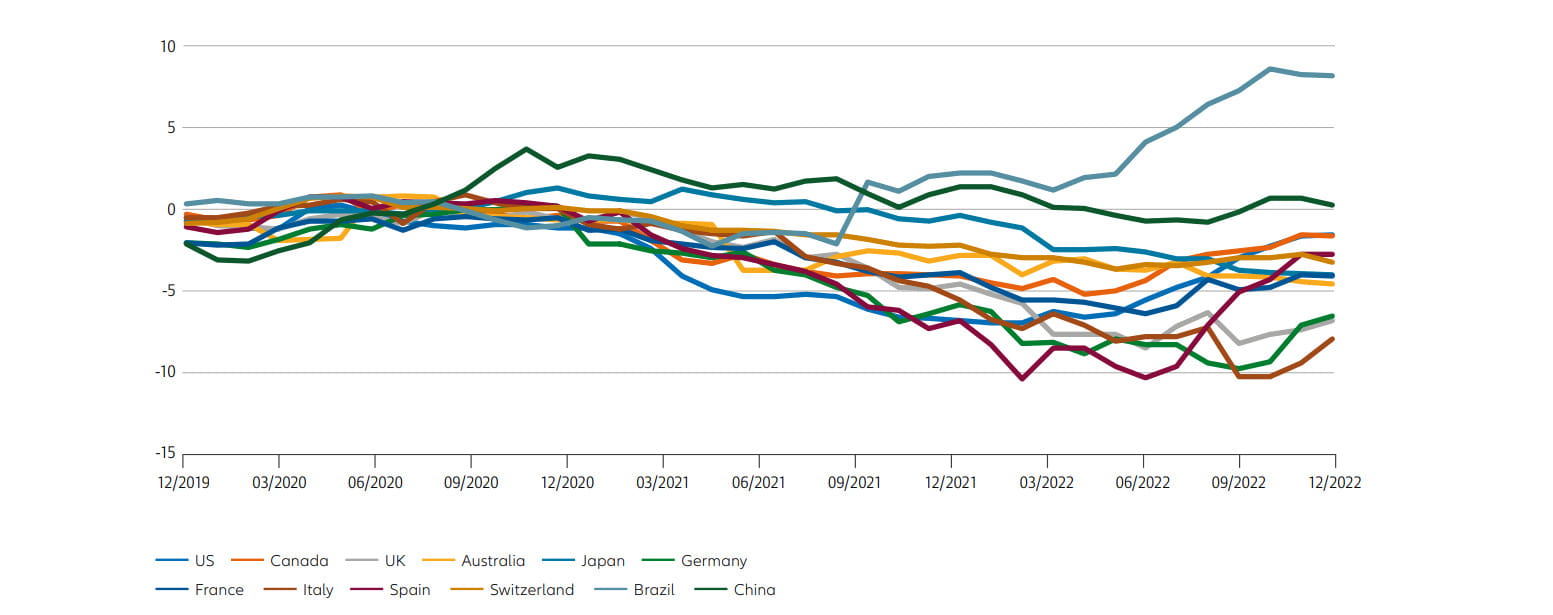

This divergence, which to some degree is reflected in real (after-inflation) short-term bond yields (see Exhibit 3), may create opportunities for those prepared to be flexible and seek out potential so-called real yielders:

- As many investors are still heavily underweight fixed income, it may make sense to start allocating incrementally to those government bond markets where peak inflation and policy rates may be more fully priced into bond yields, to avoid further rates-driven losses. As many government bond yield curves remain flattish to inverted (with short-term yields exceeding long-term yields) investors may prefer to begin by allocating to short-term government bonds first before adding outright duration risk with longer-dated bonds – particularly where there is a greater chance of curve steepening soon, such as in the US.

- The opportunities for flexible bond strategies have been enhanced by the close attention markets are giving to inflation and rates. This opportunity set is particularly rich for those investors that seek out cross-country relative value positions across the full duration and yield-curve spectrum, as well as from select exposures to credit and currency markets.

Exhibit 3: divergence in economies is reflected in government bond yields

Source: Bloomberg. Allianz Global Investors. Yield data as at 31 January 2023. Latest available official inflation data for the month of January 2023.

3. Position for a revival in high-income bonds

Some higher-income areas of fixed income have seen an improved performance so far in 2023. This reflects a growing confidence among investors that inflation may have peaked, and interest rate rises are coming to an end.

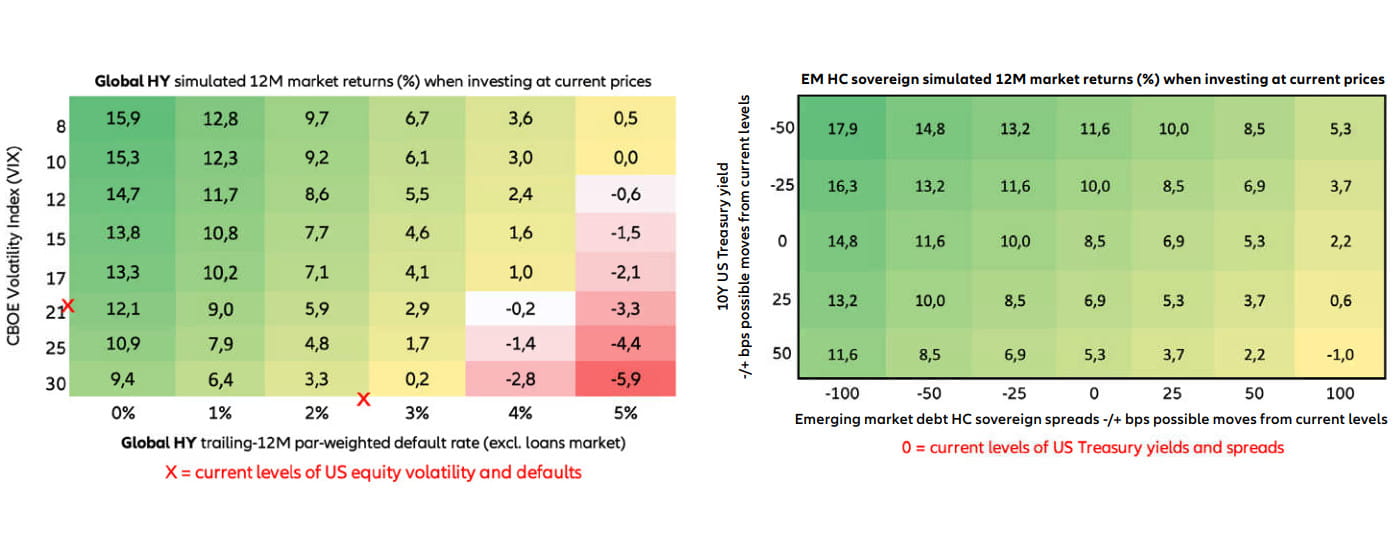

While we think this confidence may be premature, an eventual steadying in inflation and rates could signal a future entry point for less tactical (ie, longer-term) investments in global high-yield corporate bonds and emerging-market external sovereign debt (see Exhibit 4).

High-yield corporate bond issuers are generally in good financial shape. Many have lengthened the maturity of their debt, leaving less short-term debt to refinance than during previous years. Market anticipation of a “soft landing” – whereby the economy slows but stops short of recession – lower input price inflation and improving conditions in capital markets have lowered default expectations. Bottom-up analysis suggests that mostly only small B- and CCC-rated issuers remain at risk.

Meanwhile, this year could be better for emerging markets. They are showing signs of decelerating inflation and growth stabilisation, partly explained by faster-reacting central banks and a rebound in activity from China’s lifting of its Covid-19 lockdown. Emerging-market external (hard currency) sovereign debt has historically been hurt by tighter US dollar global liquidity and a stronger US dollar – a reversal in both of those trends has the potential to drive further capital flows back into the asset class.

These areas of fixed income can be volatile and present a higher risk of default. Investors should be selective and consider actively managed strategies. In both high-yield and emerging markets, we favour strategic allocations to higher-quality issuers.

Exhibit 4: at current yields, high-yield corporates and emerging-market sovereigns offer a potential income cushion and upside

Source: Bloomberg. ICE. Allianz Global Investors. Data for global high-yield as at 15 February 2023. Data for Emerging market HC sovereign as at 16 February 2023. Global HY=ICE BofA Global High Yield Index. Emerging market HC sovereign=JP Morgan Emerging Market Bond Index (EMBI) Global Diversified. Past performance does not predict future returns. See the disclosure at the end of the document for the underlying index proxies, important risk considerations and simulation methodologies.

4. Participate in the green transition through sustainable bond investments

A relatively mild winter and lower natural gas prices have helped ease the energy crisis that afflicted Europe last year. But the crisis revealed vulnerabilities and dependencies in energy supplies that underline the need to transition to a lower carbon economy. With higher energy prices affecting lower-income households disproportionately, a transition would also contribute to social goals.

This transition requires financing. For example, the expansion of cleaner energy generation and storage needs urgent finance. Carbon capture and utilisation should be other areas of focus. Funding for much of the huge scale of investment required is likely to come from the debt market: an estimated USD 5.7 trillion of investment is needed annually by 2030 to meet the Paris Agreement goal of limiting global warming to 1.5 degrees Celsius.1

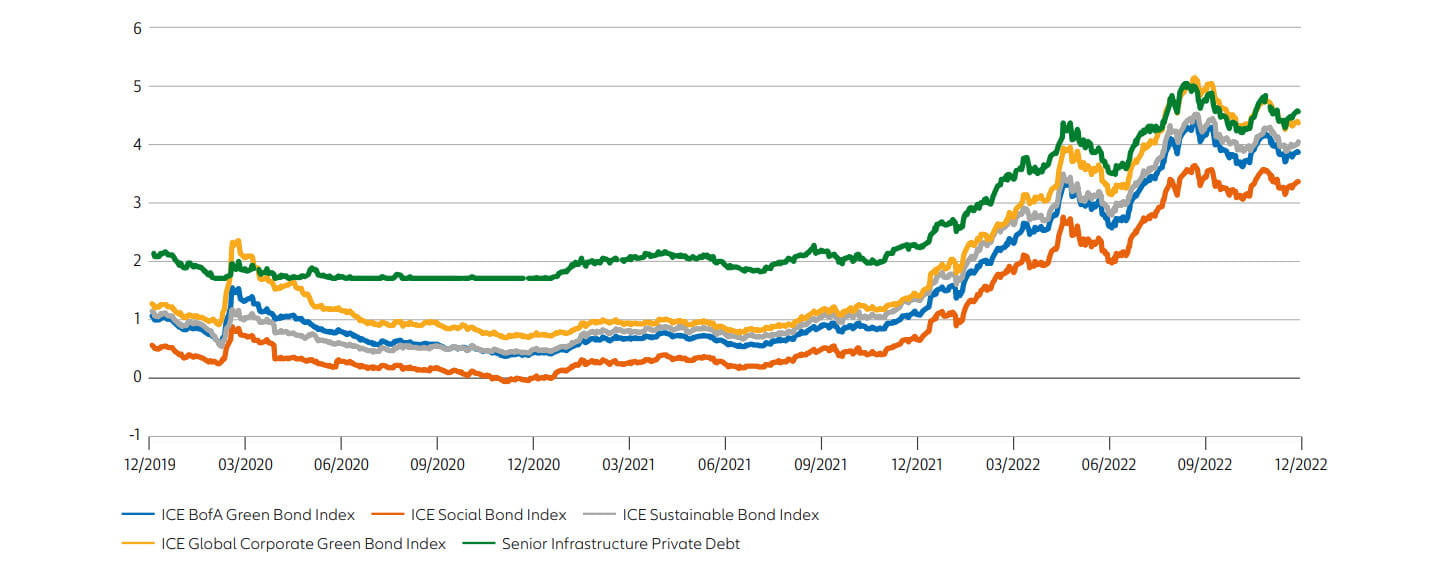

Encouragingly, the latest data suggests investor appetite for renewable energy projects is high.2 And the potential yields offered by sustainability-labelled bonds may help the asset appeal to a broader range of investors beyond those with specific sustainability goals (see Exhibit 5). According to Bank of America, issuance of green, social, sustainability and sustainability-linked bonds is expected to reach USD 1.1 trillion in 2023 – a return to 2021 levels.3 The growth within this category away from green bonds allows investors to better direct their investments to social or Sustainable Development Goals (SDGs).

We see Europe out in front in terms of setting robust sustainability standards. As a result, the euro investment-grade corporate bond universe may currently enjoy the broadest opportunity set for investors in high-quality green and other “use-of-proceeds” bonds, as well as public debt aligned with the 17 UN SDGs.

Exhibit 5: yields have picked up for sustainability-labelled bonds

Source: Bloomberg, Allianz Global Investors. Data as at 31 January 2023. The yields for the ICE BofA indices represent theweighted average of the yields of the constituent bonds denominated in their local currency. The yield for investment-gradeinfrastructure private debt is an approximation, composed of the EUR 15-year mid-swap as a reference rate (with a floor atzero when it goes negative) + 170 basis points. Past performance does not predict future returns. See the disclosure at theend of the document for the underlying index proxies.

Bonds: versatility in a volatile environment

See a brief overview of the new opportunity set in fixed income

1 Source: International Renewable Energy Agency (IRENA) – World Energy Transitions Outlook 2022

2 Financing set a record high in 2022 for the first six months of a year, reaching USD 226 billion – according to Bloomberg’s Renewable Energy Investment Tracker report. Source: BloombergNEF – Renewable Energy Sector Defies Supply Chain Challenges to Hit a Record First-Half For New Investment | BloombergNEF (bnef.com)

3 Source: ESG in Fixed Income Quarterly, 12 January 2023, BofA Global Research